It has become our new weekly ritual, though I dearly wish it was anything but. The Department of Labor’s Employment and Training Administration informs the country every Thursday just how many (or a reasonable approximation) of its citizens, formerly working, have filed for determination of unemployment insurance eligibility. Eight months after the initial eruption, we are nowhere near back to normal.

In fact, the numbers continue to be staggeringly huge – which is why this has to become a weekly tradition. Not merely for those who follow these things closely, more so to make this known as much as possible to those who don’t normally follow. While other economic accounts suggest a big comeback, this right here refutes each and every favorable interpretation based on them.

Folks, this economy is in big trouble. There’s really no other way to put it (well, the bond market is putting it another way, using instead the language of yields and rates, but still adding up to the same thing anyway).

And this comes at us in two dimensions, the one more immediate and obvious though the second far more concerning because it’s not just about today.

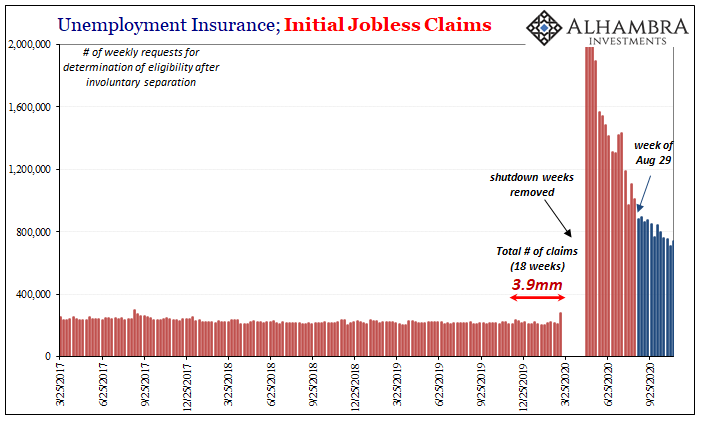

What I mean by the first part is simple enough; total weekly filings remain elevated, to put it kindly, well in excess of not just the pre-March averages but actually still higher than what before March had been record levels. As of the week of November 14, last week, an astonishing eight months in, initial jobless claims were a reported 742k.

Seven hundred and forty-two thousand. Mid-November.

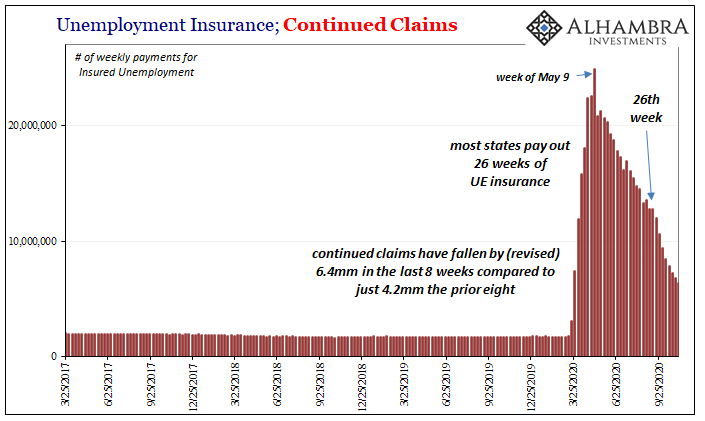

Continued claims, meanwhile, are falling by an accelerating rate. Normally a welcome sign of recovery, in this case, some improvement in the labor market but mostly instead as claimants exhaust their 26 weeks of regular state fillings. Several hundred thousand did so during the week of November 7, and most of them found their way to extended federal benefits rather than return to work.

