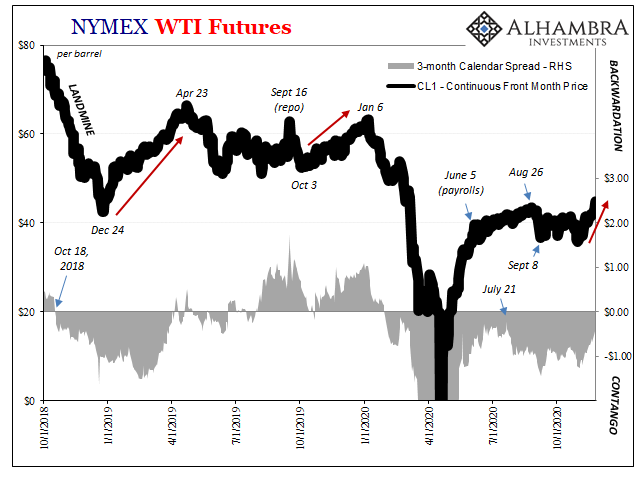

The oil market has caught a mild case of the raging disease. Not COVID, rather the purported cure for it. Vaccine-phoria has visited the energy sector and propelled oil prices upward while pulling less contango in the futures curve, awakening this commodity market from its post-August doldrums. It had been that detour in WTI which began to suggest this summer slowdown in the US and global economy was a real thing.

On the one hand, prospects for a COVID-less future which presents a somewhat plausible path back toward a normal (at least in the post-2008 sense) economic condition. On the other, an absolute certainty that the rebound of today took a bad turn five months ago and hasn’t yet been able to regain its footing since despite an overwhelming inflow of “stimulus.”

The classic clash between today and tomorrow. For the oil market, we’ve been here numerous times before; “here” being a temporary infatuation with some kind of game-changing development.

From late December 2018, the bottom of that year’s devastating (Euro$) landmine, crude rallied for months on end – all the way to late April 2019 for what should have been a convincing 54% gain. A “Fed pause” had been talked about in the very same way that Pfizer and Moderna’s coronavirus breakthroughs are now. Jay Powell’s promise to stop “raising rates” was said to be the cure for the “unexpected” downturn that had already turned Europe (and Japan) toward recession.

Blamed on a combination of those hikes (“policy error”, it was called) and trade wars, a more compliant Federal Reserve couldn’t possibly lead to anything but more robust demand. Even WTI – for a time – agreed.

The problem, of course, was that the Fed hadn’t been responsible for the downturn and could not, could never, keep the US economy from joining its Atlantic and Pacific counterparts. There never, ever is decoupling.

This euphoria cycle repeated once again if in reduced fashion beginning with October 2019’s not-QE and “repo” operations madness. Similar premise, same result.

That’s what markets do; they fluctuate and discount material factors which might alter probability spectrums. Meaningful changes in these, however, categorical shifts in underlying fundamentals are related to us across many market prices and indications. Temporary euphoria comes and goes all the time.

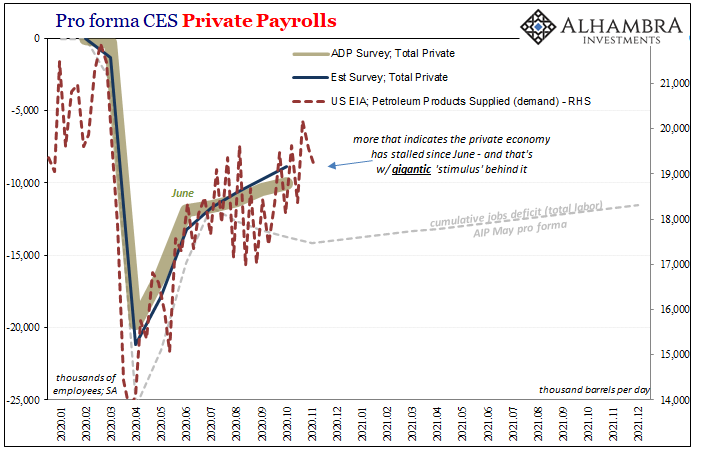

But this isn’t about that or really the oil market. Rather, it’s about the summer slowdown; the here and now, where we are today. This wrong turn in the rebound continues to show up everywhere, including, maybe especially, energy:

