The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state. Government officials have decided to pause their efforts for two weeks so as to try and sort out what “might” be widespread fraud.

The state is also using this time to get after a substantial backlog of previous initial claims yet to be processed. So, possibly fewer legitimate claims due to dishonesty, though maybe more claims if they’d all be processed at the time they’d been filed.

In other words, we have no how many claims are being honored in California versus how many “should” be completed therefore representing the underlying economic state of that state. In lieu of any administering during these two weeks, the DOL reports that it will just plug in the last number it had from Cali and then revise in mid-October.

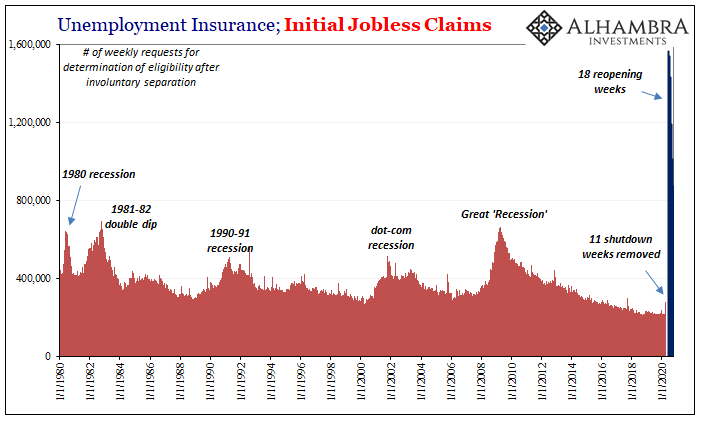

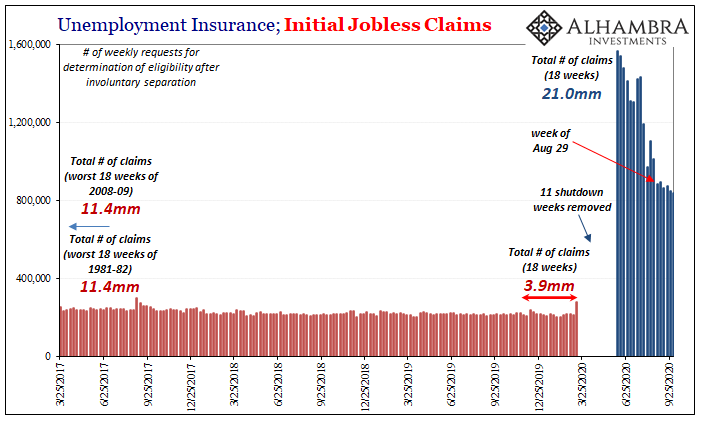

Either way, it’s still really bad. The latest weekly figure from last week, the week of October 3, remains above 800,000 yet again. The running total of initial claims filed during this economic reopening since June is now an unthinkable 21 million; during this “recovery.” Would it really matter if California finds even tens of thousands of fraudulent claims? Nope, it wouldn’t move the needle one bit.

And that alarming number doesn’t include the even more unthinkable 42.7 million who had filed from mid-March through the end of May. Either almost half of all workers have sought unemployment aid, or millions upon millions, maybe ten or more, have been laid off more than once filing jobless claims multiple times. Is one of those better than the other?

In a related data note, the DOL is also looking into discrepancies in how federal pandemic relief claims are being reported, as well. Until that gets sorted out, we’ll leave them out of our analysis.

We simply don’t need them. Reopening was the period of gigantic positives, yet here we find in one of the most important accounts of all an even more gigantic negative of 21 million. Again, not including the 42.7 million prior, 21 million in only 18 weeks would otherwise be unprecedented – and it’s not even close.

Based on the data the DOL has put out, you see not just the continuing of historic labor market disruption perhaps more importantly how what improvement in it might have leveled off at the end of August. More post-July slowdown.

September has been a rocky month in a lot of places, dollar-wise, so again to find something similar (and suspected to be related) hitting the front end of the employment condition isn’t as unsurprising as it is not good. Not only is the level of employment still way, way below recovery, more data that consistently indicates a slowdown in an already too slow rebound bodes ill for looking ahead.

