You have to laugh at the absurdity of the puppet show theater. A few months ago when bond yields backed up a little bit, as they do from time to time, everyone from Bond Kings to Dollar Crash-ists to Economists to just about every writer at the Wall Street Journal and Bloomberg became fixated on yield caps (or yield curve control, if you prefer the extra helping of myth).

And why wouldn’t they? Given the existing intellectual paradigm which posits the central bank at the center of the economic universe, Jay Powell hadn’t just saved us from GFC2 he just may have overdid it. Inflation had become, they all said, our primary danger. Forget the huge economic and financial crater that were in, the Chairman of the Federal Reserve had explicitly declared a biblical-scale flood.

For policymakers, the talk of yield caps and the alleged justification for them was a good problem to have after having stared into the face of monetary deflation. We can all agree, at least, on that one thing: deflation is, by far, the worst of all monetary evils (h/t John Maynard Keynes).

What are we to make of, then, how several months later on it seems the idea of yield caps may officially have been declared DOA? This latest written FOMC policy pablum is noteworthy only for what’s not really in it. Yield caps have fallen well out of favor (despite continuing angst over “Treasury market difficulties” that are, in reality, of a very different sort than these people will ever be able to conceive).

If ripening fears over inflation mean that monetary authorities will have to impose yield caps, their growing lack of interest in them must therefore mean…? If you’re an Economist, even more inflation!!!

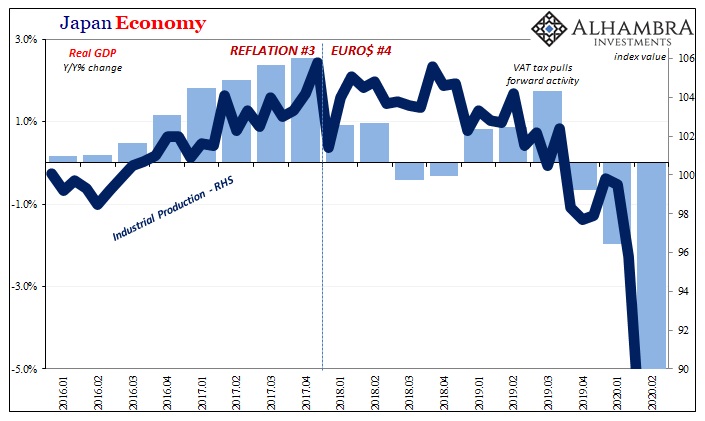

There are very grave economic consequences to this stuff that have less to do with consumer prices than the CPI. Deflation in this colloquial sense means monetary restraint upon growth and recovery rather than specifically 1930-style collapsing prices. It is the former that we’re grappling with right now while, contrary to the Bond Kings, we’d also be wise to keep an eye on (the return of) the latter.

We’re a hair trigger away from negative UST yields, not runaway inflation.

Contrary to another popular misconception, this isn’t just a bond market thing. Inflation, we’re told, is bad for stocks. And history has shown that, yes, during periods of uncontrolled consumer price excess stocks don’t do very well.

But what about more recent history and data? For one thing, we don’t really know about how stocks perform with inflation because there has been so very little of it (despite constant official efforts to change that). What we can analyze, and what’s relevant to our analysis here, is inflation expectations and really what must be driving them.

To begin with, stock prices absolutely bely the notion that Fed “money printing” is behind the general rise in share prices. Not only is this idea technically inaccurate, it’s historically ignorant as I pointed out rather recently. Instead, we can pinpoint the central bank’s influence as specifically expectations – and therefore whether or not share prices are acting in agreement with how central bankers are attempting to manipulate them.

While the Fed was reducing the level of bank reserves on its balance sheet back in 2017 the market had been gripped by a sense of pure euphoria fed, in large part, by those very things. Why? Not “money printing” but:

Ironically, the Fed was signaling to portfolio and fund managers this time through rate hikes as well as eventually quantitative tightening. In the immediate aftermath of the crash, QE and bank reserves were meant to convey conditions supposedly consistent with a low risk environment (conducive to broad share buying) because of all the “money printing.” By 2017, rate hikes and QT were meant to convey the same thing this time due to economic growth and recovery in reinforcing the message that QE and bank reserves had worked!

