Emperor Xi of China is still at. Showing no signs of letting up, still looking like the early stages of a purge, Communist Party Leader Xi Jinping continues to reorder the country’s vast security apparatus. His current target is the internal police and security force, which used to answer to the State Council.

Now it answers to the Party, not the government; Xi’s Party, by the way. It has now been firmly entrenched alongside the military which has long been his source of power. A highly public ceremony held a few weeks ago on August 26 was replete with Party symbolism, though not merely symbolic.

This latest move reaches much beyond policing on into the vast “justice” bureaucracy. The more Xi mimics Mao, the more you know trouble lurks just under the carefully manicured surface.

Across the country, a political study campaign is underway at political and legal affairs-related organizations such as police forces, prosecutors offices and judicial chambers. The campaign teaches the “spirit of rectification.” It emphasizes the Yan’an Rectification Movement, which Mao Zedong launched in the early 1940s in Yan’an, Shaanxi Province, the party’s revolutionary stronghold.

“Rectification” is not a happy term; it specifically means join Xi or suffer a whole range of potential consequences. There are, for government officials, no other available options.

These are not the actions of a dictator completely confident in his position. After all, to this point up to now, his political opposition has been especially…meek. Why go after those who haven’t caused Xi even the smallest headache?

The answer, I believe, is that China’s situation is poised to become even more unsettled than it already is and has been, thereby, potentially, opening the door for his erstwhile rivals to more forcefully assert a contrary voice – and vision. Given the poor state of the Chinese economy, they might be able to claim, convincingly, that it doesn’t have to be this way.

Choke off the opposition before it can ever gain a foothold.

From the way it’s being told in the West, however, what more could Xi do to make everyone happy? In 2020 in particular, the Party and the government have reportedly flooded the country with more “stimulus.” Many of these outside (technocrat inflation-ists) observers point to arcane measures like Total Social Financing as an “A ha!” proof of Xi’s economic commitment.

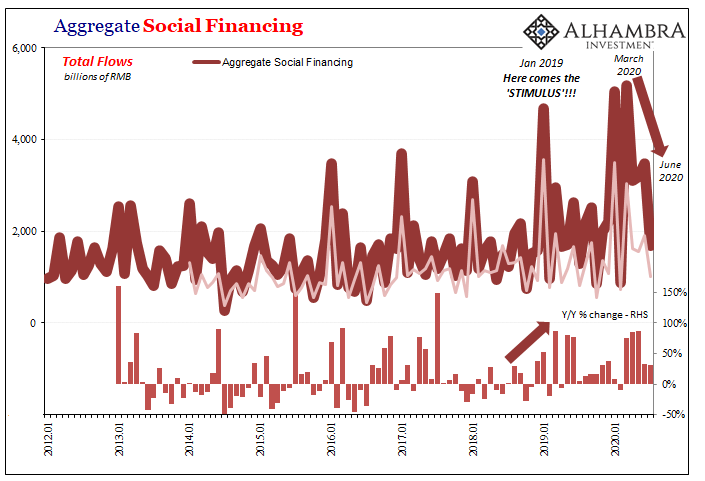

In response to the COVID pandemic (actually the economic shutdown unnecessarily imposed due to it), TSF flows (actually aggregate credit flows) were up big between March and June this year. According to the People’s Bank of China, AFRE (aggregate flows to the real economy) grew by 75% year-over-year in March followed by +86% in both April and May.

Screw the Fed, there’s your global inflationary flood!

Yeah, no.

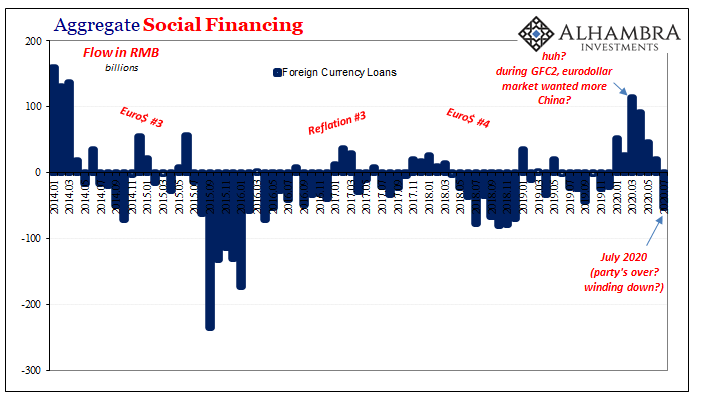

Even in the historical context of flows, this year’s bump’s is not really all that different from how it had been during Euro$ #3 (2014-16) – the lack of results from which is what had led Xi to begin his authoritarian push in the first place.

