The original “V” narrative was simple and straightforward. The economy was turned off by governments prioritizing modeled simulations of something like the Black Death, but it would be easy enough to turn it right back on especially with the aid of so much “stimulus” being added in every possible way. Monetary, fiscal, you name it.

Piece of cake. Legitimizing the choice of overreacting to disease projections.

The very fact the “V” has already shifted is itself a big clue. A cakewalk it hasn’t been. On the contrary, what’s left of the original “V” has been transformed recently instead into hopes for more “stimulus” – without ever squaring how more of the same which hasn’t produced the intended results would suddenly become effective.

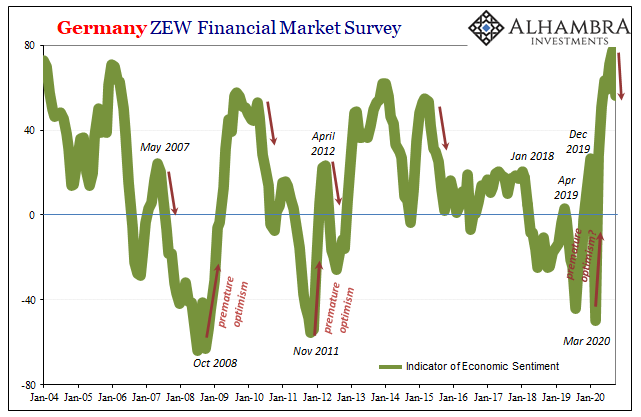

As we’ve noted almost every month since March, Germany’s ZEW survey showed how that country’s business sector had really, really taken to the original narrative. They really bought it (only figuratively, unfortunately for the ECB). In fact, ZEW sentiment in September was the highest it had been in 20 years.

It is therefore noteworthy that in October consistent with the “V” undergoing this disappointing transmutation the same German sentiment index tumbled by more than twenty points from its cocaine-like high last month. While overall the number remains ridiculously elevated, a monthly decline of this size is in danger of placing Germany’s infatuation with “stimulus” into the same category as some (all) of the other times disappointment with it has followed.

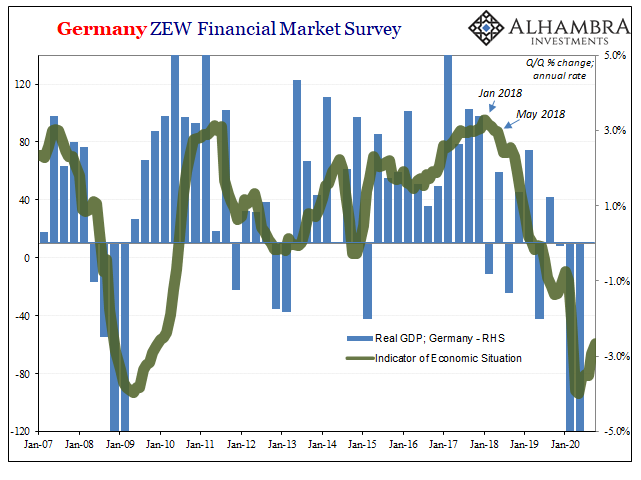

The ZEW’s situation index demonstrates why; it has barely moved off the bottom. Everything about future sentiment has been about a future that increasingly appears only distant. Maybe too distant; thus, the “need” for more “stimulus” so that the economy doesn’t fall back while it waits for presumed recovery the first round of “stimulus” hadn’t created.

Welcome to Economics, 2020-style.

Looking at not just the ZEW’s situation index also around the rest of the world you can see why. It’s just not nearly enough. There’s been a reopening and that’s put back some of what’s been lost, but curiously only some. You’d have thought, given the tale of the first “V”, that economies would have come roaring right back.

It’s now obvious they haven’t; not even close (and this was always a long shot from the beginning; central bankers merely attempted to dazzle the world with their puppet shows in the vain hopes that people would be enough distracted not to notice the huge hole everyone has been plunged into).

