———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Castbox: https://bit.ly/3fJR5xQ

Breaker: https://bit.ly/2CpHAFO

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

SoundCloud: https://bit.ly/3l0yFfK

PocketCast: https://pca.st/encarkdt

PodcastAddict: https://bit.ly/2V39Xjr

———WHO———

———WHY———

How much is several? What is a few? If you were to put a numerical value on “probably” would it be more, or less, than “likely”? To your podcaster’s great consternation the linguistic gatekeepers of Middle English were rather disinterested. As a result we’re constantly late or early. ‘I thought we were to meet in a few hours, no?’ ‘No! It was several.’ ‘Oh, right.’ Women seem to revel in these nuances, arriving for a date with this podcaster when it pleases them and then claiming etymological immunity.

Which brings us to the word transitory. Admittedly there is SOME lexicographic nuance: momentary, transient, impermanent, temporal. However, the Federal Reserve – like the proverbial camel – stuck its thesaurus-nose into that nuance and CHARGED into the economic-tent of the past decade. Why did the 2009-10 Green Shoots recovery fail? Transitory European Sovereign Debt Crisis, gummed Bernanke. Why did the economy swoon in the first quarter of 2014? Transitory Polar Vortex, chomped Yellen. Why did inflation not accelerate despite ‘full-employment’? Transitory cellular data-plan price war, gnawed the FOMC. Why was Globally Synchronized Growth tripped up? Transitory political trade wars, chawed Powell.

So here we are, 10 transitory-filled years later. Now, unless there are glaciers listening to this podcast – and it needs all the ratings assistance it can get – it’s likely the audience is in unanimous agreement that the definition of “transitory” has been tortured to death. Indeed, the Federal Reserve agrees! And Transitory has been retired. Or cremated. Still, instinct informs your podcaster that much like our zombie economy, the transitory excuse is undead and will walk again!

———WHEN———

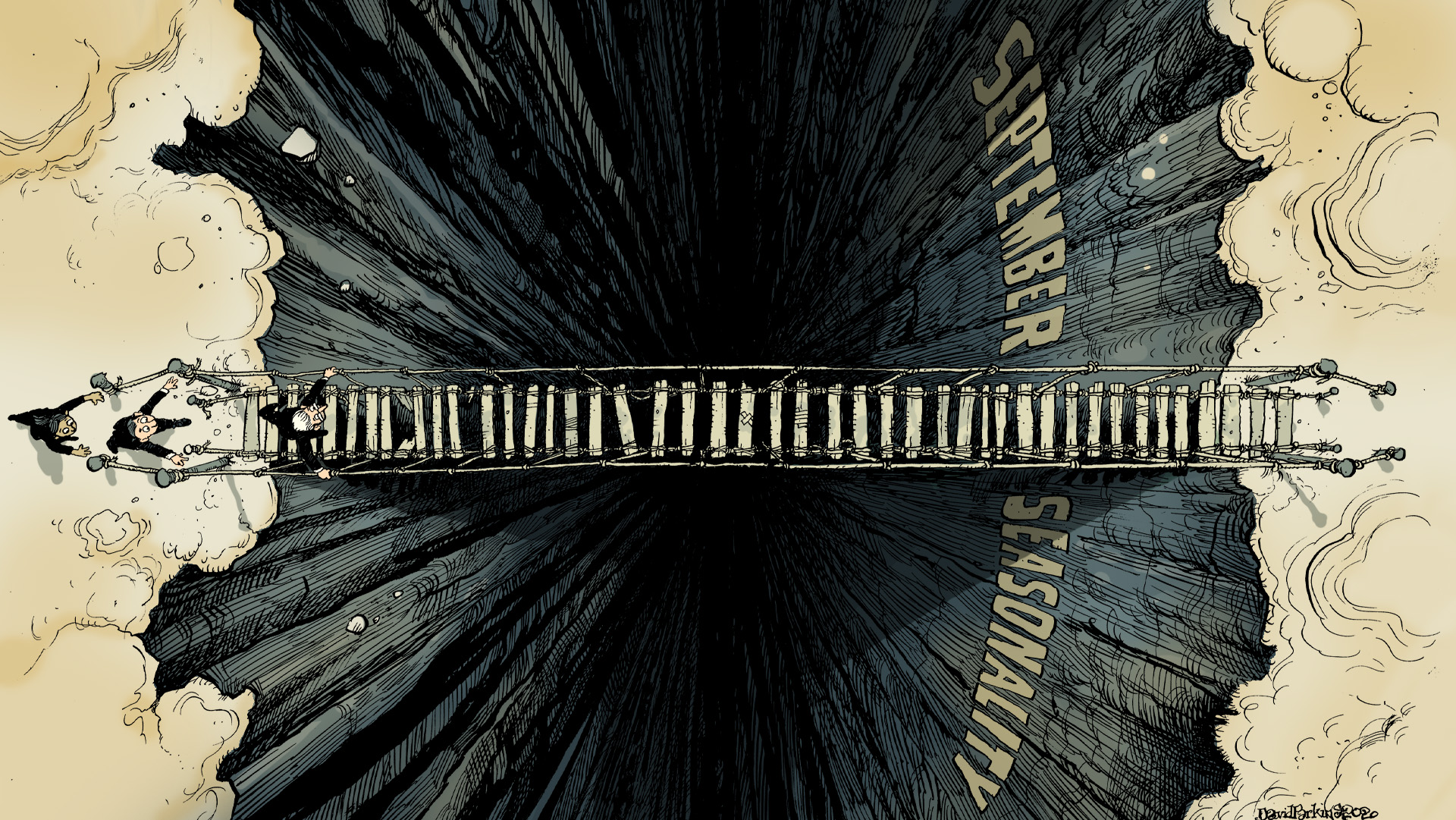

00:05 Capital flow seasonality, not merely a historic phenomenon, calendar bottleneck dead ahead

03:40 What is the oil supply situation in the United States?

05:00 West-Texas oil futures are in contango – still! What are the economic implications?

08:01 Crude oil and gasoline inventory levels in the US are quite high – there’s too much of it!

09:11 Risk aversion – the conceptual link between capital seasonality and a declining oil market

10:23 The Japanese yen is another market that’s glowing orange – a monetary warning

15:36 Treasury bill yields are not signalling disorder; credit spreads are no longer improving

———WHAT———

COT Black: Closing In On Mid-September, What About Oil?: https://bit.ly/3mhs9BR

Bottleneck In Japanese: https://bit.ly/3hof06B

New York Clearing House Banks Monthly Movements of Cash to and from Interior (1905-1908): https://bit.ly/3hsLYCK

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch