Unlucky number thirteen. Sunday marks the thirteenth anniversary of the day in which everything changed. It hasn’t yet dawned on history because the history of this age hasn’t yet been written. It’s been scribbled down in notes and anecdotes, of course, as we’ve moved slowly along the X axis further toward the right. Yet it’s the Y axis where together enough people haven’t quite noticed what’s exactly been missing for all this time.

We’ll notice it much more this year on the thirteenth anniversary than we did on, say, the eleventh or the seventh. Anniversary of what, you ask? Three-month LIBOR moved 12 basis points. Yep, a whole dozen. Wow, right?

However, as unappreciated seeds go, it just hasn’t been the same for the world since they were planted in the lamentably fertile dirt of the unimaginative. I wrote six years ago on that seventh (or, one day beforehand):

To dryly observe what happened understates the severity of the event, as London trading for “dollars” saw an inordinate discrepancy that cannot be fully comprehended by mere factual recollection. On August 9, 2007, 3-month LIBOR rose from 5.38% to 5.50%; a trivial number at first glance. But in the context of global dollar flow, it was an immense tremor that kicked off the spate of “emergency” monetary measures that ultimately followed.

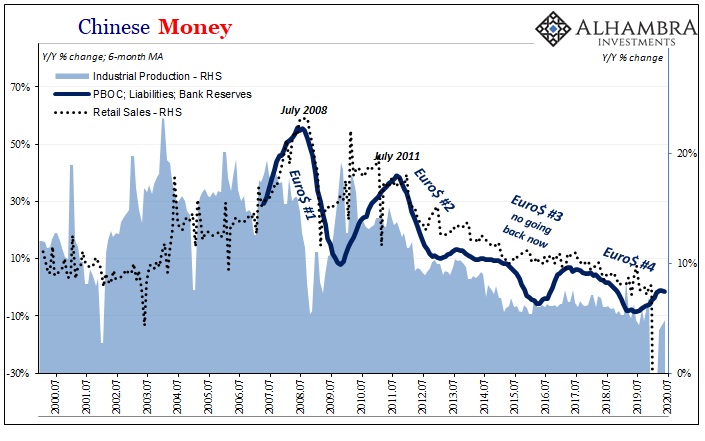

What did follow from August 9, 2007, was far more than a global dollar shortage, indeed more than the first global financial crisis since the dreaded and dreadful 1930’s. While subprime mortgages then and now fill out the catalog of excuses for it, even the literal happenings betray their mighty significance.

That meant that for more than a month, eurodollars were in very short supply, as LIBOR persisted above its previous structurally apparent relationship, at the same exact time federal funds were “overly” plentiful – and thus the geographic fragmentation that eventually led to panic was opened, never to be resolved by a policymaking framework incapable of understanding exactly that. For “dollars” to be at odds in such dramatic fashion on both sides of the Atlantic, ostensibly delinking banking institutions from themselves (their subsidiaries) was the end of the road for the financial system as it existed from the 1980’s to that point. It was, from there, a fully violent paradigm shift.

Except, no, it wasn’t. Not truly. The term “paradigm shift” is well-known, of course, but bastardized from its origin, a not insignificant change in its scope and meaning. And in the context of this monetary system and what it has wrought, and what it will, someday, look like to escape from it, only the original meaning can count.

Dr. Thomas Kuhn wrote his groundbreaking opus The Structure of Scientific Revolutions fifty-eight long years ago. It isn’t lost on me the timing, an age of revolution in a lot of things perhaps more than anything the global monetary system.

What Kuhn had been seeking was an answer to an anxiety that had truly bothered and perplexed him; as it would any of us. Was Aristotle an idiot? No, seriously, because, as Kuhn later testified, to the modern educated man it sure seems like he must have been.

The question I hoped to answer was how much mechanics Aristotle had known, how much he had left for people like Galileo and Newton to discover. Given that formulation, I rapidly discovered that Aristotle had known almost no mechanics at all. Everything was left for his successors, mostly those of the sixteenth and seventeenth centuries. That conclusion was standard, and it might in principle have been right. But I found it bothersome because, as I was reading him, Aristotle appeared not only ignorant of mechanics, but a dreadfully bad physical scientist as well. About motion, in particular, his writings seemed to me full of egregious errors, both of logic and of observation.

Lionized in the Western canon, there was simply no way to come to a conclusion that a man standing atop it could have been what he sure seemed to have been.

