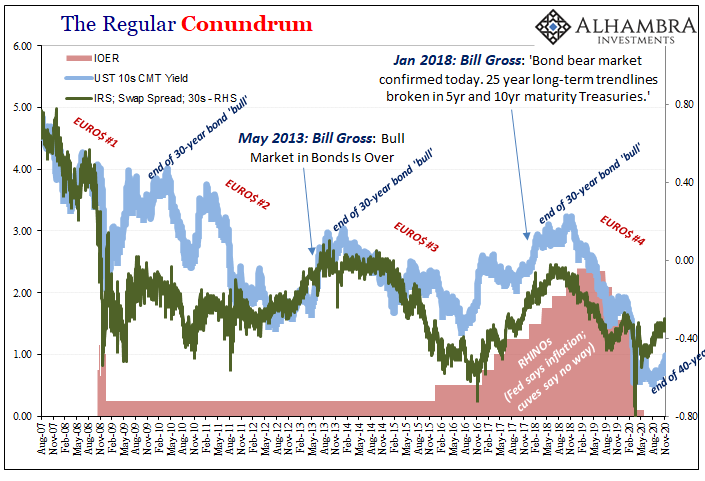

It’s easy to pick on Bill Gross because he made it so easy for everyone to do so. Time and again, he called for an end to the bond market “bull”, seeking to make huge profits on the fixed income massacre he said would soon follow whichever one of those decrees. There were several and they weren’t limited to just US Treasuries.

The real reason why we highlight Mr. Gross as opposed to some other so-called Bond Kings is that, in one very important sense, he got it exactly right. Low yields are a choice rather than the permanent condition they might otherwise appear to be. A choice of central bankers to keep doing QE’s as well as a choice made by politicians, and the voters who vote for them, to continue tolerating this madness.

Ironically, it is opportunity at least more broadly speaking which is why what Gross had hoped will happen. In other words, when the real economy finally pulls itself up out of the toilet for once, when it looks like this is actually for real and not just some mirage concocted by central banker bumper sticker slogan, that’s when the “bull” market dies for good.

Or, as Bond King Bill put it when in May 2013, during one of his (several) end-of-bond-bull proclamations:

The manager of the world’s largest bond fund stressed that a bear market in bonds won’t start until economic growth and inflation pick up — an arrangement that he doesn’t expect to see immediately. [emphasis added]

Funny how “doesn’t expect to see immediately” is doing so much heavy lifting in that quote. May 2013 was, you’ll note, seven and a half years ago. Therefore, what we can piece together from just these two things is that, for seven and a half years, there must not have been “economic growth and inflation” picking up.

Even the Federal Reserve has of late given up pretending on the inflation side.

Since markets are forward-looking and probabilistic, what that had meant – even during 2017’s inflation hysteria – was bond yields reflecting only a small change in probability for this inflationary outcome. Rising nominal yields didn’t rise all that much, certainly nowhere near as much as Mr. Gross or his peers had been chirping about, while flattening curves combined with reluctant nominals discounted future likelihoods it was ever going to get very far.

It never got very far.

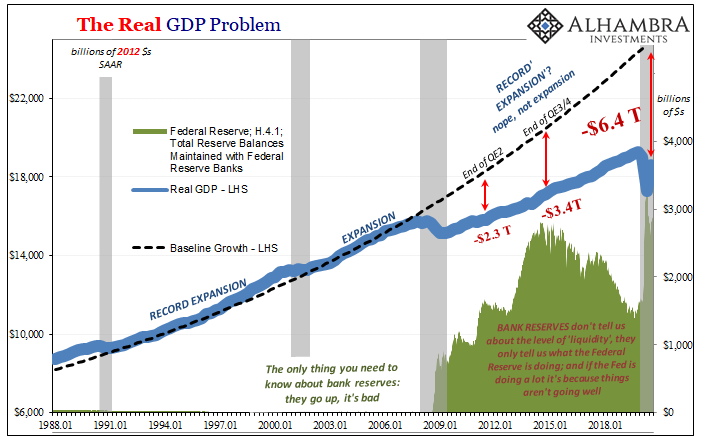

At no point during that very long period did it realistically look like recovery was happening. In reality, I mean; in the financial media drawing from central banker opinions, recovery had always been a done deal. It was widely reported as fact, a huge part of the social and political problems we’ll have to contend with for a long time (but that’s another story).

In the middle of all of this was the same thing: QE. You can therefore understand why central bankers would want to outright cheer economic conditions to the point of purposefully skewing their views (with the unemployment rate). And in 2017, the pressure for doing so was at its maximum (inflation hysteria).

Alas, no BOND ROUT!!!!

