You pick up a newspaper (metaphorically, hardly anyone does this literally anymore) and you’d be left with the impression the year is 1979 again. Forget 2017; that was child’s play, more like 1968 in the mainstream imagination. October 2020 is going to mark the beginning of the biggest one in decades.

Any day now.

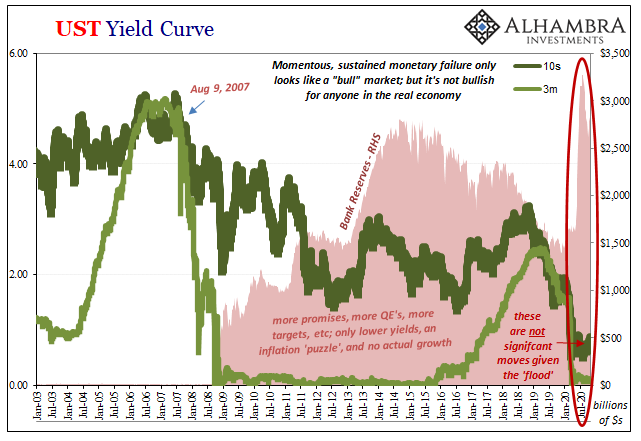

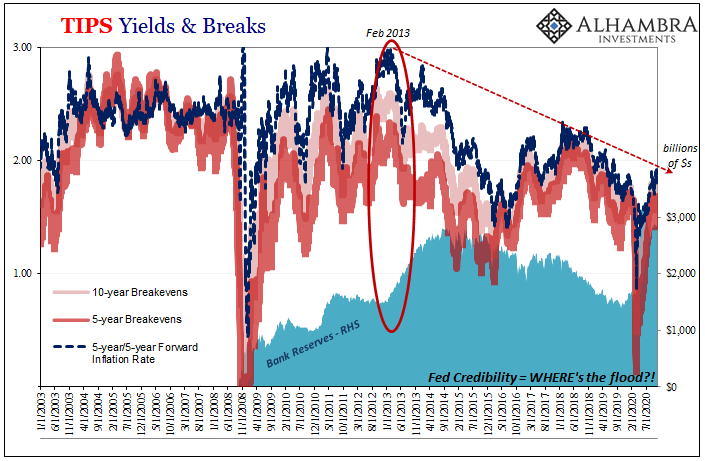

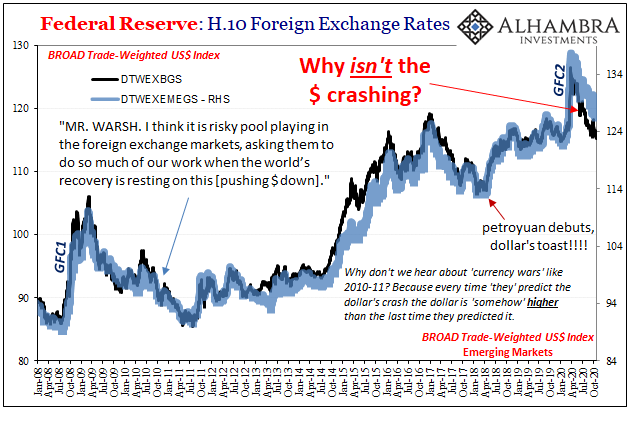

Inflation, of course. The Fed, the media says, has printed so much money it’s only a matter of time. Once the glut of cash filters its way into the real economy (not just the stock market, as is also alleged) it won’t be long until we begin longing for the (years) days of disinflation.

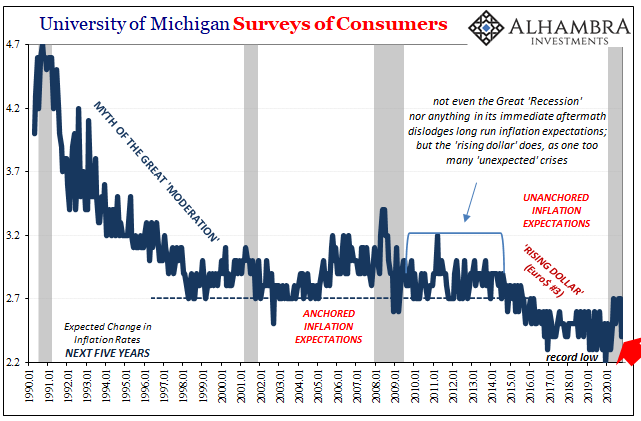

Saner heads, however, continue to prevail. Not just where they’ve been most sane – the bond market – even regular, everyday folks seem to have tuned out this utter nonsense. Yes, nonsense. This isn’t everyone’s first rodeo with QE and such. It really doesn’t take much to notice and appreciate how the constant stream of Bloomberg and Wall Street Journal stories have changed only their dates.

You don’t have to pay close attention to have realized everything being said now has been said to death at several points along the last decade or so. Just three years ago, 2017, absolute hysteria. Same with 2014, though more “transitory” then than hysterical.

Each time, huge spike predicted none ever materializes. Why doesn’t the media, or central bankers, believe people notice these things? Ideology is a powerful, powerful drug. The opiate of the “experts.”

While many if not most of those want desperately for the technocracy to be real, the public by and large sees right through them caring more about, you know, results versus promises.

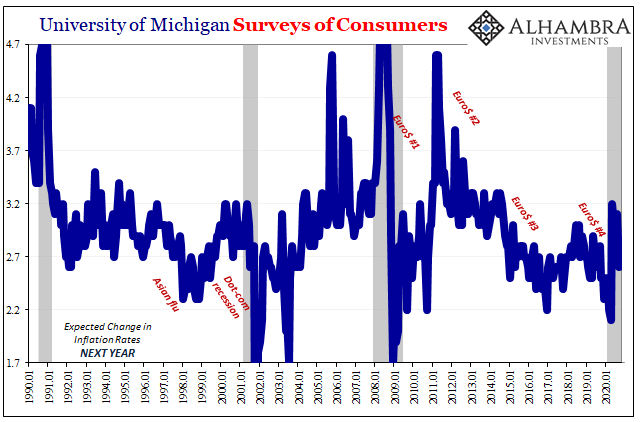

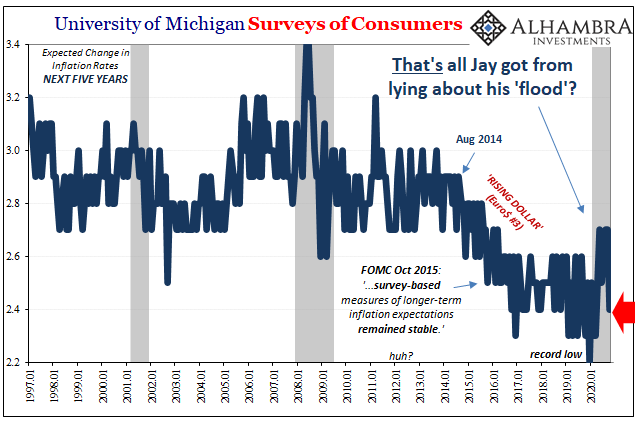

According to the University of Michigan’s Surveys of Consumers, Jay Powell’s post-March puppet show held only some modest attention and only for a brief moment. All that lying about digital money printing, the QE’s and corporate bond “support”, these things only managed to raise consumer inflation expectations by very small amounts for what is shaping up to be a few months at most.

In the grand scheme of things, how does this data (and the mountain of other surveys showing the same results) get reconciled with the media’s sensationalism about the Fed’s money printing avarice? The key word in what I wrote is “sensationalism” because that’s all it ever was.

In the UofM’s data, it didn’t even bump up to the pre-2014 (Euro$ #3) level in short run expectations. Those longer run, 5 years, barely moved. The smallest little blip despite Jay’s reported, repeated “flood” and even that much is gone already. It would be nice if Chairman Powell was just once made to explain this instead of every single reporter acting as his personal stenographer.

And it only gets worse from here.

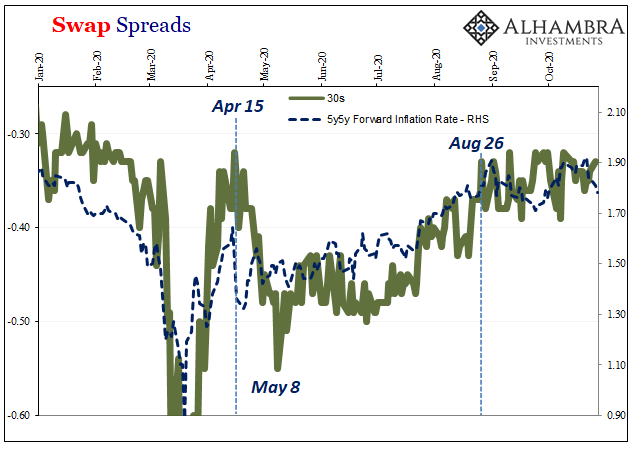

In the bond market, the Fed’s got bigger problems – meaning views on the real economy as a whole, not just the anticipated trajectory for consumer prices, it’s about rebound (lack thereof) and how that works out to inflation expectations and nominal yields.

