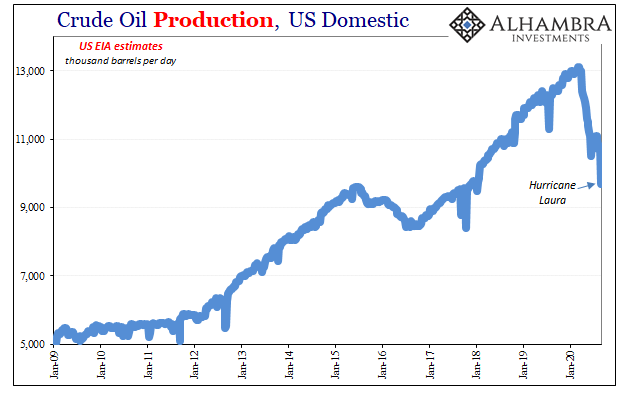

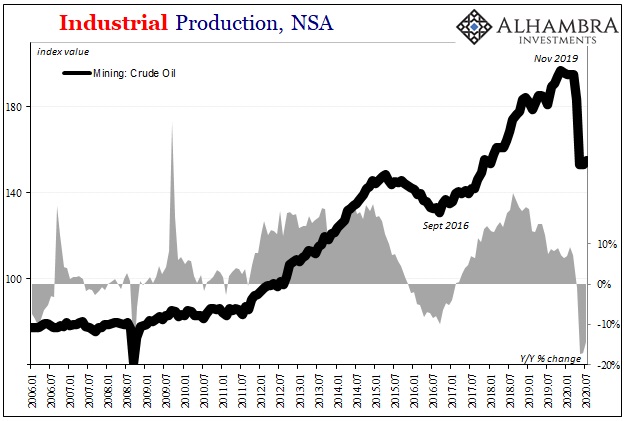

According to the US Energy Information Administration (EIA), crude oil production fell below 10 mbpd during the final week of August 2020. Hurricane Laura had looped through the Gulf of Mexico, forcing the widespread shutting down of drilling and pumping activity throughout the offshore oil patch. It was the first time total American crude supply had dropped below that level since early 2018.

This was, of course, on top of an even larger disruption dating back to the week of March 13. Using EIA figures, domestic production had topped out six months ago at more than 13.1 mbpd. What that means is one-quarter of all previous crude mining has been shuttered over a period of just about one-half of a total year.

So, how in the world can crude prices be falling sharply?

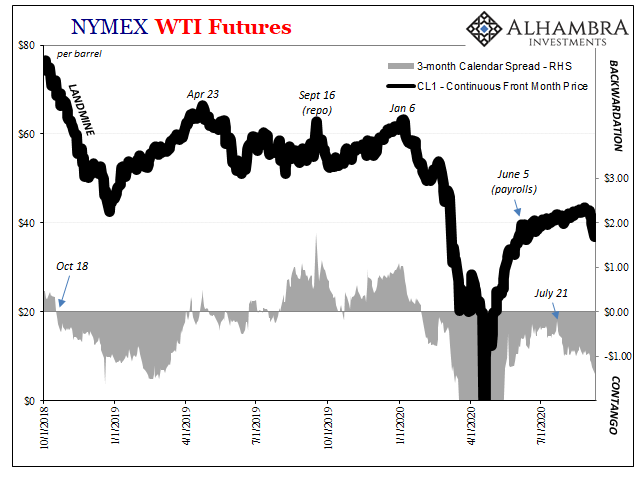

The short run answer may be that big quirk which lies in the middle of every September – the calendar bottleneck in financing which gets transmitted throughout the eurodollar world by whichever form of risk aversion might be most pressing upon dealer balance sheet factors at each moment.

The more intermediate term answer can be found in the crude curve itself. Like bonds and many other market prices, “something” happened after June 5. We know very well what did happen on that date, it’s what has followed which may have been seemed counterintuitive.

You probably remember that particular day because it was the first of the big payroll bonanzas, the one which surprised with millions of gains instead of the millions of losses still being forecast at the time.

