Because it worked out so well for Jay Powell? No. They have no idea what to do now. Zero. And they are out of ideas.

I’m writing about the ECB here, but it begins first with the Federal Reserve Flustered by years of a very low unemployment rate stuck several points below where “full employment” had been estimated as late as 2015, its policymakers had become flummoxed by year upon year of waiting. Janet Yellen declared full employment and recovery at hand, handing off to Jay Powell a regime of steady rate hikes intended to head off the inflation which was sure to follow closely behind.

Inflation which, by the way, was meant merely to confirm the recovery thesis. So, if no inflation…

In December 2018, however, just as everything was falling apart (as the bond market increasingly predicted) the Fed got fed up by this inflation “puzzle.” It undertook a well-documented (around here) grand strategy review which, not a joke, ended up with average inflation target as the promised fix.

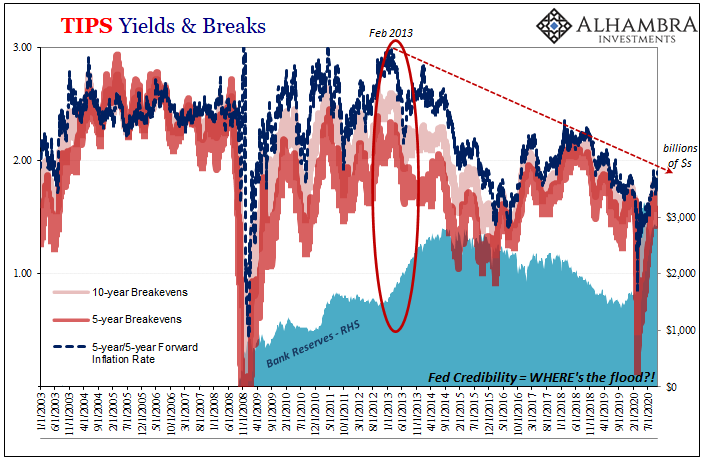

First, though, to convince interested parties that somehow average inflation targeting was different than a symmetrical inflation target which hadn’t been exactly the same as forward guidance. It’s not going so well. It hasn’t gone well since February 2013 at the latest.

Not only has the Fed stepped all over its past explanations and excuses for not being successful, the more immediate problem is an economy facing even greater challenges than a dozen years already without recovery. To put it succinctly, Jay really, really needs to come through this time.

And he says he will – based on absolutely nothing of substance.

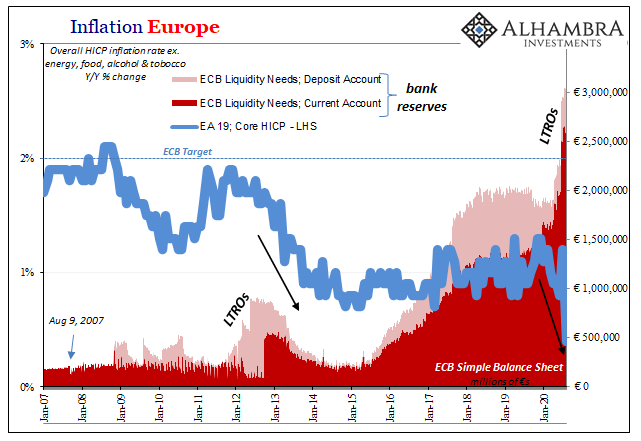

Faced with the same longer-term problems – as well as an even greater short run shortfall – guess what Christine Lagarde’s ECB announced just recently. Yep, a grand strategy review of its own that doesn’t need the Fed’s year and a half of “study” to predictably end with the all same conclusions.

Average inflation targeting is on its way to Europe! Our long global nightmare has ended.

The ECB has started a strategy review which is studying how to adapt its policy to the current economic reality.

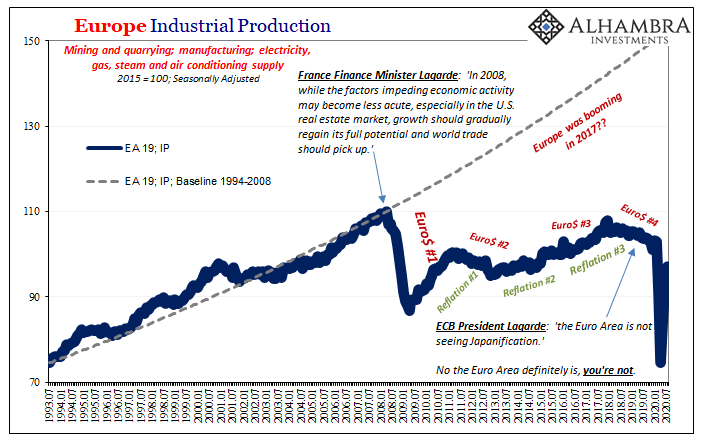

And what is that “current economic reality?” It ain’t what it was ever promised to be going back thirteen years now. This is what the new “V” narrative is really supposed to be based upon. Seriously.

Small wonder, though, why the ECB and Lagarde is panicking into showing her (empty) hand. Europe’s economy, as I wrote, is in even worse shape and all the data displays the same post-July stumble as around the rest of the world.

Europe, like America, is slowing down way, way short of recovery; thus, the end of the original “V” leading to this ridiculous lack of ideas being displayed left, right, and center.

You can just hear officials’ private conversations worldwide: now what do we do?

