When people accuse the Federal Reserve of anything when it comes to inflation, they say the central bank is cooking the books to hide it. Back in 2000, for example, monetary observers were aflutter as policymakers shifted away from the CPI and to the PCE Deflator as their ultimate standard for broad consumer price behavior. The bastards, the latter widely known for its much slower pace than the former.

In late 2005, one of Alan Greenspan’s final acts as Chairman was to announce he was getting rid of M3. Once more, critical observers charged him and the rest of his central bankers with covering up the source of the inflation they were now hiding out in the open under the other statistic.

The truth has been, however, very different. While there are endless arguments to be made about the CPI versus other measures of inflationary conditions, except the obvious correlations thereof with downside, deflationary cases, at least with M3 the Fed had been honest.

They had no idea how to define money, and M3 was misleading as it related to that fact. In the middle 2000’s, policymakers had a choice to make; either undertake an expensive, expansive examination of the real underlying monetary system and try to work toward a more comprehensive and effective, appropriately grounded understanding, or just ignore the shadow system and hope jiggling the fed funds rate around a little here or there was enough “monetary” in its policy.

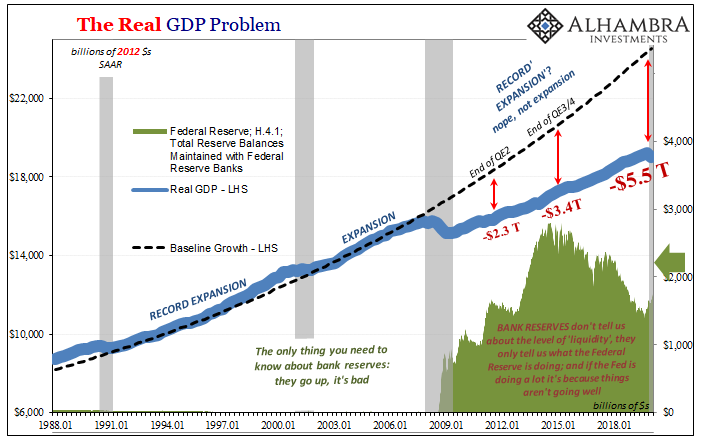

They unwisely chose the latter, the whole world paying for their gross dereliction with this broken post-August 2007 economy.

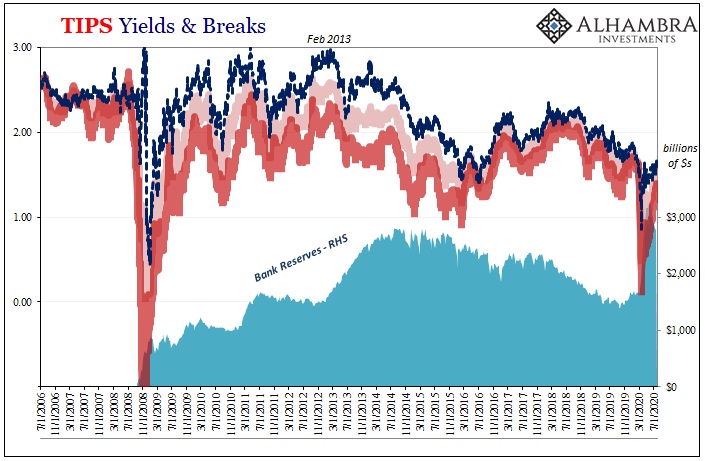

During it, consequently, each successive Fed Chairman from Bernanke to Yellen to now Jay Powell has desperately tried to court, coerce, and otherwise conjure inflation from thin air. Unsuccessfully, mind you. Rather than hiding a more serious rise in consumer prices, they have been actively encouraging it for many, many years.

Since March 2020 and GFC2, more than ever.

