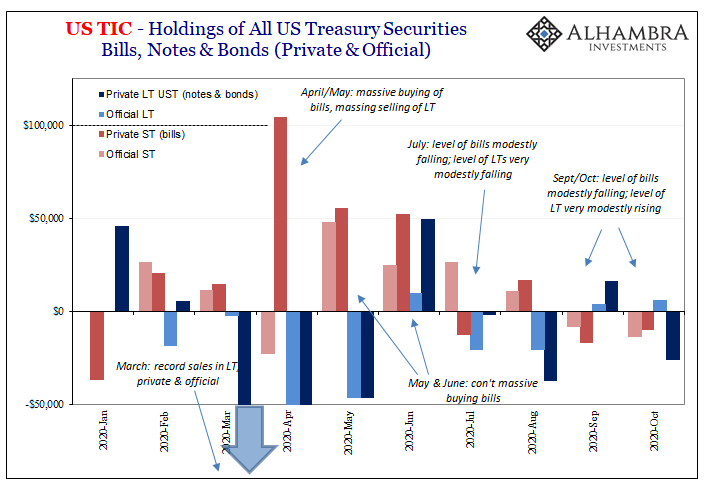

Since we highlighted the action in T-bills yesterday and the day before, it’s worth at least mentioning what TIC had to say about the instruments. Foreigners had been reducing their holdings of them not out of growing distaste but rather the opposite. There’s not nearly as many of them, not enough for what’s demanded, the Treasury Department quite purposefully (and unhelpfully) supplying fewer of them.

As we expected, according to TIC, foreign holdings of bills declined again in October by nearly the same net amount as during September.

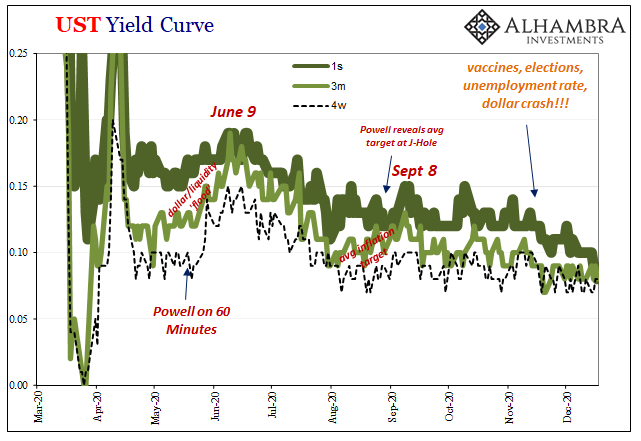

Yet, you’ll notice, bill prices have only gone up (yields down). Collateral shortage, which we know from experience only beginning with Lehman Brothers, what really happened at Lehman Brothers, isn’t likely to mean anything good money-wise in the global system.

With fewer bills left outside the US, perhaps impeding funding leverage, foreigners have been left to sell other US$ assets in lieu – including LT Treasuries. This is not a reflation thing, let alone some growing inflationary distaste.

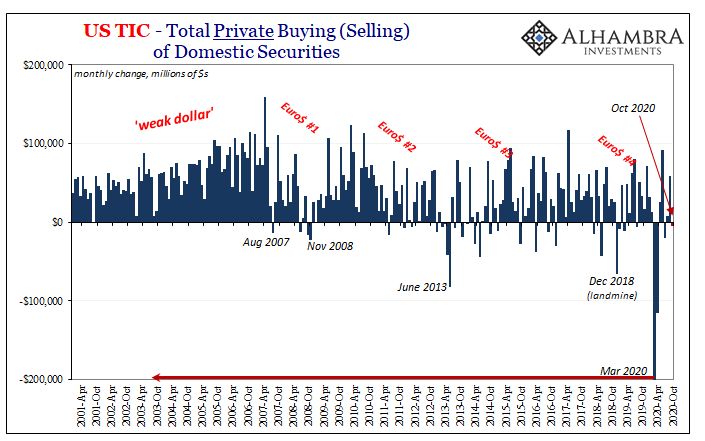

On the contrary, when especially private foreign holders sell on net (below) that’s been a very consistent indication of the same global dollar shortage growing more extreme. The decline wasn’t big during October, but it needn’t be; lack of buying is already a clear signal of dollar tightness.

Since 2009, a negative private net has only happened 30 times out of those 140 months; and that’s been a period under which systemic dollar shortage has been the underlying condition. Most of the private side negatives have clustered into these specific eurodollar squeezes. Ten of the 30, for example, have taken place just since February 2018 under Euro$ #4 (including the latest one in October 2020).

Before GFC1, in the thirteen years between 1995 and 2008, the period of maximum global eurodollar expansion, private net monthly selling was limited to just three of those 156.

You very rarely see this kind of thing outside of global monetary shortages.

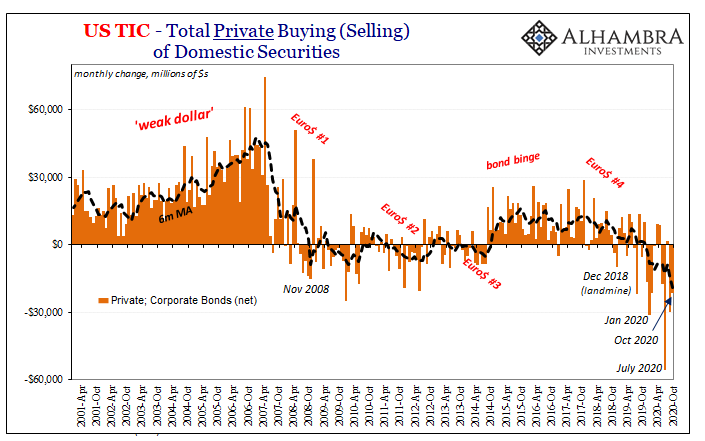

Because of this, in October private foreign holders involuntarily redeemed more than ST bills and sold more the LT UST’s. As has become common since late 2018’s Euro$ landmine (which was a clear amplification of Euro$ #4), these same entities have also been (net) selling corporate bonds at an increasing rate. This continued in October 2020, with another hefty decline in reporting holdings.

This is, as you can plainly see above, unprecedented.

These are not inflationary signals by any stretch – but are very consistent with the hidden things going on in China as CNY makes like 2017 again. On the contrary, contradicting Jay’s flood myth, it’s the same dollar shortage which isn’t supposed to be possible with all those bank reserves.

Something’s tight instead, and, I’ll write it again, the bills give you some really good insight into just what that might be; where this tightness and risk-aversion may be coming from.

Stay In Touch