The way you hear it nowadays, the dollar just can’t catch a break. If it’s not a load of “V’s” indicated by some obscure data point (like the otherworldly spike in US home ownership levels), then it is Jay Powell who is clearly gunning for the US currency. He can’t kill it fast enough, having had more than enough of King Dollar. And you obviously never, ever fight the Fed.

While all of that is hideously untrue, of course, I suppose it still comes out as a small measure of progress. You only have to go back in time a couple of years, early 2018, when conventional wisdom said a rising dollar was a good thing. Strong dollars. No more of that except in the smallest pockets of this ongoing monetary ignorance.

When a top central bank official promises that he’ll have to continue to do a lot, a lot more than the huge amount already done, that’s a good thing?

Obviously not, but that’s the day and age we live in. While more finally recognize the dollar’s direction for what it truly means fewer, it seems, are able to understand why it moves like it does. Powell’s got little to do with it except in these circumstances where he’s obviously failing.

I’ve written the same thing ever since QE2 in the US (and I believe I wrote it up previously almost word for word in a short note to long ago clients about QE2 in Japan, but that was all the way back in 2001 and was never published anywhere) – if you have to do it twice, it didn’t work. At the very least, it couldn’t have been “quantitative”, now could it?

When in the middle of 2010 Ben Bernanke realized he was in big trouble even after the inflationary panic associated with QE1, he went ahead with QE2 despite a whole lot more forceful and widespread (ultimately wrong) criticism over how he was surely going to destroy the dollar in the process. Brazil’s Finance Minister at the time, Guido Mantego, accused the Fed Chairman of igniting a currency war with his “reckless” “money printing.”

But if the Fed was tanking the dollar, why didn’t the dollar tank? You can argue that such wasn’t the goal of US QE, still there must be something wrong with the textbook view. Whether intentional or not, by all established accounts the dollar “should” have fallen and fallen further. That’s why when Minister Mantego showed up on TV and all over the internet everyone just nodded their heads.

See what I mean about not understanding either QE or the true power behind the dollar’s exchange value?

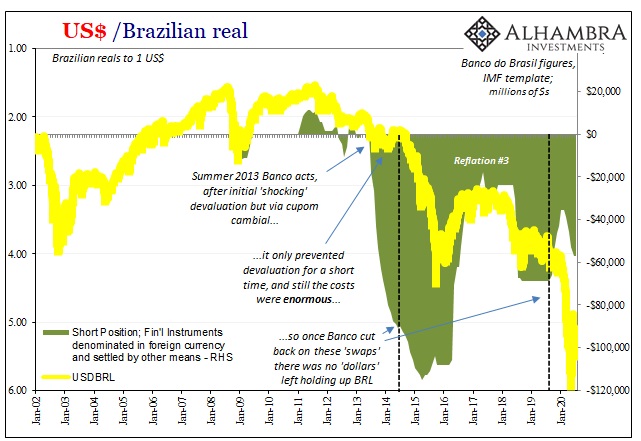

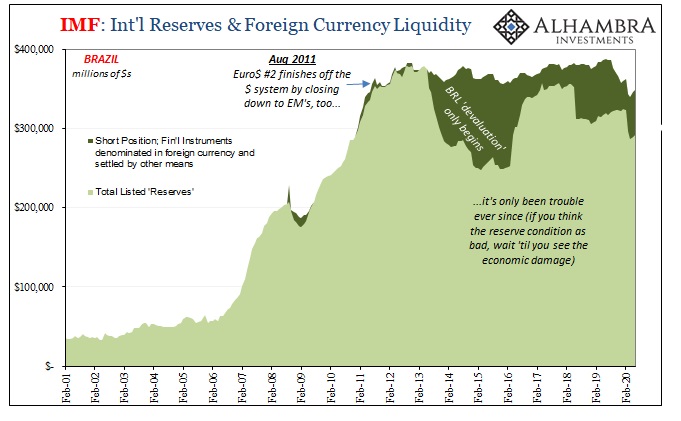

Within months of making headlines around the world, Euro$ #2 instead showed up in Montego’s Brazilian system and began forcefully debunking those “debasement” claims while simultaneously wrecking, in a growing deflationary manner, the parts of the global economy which previously appeared to have had escaped GFC1 (the first global dollar shortage) – starting with Brazil.

Less than two years, it was Brazil’s currency, not the dollar, which would slide uncontrollably toward painful oblivion – a forced, not voluntary, “devaluation” that the country still struggles with to this day. The eurodollar system matters, not Fed Chairmen.

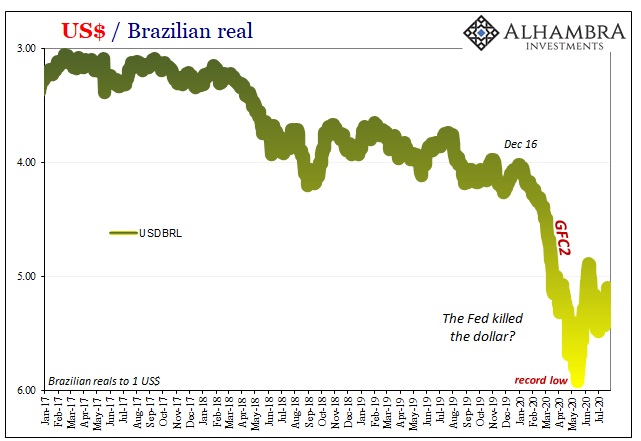

If Jay Powell is busy killing the dollar, as is widely claimed right now, nobody asked the Brazilians about what they think and are seeing on the matter. While the real is up a little bit from its record low set in later April (after weeks of “money printing” didn’t move it), it really isn’t; not meaningfully different despite all the fuss about the dollar’s decline.