Not only that, there had been a similar-sized “stimulus” flow early on in 2019 that hadn’t accomplished much in China’s real economy, either. After all, the Chinese system entered the COVID era on a substantial downswing despite 2019’s noticeable acceleration in AFRE.

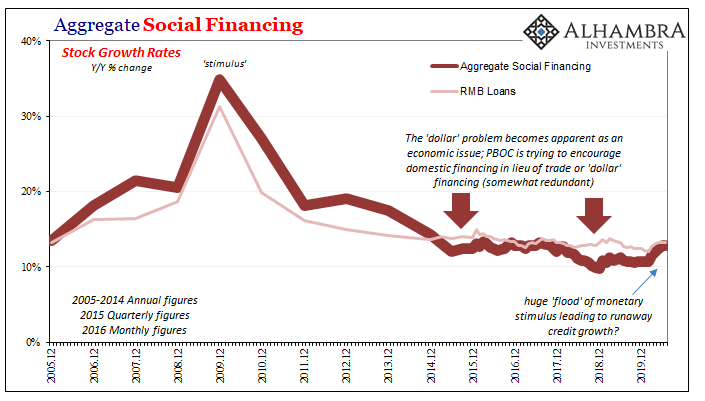

Stock versus flow, for one thing. More appropriately examining TSF by its changes in total stock reveals just how little China’s authorities are doing (or allowing in credit) even though the circumstances facing the Chinese economy are, by far, the most serious its modern Communists have had to deal with. These numbers are all about stabilizing, as best as possible, not flooding.

Blow more bubbles to counteract it, or shore up the politics in order to ride out the storm? We obviously can’t know which would be more effective, though we can make reasonable guesses, all I’m saying is that it’s pretty clear which option Xi Jinping has chosen for himself and for China.

In terms of credit stock, that “enormous” “flood” of RMB financing had merely pushed rates back to where they had been in early 2018. And I’m using the past tense here because data for the month of July (the latest figures) already suggest that’s the most China’s going to get out of it; credit at these levels seems to be rolling over, not accelerating.

While TSF and ASF will continue to be a distraction for Western technocratic sympathizers desperate to hang their inflationary hat on any central bank or credit system, more important to me is finding what I wrote about to end last week: missing “dollar” inflows.

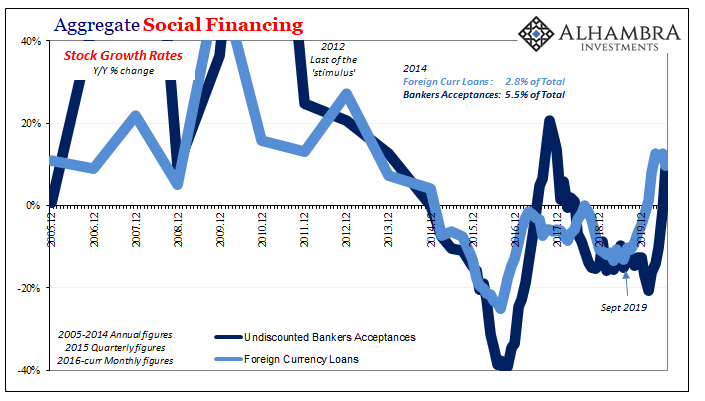

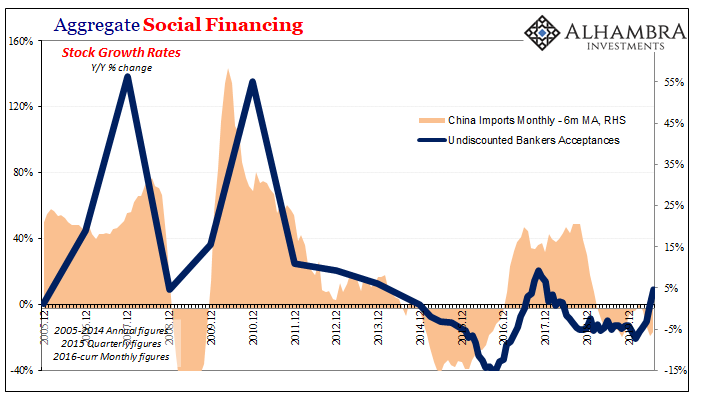

There are, as I wrote, inflows but it’s not at all clear where they are coming from; or why (organic, or the Brazil plan?) Part of it is certainly merchandise trade, a burst of Chinese import activity which typically has been accompanied by foreign currency lending (often in the form of bankers acceptances, which you can read about in detail here).