That only raises the question, why would bonds and oil together come off their respective solidly reflationary trends right after one of the most surprisingly awesome labor market numbers in history?

With regard to the reopening of the economy after the (unnecessary) COVID shutdowns, it really does seem to be a case of “buy the rumor, sell the news.” If not exactly sell in WTI, then at least stop buying so emphatically.

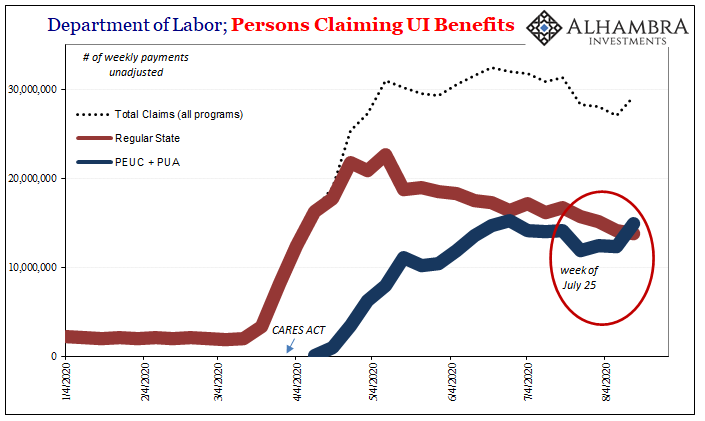

Such caution was corroborated by mid-July and the growing signs that whatever positive forces aligned by the reopening process may have by then begun running their course. In the oil market, as bonds, it represented a troubling scenario. With labor market momentum waning since that same moment (represented by jobless claims, below), that has left all markets to digest growing questions about demand therefore the real economic condition entering the crucial month of September.

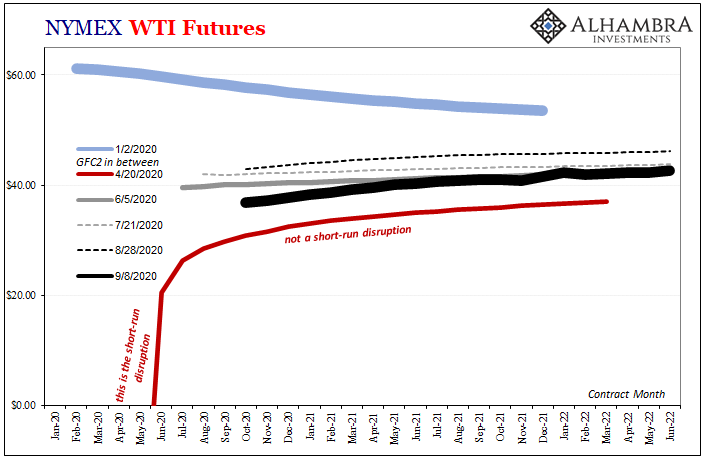

In the WTI market, the futures curve never once pulled itself up out of contango – which is now getting worse again late August/early September. Throughout the entire rally since April, no backwardation at any point thereby suggesting despite the massive cuts in supply (not just in the US) the (physical) market had never been able to favorably rebalance itself.

Back in April when the front month WTI futures contract went deeply negative, the negative oil number getting all the attention, it was the back end which was most concerning. The problems it represented haven’t gone way, only becoming more stubborn in the form of bigger and bigger production stoppages. More than 25% of domestic production pulled off-line, and still contango throughout.

Thus, the curve shape has remained disturbingly constant since late April’s negative number even if more slowly rising up as a whole toward the lower $40’s. As I wrote at the time:

If anything, after what happened in March, the central bank has proven all over again that its performance is directly proportional to how bad things get. The worse the crisis, the less you can expect from policymakers. In that way, negative Monday May 2020 oil and its roll fiasco are most relevant and poignant.

And now the next “L” looms larger and it stands for Lesson and Long-run; as in, learn demand destruction.