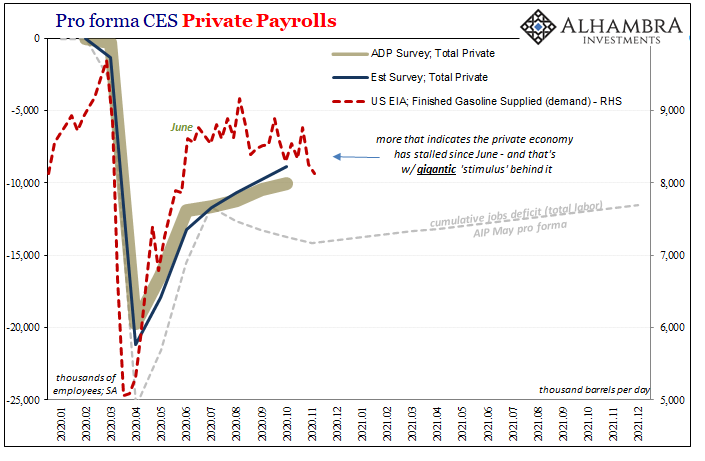

The contrast between today and tomorrow could not be starker; just look at domestic gasoline.

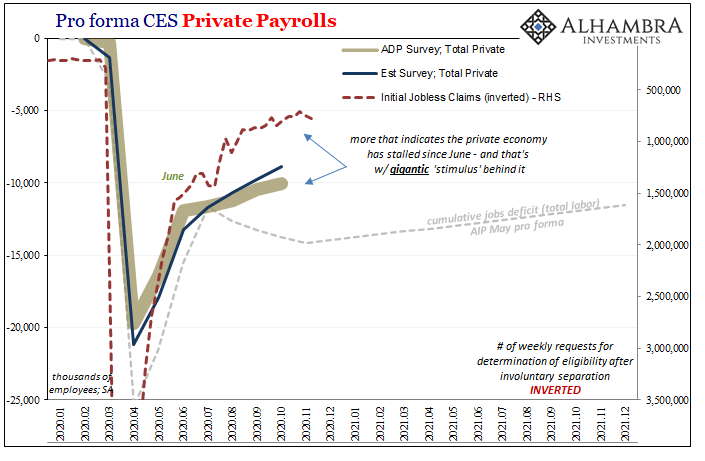

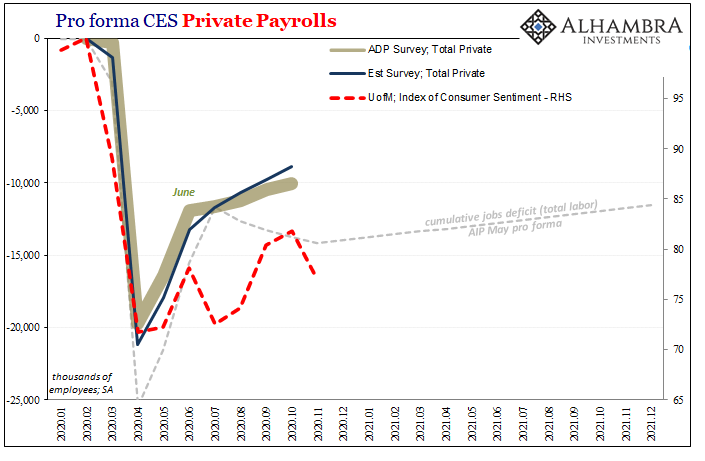

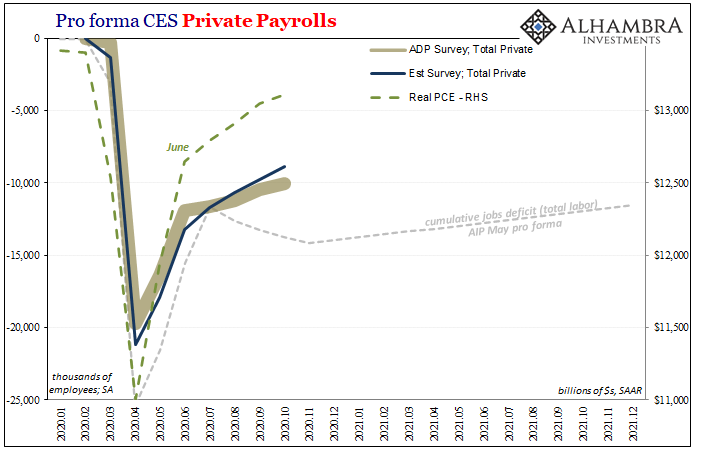

It’s not just energy demand and use, obviously. This unwelcome June-ish inflection, again, is everywhere and in practically everything. Due to the Thanksgiving holiday in the US, we’ll have to briefly move up our new Thursday ritual of reporting on unbelievably awful levels of jobless claims to Wednesday, today.

