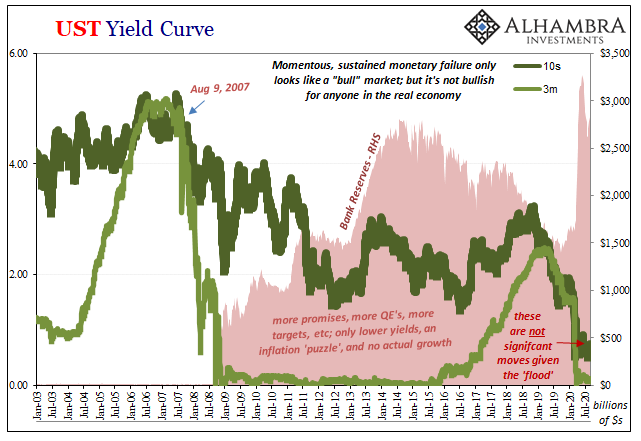

Does anyone remember “transitory?” I know I do. I spent years ridiculing the idea. But after 2019’s interest rate debacle, cuts rather than hikes, the Federal Reserve very quietly banished that particular word. This was, of course, during the course of the central bank’s “exhaustive” study surrounding its major inflation puzzle.

“Transitory” had been the primary way in which Fed officials kept deluding themselves, therefore leading the entire institution (and the public) directly into such prolonged confusion.

Each and every time inflation would inevitably undershoot, authorities would blame “transitory” factors. All that meant was, given time, the economy was supposed to have righted itself and once it did monetary policy success in the form of full employment would be revealed to all.

I still can’t help but chuckle in review about Janet Yellen’s yearlong fixation on Verizon. Verizon. Remember that one? Lack of real economic growth, therefore too little revenue expansion for that key telecom, had pushed the company to start massive price discounting – the data plan wars! To better compete, because it had no pricing power, Verizon unveiled its own unlimited data plan thereby significantly cheapening its service.

The effect was substantial, so much that it materially affected the inflation indices and each of their core measures. And then, get this, it showed up in the FOMC meeting minutes. I mean, this was the middle of 2017, the very launch point for globally synchronized growth, and the FOMC was talking instead about…wireless data plans thwarting confirmation of the economy’s take-off?

If only policymakers could channel such creativity into productive uses.

Verizon had been, of course, just the latest “transitory” factor to spoil the planned QE parade. This particular piece of the farce took off all across the mainstream media always eager to parrot whichever latest absurd excuse, so I wrote at the time in response:

The Fed’s inflation policy is always beset by “oneoff” factors that form an unbroken string tracing back in time now five years. Each of these do, in fact, appear to be plausibly characterized in such a way, at least until put together in a more comprehensive review. Once that happens, their commonality is revealed always as weak consumers.

The first reference to “transitory” I could find came from 2012 and Ben Bernanke right around the time the US (and global) economy “mysteriously” suffered its first setback (Euro$ #2) without yet having recovered from the initial break only a few years prior. More QE!

What followed was about eight years of continuously using the term “transitory” such that the word itself in the central bank sense had lost all meaning; a comical farce with enormously tragic consequences. That alone told you everything you needed to know about how unserious these people are, and the dishonest depths they will stoop to in order to avoid the painful, uncomfortable truth about “stimulus”, central banks, and the real situation in the monetary system.

Implicit in this year’s central bank’s strategy review and updated “average inflation target” is the very quiet retirement of the expression; “transitory” has finally lived up to its true meaning if not the way in which it had been used for so long. In other words, only years later do these cowards finally admit, and only implicitly, they had it wrong the whole time.

Verizon. Hah!

Inflation isn’t really the issue here, either. It’s what inflation is supposed to represent, and that’s recovery; the real thing, consumer prices backing up and corroborating the unemployment rate. Going back to what I wrote in 2017:

It would only make sense that we detect the chain of causation from economy to consumer prices that instead remains missing from the policy end. In short, there are legitimate concerns as to what may be keeping inflation below the 2% target for such an extended period of time, five years and counting, far more than any tangible proof that monetary policy is or was ever effective let alone pure “money printing.”