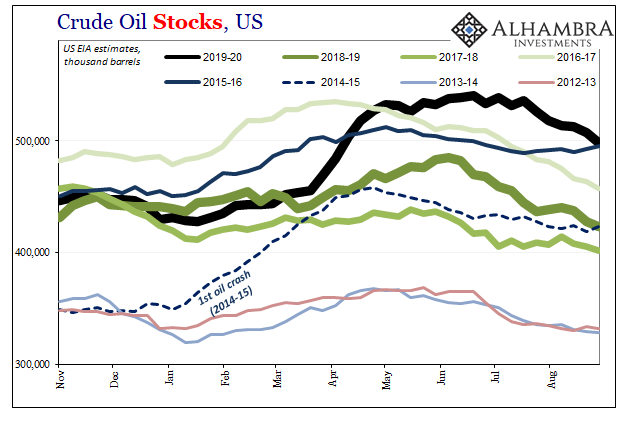

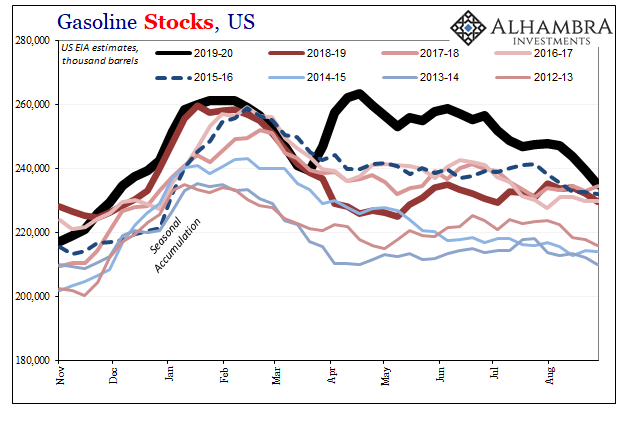

The other side of supply is demand, with inventory sticking in between. If the futures curve has been stuck in contango even with historic levels of supply disruptions, it’s only because demand hasn’t come back near enough to erase historical levels of inventory. Reopening and the labor market numbers attached to it are unmasked by crude (and gasoline) inventory figures as only part of the story.

I believe that’s why “sell the news” after June 5’s payroll report; reopening didn’t necessarily mean recovery.

Record high crude and gasoline stocks (for this time of year) just haven’t been diminished by the massive macro destruction taking place on the supply side. If the oil patch has to sideline 25% of itself just to get crude inventory down close to the same historically high level as the oil “glut” of 2015-16 had produced? Uh oh.

Implicit in such a realization is the demand side destruction which has spanned now four months and four huge payroll reports.

An overstuffed crude sector with all the “stimulus” lined up behind it has to be interpreted as a serious warning sign about, again, what’s really going on with the underlying economic condition; not quite enough “V.” And now with summer turning toward fall, and with bottlenecks lurking, this is potentially inconvenient timing to say the least.

So, if crude futures are rewriting the history of reopening, more importantly what might it mean for especially September? Are we seeing the calendar problems emerge with one week to go before mid-month?

The stock market sure seems to have joined what may be a growing oil rout, though I’d still have to see something happen in the T-bill market as well as a bigger (upward) move in certain dollar crosses before I make more out of this than a correction. On the dollar flipside, I think JPY would have to push higher for further confirmation (it’s not all that far), too.

What we know right now is simply that demand destruction has been a real problem, “stimulus” hasn’t fixed it, and now widespread or at least growing recognition of all this has the potential, at a really inopportune time, to find its way into risk aversion once more leading money dealers to yank themselves out of the market (again).

That doesn’t mean a replay of September 2008, another Lehman/AIG, or even last September, for that matter. Bank failures really aren’t a huge potential part of this possible 2020, GFC2 aftershock. Instead, I suspect it would look like more of the network outages we call a global dollar shortage (because the level of bank reserves doesn’t matter; sorry, it just doesn’t).

Oil and stocks putting everyone on notice after the first week of September. Now watch the bills.

Stay In Touch