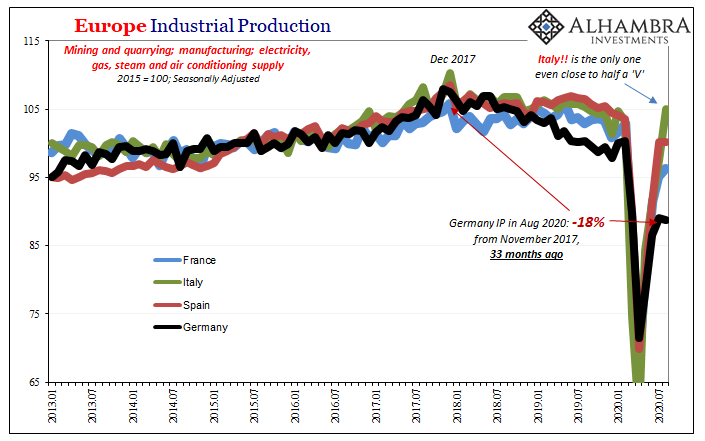

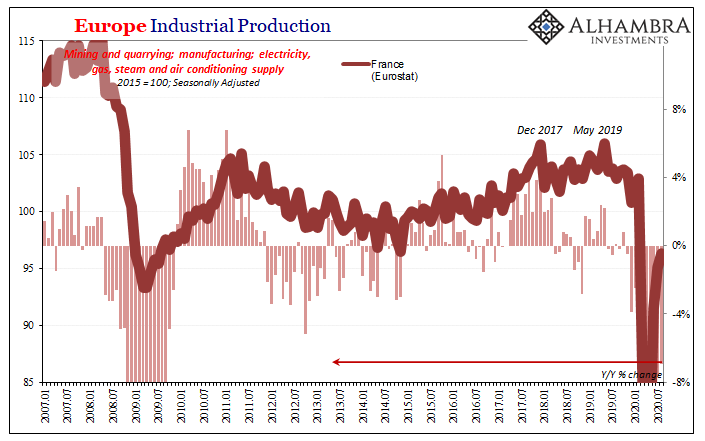

It’s amazing if only in a trivial sense that out of all nineteen European nations Italy seems to be faring best so far. That’s no nod to the ECB and Lagarde, instead most likely the simple fact of the Italian economy being hit so hard that it quite naturally has shot back up more than its neighbors – or, at least rebounded in a manner slightly more consistent with what should have happened everywhere.

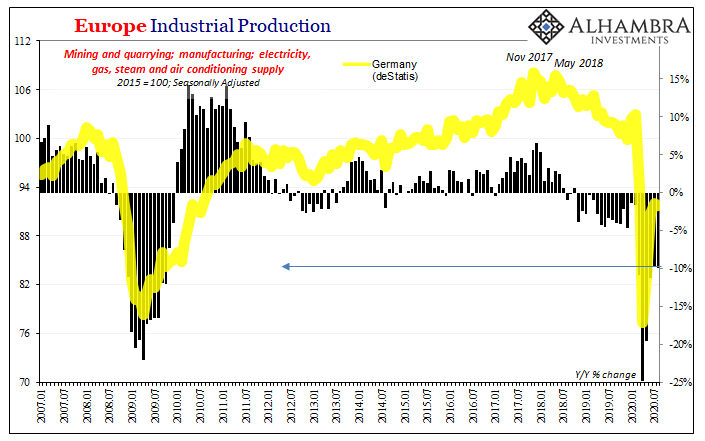

The rest of Europe, Germany most of all, instead painfully below even half a “V” this late into 2020’s summer. Add an August stumble on top. With reopening proceeding, IP like anything else should be hugely into the positives – not gigantic monthly increases from the March and April collapse, but at levels and rates well above last year and approaching far better than 2017 to make up for that huge hole. Instead, the hole keeps getting bigger, lasting longer (even though the downturn began almost three years ago).

This is no time for the fake grand strategy review puppet theater; now’s the time for meaningful reform (we all know will not happen).

I’ll write it again: these are not serious people, but these sure are serious times. One step forward: the first “V” has been put to rest, shown to have been ridiculous and absurd all along. Two steps back: more “stimulus”, the new “V”, by taking the word of the very people who gave us those expectations for the first “V.”

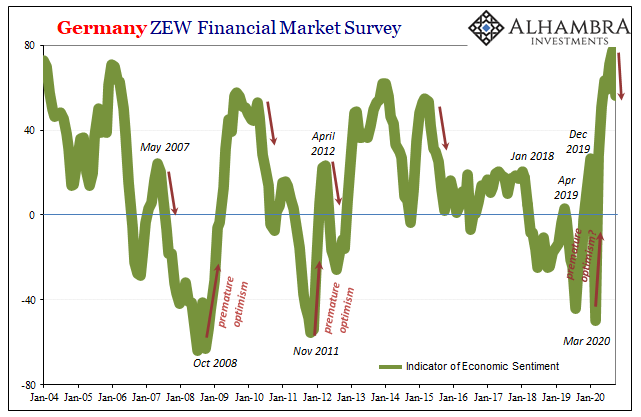

Inflation and recovery are a foregone conclusion across the world’s entire financial media even though there’s absolutely no basis to believe any of it. As we noted yesterday, not even the Germans are so sure anymore.

Stay In Touch