———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

PodcastAddict: https://bit.ly/2V39Xjr

———WHO———

Twitter: https://twitter.com/

Art: https://davidparkins.com/

How many years behind are regulators, from the leading edge of money? Consider, seven years AFTER the crisis, Europe introduced legislation (2014) to track securities lending. Not until 2020 did data collection begin. Besides, this, and other, money activity was brought to our attention in 1981!

A 1993 paper by Milton Friedman averred the data showed this is how economies operated, and indeed they did — in the post-WW2 experience. Friedman referenced an earlier work of his, from 1964, with data that stretched over a longer period that ALSO showed this. And indeed, the 1879 to 1961 period does, as long as you exclude the war cycles and 1945 to 1949 because, as Friedman put it “of their special characteristics.” So, if your podcaster understands this correctly, if you exclude permanent shocks and data discontinuity then one is welcome to assume no permanent shocks.

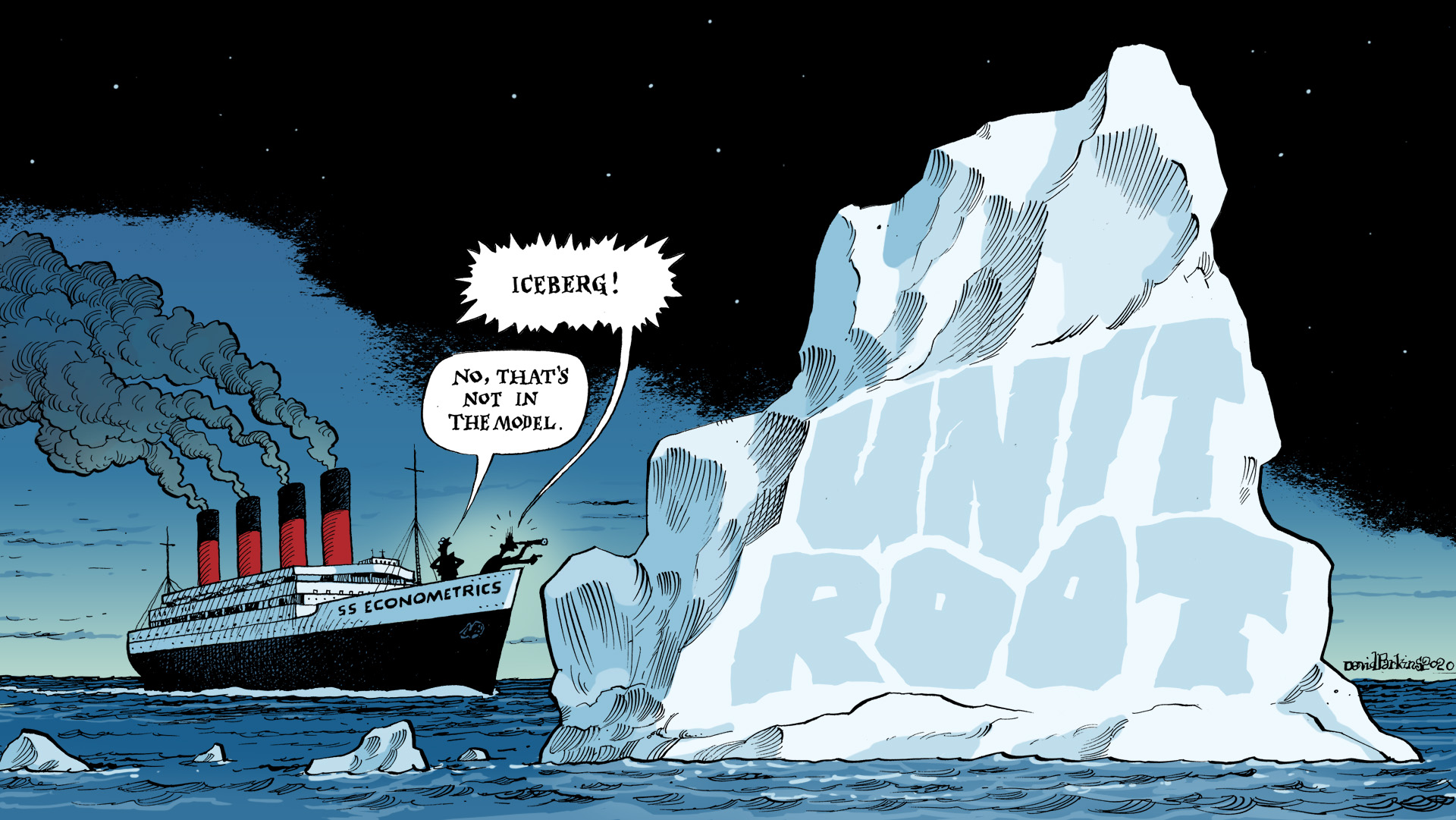

Now, your podcaster is admittedly missing something here. For one, he’s missing econometricians’ razor-sharp intelligence. Second, he hasn’t won a Nobel in economics – not yet at least. The cost of this lacuna is that shoelaces give him trouble – all his trainers and loafers have Velcro. Simultaneous gum chewing and walking results in emergency trips to the dentist. And hot dogs are eaten with the bun in one hand and dog in the other. But the benefit of not having a towering intelligence is not falling prey to hubris. In believing intricate mathematics model out permanent shocks. In believing that it can go back to the way it was. The year 2008 was a permanent break. Like 1914. Like 1929. Like 1945.

01:06 How far behind the times are monetary authorities from the leading edge of money?

02:27 What crucial event occurred in September 2019 in the monetary realm?

03:58 Why did the Fed say its reaction to September 2019 WAS NOT quantitative easing?

07:10 Why does the repurchase agreement market deman “on-the-run” US Treasury securities?

09:17 What crucial event occurred in March 2020 in the monetary realm?

11:14 Was 2011’s Operation Twist relevant to the Treasury Bills / “on-the-run” issue?

12:40 What crucial event occurred in May 2018, specifically May 29th?

14:24 What links May 2018, Sep. 2019 and Mar. 2020 together? Securities Financing Transactions.

16:56 European regulators are peering into SOME of the shadows – but it is taking a LONG TIME!

20:39 How far behind the times? A 1981 paper by Günter Dufey and Ian H Giddy offers context

———WHAT———

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch