The Presidential election was supposed to have been a big one. Yields were low, or high, based on how whichever expert or financial media article was interpreting the manner of trading in bond markets. You could take your pick; a “blue wave” was bad, as in BOND ROUT!!! due to inflation and potential for even more (how?) spendthrift ways in government. A tossup election was both good and bad, opinions split on the ramifications.

Either way, nearly everyone said November 3rd was pretty much certain to radically redraw the yield curve and burst the bond “bubble.” From summertime to the day of, election, election, election at least all over mainstream financial commentary.

And it’s not like there hadn’t been something like this before. The charts had already been making the rounds on social media comparing yields in 2020 with the pattern for them in 2016. After Trump’s upset victory last time, bonds actually did selloff substantially.

Then even bigger news. To begin last week, Pfizer belatedly shared the promising results of its COVID vaccine. Game changer! Like the election, that’s what “everyone” had been saying. Cure COVID, cure deflation. And if that one wasn’t enough, on Monday we find out about a second vaccine in as many weeks.

Boom. It was all over.

Suddenly, everything at once had been lined up perfectly, absolutely perfectly for reflation. A reckless Fed pledging more. Overseas announcements of already more. Stimulus, lack of rioting, vaccine. Everything, I mean everything, was happening the right way. Treasury rates were primed to head to the moon (and the dollar to zero).

So, why didn’t they?

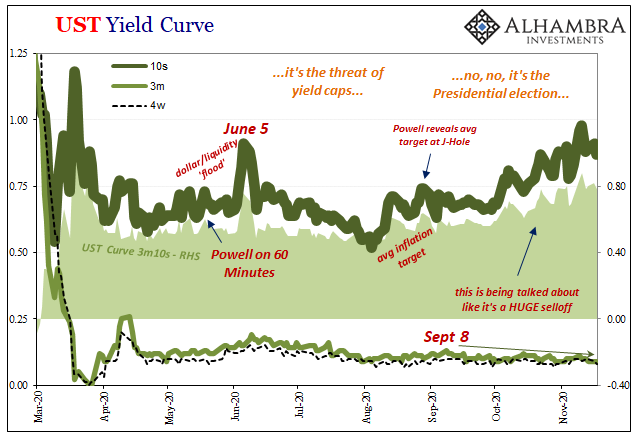

For one thing, the Treasury market wasn’t primed to selloff at all. Nominal yields had been pushed higher, sure, but not on actual reflation which continued to be conspicuously absent in all the other key bond market prices and indications. Only beginning with the short end (bills).

What had been happening was simple and misleading: long bond/end shorts were using whichever news to short some more – and that’s all it was.

Even so, the upward move in yields qualifies only as a market fluctuation, and not even that much of one.

Two vaccines and a relatively smooth election (relative to what could have happened), the 10-year US Treasury yields is…right where it was on November 2. The 10s dropped a few bps afterward, closing that week to yield 83 bps. Big short-term, one-day spike higher on Pfizer, up just shy of 1%, but, again, today pretty much back where we started.

Neither the election nor the vaccines have, to this point, made any difference whatsoever. What’s driving the market’s outlook simply has nothing to do with either of those, a fact which is pretty evident now just as it really has been for months.

Obviously, the election-is-uber-important people, like those who’ve been pounding the table for vaccine-phoria, have been missing everything else. What they’ve been missing – the same as always – has been basically the entire rest of the bond market.