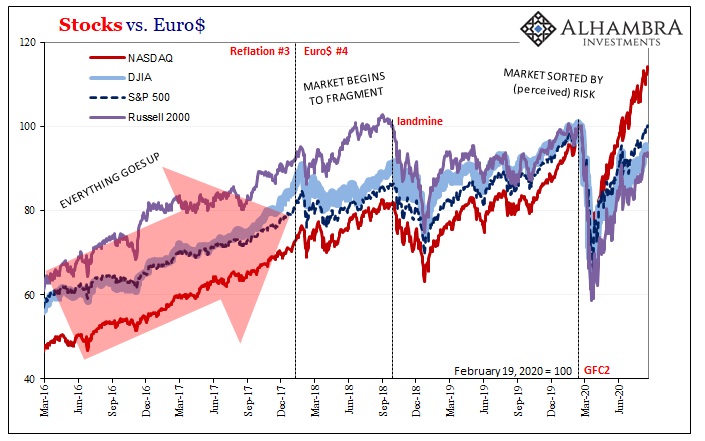

Thus, inflation expectations during Reflation #3 were driven by a confident Fed moving forward with “hawkish” intentions like rate hikes and QT. That signaled to the stock market our “best and brightest” economic minds foresaw little to nothing which might impede the economy’s magnificent and impressive future acceleration.

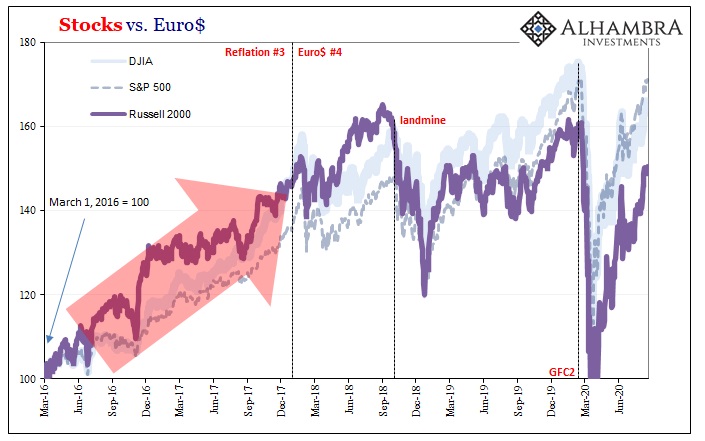

In terms of specifically inflation expectations, the higher those went (in mainstream perception as opposed to market-based bond views), the more hysterical the inflation forecasts, the higher share prices soared. All shares. These positive inflation expectations were very much equity-positive.

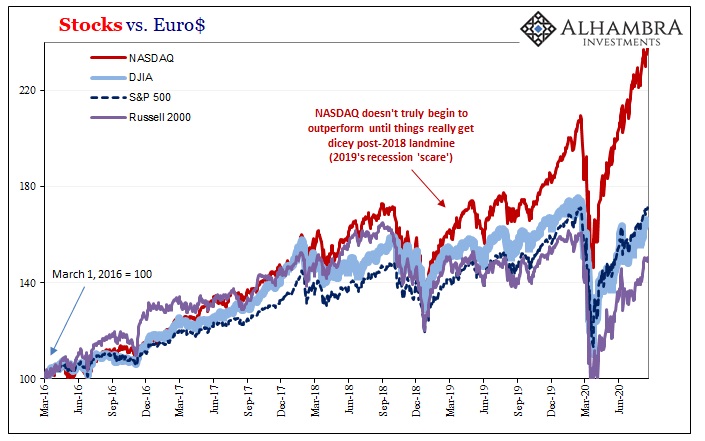

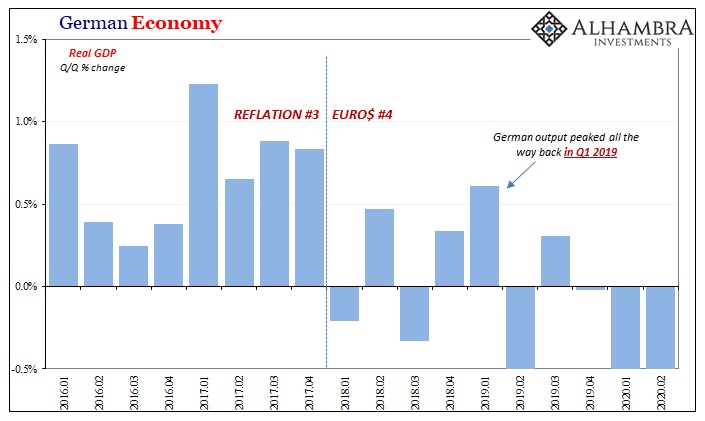

Look what happened, though, once Euro$ #4 emerged. Suddenly, as the economy was stopped in its tracks, the uninterrupted bull market on Wall Street got interrupted. It wasn’t halted, but stocks have noticed the change. While mainstream reports about inflation expectations barely budged, especially during 2018, share prices began to shift toward more like the bond market view.

