It doesn’t quite rise to the level of the LABOR SHORTAGE!!!! fiasco, not yet, but it’s moving up toward that territory. This, of course, had been during Inflation Hysteria #1 when at its absolute peak the unemployment rate was being used to justify expectations for not just a little more in consumer prices but a lot more. In 2018, in particular, there were widespread anecdotes, hardly a day would pass without some mainstream media story about how companies were struggling to cope finding enough workers.

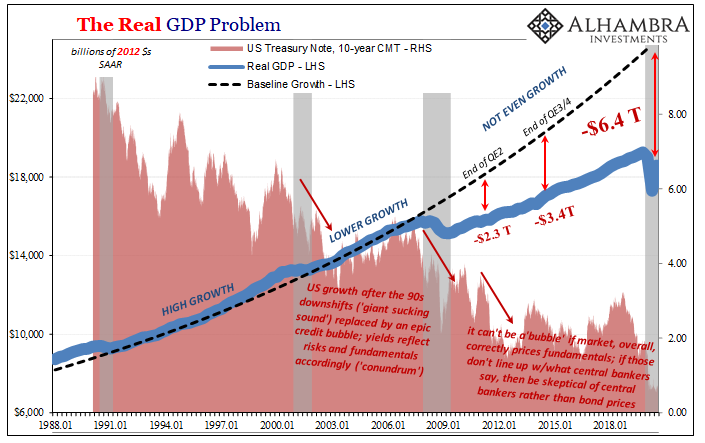

The idea then was as simple as it was pleasing to Jay Powell and those like him who’d spent years waiting on just this sort of confirmation for monetary policy in QE form. Had it been happening that way, this would’ve meant officials hadn’t screwed up as badly as it appeared (certainly from the bond market perspective). A bout and burst of inflation would’ve signaled how macro slack had indeed been fully used up and whatever shape the economy was in at the time equaled full recovery and full employment regardless.

Never much more than anecdotes, however, the data on the side of the hysteria consisted of the unemployment rate and then the Job Openings portion of the JOLTS survey. That was it. Neither was corroborated by anything else, in particular bonds yields and their curves, let alone other sources for wages or prices – thus hysteria.

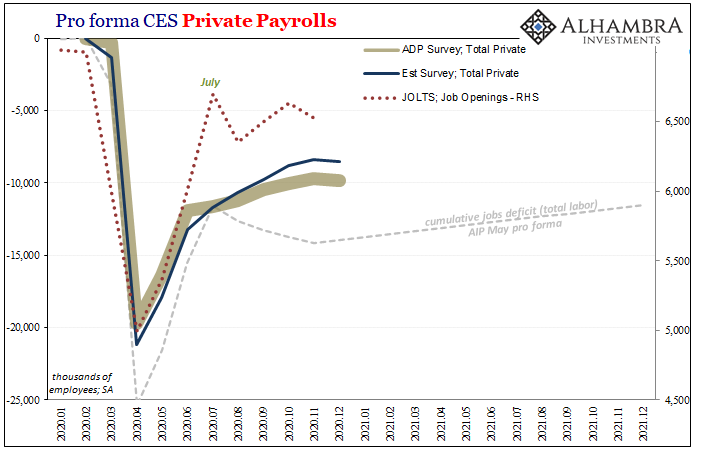

Nowadays, sunk deep in recession, a recession that has easily bested and outlasted the original “V” expectations, there can’t be a labor shortage, can there? With so many people out of work, more during December 2020 than even the worst month of the Great “Recession” (not to mention the nearly 10 million others who while still employed also experienced some disruption in hours or work), are we to believe the labor market might still contribute to this budding second hysteria over inflation?

Yep:

The deliveries struggled due to issues surrounding transportation, labor availability and uncertainty about the future holding back increased investments, according to ISM Manufacturing Business Survey Committee Chair Timothy Fiore said. [emphasis added]

According to both the ISM as well as IHS Markit’s PMI estimates, supplier delivery times have surged over the past few months like they did during the initial contraction earlier in 2020. While these contribute positively to the headline indices, they are not necessarily a positive indication. It means that it is taking longer for suppliers to fill orders (presumably, in normal times, because they’re too busy).

In an abnormal situation like this it might indicate instead of a labor shortage, a labor bottleneck.

Or, it might just be the other factors mentioned above, especially “uncertainty about the future.” In other words, the deflationary pressures of employers up and down the supply chain more concerned about bringing back payrolls, hiking their costs and drawing down liquidity. Not carefree recovery and animal spirits, extreme caution and risk aversion; the antithesis of recovery.

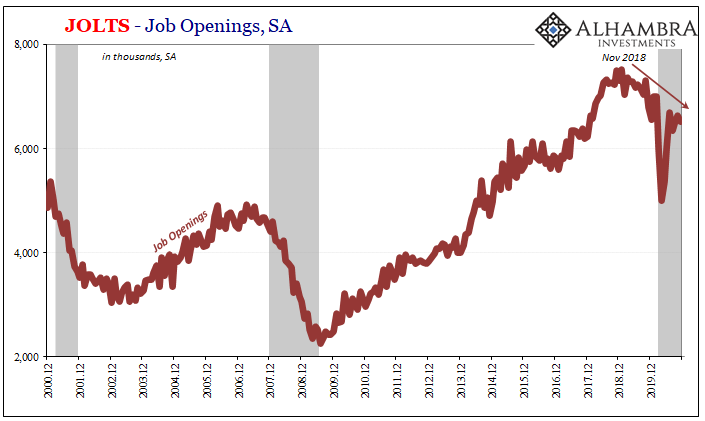

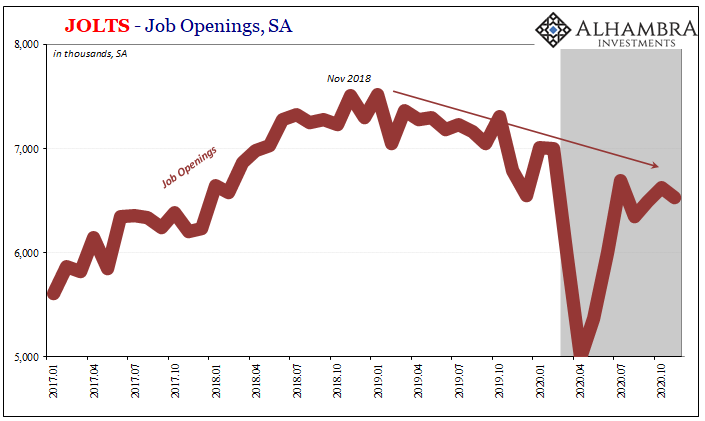

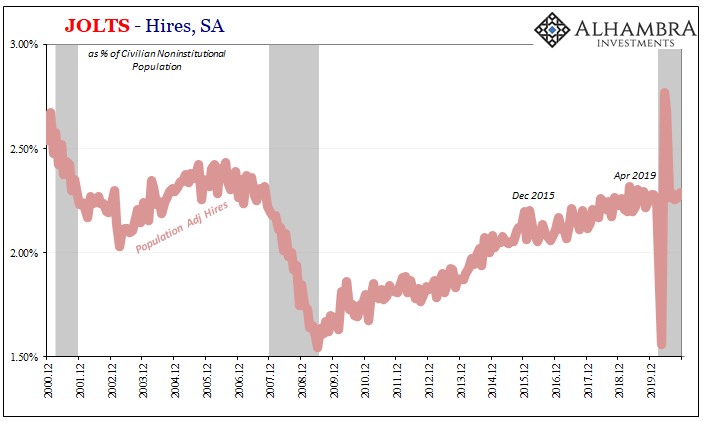

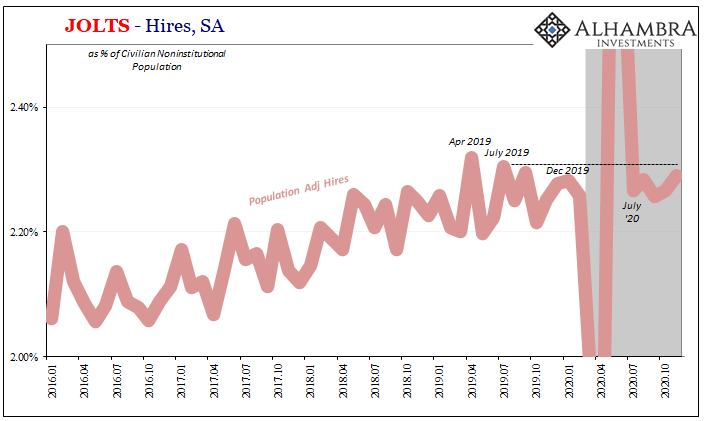

Fortunately, the BLS is here to give us more data. Ironically, the data supplied which suggests the latter scenario is…JOLTS Job Openings. Like a labor shortage, a labor bottleneck would create sky-high demand for labor which is exactly what JO attempts to measure. Back in ’17 and ’18, the level of JO rose sharply but was never corroborated by anything else including the level of hires (JOLTS HI).

Nowadays, JO comes in on the opposite side, but unlike the previous period, Hysteria #1, during Hysteria #2 JO is on the same side as HI. The reported, estimated level of labor demand – economy-wide – remains suspiciously subdued. Likewise, the rate of hires across the economy as also projected by the rest of the BLS’s labor market data, the CES and CPS.

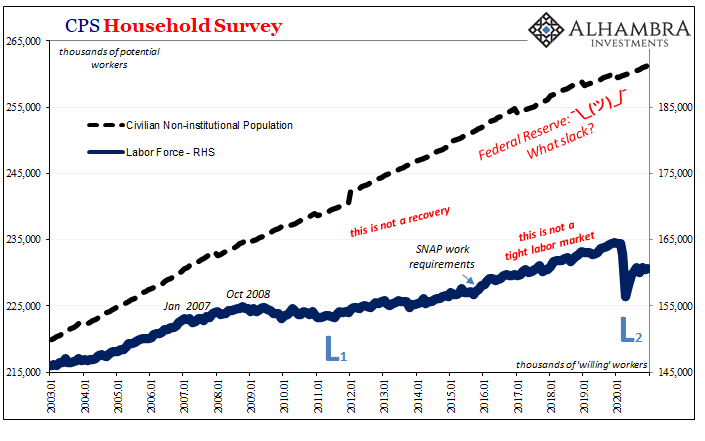

In that last category sits the Labor Force estimates, outside of which is where American workers keep refusing to re-enter the economy. That, too, is a corroborative indication that demand for workers is poor, at best. These millions aren’t even bothering to look any longer; no wonder, since indicated demand for them hasn’t come roaring back even after such a huge disruption months ago.

This doesn’t mean there can’t be a labor bottleneck or two, it’s just that if or where any pop up they are more like the LABOR SHORTAGE!!! anecdotes from a couple years ago. Good stories, not data.

In other words, this Inflation Hysteria #2 is narrowed down to practically Uncle Sam and nothing else. Even #1 had JO – for a few months.

Stay In Touch