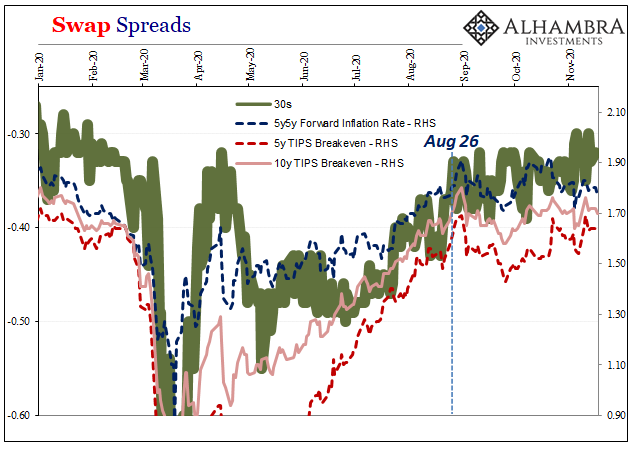

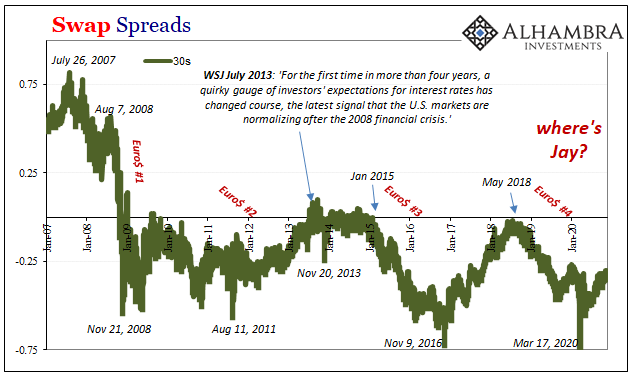

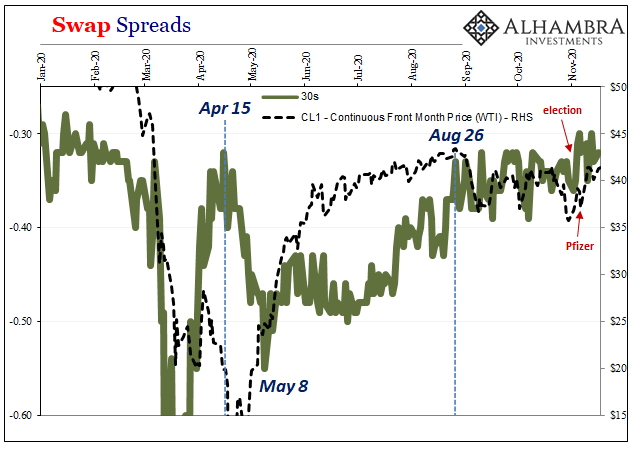

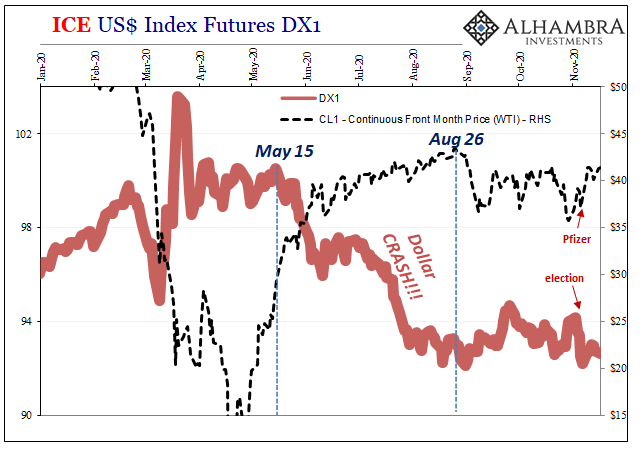

Risks, not reflation, have been rising since June. And uncertainty had already taken an unwelcome turn toward the real economy and the markets back at the end of August. Closing in on three months where everything, I mean everything outside of nominals at the long end UST, told you to hold up on reflation.

Even the DOLLAR CRASH!!!! was halted.

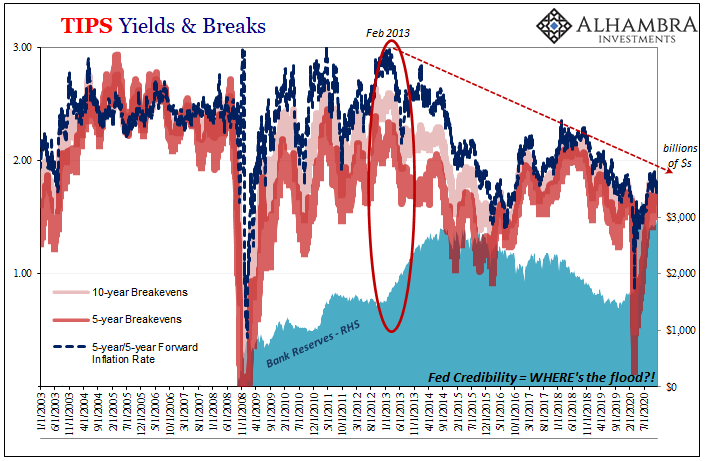

Inflation expectations, a big one, despite the voting and the vaccines haven’t budged. Seriously, they’ve barely moved in months. Not only that, it’s not like they’ve already achieved some high level. Quite the contrary, inflation expectations have been stalled out at historically low levels.

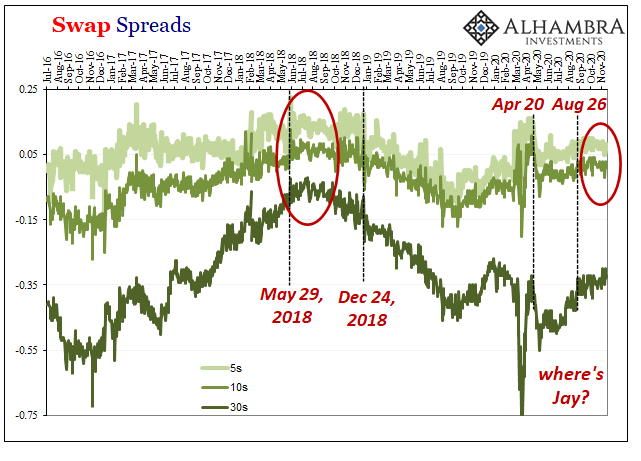

There wasn’t even modest inflation in swap spreads or WTI. Nothing. Just shorts shorting longer UST’s on whatever “important” news seemed important to the mainstream unaccustomed to really understanding bond yields. Jay Powell, most of all.

As I wrote earlier today, as the preponderance of economic and financial evidence keeps pointing directly at the disinflationary, procyclical slowdown instead of acceleration continuing into another month:

No wonder how even after two COVID vaccine announcements in as many weeks, there has not been the smallest hint of an actual BOND ROUT!!!! A vaccine is great news…for 2022. Between now and then, the evidence continues to show how we will likely have serious economic problems to confront first.

To those who thought the election would actually matter, like those who thought the vaccines would change everything, to all of them they had operated under the assumption reflation had been a foregone conclusion. The rebound was like a recovery. After all, Jay Powell had told them this was so.

Therefore, election results plus an end to COVID would’ve meant a guarantee of pushing reflation all the way home. On top of QE and more Uncle Sam, what could possibly go wrong?

The simple truth, as you can see quite clearly, it never once had been that easy. And that was before back when gigantic positives were all around. The bond “bubble” was supposed to be burst under such huge pressure. What we see instead, however, is that the pressures continue to be on the other side; the procyclical, deflationary side. As a consequence, those “big” things, the election and the vaccines, they barely even register. In places like swap spreads, the shorter tenors, they don’t even show up at all (below)!

Stay In Touch