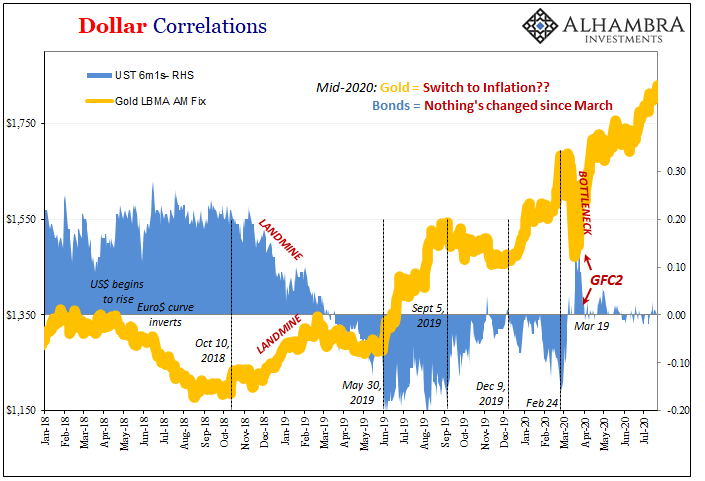

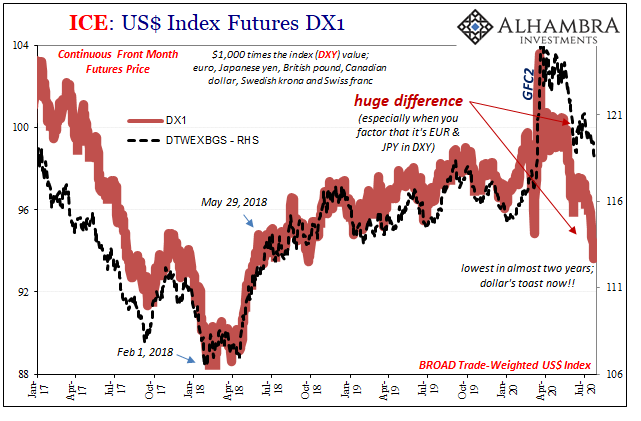

This has led to what I wrote yesterday amounts to an ocean of confusion. We’ve got gold skyrocketing and the dollar crashing – at least that’s what’s been reported.

So far as gold has been concerned, the anecdote is at least technically true though what gets omitted are the correlations that matter and therefore the true meaning behind its 45-degree ascent. Not inflation, in other words. Strike 1.

Where the dollar is concerned, being down against the euro is immaterial at times like these while against the yen it is actually rising dollar stuff.

Strike 2.

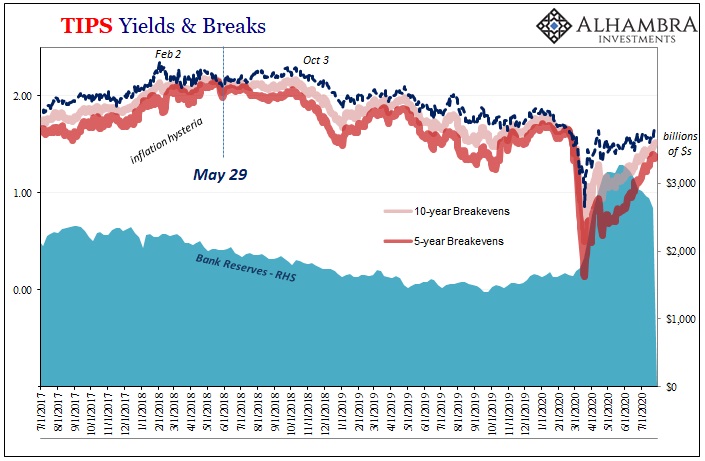

Having measured Jay Powell’s work indirectly by these other important indications, how about more directly in terms of inflation expectations?