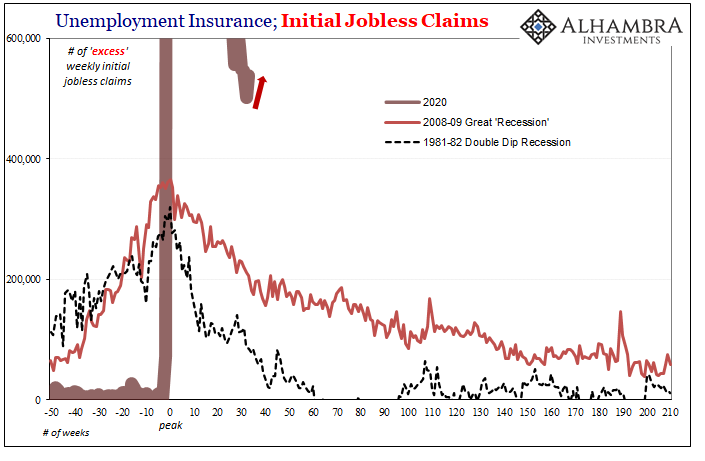

For two weeks in a row, initial filings have surged and as of last week totaled an absolutely ridiculous 778,000. That’s up 67,000 from two weeks prior, an absurd 9% increase from a level that was already in record (pre-March) territory. Once more we find that this deviation in trend traces back to around June.

If the labor market is struggling, you can be sure that workers as consumers must be, too. While the vast majority are feeling somewhat normal again, even acting that way, it doesn’t take all that much to be left outside of “normal”, cast by a malfunctioning economy into at best uncertainty, for the system to derail or remain fundamentally weak.

Even the worst recessions only directly impact a very small proportion. This thing’s proportions were never small, and they remain huge by most historical standards.

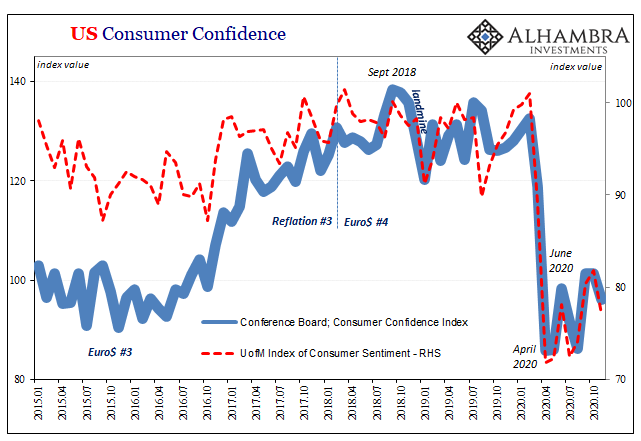

Both the Conference Board and University of Michigan’s measures of consumer confidence easily display the lack of confidence in the economic rebound. These remain substantially below February 2020, closer to the trough than getting back anywhere close to even.

This despite a supposedly rip-roaring stock market revisiting new record highs and therefore, somewhat like WTI over the past few weeks, advising the world as well as American consumers how the future could only become wonderfully, terrifically bright.

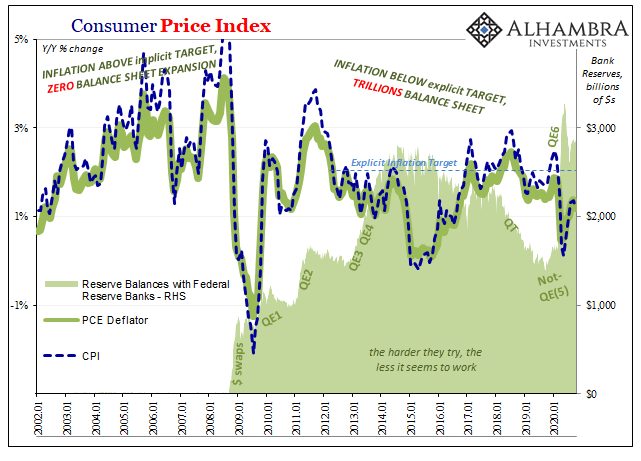

It’s the same message that the Federal Reserve and its myriad methods for undertaking this combined QE6 has been sending since it all began. One more time: if you believe the central bank is printing money, that this massive increase in bank reserves amounts to recklessness in using the printing press, you’ll have to also believe the near future will become inflationary and thus act today on this motivating impulse.

Inflation therefore becomes a self-fulfilling prophecy, bringing about with it meaningfully accelerating economic activity, growth, and full recovery.