The answer, as Kuhn painstakingly detailed by examining scientific progress itself, was this concept of a paradigm shift. Progress is not linear, rather it quite often goes for a very long time in a settled state – no matter how unsettlingly wrong that state – before the lightning of truth strikes someone, somewhere, in the process sparking the revolutionary new thought.

Aristotle was no moron; he was an enlightened intellectual within his own paradigm. Back to Kuhn:

There is no way to “correct” Aristotle’s views about the void without reconstructing much of the rest of his physics. Those remarks, though both simplified and incomplete, should sufficiently illustrate the way in which Aristotelian physics cuts up and describes the phenomenal world. Also, and more important, they should indicate how the pieces of that description lock together to form an integral whole, one that had to be broken and reformed on the road to Newtonian mechanics.

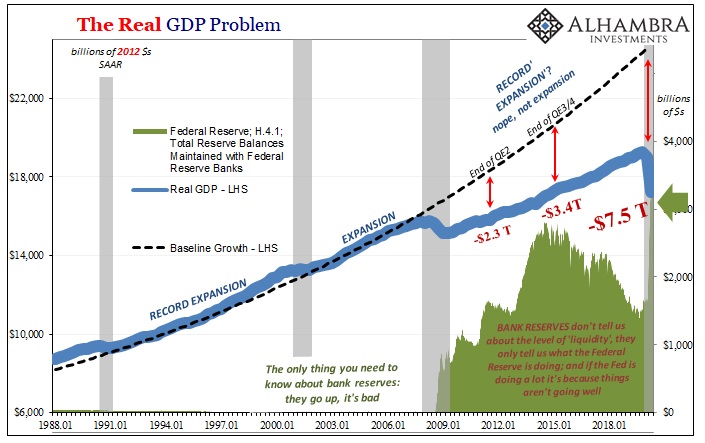

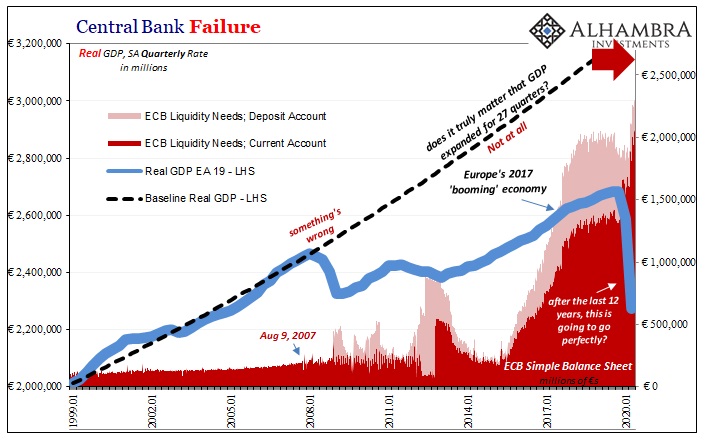

For our purposes here, those which are spinning into greater and greater consequences, as distinguishable, obviously, from better and better circumstances, August 9, 2007, had not been, strictly speaking, a paradigm shift. The system broke and from that day forward it has operated differently, plaguing all of mankind as it stays this way with QE’s lumbering toward numbers in the double digits and useless, inert bank reserves piling up into the tens perhaps hundreds of trillions (where Japan already is).

No, instead “our” gross misunderstanding of what had happened has meant the science of that monetary system remains as dark and unilluminating as it was on August 8. And that, dear friends, explains how thirteen years later this damnable anniversary still matters.

The system changed, and it change the whole world; our conception of it hasn’t.

Jay Powell, like Janet Yellen and Ben Bernanke, is no idiot. These are extremely intelligent people who most often possess and act on noble instincts and honest intentions. What they lack is the same thing Aristotle lacked for figuring out how the world actually works. Theirs is an approximation, a too-undeveloped frame of reference and worldview therefore unsuited to the task they have before them; that much was made clear only starting on August 9, 2007.

Where they’ve taken themselves, and us, off the rails is in refusing to recognize persistent signs (conundrums, if you like) which demand a more thorough and comprehensive introspection. It’s not stealing, but it is a dastardly form of corruption. Natural, understandable, but no less contemptible.

But therein lies salvation. The key to escape and a much brighter future lay in nothing more challenging than knowledge. Once the spark of scientific revolution reaches its critical state and a critical mass, humanity’s better angels will take it from there. When the paradigm does truly shift, as it will, truth in the modern age though elusive never constricted in the way it had been for much of the ancient epochs, not one answer but many will be put forward.

Ingenuity to this point has been totally unmined if only by the continued darkness of the pre-August 2007 mindset which prevails, and it will be unleashed finally by the revolutionary truth-bound future understanding can only stake.

