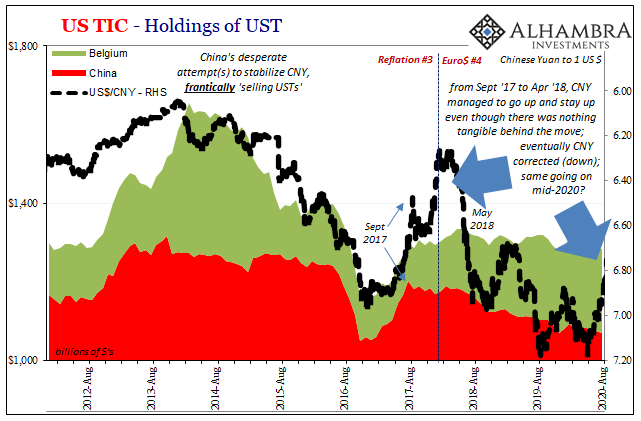

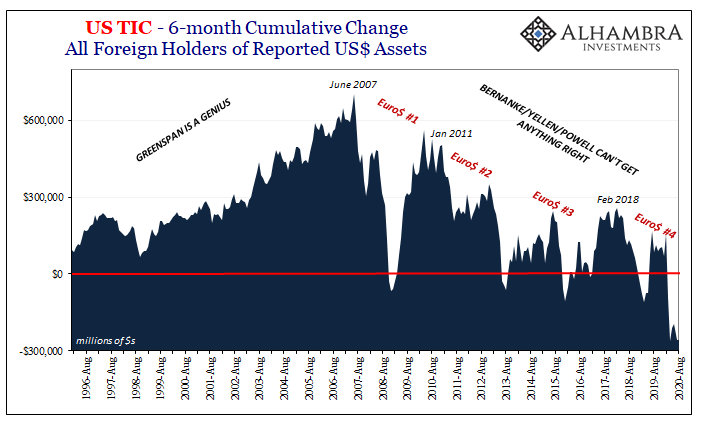

The dominating feature during the last months and days of globally synchronized growth (Reflation #3, to you and me) wasn’t inflation nor growth. It was instead CNY. Taken at face value, the marvelous resurrection of China’s currency after 2014-16’s debacle (Euro$ #3, to you and me) did seem consistent with a global dollar system (eurodollar, to you and me) rebound.

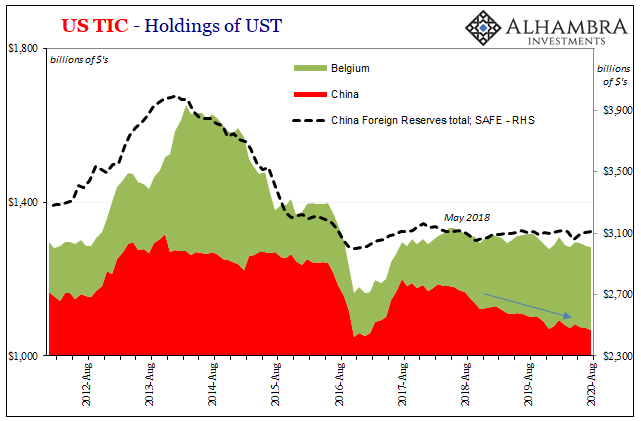

And there was a legitimate basis to believe this – up until September 2017. Before then, you could see as CNY rose the level of reserve assets (especially UST’s, according to TIC) were rebounding, too. That’s what we should see; the latter confirming the former, more eurodollars in the global system ending up in both official as well as private foreign hands.

The very essence of reflation in this the eurodollar’s world.

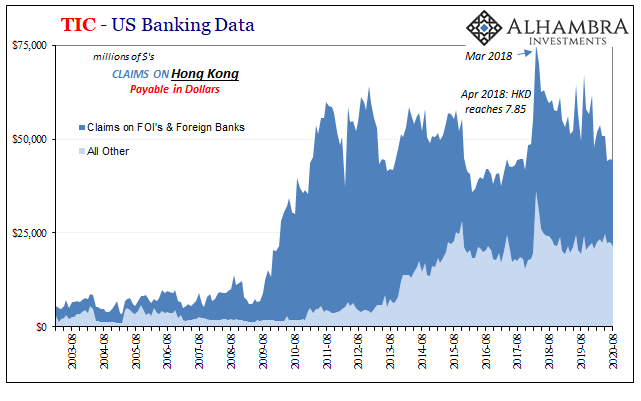

But – and it was a big “but” – not all was sitting right, nor everything lining up just so. For one thing, Hong Kong’s dollar was behaving suspiciously. Blatantly suspect in that its exchange value against the US$ was near exactly the inverse of China’s. No time more so than in the early days of September 2017, which was pretty solid evidence “something” was going on behind the scenes.

What, exactly? To this day, who really knows. I wrote in October 2017, looking back on that questionable summer using TIC, about those reservations:

In other words, someone is very likely “supplying dollars” (borrowing them in repo?) through Hong Kong as one way to help alleviate China’s broader “dollar” problem. Since that by definition hurts RMB liquidity given China’s monetary pyramid, it really wasn’t surprising to see the PBOC announce an RRR cut for next year.

These would together cover to some degree China’s banks on both ends, “dollars” as well as RMB. What about HKD? It appears to be (part of) the cost of doing all this, one that Chinese authorities might be counting on Hong Kong’s sterling reputation to more easily absorb (at least relative to the shakiness of CNY’s). Those costs are not only one-time, however. Unless this works, they will be added to the bill coming due at the worst possible moment (in other words, just like all the previous attempts).

Yeah, that last part did eventually happen. The “bill coming due at the worst possible moment” explains an awful lot about April 2018 and thereafter. While clueless Jay Powell was going on and on about inflation and accelerating global recovery, due supposedly to the Fed’s belated success with QE’s that had ended years before, China (as well as every other currency around the world) was slamming that back in his face while being confronted by another dollar shortage which would soon wreck everyone’s plans.

That much became clear when, in the following months, the eurodollar curve first inverted (June 2018) followed by others and then the landmine beginning October 2018 which (should have) erased all doubts.

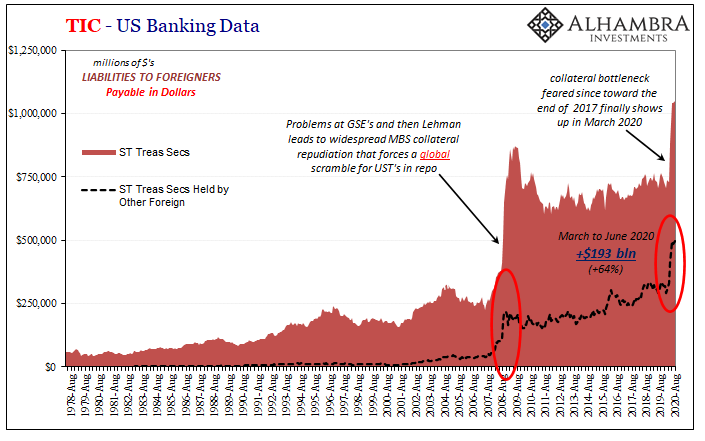

Just before all that, though, from September 2017 until mid-April 2018, for seven long months CNY remained strong. This time it wasn’t “backed” or corroborated by apparent inflows of legitimate (for lack of a better term) eurodollar sources. CNY spiked as inflation hysteria grew wild in the final months of 2017 – but where were the UST’s (above)?

They were nowhere, leaving us to suspect Hong Kong even more strongly; covert means of recruiting state-owned banks under forward cover to (Brazil strategy) borrow more heavily in dollars via Hong Kong counterparties in transactions that will probably never get uncovered.

Sure enough, anecdotal data from TIC appeared to partly confirm our suspicions; December 2017 through March 2018, what that data shows is how US banks suddenly lent (US bank claims) ~$27 billion to Hong Kong banks, representing an 80% increase in just those four months. Twenty-seven billion doesn’t sound like a whole lot, and it isn’t, not really, but that’s just what we could see.

Where those dollar borrowings ended up, who knows. We can guess.

But what happened in April 2018? Again, we don’t know for certain though it’s more than reasonable to surmise that the dollar pullback (shortage) which had been gaining for months by then (as seen in EFF, LIBOR, repo, etc.; the FOMC lying through its teeth about “too many Treasuries”) suddenly reaching a tipping point from which it would have been no longer economical for Hong Kong banks to redistribute in this manner.

Even if the PBOC “demanded” it.

The consequences were immediate and sharp; CNY plummeted, reinforcing the global shortage and upending every last bit of mainstream convention about what was going on in 2018 (CNY DOWN = BAD). Even the Indians were flummoxed enough to scorch the pages of the Financial Times complaining (though, as usual, experiencing the symptoms without being able to properly finger their true cause).

Inflation hysteria eventually died down and then very quietly disappeared altogether. Jay Powell’s rate hikes and his recovery scenario drowned out by the landmine’s introduction to by then widespread funding problems wreaking havoc globally.

And that explained 2019.

Today, déjà vu. Inflation right now isn’t present or even indicated, yet “we” are on the verge of another hysteria. Just open up your browser and click or tap onto any mainstream financial media outlet. Talk about inflation in the financial press is ubiquitous just as it was in late 2017 and early 2018.

Coming down on the side of this conventional narrative are only a (suspiciously) few indications. One of them, perhaps most prominent, CNY. China’s currency is again on the rise.

And like late 2017, there’s nothing behind it – that we can see. In this case, using TIC figures as well as those from the PBOC and China’s SAFE, it’s unsupported by anything that we would expect under even marginal reflation conditions. Again, eurodollar reflation leads to more dollars in more private as well as official hands. Not happening (below).

More than that, as you can see on the chart above (TIC: Hong Kong), there’s no HK slush fund in operation, either.

Something is going on here, and it’s not a dollar flood of any type. If anything, there are more and more signs of at least the underlying 2017-type hollowness.

For one, as I wrote in a separate October 2017 article (October 2017 really did turn out to be a pivotal time for a whole lot of reasons):

The Chinese government has sold its first dollar bond issue in thirteen years. Given that fact alone, the idea is causing more than a little confusion, perhaps consternation. Why now? What are they really up to?

As I noted back then, China’s government didn’t actually need to borrow any dollars from the Eurobond market – or anyone. They were active instead intending to set a benchmark price from which they hoped the rest of China’s dollar-starving companies (including financials) might be able to more easily follow.

This bond business is really another indication of the continuing negative progression for China’s “dollar” problem; specifically that this (in some ways impressive, at least imaginative) Hong Kong plot might not have worked out well enough to buy more time. If that was the case, you would expect Chinese officials to have a Plan B lined up (or Plan Z, as it might be more realistically classified).

Ultimately China’s real problem is Janet Yellen. Not that her RHINO’s [rate hikes in name only] are causing eurodollar problems, but that the US central bank pays no attention at all to eurodollars and sees them as nothing more than a funny, quirky little niche part of the global market rather than the world’s actual, effective reserve currency.

If eurodollar system reflation was going on, the government shouldn’t have needed to do this. If the Fed’s QE’s had worked, the eurodollar system would’ve been supplying what China’s financial and non-financial system required and then some. Exactly what Emil and I were discussing just recently; the Federal Reserve is not a central bank taking care of the dollar-based monetary system, it is instead a domestic bank authority which pays almost no attention to anything beyond this strict mandate.

Just ask the Chinese. Or Zambians, for that matter.

Ever since October 2017, guess what has become an annual ritual? That’s right, the Chinese government seeks to reset its dollar benchmark by issuing a new bond. October 2020 was no different.

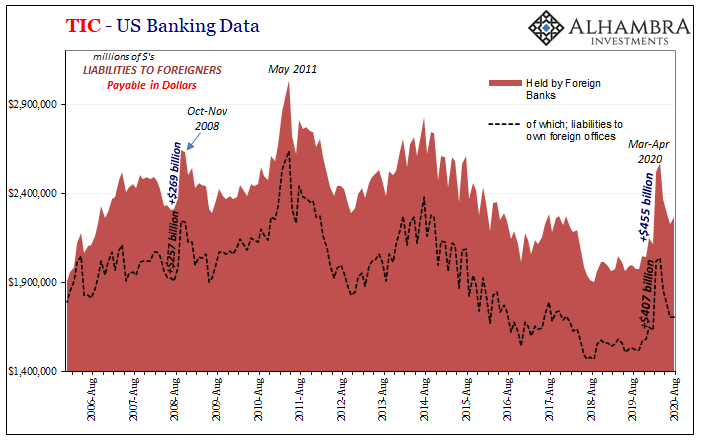

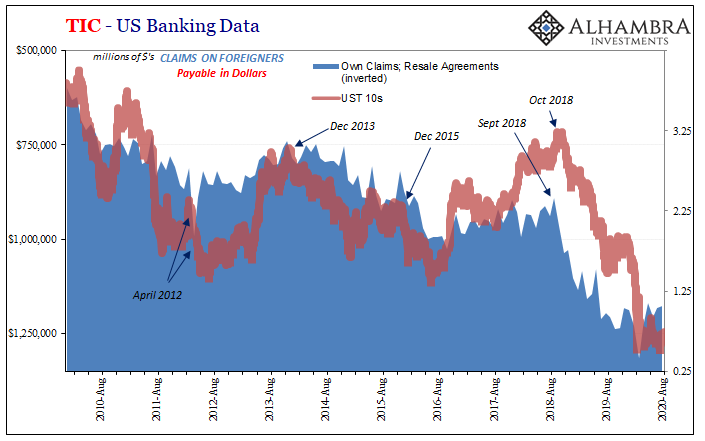

A walk through the rest of the TIC data (updated to August 2020) also reveals the lack of much movement as proxy for the eurodollar system. No reflation.

The top chart (of the three) immediately above shows that US banks continue heavy borrowing (red) of ST Treasury securities (T-bills) from foreign firms. Not a good sign, collateral-wise. The middle defines the winding down of overseas dollar swaps that were never really overseas (meaning Jay’s global flood of dollars was more of the same ultimately useless puppet show).

And the bottom in blue demonstrates both the relationship between UST yields (longer end) and repo market funding heading out in the other direction to the rest of the world (US banks borrowing ST Treasuries from foreign banks while lending cash to them; yeah, sure, Jay Powell’s got this covered with another trillion in useless bank reserves).

Repo extremes, especially, have come down since March and April – but why, like the dollar itself, only a very little?

A hollow jump in CNY, more evidence for eurodollar tightening than loosening, and a mainstream media wild for inflationary scenarios utterly convinced there can’t be any others. What is this, the fourth quarter of 2020 – or a second stab at the fourth quarter of 2017?

For China – and everyone else – they’d better hope 2020 represents meaningfully different. Otherwise, what I wrote in October 2017, the first time, would also apply if it does turn out this way: “Unless this works, they [hidden dollar shenanigans] will be added to the bill coming due at the worst possible moment (in other words, just like all the previous attempts).” While the world proceeds cautiously (and then hysterically) toward designs of inflation and recovery, the seeds of its reverse already sown.

Unfortunately, everything I’ve just written has been hidden from the public’s view. While it may turn out that we’re repeating history, for most people they’d never know it. That’s the corruption.

Stay In Touch