Forget scripted television. If you want Game of Thrones-style palace intrigue, you can do no better than Beijing in 2020. There are all sorts of rumors floating around, few of which can ever get confirmed. It’s not that there are rumors but rather how many of them, and how they don’t seem to be stamped out with the usual regularity and gusto befitting Emperor Xi’s post-19th watershed.

And that’s largely the focus – Xi taking his foot off the economic gas pedal as he dictated way back when. Not that China much controlled it anyway, the Chinese leader simply bowing to reality. Many of his rivals, and there remain quite a few (princelings, mainly), seem to be uneasy about how the Communist leadership is just letting the economy go down without much of a fight.

On July 31, for example, the global news media was alive with the Chinese’ alleged replacement for the US GPS system. Always Xi vs. Li (Keqiang, China’s nominal number two), there were whispers of number one purposefully humiliating his second at the ceremony.

While heralding the Beidou-3 satellite network, Uncle He when he purportedly announced the names of the high ranking officials in attendance so as to let each of them bask in the customary (forced) round of applause quickly didn’t do the same for Li – who stood expecting to be given time to savor his ovation only to have Uncle He quickly move on to the next in line. A chastening dishonor for someone in his position.

If it’s true.

Even more serious than that is the possible ongoing housecleaning over at the Political and Legal Affairs Commission (PLAC), the Chinese equivalent of the US Justice Department (only without the federalism). It is the bureaucracy which overseas courts, police, both secret and regular, and especially prisons, both special and regular.

Whenever Communist authorities have needed to purge rivals in Communist China they’ve done so by conducting wide-ranging “corruption” probes. They’re all corrupt, so it’s not that difficult if you gain the disfavor of someone higher up or more influential.

There’s been one reported to have been ongoing for the PLAC pretty much since Xi Jinping took power back in 2012. This had been where many of his rivals, the princelings, or their descendants, had been left any power base (Xi’s is instead the military).

On July 8, the Secretary-General of the PLAC, Chen Yixin, announced that another round of investigations within his agency were imminent:

The PLAC teams are impure, unjust, and lack executive force. Some members even violate law and discipline. They are bad horses, have bad impact, and have done great damage. We have to turn the blade to face ourselves … in order to treat the problem.

This has led many observers to speculate about potential dissension high up in the authoritarian structure. Xi’s status as unchallenged leader may not be as unopposed as outwardly it can most times appear.

It’s not like China as a country isn’t facing a barrage of problems, only beginning with the rain. COVID, yes, but more so the global backlash. Short-term economic problems that are being met with long range plans for supply chain independency which necessarily means less and less to include the Chinese. Then there’s Hong Kong.

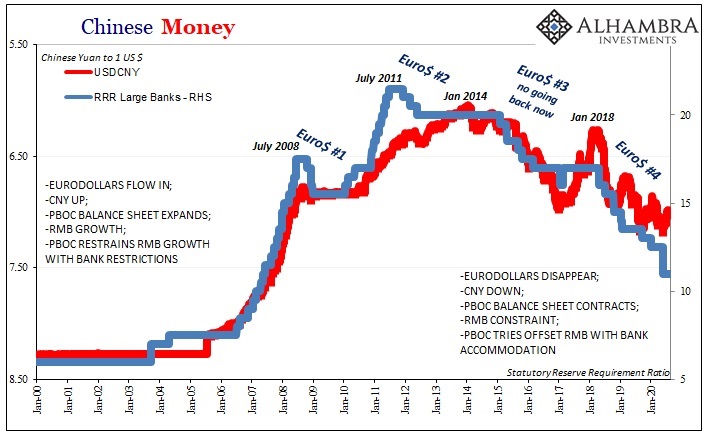

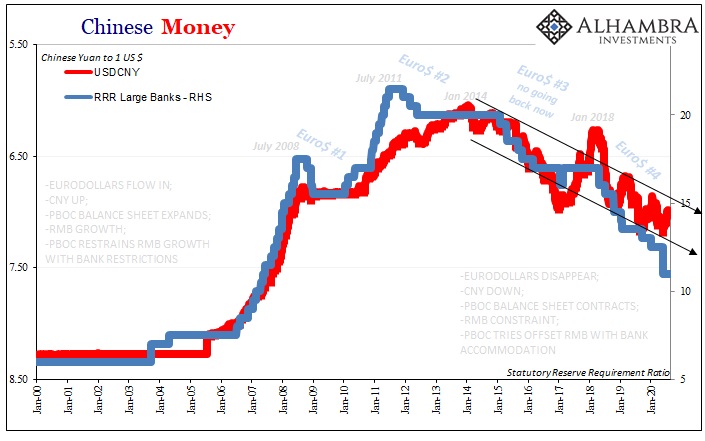

And above all, an economy that hasn’t been “right” since 2011. Why 2011? Easy:

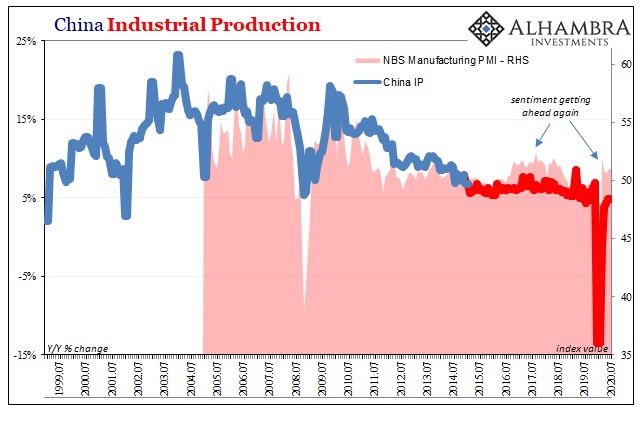

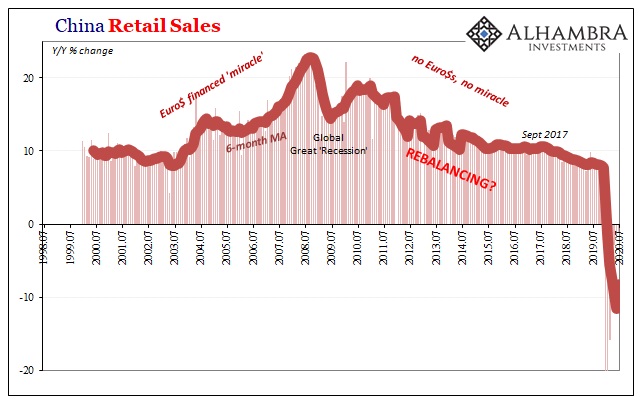

China’s latest batch of economic numbers – the Big 3: Industrial Production, Retail Sales, and Fixed Asset Investment – all paint a picture of a system still struggling with this year’s travails to say nothing of the longer-term decline which almost certainly is playing a role in making recent difficulties stubbornly worse as well as the political fallout they may be unleashing.

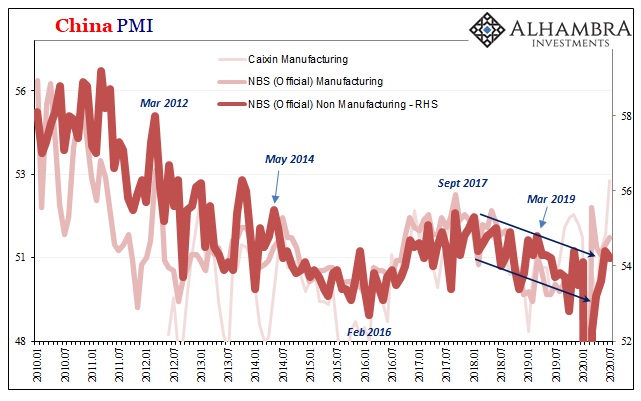

What I wrote earlier today about how to view US retail sales and industrial production applies more so to China which is several months further along in the rebound/reopening process. It’s actually not good that in some accounts, like IP, everything just went back to where it was beforehand. Year-over-year growth in industry during July 2020 was a disappointing 4.8%, which is only now getting back to around the same rates of concerning expansion Chinese industry had posted all throughout the preceding months and year.

That’s not how a recovery behaves especially following a huge decline. And that’s the good data.

