Wait, wait, wait. Hold up. The Federal Reserve just concluded its near two-year long Grand Strategy Review. The purpose, in its most basic component, was to figure out why inflation hadn’t shown up in the manner everyone at the Federal Reserve spent years promising even though the unemployment tumbled to 50-year lows.

The labor market was so tight, inflation was guaranteed. Then it didn’t happen.

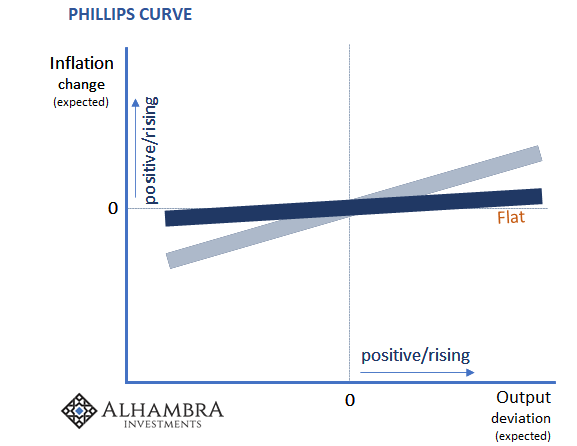

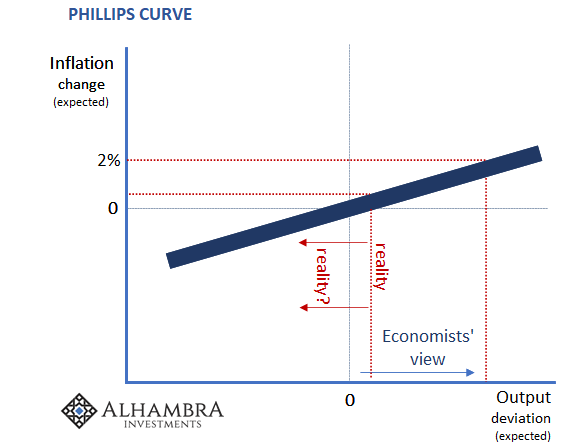

Behind the resulting monetary policy change (spoiler: not a change) to an average inflation target revealed last week first lies a flattened Phillips Curve. As I wrote a few days ago in disbelief over this brazenness:

This [inflation puzzle] has led central bankers and the academic Economists who follow them to wonder if the Phillips Curve might have flattened. As you can see above, with this shape even expectations for a robust economy wouldn’t necessarily create all that much for inflation (because of expectations).

The theory fits the narrative with the unsatisfactory real world results.

OK, fine. But if the Fed now believes there’s not such a tight relationship between a tight labor market and sustained broad consumer price advances then someone didn’t tell the C-suite Ivy Leaguers running Corporate America (or the Wall Street Journal reporters being told to write about them in this way).

Finance executives are increasingly worried about salary and benefit costs as they scrutinize company expenses amid the ongoing coronavirus pandemic, according to a third-quarter survey of about 1,070 executives released Thursday by the Association of International Certified Professional Accountants, a professional organization…Labor costs create inflationary risks for companies, because the rate at which production costs rise can indicate future price increases on goods.

See what I mean (thanks T. Tateo)? Sorry, guys, you can’t have it both ways; either the Phillips Curve is flat, or it’s not. If it is convenient for you to flatten the sucker out in order to attempt a coherent (though dubious) explanation for the past few years not going the way they were supposed to, then you can’t just conveniently go back to the steeper Phillips Curve in order to push an inflationary narrative about an inflationary future that right now not even the stock market is buying (or is it because?)

Please, at the very least, pick one talking point and stick with it.

What’s really going on here is even worse than that. Corporate America is simultaneously exposing itself and the Fed. Before all this latest nonsense, the same survey had shown widespread deflationary expectations in wages. Now inflationary. What changed in between?