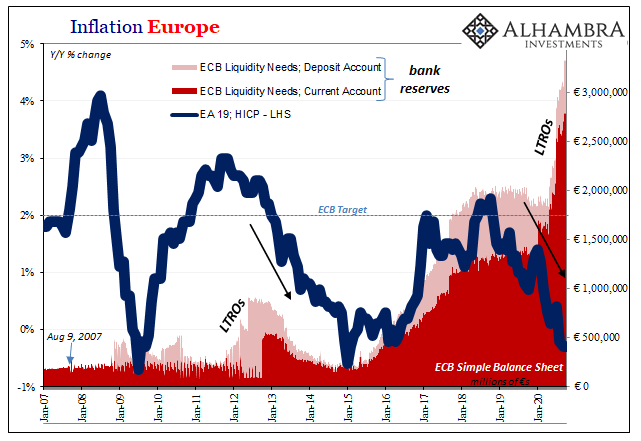

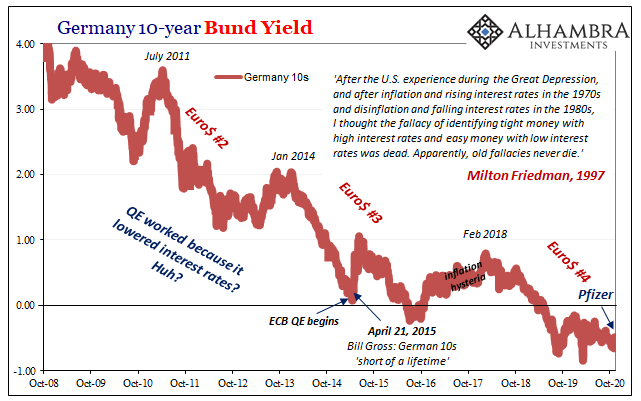

As I wrote, Mr. Gross hadn’t been content to try and kill just the Treasury market. He had done the same thing elsewhere when in April 2015 he predicted German bunds represented the “short of a lifetime.” The ECB had just begun its first full-blown QE program (though it had followed nearly a year of negative rates and several months of “targeted” LTRO’s, obviously neither of which hadn’t accomplished much) that, like Gross’s feelings on the Federal Reserve’s late 2012 QE’s 3 and 4 (yes, there were four to that point), amounted to surefire inflationary recovery.

The BOND ROUT!!! in either market was predicated on QE being effective. How it might be so, to my knowledge Gross never explicitly stated or betrayed knowledge he actually knew (other than just trusting econometric models, in those he was well-versed). However it was supposed to work, he thought it definitely would.

And, again, if it had worked he’d have been absolutely correct.

But it didn’t work. Not once. Not in any place it has ever been tried.

When Gross shouted his bund short in 2015, that specific German federal security yielded near zero, a mere +7 bps; lots of room on the upside for shorts. That much is very easy to understand, the path of least resistance always seems to line up in that direction. They’ve got to go higher, don’t they? Can’t stick so low forever, can they?

Yields initially seemed to validate the theory, bund rates rising to as high as +105 bps by that September.

Unfortunately, this was just as Euro$ #3 was wrecking mostly emerging market economies, turning its sights onto the developed world, too. Yields globally would fall from there and in Germany never again approach even that modest level. The highest they would rise post-2015 was +78 bps in February 2018.

Their yield today is -54 bps. Yep, substantially lower than the “short of a lifetime” – even after Pfizer announced its COVID vaccine earlier this week.

German bonds, like their US Treasury counterparts, sold off on the announcement if only modestly (putting it kindly). Since Tuesday, bunds, schatzes, and bobls, however, are back on the rise (price-wise).

What that suggests, vaccine-wise, is that the market isn’t projecting Pfizer’s breakthrough as significant in the same “economic growth and inflation pick up” manner needed to spark the long-awaited recovery. And that’s huge because Europe is right where a COVID vaccine would, right now, make the most difference.

The European economy is teetering on the edge of re-recession because, we are told, there’s a second (third?) wave of coronavirus cases giving governments the green light to overreact for a second time.

A lack of BOND ROUT!!! at least in the short run therefore indicates markets don’t believe the vaccine will make any difference in that short (and intermediate) term. Either it will arrive in sufficient quantities too late, or ending the COVID-fears pandemic won’t be enough to boost the economy because there’s too much damage sustained already.

The vaccine’s just not a game-changer.

There’s also another factor to consider, the same one that Bill Gross had been missing since 2013 (and long before that); the same thing that held German bund yields to just +78 bps on the rate upside.

What I mean is, the European and German economy never got the chance to become inflationary, to experience recovery and therefore realistically project opportunity in the real economy. Euro$ #4 intervened first (which was, in many ways, already priced into yields throughout 2017 and the first few months of 2018, in that the bund market like the UST market was trading as if a fourth eurodollar episode was too high of a probability for “globally synchronized growth” to ever get anywhere).

In other words, the chances of the global economy souring again were consistently judged to be far better than the chances of it soaring. This imbalance or asymmetry of inopportunity versus opportunity, defines low yields.

For Europe, that had meant two years of downturn and then recession before COVID ever showed up. Pfizer also can’t erase such a weak and devastating starting point.

In 2020, then, already seriously damaged this meant European businesses went into this thing in no mood to hear about QE fantasies and central banker predictions for inflation and acceleration that hadn’t worked out before; more to the point, proven beyond any doubt dead wrong – and not just for a few months – as Europe spent two years spiraling down toward a pre-COVID recession no ECB posturing seemed to have been able to prevent.

More QE will suddenly be effective after the recession got so much worse?

In terms of opportunity – and seeing opportunity – it was the exact wrong thing for badly needed risk-taking confidence. What is recovery other than businesses (and the money side) in the economy willingly, confidently taking risks on the rational belief that things will turn around and end up turning out good (inflationary) enough in the near future?

And now a summer slowdown shows up throughout Europe, too.

Each time we have to hear interest rates have nowhere to go but up, interest rates are significantly lower than the last time we’d heard this.

Gross was right. The day a real recovery becomes a real possibility, that is when the bond market changes. It’s a day everyone around the world will celebrate; the BOND ROUT!!!! will be a glorious thing. Vaccine or not, globally the market is telling you it isn’t here yet. Not even close.

Not COVID or vaccines, we’re still dealing with the same mess left over from 2008. That’s the thing Gross and the others like him missed on; the very thing QE just cannot, and will not ever, fix.

Stay In Touch