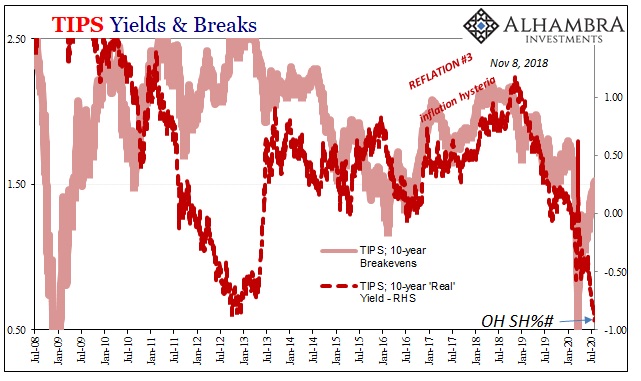

Beginning at the 5-year inflation breakeven rate (the 5-year nominal UST yield minus the 5-year “real” TIPS yield) it sort of looks like the Fed’s been successful. Inflation expectations are rising, at least, and they seem to be shooting up at a pretty solid rate.

But you have to keep in mind that TIPS investors get paid by the CPI, which means by and large WTI. In other words, production cuts across the globe and shale plays plugged for probably a prolonged period, all of which has gotten oil prices back up to just $40 (and the futures curve still in contango).

That’s enough, however, for TIPS investors to pay rising prices for these instruments in order to get paid a very modest expected protection, though higher than a few months ago, derived from WTI’s heavy input on the future CPI.

The flipside of TIPS breakevens are those “real” yields which continue to sink to extremely low levels – the 10s now at record lows and still falling. With a lid on nominal Treasury yields, this rebound in oil prices is therefore subtracted from economic expectations; slightly higher crude to further immiserate workers and consumers who should be expecting otherwise deflationary pressures throughout the real economy.

Thus, for all of Jay Powell’s alleged money printing, trillions at a pace far greater than during Bernanke’s 2008 frenzy, this is all we’ve got? Real growth expectations falling to record lows, and at best a modest rebound in oil expectations predicated on the same processes (production therefore job and investment cuts) which should further contribute to already suspect, deflationary economic circumstances.

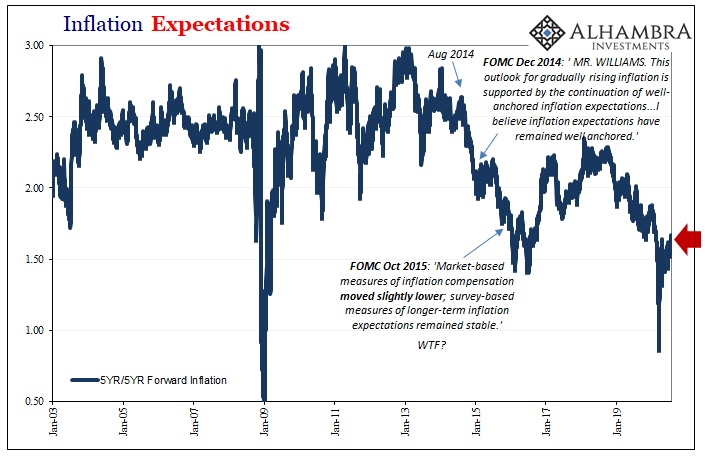

That’s why longer run inflation expectations have barely budged despite the Federal Reserve’s balance on bank reserves. The 5-year/5-year forward inflation rate remains today at one of its lowest levels on record, much closer to crisis lows than at any of the previous recovery fictions.

Strike 3.