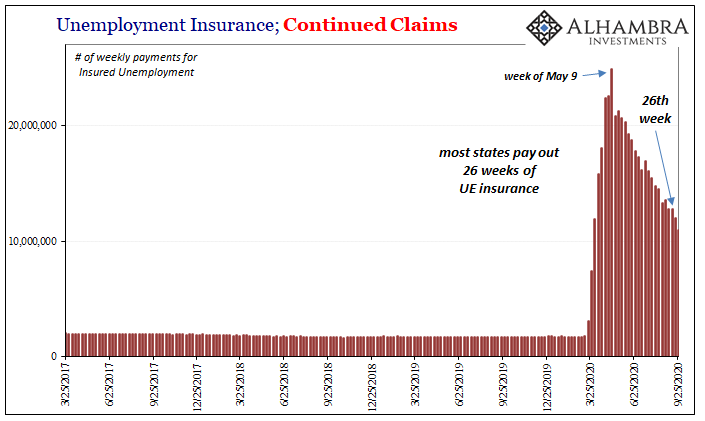

As does the length of time. Most of the states (who are responsible for paying unemployment insurance on approved claims) give 26 weeks of these regular benefits. As of mid-September, we are now past that point for those who filed in the initial few weeks and haven’t experienced the reopening surge and have remained unable to go back to work.

Continued claims dropped more noticeably over the final two of September for this reason – although the CARES Act provides for additional pandemic unemployment payments (PEUC) once state disbursements have been exhausted. According to the latest figures on them, FWIW, the DOL says as of mid-September right at the edge of the first 26-week cutoff there are now 1.9 million being paid through this program compared to 850,000 the first week in June.

Despite all these statistical uncertainties and government bureaucratic mess – because, in part, of the government’s dependably bureaucratic mess – the labor market picture beneath the gigantic positive headline gains is actually pretty clear.

The labor market remains in deep trouble. The artificial high of government cash payments has only masked increasingly durable economic pain and perhaps longer run damage.

Not only are we left to wonder if it’s getting better anywhere close to fast enough, in raw economic (factoring out non-economic reopening) terms we have to ask if it is even getting better at all.

It almost certainly is but this shouldn’t be a question at this point.

And it’s not one which is being asked exclusively by outside observers; as I wrote for last week’s payroll report:

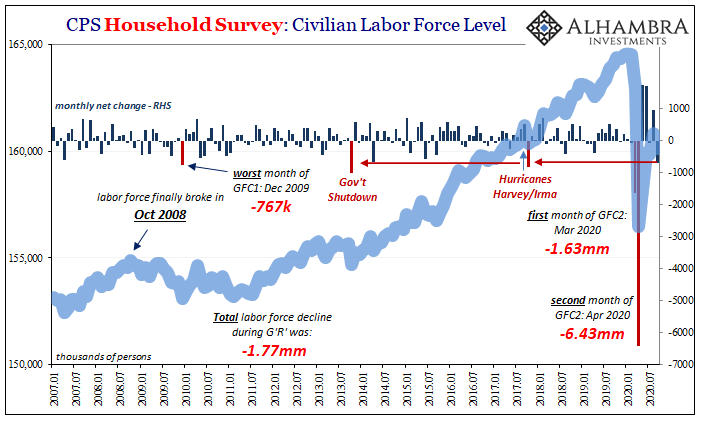

People say I’m too negative, but neither of these surveys suggest I’m near an extreme. That’s the Labor Force.

Don’t take my negative word for it. Look at the data provided first by the BLS and then some unrelated figures from the Federal Reserve to back them up; both coming out workers’ collective assessments of their own situations. As to the former, as noted with payrolls, the labor force itself dropped by an unusually large amount in September. Not a good sign of confidence in the rebound from inside that rebound.

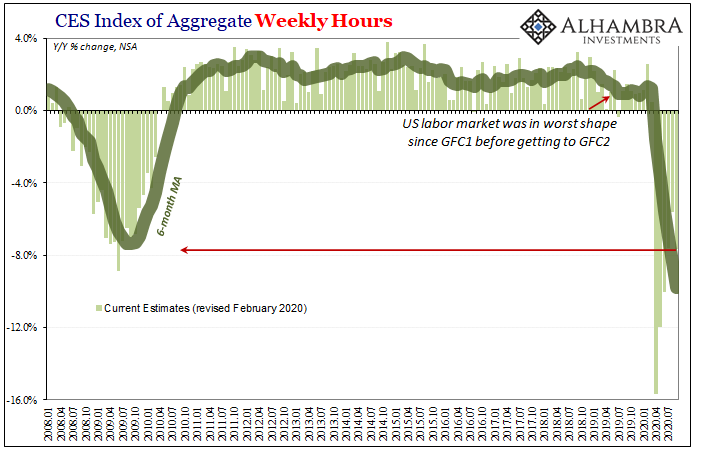

In addition, total hours during September were awfully short; consistent with the disappointment and fall in the labor force.