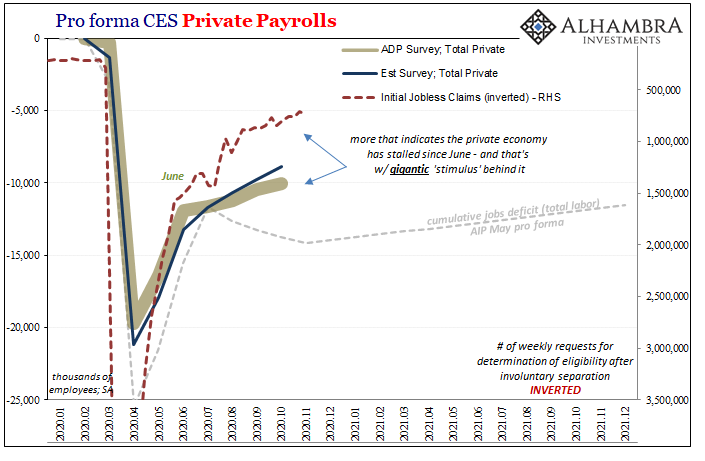

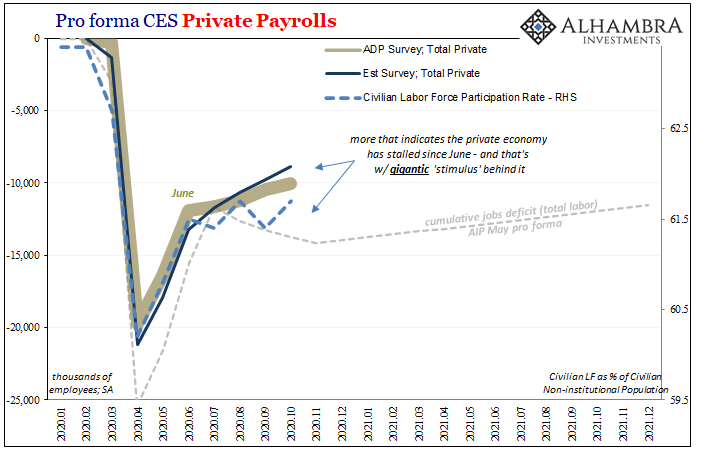

It’s the second element of these trends, though, where we find the most concern: rate of change. As we’ve been carefully chronicling all summer, there’s been an obvious and definite change in the character of the overall economic rebound dating back to around June and July. Markets picked up on it right away (June 5).

Same thing in jobless claims where the initial reopening frenzy had led to the most gigantic positives that all of a sudden started to fizzle out right in that same timeframe. It’s still a rebound, but it’s quite clearly not the same thing.

That bend or inflection is the reason why initial claims remain up at record levels – the labor market just isn’t healing at nearly a sufficient rate.

What’s more, this is something we’ve seen before, therefore raising the potential of repeating what came before. That’s the bad news. This asymmetry or permanent shock stuff.

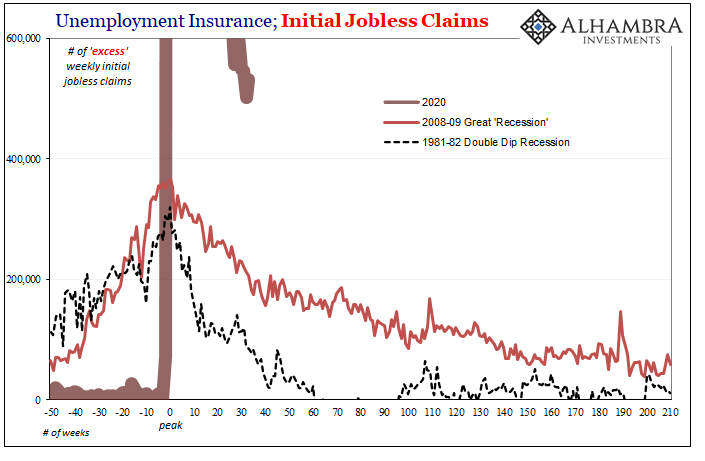

If we compare the biggest recessions of the last four decades – 1981-82, 2008-09, 2020 – and normalize jobless claims in them to “excess” filings over and above each pre-recession average, what we find is:

In other words, both 81-82 and 08-09 started out with largely the same very sharp (destructive) rise, taking a little over a year to reach respective peaks.