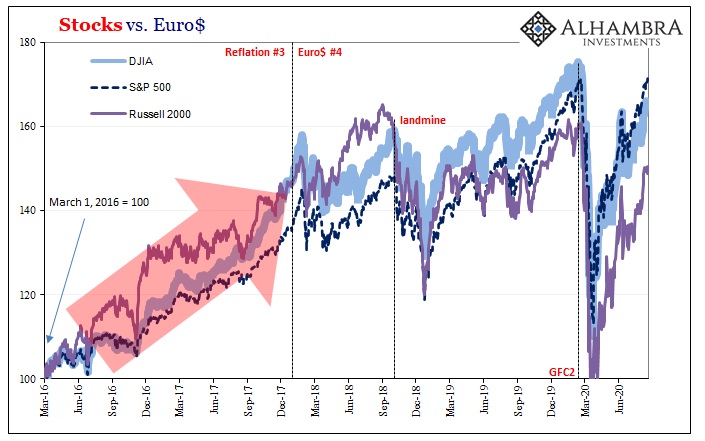

That meant stratifying equities by gross perceptions of risk. In other words, whereas every part of the stock market had participated in the inflation expectations boom (which was all globally synchronized growth really had been) during Reflation #3, beginning with Euro$ #4 investors have increasingly avoided the riskier ends of the spectrum preferring their own version of flight-to-safety.

It’s most evident at the opposites. The NASDAQ continues to be widely looked upon as invulnerable, the least risky (valuations don’t matter), made so by its top-heavy format dedicated to the indestructible FAANGs. At the other end sits the DJIA and Russell 2000. The S&P 500, the big caps, lies in the middle but more toward the bottom than the top (even for large caps, including 500 of them is more significant exposure).

The Dow is a stock average comprised from the shares of industrial companies. Where has the deflation of Euro$ #4 been most obvious in the real economy? Trade and industry.

The Russell is by definition hugely exposed to smaller companies which don’t fare well at all under our colloquial definition of deflation – which is exactly what the shift to Euro$ #4 represented. As a result, the Russell hasn’t been devastated by any stretch, but it is lagging each of these other indices and the current level today remains significantly below its record high as well as below the index value posted back at the end of Reflation #3 more than two and a half years ago.

Stock investors may be more sanguine about things than bonds, but they are demonstrably aware of this change in general condition (the balance of expectations shifting toward the deflationary side) brought out by the renewed global dollar shortage and its quite predictable effects on the global economy.

What had been a uniform bull market began to fragment during 2018, a process which was boosted by late 2018’s Euro$ landmine. Throughout last year and this year, risk perceptions account for the stark difference between the various index performances.

In other words, even the stock market, when you look at it from above, it has, too, transferred out of inflation expectations and if not completely moved toward deflation expectations then at least aware of the growing and real possibilities they might bring about even for these earnings-starved “efficient” markets. More importantly to us in August 2020, they haven’t been moved back even though it’s been reported as fact by the financial media.

The more it remains fragmented, the less perceived chance for reflation-style inflation. In stocks! At record highs!

No wonder yield caps have fallen out of favor. Like bonds, this mainstream obsession over runaway inflation expectations isn’t actually a thing in share prices, either.

The NASDAQ is truly soaring but that’s actually a function of (relative) safety, believe it or not. And even though the S&P 500 is putting in new highs, it’s not at all the same thing as 2017’s new highs (or even those of 2019). Much of the wider market is lagging, no uniform bull in 2020, just the usual inflationary bull.

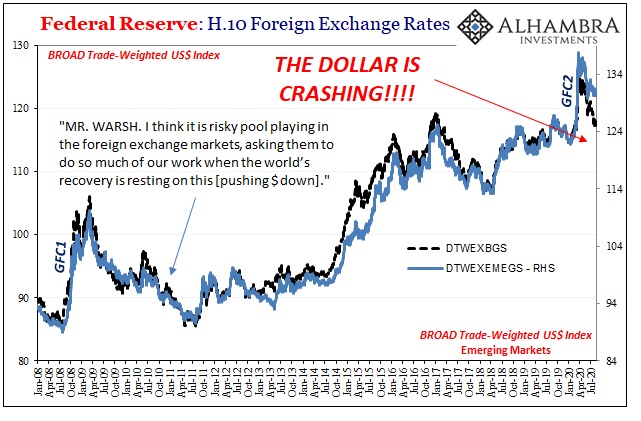

Dollar, yield curve, the whole stock market. It’s now mid-August. Where’s this f-ing flood? It’s only in the pages of the financial media (by design) or rolling off the tongues of these Bond Kings who don’t seem to understand much about bonds, and dollar crash-ists who have demonstrated time and time again their inability to figure out the dollar.

Stay In Touch