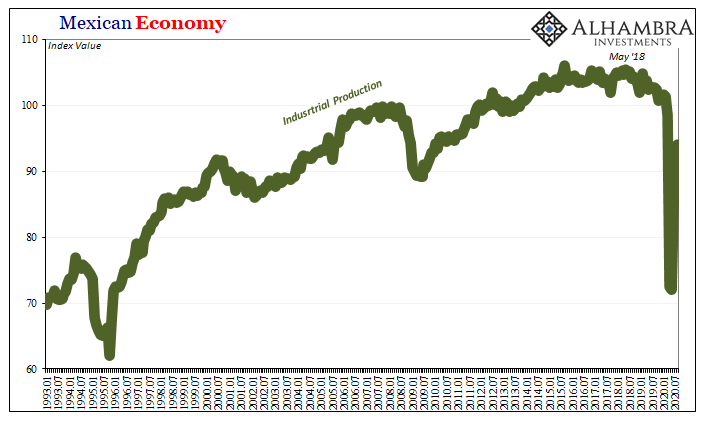

Take Mexico:

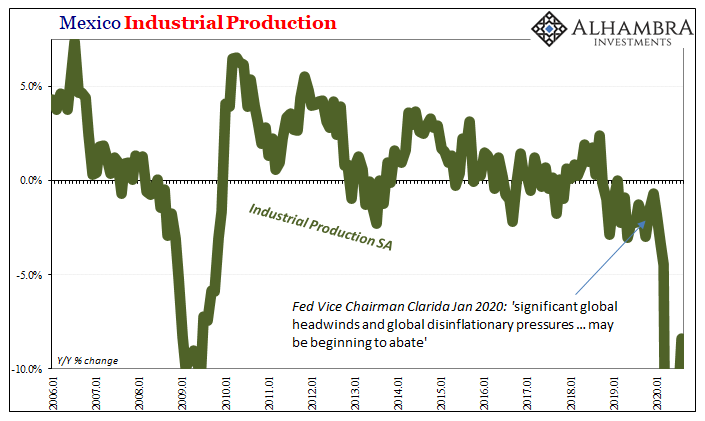

Industry in that country, one whose economy is heavily dependent upon global trade conditions therefore the global economy’s overall direction, has absolutely come back from the bottom. Over the last several months of summer, however, that comeback has slowed remarkably – such that the level of IP during August, the latest figures, was only back at levels seen a decade ago in 2010.

That’s not what the first “V” had promised. Why isn’t Mexican industry by now running at record levels to make up for lost revenues and profits? Why still down in 2008-09 levels as well as rates?

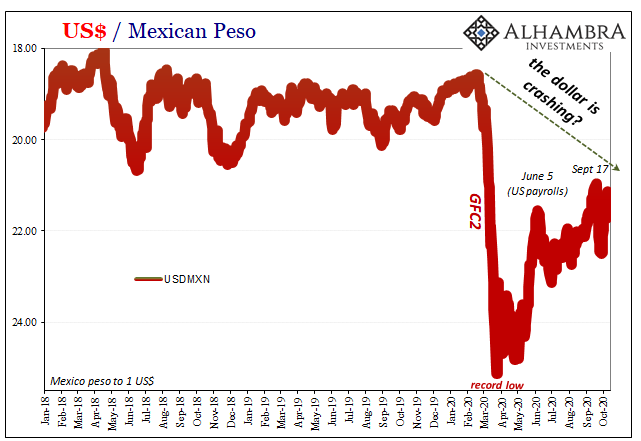

One more obvious consequence is therefore continued heightened risk being priced out in the funding/currency market in (euro)dollars. No dollar crash sighted here; the peso continues to trade significantly lower than where it had been for a couple years during Euro$ #4 up to March despite all we kept hearing about with reckless Federal Reserve dollar printing.

Like the economy, the currency is rebounding but one that remains conspicuously short given all the fluff that had gone into the “V.” This is a categorical difference.

Maybe those dollars, like recovery, went somewhere else? After all, as usually happens when something like this shows up in EM economies like Mexico, it gets easily dismissed as one-off idiosyncrasies; Mexico’s problems are Mexico’s alone.

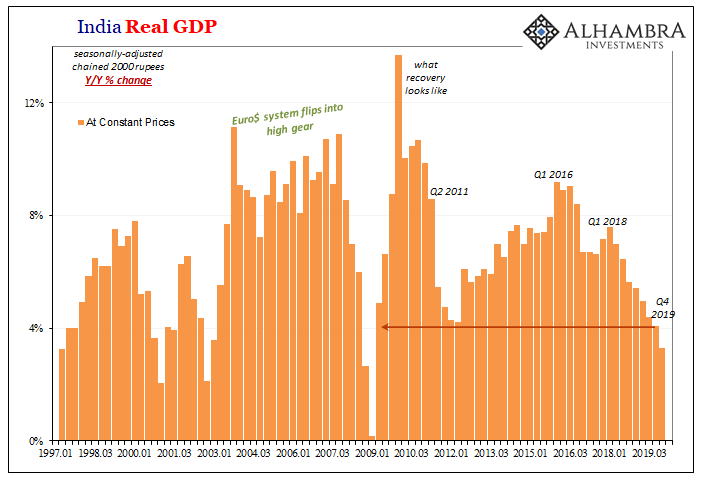

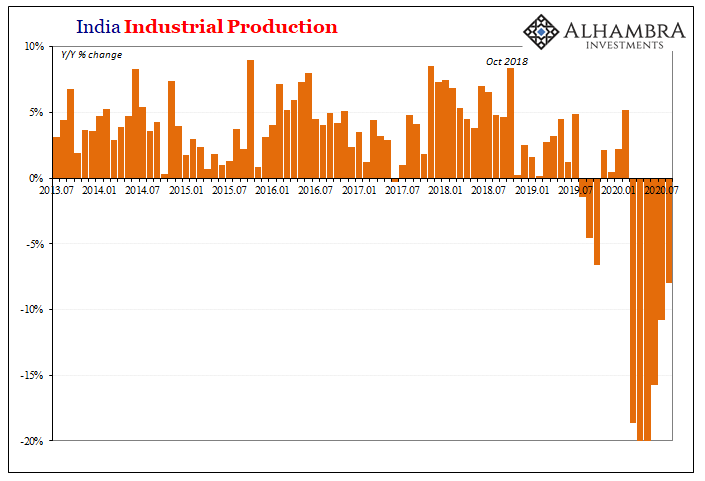

Like Germany and Mexico, however, when you look around the rest of the world (even China) it’s just not there. India, for example, Industrial Production in that country had rarely experienced any decline before the end of 2019. As if to prove how nasty Euro$ #4 had been before COVID, the Indian economy had found itself in a downward spiral that had spanned several years before even getting to this year (belying the idea the global economy was in good to great shape heading into March 2020).

Like Mexico, Industrial Production in India continues to rebound but not recover. Conspicuously sluggish instead of unambiguously roaring. It’s up from March, but that’s no standard to go by (currency as well as economy). As of August 2020, the latest estimates, IP was down an enormous 8% from August 2019 when IP was already down 1.4% from August 2018.

For an economy that had only rarely seen any industrial decline for a decade, and even then it was only a small fraction, in August during the rip-roaring global “V” that was supposed to get the world right back on its feet here’s yet another one displaying the stubbornly familiar “L” style tendency.

Not only is Indian industry 10% below August 2018, it’s nearly 20% behind where it would’ve been this year had Euro$ #4 in 2018 never interrupted 2017’s “globally synchronized growth.”

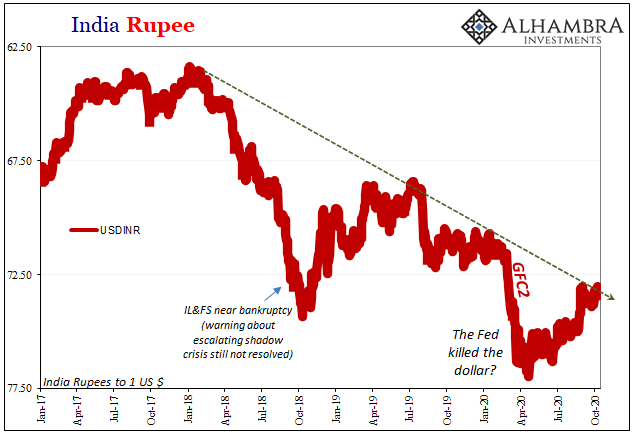

Like Mexico’s peso, India’s rupee has also come back up against the US dollar but remains substantially lower than its pre-March level when India was already in deep trouble.

We could go on and on but you get the picture. The global economy together continued to come up short at the end of summer (see: US labor market). So short, and now heading into fall, that first overly optimistic view of easy, complete recovery expressed from the very beginning of the crisis has been all but put to rest.

Actually, this changing “V” and what it really might mean, even the Germans seem to be sobering up to it.

Stay In Touch