This matters in setting our expectations for what comes next, and not just in the context of “reflation.” The US and global economy remains structurally unsound.

It’s that last bit which is relevant in the context of the unemployment rate view once again. This labor market number, as noted last week, has produced a pleasing picture of an economy well on its way to being mended after the earlier severe dislocation. To that end, the central bank is once more forecasting inflationary consequences which would, if they ever do show up, verify that interpretation.

The Fed is even counting on it, as specified by its “average” baloney.

How can we be right back into the same dissonance? The unemployment rate and the supposedly updated Fed says inflation and growth, maybe even a better “V” than previously thought. Yet, on the other hand, oil and other labor data totally spoiling the party – as if it was 2017 all over again.

For one thing, Jay may say he’ll allow inflation to go above and stay above the policy target for a long time, but he’s been largely silent on just how that actually might happen (just as he’s been silent on why, with “transitory” no longer an option, it hasn’t to this point). In truth, his justifications just won’t matter.

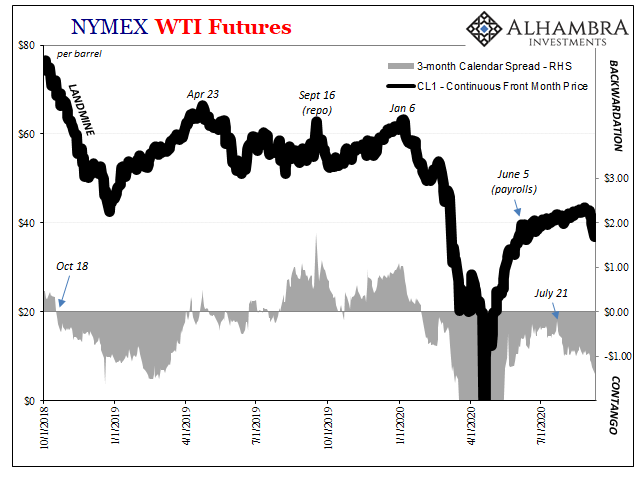

Because just as Powell claims to have hit the gas, what does WTI do? Fed officials can talk however they want, put it in as emphatic language as they can possibly create. Let’s face it, this inflation stuff is going nowhere without crude oil.

This whole J-Hole event had already fallen flat and now it’s at risk of being completely flattened by another “transitory” (sorry, force of habit) oil breakdown.

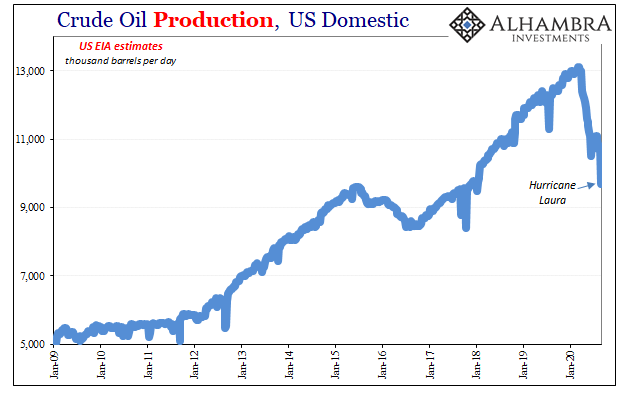

That’s all the more curious considering what I pointed out earlier this week – historic levels of supply cuts in oil (above), and how such massive curtailment of production has completely failed to pull the WTI futures curve out of contango (now steepening again).

This can only point the dirty finger in the direction of economic demand, which means no “V” before even getting to the question of downstream inflation. More importantly, the oil market is hardly alone is setting up these unsettling interpretations.

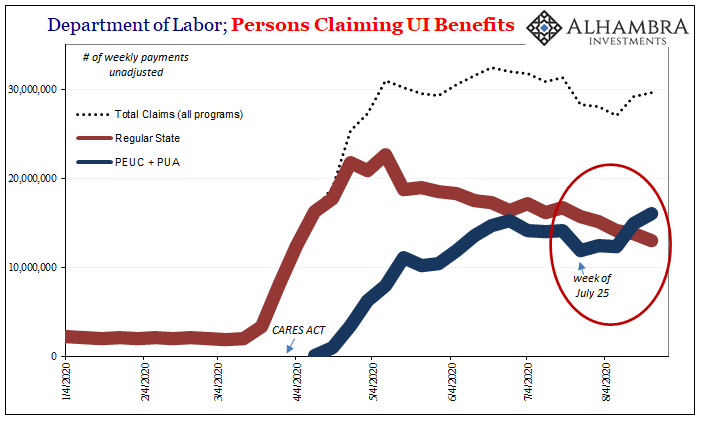

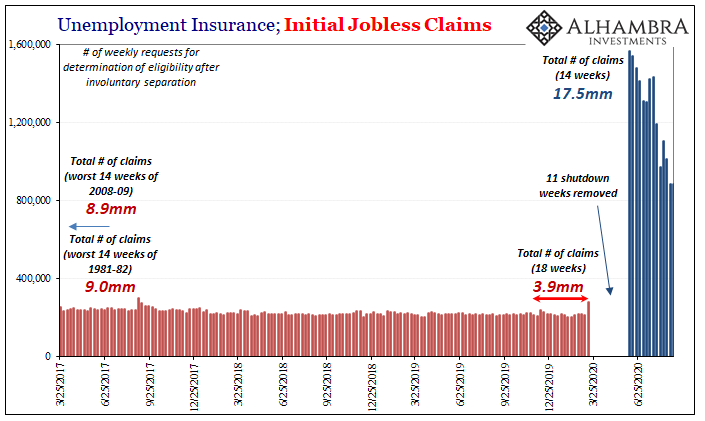

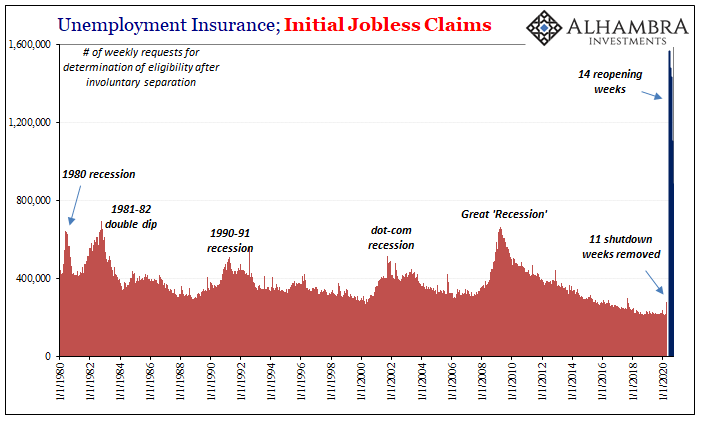

The government continues to report only minimal progress in terms of regular jobless claims, while at the same time reporting a very alarming rise in the irregular types (federal). That continued yet again in the latest data (which is staggered by week: initial claims are for last week; continued state claims are for the week before; and the federal/pandemic claims are a week still further in arrears).

When you look back on 2017 as the best of times, all of this stuff really does hit home. Repeating what I wrote back then, “The US and global economy remains structurally unsound.” Yep. And if that phrase applied to three years ago when reflation, at least, was actually happening, “remains structurally unsound” sounds ridiculously understated for what we have going on right now.

Transitory is dead. RIP. But that’s only the smallest sliver of progress. Thanks, Jay, for now stating eight (or thirteen) years too late what was obvious the whole time.

This inflation stuff is really just that simple. Forget inflation targets, R*’s, Economist techno-babble econometrics; central bankers haven’t a prayer without oil or an accurate unemployment rate. As Summer 2020 grows long, they don’t have either. Again.

And the reason is equally simple: remains structurally unsound – and then some.

Stay In Touch