———-WHERE———-

———-WHY———-

[Emil’s Summary] Baseball. Summer. The nation’s pastime. For well over a century the sport has nestled itself in the romantic nook of America’s soul. Its greatness captured in sentimental movies like The Natural and Field of Dreams. But light is balanced with darkness and for all its majesty the sport bears scandals and self-inflicted wounds: the 1919 Black Sox, a racial barrier. And of course, there’s that gray space between light and dark where tragi-comedy lies. The 1888 poem Casey at Bat. Yogi Berra’s relationship with paradox and irony. The Red Sox and the 20th century.

Like any phenomenon, the game has a full life that cannot be reduced to just one idea, one moment, one game. To do so would be the height of chutzpah and ego. So let your podcaster oblige. The greatest game ever played was on February 2, 1946. Known as the Baseball Bugs game it took place in New York City’s famed Polo Grounds where the Tea Totallers hosted the Gas-House Gorillas. The aged Totallers – one could even go so far as calling them elderly – were no match for the unshaven, cigar chawing players with shoulders as broad as the outfield placards. By the fourth inning the visitors were up: 96 to 0. So total was the farce that the home team turned to fans in the outfield for help. One such wasn’t even a man. Or woman. It was a rabbit. Bugs Bunny.

He struck out the first Gorilla with fastballs. Then – well – he changed baseball history with a single, off-speed pitch that struck out the side as three Gorillas swung three times each before the ball reached the plate. Players ever since have attempted to recreate the throw. And though pitches such as the Fossum Flip, Super Changeup, balloon ball, parachute, gravity curve and the Monty Brewster have come close, nothing has been seen like that magical day in 1946. Nothing until America’s central bank came up to bat on August 9, 2007.

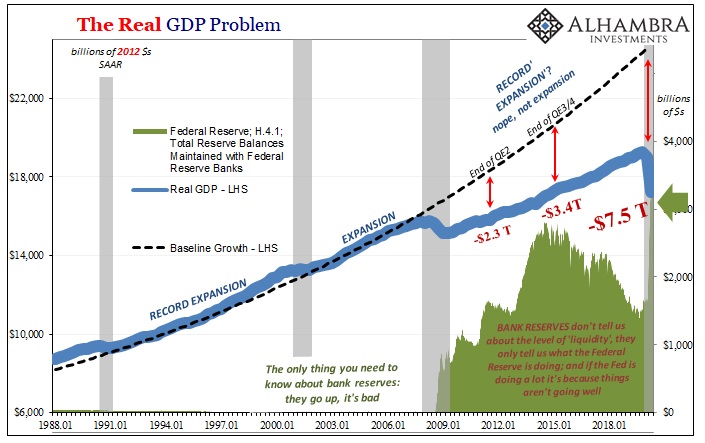

For 13 years the Fed has been hacking at the same pitch of monetary disorder. And unlike the Gas House Gorillas, apparently there is no limit to the number of swings it can take at this slow-moving soap bubble. In this, the Frank Robinson episode of Making Sense, Jeff Snider recounts just the three most recent strikes: Gold, Dollar, and Inflation Expectations. As part of the discussion we’ll talk about Goldman Sachs’ claim that “real concerns are emerging” about the dollar’s reserve currency status and note that negative yielding US bonds are only a hare’s hair away. Also, the Euro, the yen and other important things like Magnum PI’s mustache and whether Jeff likes baseball.

———-WHEN———-

00:05 The DXY dollar index doesn’t include emerging market currencies.

01:07 Is a weaker dollar good for the United States?

03:02 Many officials, internationally and in the USA, believed QE would devalue the dollar. It did the opposite.

10:33 Are the Russian ruble, Indian rupee, Chinese yuan telling the same story as the Brazilian real?

12:10 Why isn’t Europe’s euro acting like the US dollar and Japanese yen as safe haven?

———-WHAT———-

OMG The Dollar!!!: https://bit.ly/2XfRamq

Kevin Warsh Quote (Jerome Powell Is a Barely Adequate Writer of Fiction): https://bit.ly/2BNmHV3

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch