On Monday, November, 9, pharma company Pfizer announced that in partnership with Germany’s BioNTech the pair had finally come up with the answer. The world infested with COVID could breathe easier safe in the knowledge a vaccine had been discovered, proven, and already close to approvals and production.

“Today is a great day for science and humanity. The first set of results from our Phase 3 COVID-19 vaccine trial provides the initial evidence of our vaccine’s ability to prevent COVID-19,” said Dr. Albert Bourla, Pfizer Chairman and CEO. “We are reaching this critical milestone in our vaccine development program at a time when the world needs it most with infection rates setting new records, hospitals nearing over-capacity and economies struggling to reopen. With today’s news, we are a significant step closer to providing people around the world with a much-needed breakthrough to help bring an end to this global health crisis.”

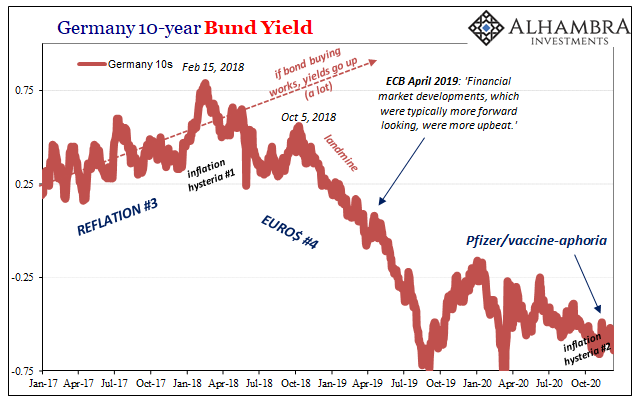

Market reaction was immediate, though suspiciously muted (we’ve covered the US$ indications throughout this week). Over in Germany, not just where BioNTech is located but also a country’s whose economy is under immediate threat of further government overreactions to the dangers, its bond market likewise popped.

The 10-year bund yield, for example, jumped 14 bps over the course of that euphoric day and the one which followed (more the latter, German trading had closed by the time the press release was sent out). By the end of trading November 10, at -50 bps “yield” it was the highest (meaning least negative) rate in several months. The day after that, -49 bps.

That was it, though. Since, buying in these safest, most liquid instruments has returned as if nothing has changed. Through the middle and end of November right on into the middle of December, bund (and schatz) yields have returned to the depths of disinflationary non-recovery.

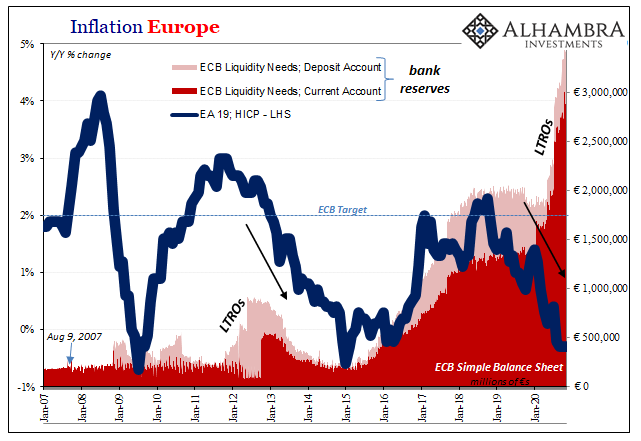

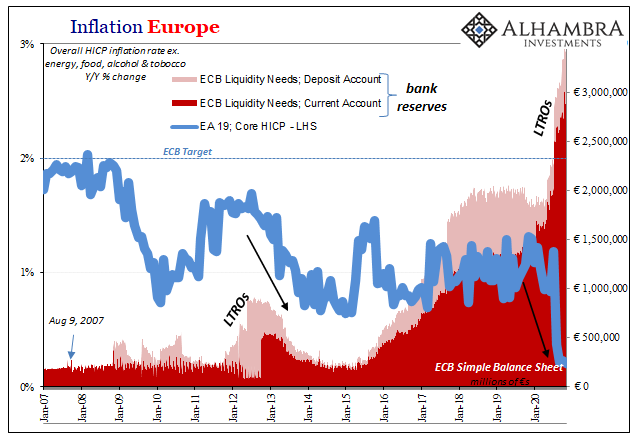

Not even minimal vaccine-aphoria. And that’s on top of more, half a trillion more, ECB “stimulus.”

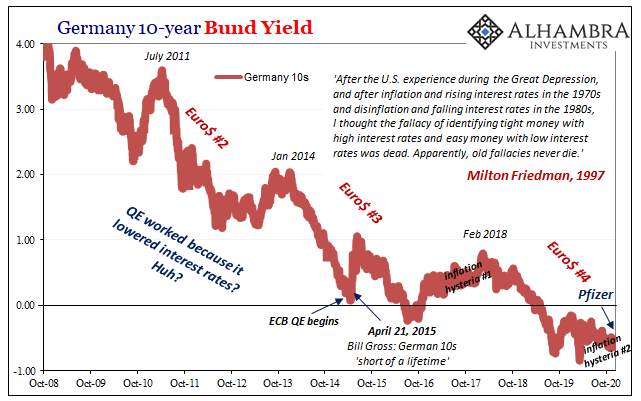

Having spent this week reviewing the various markets and the contorted interpretations of them which had formed Inflation Hysteria #1, it was important, I think, to end it with Germany’s. As I’ve been writing, there’s so much less to Inflation Hysteria #2 than there ever had been of #1. It’s not even close.

Somehow, though, it’s become even more hysterical. Maybe that’s due to the fact of how detached rhetoric has gotten away from reality.

During #1, at least then German yields were rising. They never moved all that much, truly unimpressive, but they were actually trudging in the correct direction however minimally.

Now in #2, not even in the wake of vaccine-aphoria plus yet another huge shot of “money printing”, they aren’t going anywhere. Back down near recent lows, back to among the lowest ever recorded. This hysteria rerun is really something.

Stay In Touch