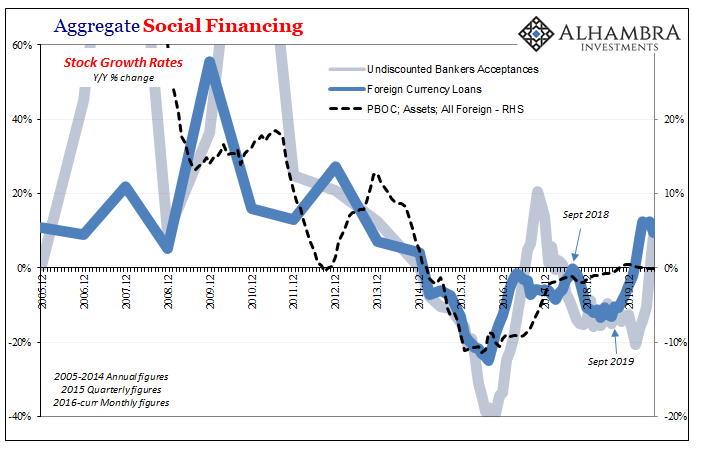

As you can see immediately above, acceptance activity (stock growth rates) follows along pretty closely with Chinese imports – and Chinese import trends are dictated by the eurodollar squeeze/reflation cycles. Unfortunately, like the credit statistics, Chinese imports have disappointed for each of the last two months (July and August), both small contractions from the levels put up during the summer of 2019 when things weren’t going well at all.

Sure enough, undiscounted acceptances (flows) dropped in July for the first time since February.

Might we have found (one of) our mid-July culprit(s)? If the reopening trend hit a material snag around that time, and it does seem to be that way, then dollars to RMB to global economic conditions, you’d expect something like this to show up in key markets like oil.

The big question that’s left unanswered is the PBOC’s balance sheet. Ever since last September, CNY has been relatively stable (I wouldn’t say strong) and going back to early last year, the period immediately following late 2018’s landmine, the Chinese central bank’s reported level of FX assets has been ridiculously unvaried. Engineered, you might say.

Dollar “inflows”, but from where and for what reasons? Bankers acceptances say reopening reasons, but those only apply March to June 2020. Looking at the AFRE stats, there’s also the discrepancy in foreign currency loans that just so happens to date back to last September (below) leading to a substantial increase in them…during GFC2?

Between September 2018 (landmine hit in October 2018, as I had warned at the time) and September 2019, foreign currency loans in Chinese lending data accelerated to the downside like we’d seen during other global dollar shortages. But while those “dollars” were disappearing they weren’t falling off the PBOC’s balance sheet (ghost outflows).

CNY falling, though.

But then, beginning October 2019, foreign currency loans turn around and once again “dollars” don’t show up on the PBOC’s balance sheet (ghost 2020 inflows). CNY no longer falling, some up and down while moving overall sideways.

Like acceptances, foreign currency loans have changed back to outflows (monthly foreign currency loan flows were negative in July).

The data is incomplete, even as TSF/AFRE figures intend to be exhaustively comprehensive they are only a partial look at Chinese dollar flows; therefore, this doesn’t really give us the full picture nor really tell us exactly what we want to know. It does, however, add to the list of indications more than hinting at big “dollar” discrepancies going into (and coming out from) China, more partial fingers pointing in the direction of PBOC authorities probably attempting to smooth out CNY’s direction for as long as they can.

And those things get added to the list of global deflationary factors which have included TSF and AFRE numbers all along.

Xi Jinping isn’t clamping down politically because he’s super confident about China’s ability to easily handle the global situation, ready to unleash the PBOC and banking flood that’s already been reported as fact in all Western media outlets in order to do it. Rather, the PBOC is almost certainly acting out quietly behind the scenes holding on for dear life while Dear Leader gets his rectification ducks in a row.

Stay In Touch