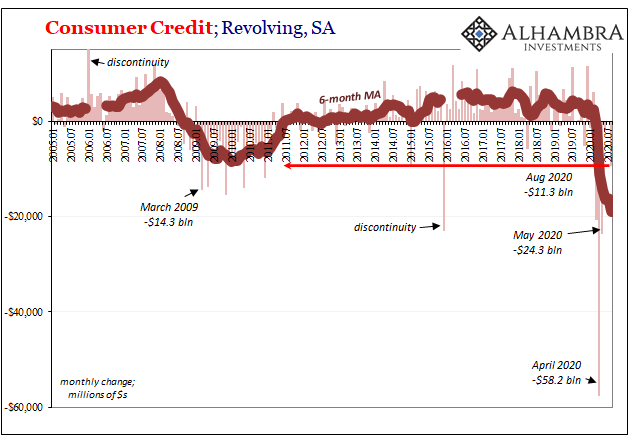

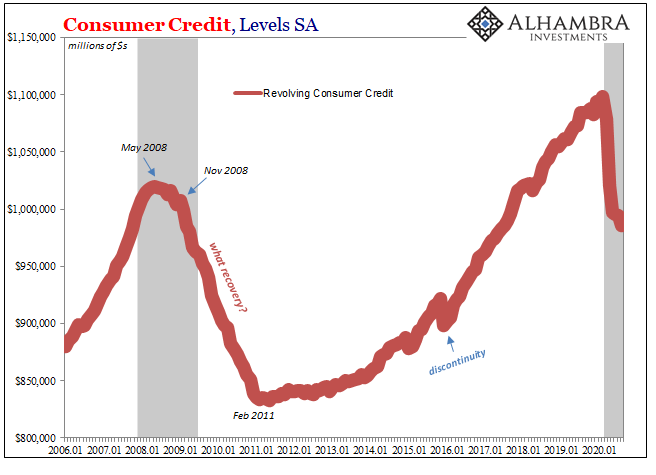

Backing these up is the Fed’s latest update for consumer credit. During the month of August, the aggregate level of revolving credit (seasonally-adjusted) fell also by an unusually large amount. Other than April and May 2020, revolving balances overall hadn’t fallen this much since all the way back in 2010 (not including 2016’s discontinuity).

Together with the labor force estimate for September, revolving credit in August like jobless claims in both months are indicative of serious uncertainty at all ends of the economic spectrum.

Revolving credit, in particular, and especially these macro-related declines in them, have been found to be related to higher-income workers paying down balances out of an abundance of caution. The more they see continued, unanswered upset across their slice of the economy – QE obviously doesn’t count and never really did – the more abundant that caution.

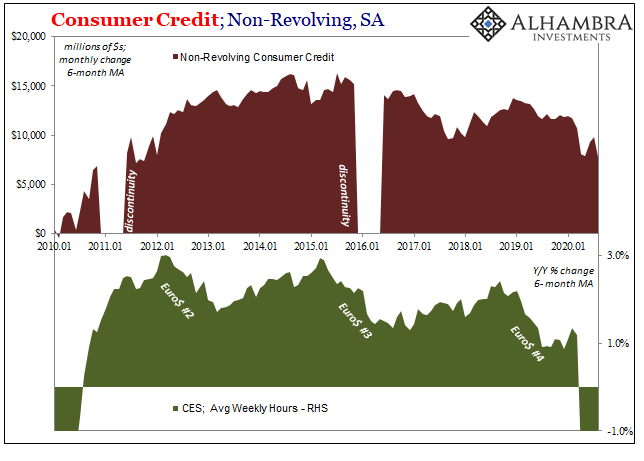

And it’s not just the revolving variety of consumer lending, either. We’re starting to see lower monthly additions of non-revolving, installment consumer credit, too. The 6-month average monthly change up to and including August 2020 was the lowest since October 2011. The arrow is pointing in the wrong direction here.

Like other labor data, particularly hours, there’s an obvious correlation as well as a reasonable basis for determining causation; and it’s not robust recovery.

Yes, gigantic positives in all the headlines but even many of those are being misinterpreted (often on purpose). PMI’s, for example, failing to break out of the mid-50’s (lower 50s for many) are actually far more consistent with all the troubling data contained here. In fact, we can add those on this growing list of an economy coming up way short.

The underlying economic fundamentals getting away from the positives contributed by the non-economic process of reopening seem to be asserting themselves. The labor market remains a mess, to some degree of historic disorder (we’ll wait on California to figure out to what exact degree). Consumers sure don’t appear to be confident despite Jay Powell’s emotionally bucking up the stock market.

The end of summer was unlike the beginning of summer when we still need the end of autumn to be like it was in the very first weeks of May. As I wrote yesterday, it’s just nowhere near enough.

So, yep, more “stimulus” that never stimulates. Woo hoo, right?

Stay In Touch