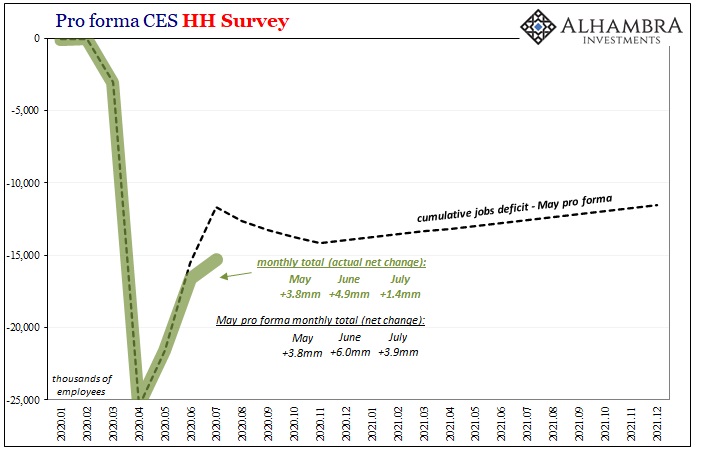

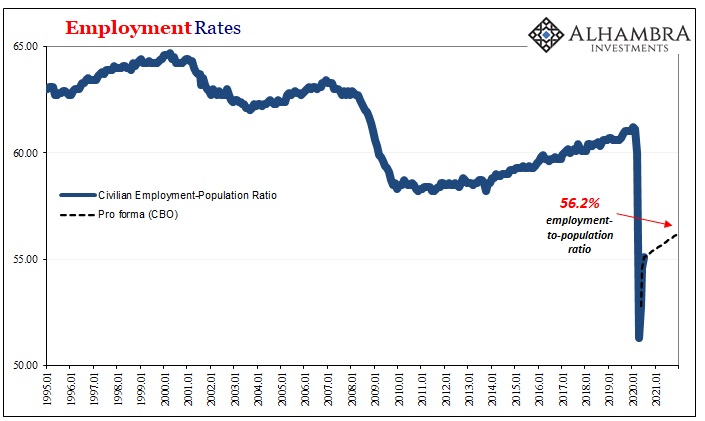

Taking their cues from the central bank, we’re actually supposed to believe that labor costs are going to be businesses’ primary problem with currently 15 million (a number that might not change all that much with tomorrow’s payroll report) fewer jobs than there were just a few months ago. So much slack it’s not just greater than the fullest extent of the Great “Recession”, it’s incomprehensible.

If these corporate suits are simply looking ahead to next year and thinking it’s all easily put back to normal, where would they even get such an idea? There’s no data to support the view, exposing only Jay Powell’s lurid non-monetary influence.

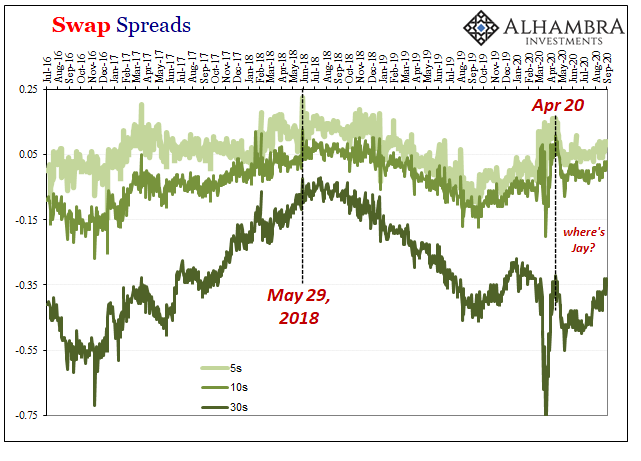

The labor market hasn’t changed, slack abounds. What has is…average inflation targeting. And even though that isn’t actually a change, either, it is definitely meant to be a signal; one that Corporate America quite predictably has dutifully picked up (the inflation story being reinforced continuously since April) and is being actively regurgitated back into the noise of the mainstream ether.

To begin with, do we have to go back and pull up all the quotes from 2017 and 2018? The same ones from when there was only about 15 million or so in hidden or “missing” labor from the unemployment rate’s denominator? Now, there’s still those plus an additional 15 million right out in the open.

But upward wage pressures are the economy’s biggest concerns right now? Of course not. Like the idea just a few months ago that rising rates had been our greatest risk, I’m going to go out on a limb and predict that this whole thing will last just about as long. It’s the timing which stands out.

This is about as obvious as it can be. And it is a direct view into just how unserious many key layers in the real economy are operated. From monetary policymakers (who don’t do money, but keep pretending so that you think they do) to Corporate suits who love, love, love the puppet show.

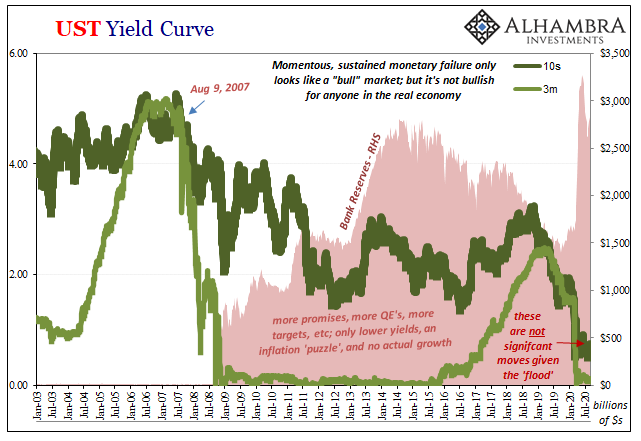

I’m not saying this is some deep conspiracy; it’s not. There is an inflation story and bubble that has been building and perpetuated for months, almost half a year, one that would never get challenged, and is just taken for granted by all those snugly nestled inside of it. Not in the real economy, mind you, nor in the major financial markets (not even a blip there). For quite a lot of smart people, if the Fed says something who would ever think otherwise. After being trained by Economists in all the “right” Economics schools, these people really believe in these things without question.

It’s a worldview, not an always-ongoing experiment nor any attempt at reconciling major differences. So much, they’ll say so to unrelated surveyors quite detached from what’s actually happening downstairs from their offices.

Small wonder, since, via the stock market that loves this stuff, too, the Fed’s puppet show pays the vast majority of their compensation. Insert Upton Sinclair here. The least they could do is pay the Fed some of its generosity back. Even today, at the most obviously ridiculous time.

Rising wage pressures are the biggest worry for Corporate America right now? I’m telling you, it’s harder and harder to argue for capitalism when this is how what everyone thinks of as capitalists operate.

Stay In Touch