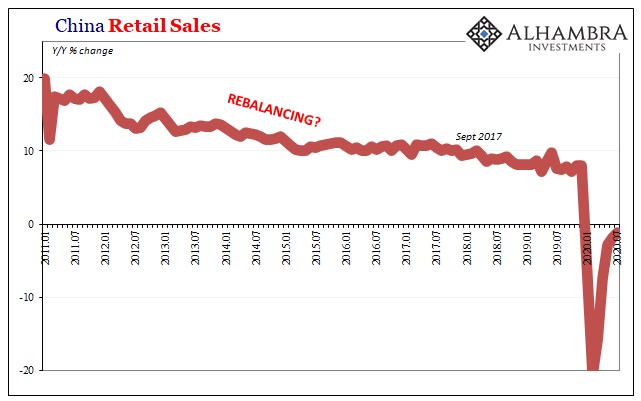

Retail sales suggests much, much worse; still contracting, -1.1% year-over-year last month. No more needs to be said, especially after five months of rebound/reopening.

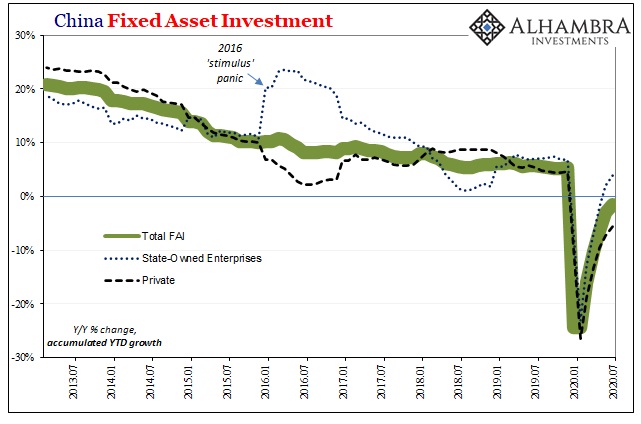

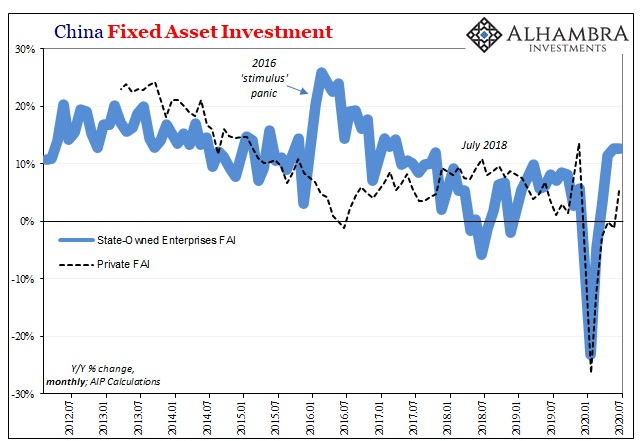

I think the big one, though, at least in terms of the political situation is FAI. While government or public (state-owned) FAI has been pushed solidly higher, it’s nothing like what Li Keqiang’s faction had attempted back in 2016. And so far as 2020 is concerned, China’s economic problems are an extreme compared to even the nastiness of Euro$ #3 back then.

Again, it suggests that Xi’s bloc including Uncle He (real name Liu He) who are in charge of the economy portfolio are just letting the economy go where it will – no matter how unsettling that might be.

I do wish there was more confirmation available or even possible for these kinds of things, including some of the data (Why would IP like China’s NM PMI just go right back to where they left off? That doesn’t seem too natural to me.), but Communist regimes aren’t known to be forthcoming. Xi’s predecessors while pledging more openness did so with a wink and a nod.

Since October 2017, however, the 19th Communist Party Congress, it’s been a long, slow ride down into these depths while the increasing authoritarianism of Xi Jinping might have been as much about internal control of his government as internal control over the Chinese people who will be surprised to find out what the lack of growth can really mean for a strained system.

Even if we can’t verify the rumors, that they persist is, again, itself a signal; as much of one as the alarmingly lackluster rebound projected by the major economic accounts in July. I mean, forget central bankers and Economists who had deluded themselves (and the public), it was Xi Jinping more than any other official who had first signaled the slide from globally synchronized growth down into the depths of globally synchronized downturn and recession (Euro$ #4).

That was October 2017, during full-on Inflation Hysteria 1, all before what the Chinese and the rest of the world now faces in 2020. Inflation Hysteria 2. This time also China style?

Stay In Touch