On the recovery side, however, very different. Within a year or so, the recovery following the 81-82 cycle had been pretty much fulfilled – even though prior to 81-82 there had been a nasty if short recession in 1980 (81-82 was a double dip). Starting out bad, finishing very strong.

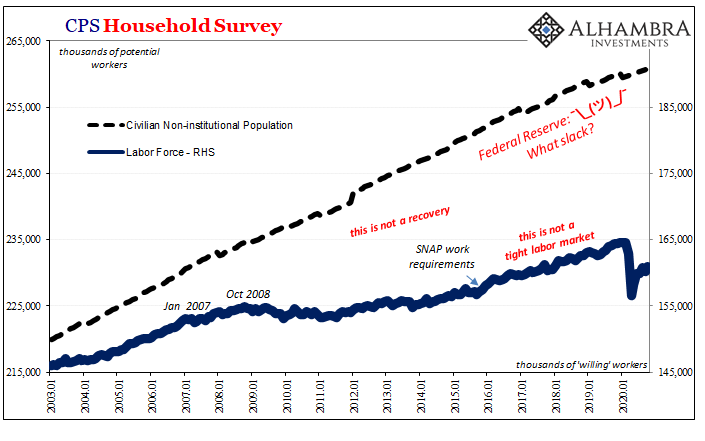

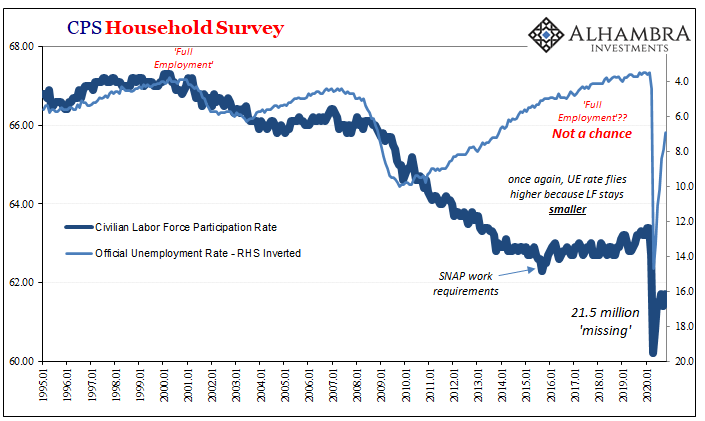

By contrast, it took a lot longer for the labor market to come back following 08-09, a fact established not just in the jobless claims data here but also labor force numbers, participation rates, and so on.

Both those contractions were huge, and in the end the unemployment rate at its highest was nearly the same. The economy of the middle 2000’s wasn’t anything like the economy emerging in the early eighties, but recovery mechanics (that unit root stuff) should have been largely the same anyway. It’s supposed to be symmetry.

Instead, we’re left to wonder about a couple really big questions I’ve asked elsewhere for publication tomorrow:

Which course does it sound like we’re currently following? More to the current point, and our future worries, what had distinguished 2008-09’s “great” “recession” from the rather nasty one in 1981-82? The answer wasn’t “idle land”, but it was, and remained, a true and rather obvious – once you stop looking to central banks for answers – “impediment in the machinery of exchange.”

There has been a very definite historical relationship between labor market problems in and after deflationary depressions when compared to even the nastiest recessions of the post-war variety. The impediment in the machinery of exchange, a monetary shortage, certainly wasn’t an issue in 1982 moving forward; that recovery truly boomed.

The one following 2009 absolutely did not boom. Not once (inflation puzzle solved).

Given what we’ve seen in the labor market data especially during this summer slowdown which has persisted well into autumn now, I ask again, which of those two possible courses does it sure seem to be like we’re currently following? It’s a rhetorical exercise given that we all know what happened in March, even though there wasn’t another “Lehman”, was all-too-similar to what happened in 2008 anyway.

This impediment in the machinery of exchange is no historical curiosity, it just isn’t widely known because of central banks which have a vested interest in you not ever knowing it. Flood of digital dollars, or something.

Stay In Touch