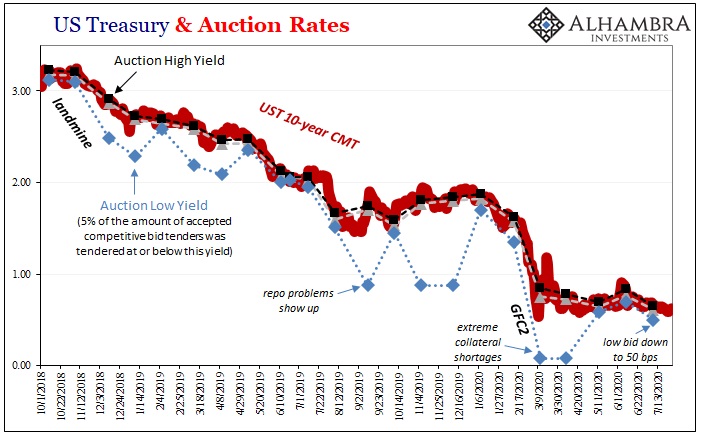

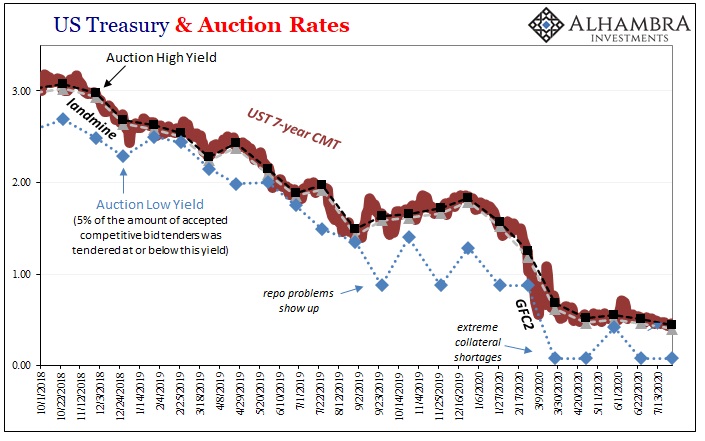

This goes a very long way to explaining the very low volatility in nominal Treasury yields. As my colleague Joe Calhoun has pointed out, outside of a truly minor disturbance toward the beginning of June (OMG, the 5s30s!), yields in notes have been very quietly, incrementally, deliberately declining.

While the media sells this as a product of markets anticipating yield caps, it’s plainly and patently absurd given the corroborating strikes in these and other markets.

No matter how much the federal government auctions, or how much of what’s auctioned the Federal Reserve buys, there’s a persistent demand for these safe, liquid instruments. Which, contrary to the mainstream assessment, tells you what about perceptions of safety and liquidity?

Not just talking heads on TV perceptions, either, but what the monetary system itself is pricing and acting upon what’s going on inside the parts of it we can’t directly observe. The very shadow system which caused the Fed to (correctly) abandon M3 a decade and a half ago.

Again, the Fed is not the independent variable in the bond market; that’s the fiction. Demand for UST’s is independently strong whether QE is heavy or light (or, as before last September, non-existent).

Strikes 1, 2, and 3 are these markets telling you the truth about Jay Powell’s attempt to sell you his inflation story. He absolutely needs there to be huge inflationary expectations because he knows that without them he’s got nothing (except inert bank reserves, proven uselessly reactive yet again) to counteract the huge negative forces already unleashed (part of them by his ridiculously ineffective monetary responses during GFC2 in March).

Nothing has changed since March – except reopening and a little crack of optimism. That’s the other side currently balancing Treasury yields. The marginal sellers who sell first based on Bond Kings and the financial media buying Jay Powell’s fantasy hook, line, and sinker along with those who see the Fed’s balance sheet (and to a lesser extent the federal government’s Treasury General Account) and can’t help but fall back on education and training thinking it has to explode into inflation.

Can all the textbooks really be this wrong (again)?

Lined up against them, buying up every last bit of what they sell, and then a little more, is the very banking, monetary system itself which continuously fades all this stupidity and gross monetary ignorance.

If, or probably when, the stupidity is revealed as having never been anything more than that, if another wave of economic or financial (collateral bottleneck) trouble grows too obvious to ignore, that’s when we’ll see UST demand overwhelming again which should, in my view, push maybe most of the yield curve into negative territory.

We’re a hair trigger away from negative nominals, not runaway inflation.

Contrary to how the story’s being told in the media, the entire balance of probability is weighted in that direction rather than Powell’s. But that, once more, perfectly explains why they are trying so hard to make everything seem like it’s on his side and also why it’s getting (us) nowhere.

Stay In Touch