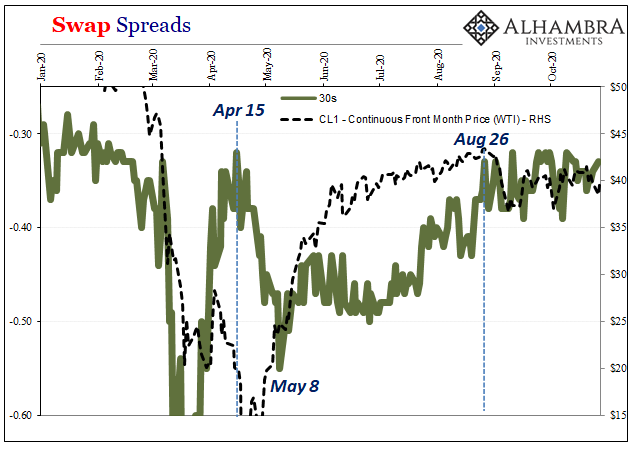

It begins with crude oil because, as we keep saying, crude oil is the intersection between the physical world and the monetary. Jay’s all talk, crude’s got actual stuff to move or store (see: April 2020). Supply, demand, and dollars all go in to the WTI curve and how this crucial commodity has been priced.

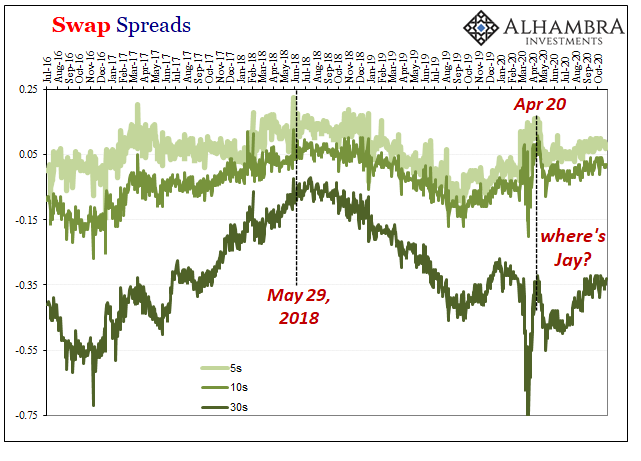

Since August 26, it has been priced differently than it had before. And before August 26 it had already deviated from the “V” script; the same which relied on the “flood” myth to do the heavy lifting alleviating the numerous questions and fears about real negative possibilities. Don’t worry about them, Jay said, look at all the QE and bask in the looming inflationary erase!

Instead, bonds and now the public are looking past the QE and back down to a more questionable reality.

What inflation? Waldo is far easier to find. If you’re Jay Powell and the Fed, that should be downright terrifying given monetary policy’s actual basis in myth and legend (sorry, expectations). Have we finally arrived at that badly-needed transition where these charlatans have exhausted their credibility everywhere else but the financial press?

That’s about the only positive thing to come out of this. Otherwise, setting aside late 2020’s new and even more ridiculous inflation hysteria, economic doubts (not election doubts) have been building for two months – without sufficiently positive answer. And counting.

This includes, by the way, what will be the biggest, most gigantic positive GDP number in history. We’ll find out later this week, but it may be so big that GDP in Q3 nearly matched on the upside Q2’s fall to the downside. This sounds terrific, and would be drastically inflationary, so why isn’t it being taken this way?

Because, all along, underlying that artificial Q3 rise is still the same questions about longer run damage underneath; not just jobless claims and the indicated ongoing destruction there, but also what that represents in terms of the aftermath from GFC2 (liquidity fears and global economic behavior changing for the worse; again, perhaps more unit roots).

In short, for everything that’s happened, everything supposedly going the right way, there just isn’t much belief it is anything other than a fairy tale. You just don’t get inflation let alone recovery based on the repeat of a crummy, boring story.

Given what’s been written and what’s been said, it should be nothing – I mean nothing – like this:

Stay In Touch