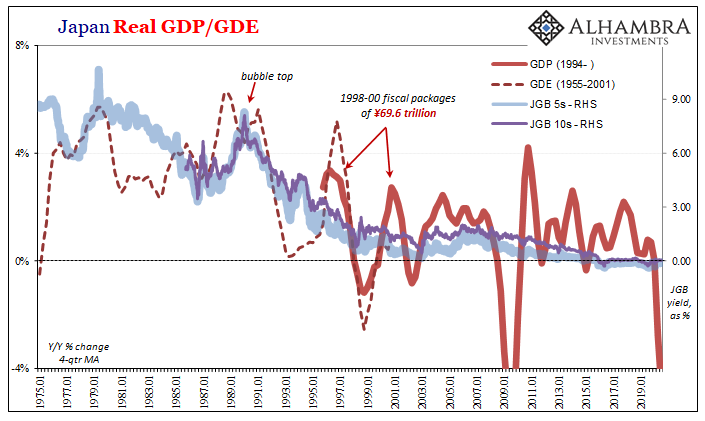

If you tally up the amount of local government debt and add it to the total owed by Japan’s central government, at the close of fiscal year 1991 it wasn’t too bad. The Japanese had always been fiscally responsible especially when compared to any of that nation’s big economy peers. In those early days of the “lost decade”, the balance was about ¥275 trillion and in terms of total gov’t debt to GDP it ended up being a bit less than 60%.

The Japanese government then spent the next few years trying to get the economy back on track using the (same) Keynesian playbook. Lots of central government spending on whatever, doesn’t matter exactly what because to orthodox Economists all that matters is “aggregate demand.” Just do things for the sake of doing things; build some useless pyramids in the desert, if you have to.

In Tokyo, officials more than obliged. By the end of FY1996, gov’t debt (central & local together) outstanding had ballooned to just about ¥450 trillion, a touch more than 87% of (stagnated) GDP.

Another “unexpected” recession began toward the end of ’97, to which the central government responded by going bigger (and engaging the central bank to an even greater extent). Huge. Massive fiscal packages beyond prior bounds. And though the headline figures that were announced to the public were themselves puffed-up, authorities weren’t being shy in ’98 and thereafter. By FY1999, the debt balance had climbed to more than ¥600 trillion (118% of GDP).

In terms of issuance, the JGB’s had been less than 40% of the market in 1990. By 1999, these were then 68% of what was being sold.

That’s not all; there were other debts to consider, including Japan’s “second budget” which consisted of the activities undertaken by the FILP. In other words, what critical mainstream Economists would later call in the next decade “money-financed fiscal expansion” in addition to all this regular “bond-financed fiscal expansion.”

Many came to believe we’d never see anything like this anywhere again.

What is "money-financed fiscal expansion?" It sounds like something new that Economists just cooked up in time for Joe Biden. A preview of MMT, perhaps.

— Jeffrey P. Snider (@JeffSnider_AIP) January 16, 2021

No. It's a theory that goes back, and more importantly it had been practiced already.

In Japan.https://t.co/POwGCjFu2L

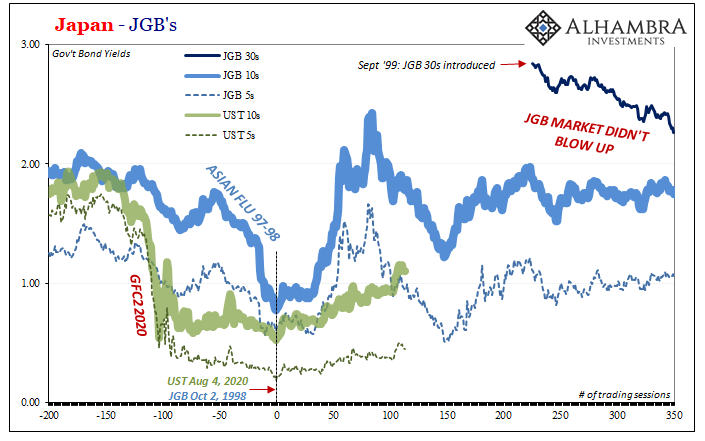

It all came together at the end of 1998, including several factors familiar to our 2021 concerns. The FILP was funded by something called the Trust Fund Bureau which would announce late that December it was going to “taper” its purchases of JGB’s. This at the same time JGB issuance was exploding. You can read all about it here, and I would urge you to do so.

The JGB selloff which was already underway by then greatly amplified by concerns there would be too much debt for any system to absorb, even the stoically consistent Japanese.

And then in the middle of 1999, the government announced the introduction of publicly auctioned 30-year long JGB bonds for the first time beginning September ’99. For those maybe not paying close attention, it might have seemed the perfect storm ready to just rip the market apart.

Nah.

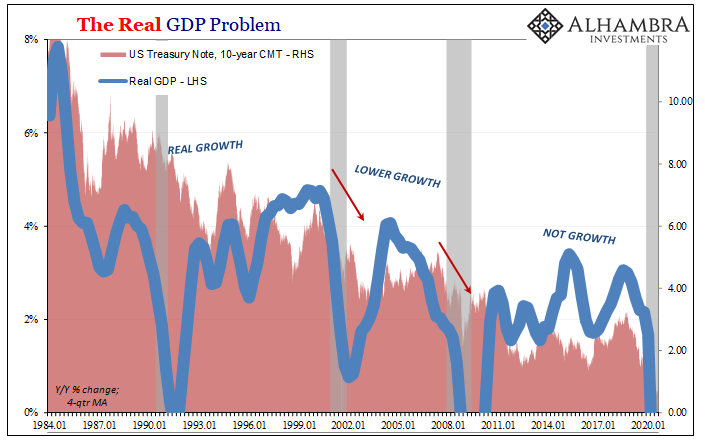

The fundamentals for JGB’s, like any government debt situated in a period of constant deflationary turmoil, they remained favorable despite huge new issues as well as the introduction of new instruments from the Finance Ministry (not just 30s; in April ’99 the 1-year J-bill was introduced, too). The government supplied what obviously had been already in high demand.

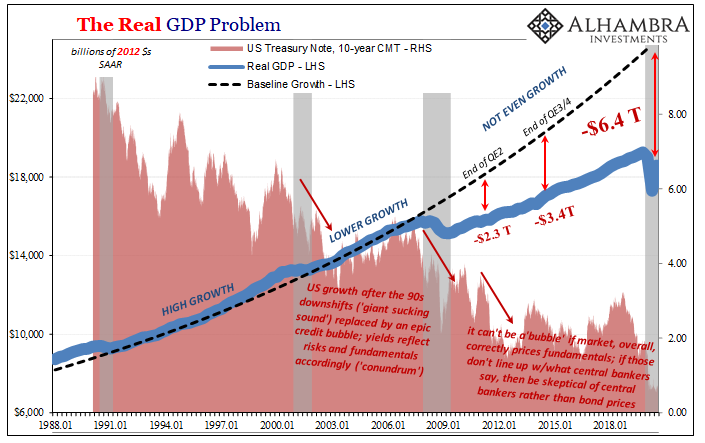

There are any number of really close parallels between what happened at the end of the nineties in Japan and what’s going on right at this moment in the United States and the US Treasury government bond market. Just today, Janet Yellen, nominee for Treasury Secretary under the upcoming Biden administration, floated the idea of a 50-year UST long(er) bond.

As usual, much noise was made out of the proposal – even though it hasn’t really been proposed. Inflation and all that, “too many” Treasuries ahead which will surely swamp the UST market over the coming months.

As per usual, Japan offers a guide for what really happens when all these truly pitiful factors come together – from an overloaded government auction calendar to overactive though clueless central bank unable to overcome the drag of a malfunctioning monetary unit to an unaware central government which simply does whatever the Keynesian textbook demands, to the point it stretches the boundaries of what used to be prudent debt-management.

Even money-financed fiscal expansion.

The JGB market was predicted at various times ready to explode, and in several brief moments (November 1998 to February 1999) even seemed on the verge of doing so. It never happened simply because the underlying fundamentals for them remained highly positive, which could only have meant thorough failure in all those “stimulus”, allegedly inflationary policies written above.

None of it works, therefore the bond market’s not in any danger. Yellen can issue her 50s should it strike her department’s mandated need, but that’s just another UST security the market will incorporate into its unchallenged appetites.

Japan was supposed to have been an outlier, and yet, again, the similarities are more than just cursory resemblance especially when you take a close look at, and truly appreciate what happened in, the late nineties. UST yields have been on the rise for months now, but that increase is nothing compared to the JGB move which had been due to nearly every single concern being voiced right now.

It more than survived, too.

You could even argue, as I would, that one key reason why UST yields remain significantly less than their late 90s JGB counterparts is that very experience; the public may know little or nothing about the episode, just as policymakers here today have certainly dismissed the plentiful and plentifully compelling parallels, but participants within the UST market are not in the dark about any of these things.

They know how they tend to work out, and not just in Japan.

This list includes already-tested money-financed fiscal expansion whether it leads to an ever-expanding list of government bond securities and auctions or not.

Stay In Touch