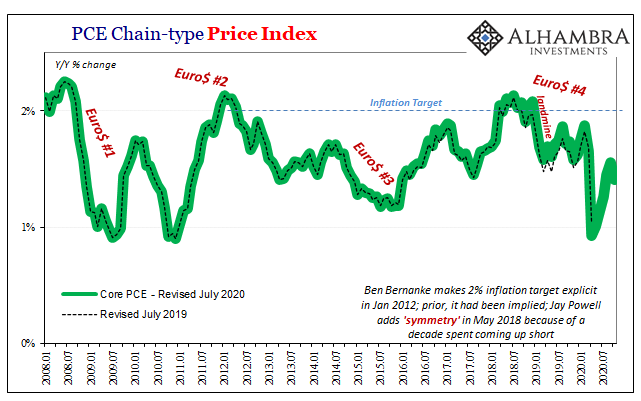

Since, however, the Fed only creates otherwise uselessly inert bank reserves, and that most people seem to have caught on to this inflation, puppet show nonsense (like they have in Japan), there isn’t a shred of inflationary pressures visible on the horizon anywhere. Instead, according to data released today by the BEA, inflation remains near historically low levels even when factoring (core PCE Deflator) oil’s rise up into the $40s.

The Fed’s preferred consumer price gauge, this PCE thingy, rose just 1.18% year-over-year in October. The seasonally adjusted index was identical to the revised September 2020 figure, meaning that the rebound in consumer prices slowed substantially, too. The core annual increase last month was only 1.41%.

After eight months of allegedly irresponsible money printing, these are not inflation figures (and trends) consistent with the results of such a thing. On the contrary, continued disinflation as displayed by both the PCE Deflator as well as the CPI instead conform to the summer slowdown materializing and then maintaining itself with no regard whatsoever to QE6 and the rhetorical monetary diarrhea emanating from Jay Powell’s mouth.

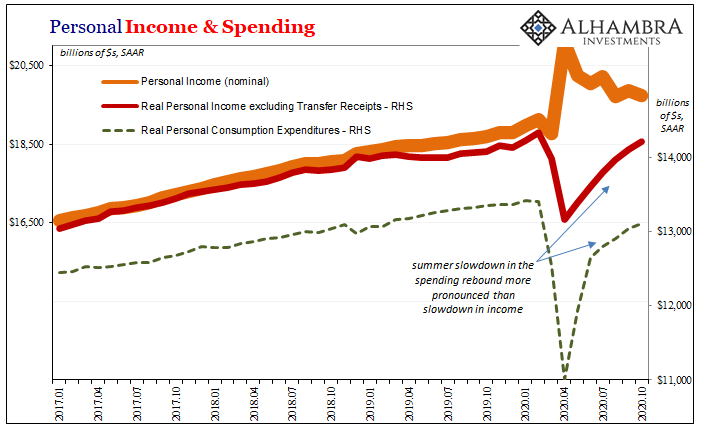

Slowing labor market, uncertainty amongst workers therefore consumers, slowing price increases even a return to discounting (deflation, as is happening right now in both Europe and Japan), you can bet there’s a slowdown in consumer spending in between the last of those two factors. As the BEA data today also shows, yep:

The summer slowdown is therefore completely, thoroughly established; it happened. More to the point, it continued to happen right on through at least up to just past the middle of November and the week before Thanksgiving (the closest to real-time being jobless claims). Today, to put it bluntly, absolutely sucks in a way it shouldn’t be sucking.

Not according to all those prior promises about “stimulus.”

Over the last few months as markets have digested this disheartening reality, promises of more “stimulus” didn’t really move the needle back toward optimism and positivity? Outside financial media faith in it, why would it? Everyone has seen how, in the middle of 2020, when all the chips are down, it didn’t work.

Now there’s a vaccine and that’s not “stimulus.” But does it represent a significant change in tomorrow, or just some small hopes for tomorrow in that, well, it’s not the same useless “stimulus?” The narrative can be different, though that’s not quite the same thing.

What we learn from oil as well as other markets temporarily overrun by these periodic crazes over various game-changing developments is that’s not really what they’re saying. Even now, the relatively small rise in oil all it’s really projecting is a minor increase in the consensus probability that maybe, possibly the vaccine could make some difference that “stimulus” hadn’t and almost certainly won’t. Just like, in early 2019, a Fed pause was thought maybe, possibly somewhat helpful to get us out of the growing globally synchronized downturn.

They all agree on this one thing, though, and it’s a big one: the rebound absolutely took a wrong turn somewhere around five months ago. It wasn’t COVID responsible for it, either. At the end of the day, what realistically fixes this? More QE that was already at full throttle when this inflection happened? More of Uncle Sam’s generosity also at full tilt?

That was all which was offered from late August to early November. Pfizer and Moderna have finally introduced something that isn’t QE or unemployment insurance. But did that change anything more than the narrative which, based on nothing other than “stimulus”, had already worn itself out?

The slowdown is real, the trouble today is real, and, balance of all probabilities, it’s going to have maybe the final say about what tomorrow looks like. Certainly whatever effects it will produce, they get produced tomorrow, too, though one tomorrow before the vaccine’s more distant tomorrow.

Stay In Touch