To the contrary, in addition to re-imposing the ridiculous (soon-to-be thrice failed) swap program to try and steady the local currency because Powell’s bank reserve bonanza hadn’t, Brazilian reserve managers and central bankers have been left to mobilize gross reserves (selling UST’s, if you like) on top of swaps. As a result, this combination has left that system with the lowest net level of “reserves” since the worst in 2016.

All that for the smallest, almost certainly temporary rebound in BRL.

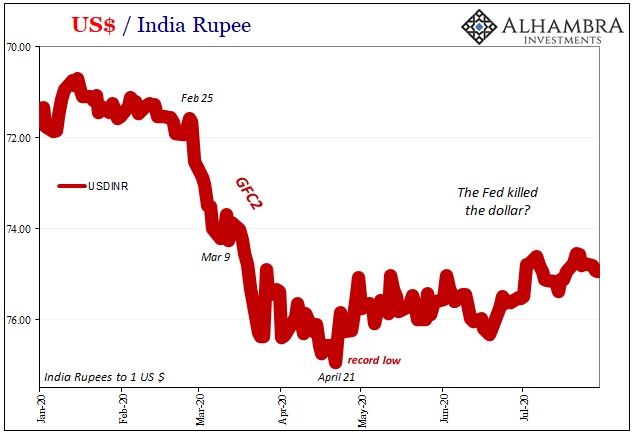

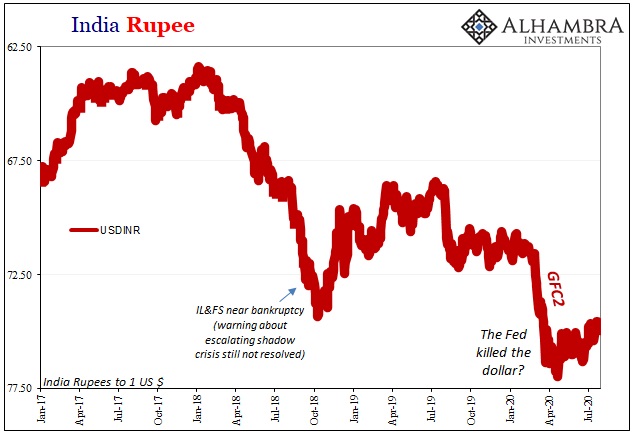

OK, but that’s just Brazil and they’ve got COVID problems. What about, say, India? The rupee, you might be surprised to learn, has traded entirely too much in the same way as the real post-GFC2. In fact, that’s really the point, one that I’ve made several times recently.

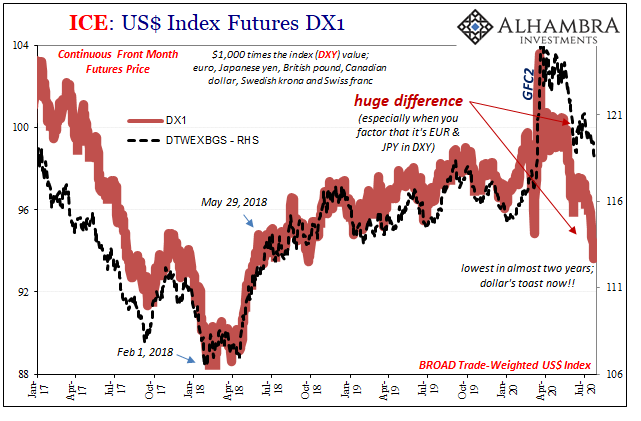

The broad dollar hasn’t budged, it’s only DXY which has.

The rupee hasn’t really rebounded, either. Better than March/April isn’t a realistic standard, and it is totally the opposite case from Jay Powell’s so-called position of dollar death. In fact, the rupee is lower right now, meaning the dollar higher against it, than it was in the panicky weeks leading up to IL&FS’s near demise in September/October 2018.

This latter event wasn’t the end of India’s monetary problems, especially as they related to shadow money conduits, rather it had only marked the beginning. Euro$ #4 had already maintained its steady grip on the Indian currency and then near-seamlessly handed India off to GFC2.

Even when you look at it year-to-date, it’s not very impressive. And this very small uptrend is far less when you appropriately analyze it within the broader context (of time and position).

All that’s really happening so far as the dollar’s demise may be concerned is that the euro is rising with the yen joining in. The former is largely irrelevant as it pertains to the real stuff behind all this, the shadow money eurodollar system’s clearly still-perturbed state, while the latter suggests worse to come within it (maybe just around the corner).

Like Euro$’s #1, #2, and #3, fixating on the euro alone will leave you out in the cold while the renewed heat of the (euro)dollar’s squeeze burns through the global economy (for another time; see: March 2020; and also widespread forecasts for the dollar’s demise, February 2020).

Thus, when Jay Powell promises, as he did today, that the Fed is going to be doing a whole lot more for a whole lot longer, is that a good thing? Is that a weak dollar thing? It wasn’t for Bernanke, so what’s changed since? Or, is this all just more rising dollar stuff causing Powell to react in the same way it once moved Bernanke while fooling every last one of their same loudest critics (though unfortunately never silencing any of them)?

Powell doesn’t have it within his hands to kill the dollar. Even if he did, like the rest of them, like March, he wouldn’t even know where to look to begin doing so.

Stay In Touch