In that way, a thirteenth anniversary is actually cause for (modest) hope. We are, must be, and ought to be, one year closer to the real paradigm shift. Having suffered through the prior years, there’s now one fewer year left for the world to struggle in that uneducated, destructive state.

People think of me as a full-blown, irredeemable doom and gloom-er and they are right to do so. Since August 2007, yes, I have definitely been one. And I will continue to be so long as the (mountain of) evidence keeps piling up in that way. Unlike 2017’s globally synchronized growth debacle, I need not grope around for molehills to hard sell full of hot air.

It’s everything – the way the dollar has dependably behaved, the bond market, interest rates (kudos to Milton Friedman for being proven right yet again), curves, China, even China’s RRRs, global trade, global growth, inflation, lack of, and on and on. A consistent and consistently tested worldview backed up by everything more than shrieking politics.

But, I fully, completely expect this gloom will come to an end. In just the last decade I’ve gone from a wilderness of where no one thought this could be even remotely possible (Dollar shortage, hah! Ever heard of QE?) to grudging acceptance of at least the evidence if not completely the interpretation of it (I see what you mean when you say central banks aren’t central, and there’s definitely a lot backing up that position, but that can’t be possible because everyone says it’s not!) to just in the last few years the words “dollar” and “shortage” not just being used more commonly but at times correctly being connected to a rising dollar that otherwise has mystified conventional analysis.

It is happening. Slowly.

When the paradigm does shift, when monetary science finally does reassert itself by throwing off the shackles of the prior paradigm of Positive Economics (damn Milton Friedman), that’s going to be a really good day; indescribably good. What follows after that day will be the mirrored opposite of what has followed from that awful day thirteen years ago.

It won’t be a single day, of course, but on this one day, the thirteenth anniversary of August 9, I’ll imagine it that way. A true watershed moment for the next golden age we are now that much closer to achieving.

For more on this topic, August 9, 2007, you can explore the links below to the Lost Decade – a deeper dive in to the heady events which sent the world spinning off its prior axis.

The title of Fitzgerald’s little gem is quite appropriately The Lost Decade. There is a quite a bit packed into what amounts to a few short pages of text. It is in many ways a parable of the Great Depression, people’s memories simply halted by the events of 1929; forcing them to live out the next whole decade in a sort of queer stupor very much like toxic, persistent drunkenness. The world that they knew when sober was gone, and there was both sadness and harsh reality to be mixed in a life wholly unexpected.

We can all, unfortunately, relate.

The Anniversary: No Going Back

It has yet to be fully digested how much the 2008 panic was centered in London rather than NYC or Wall Street. We know all about Bear Stearns and Lehman Brothers, but hidden is the vicarious pathways through which even American banks were depending on their London subs for both funding and to offer themselves alleviation from regulation. Eurodollars represented the “Wild West” of finance; boosted out of the “necessity” (created by profligate governments) to find an alternative to the gold standard which proved too much of a restraint on command.

You’ve Heard of Bear’s Funds, Why Not BNP’s?

BNP’s MMF’s do more to express the utterly complicated (and often contradictory) nature of the mature eurodollar system in comprehensive fashion than perhaps anything else. These were European money market funds domiciled in France and Liechtenstein sponsored by a French bank invested primarily in US$ ABS to beat euro money market rates. What matters about geography here?

If someone had told you in 2006 that the Federal Reserve as well as all its central bank cohorts around the world would expand their balance sheets well into the trillions, and more that such expansions (LSAP’s) wouldn’t work, you would have thought them clinically insane for just the mention of it. Ten years of lost economy is beyond our limited human everyday skills for comprehension.

August 10; Emergency Calls, Reigning Confusion, and ‘Not My Job’

It was a global crisis for banks, which is why the ECB, Swiss National Bank and others were practically begging the Fed for swaps.

Even when debating what they at the time called the ACF, making dollars available by parallel onshore and offshore auctions, they still never viewed these funding markets as they were. To these policymakers, all that mattered to each central bank was what the banks in their respective jurisdictions were doing. If banks in Europe were having dollar as well as euro issues, that’s for the ECB to handle. In fact it was easier for policymakers to think wrongly on the subject because they were having euro as well as dollar problems.

So what we ended up with was Swiss banks supplying “dollar” liquidity so that European banks could create “short” “dollar” positions in order to finance a real estate imbalance of historically immense proportions inside a country on the other side of the Atlantic. What is a dollar in that arrangement?

Stay In Touch