The ECB wants everyone to know that it is in control, and therefore has everything under control. Through an almost certainly carefully placed leak, European central bank officials have let it be known current monetary policy is practicing a kind of yield curve control. Not just the usual QE in terms of bond buying, but tailoring specific parameters within the program in order to achieve what policymakers are saying adds up to more complete financial command.

They just aren’t ready to call it full-blown YCC. Not yet.

Unlike Japan where Yield Curve Control has been a stated goal of (Q)QE dating back to that noteworthy time in September 2016, Europe’s monetary authority unlike Japan’s can’t just target a specific instrument. The European Union might claim its own central government but it yet has delivered a single, centralized budget and bond market for constituent deficits.

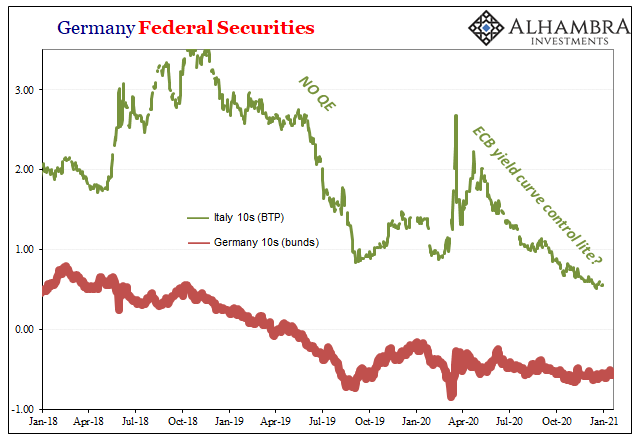

We are therefore being led to believe that the ECB is practicing its technique by fine-tuning bond purchases in order to target individual sovereign spreads. A little less German bund buying and a little more Italy BTPs. The idea, according to the leak, is yield curve control lite where at this stage the central monetary authorities won’t allow a single country’s sovereign yield to pull itself out of line with the presumed approved likeness of all the others.

Such as Italy when compared to Germany (from the article linked above).

While that strategy is similar to yield curve control, “they’re calling it something different,” said Christoph Rieger, head of fixed-rate strategy at Commerzbank AG. “My feeling is that this is an important thing for the ECB, they’re looking at it and they’re actually envious of the BOJ. They would love to have something like that.”

Yield curve control has caught on as central banks delve deeper into their toolkits after cutting interest rates to record lows and unleashing trillions of dollars in bond-buying. In theory, it’s cheaper than quantitative easing alone because investors are essentially told not to fight back.

And “fight back”, of course, means that otherwise bond markets would be experiencing a torrent of selling pressures (BOND ROUT!!!!) because of the same purportedly massive inflation these same monetary technocrats have promised each and every year for more than a dozen now. That’s the part which none of these central bankers seem able to either escape or explain.

Time nor yields, neither has ever been on the official side.

The bond market isn’t fighting back, it’s laughing at these clowns. The current clown-show isn’t a new one, merely a rerun of the same one making the rounds for years now (including prominent stops in Japan, with that particularly hysterical performance put on in September 2016).

While you might make the case Italian yields have fallen over the past eight months because of this ECB-YCC-lite testcase, and that’s arguable already, what about the much more significant drop in them 2018 and 2019? Not only had YCC-lite yet to be dreamed up, the ECB beginning December 2018 had dropped QE altogether.

In other words, while Europe’s central bank refrained from bond buying the financial system obviously did not. Banks bought Italy, Germany, you name it, without any necessary help from Governor Mario Draghi.

Why?

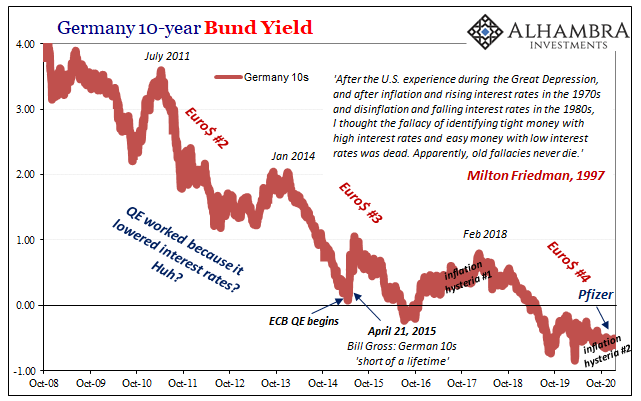

Because Draghi had spent the last months of 2017 and all of 2018 (globally synchronized growth) promising the same inflation and economic recovery his successor promises right now. As in 2021, in 2018 and 2019 interest rates could go nowhere but up – according to these same people. Only then, this had been a welcome sign of monetary policy pulling off success if a few years behind schedule.

Instead, pretty early in 2018, beginning in Germany, the bond market started to explicitly fight the ECB all over again – with everything in the opposite direction. Investors weren’t selling when authorities didn’t want, rather they were buying in quantities authorities couldn’t understand.

Inflation was, they all said, a done deal. There just wasn’t any evidence for this official position, stated plainly by Draghi back in the thick of the last hysteria January 2018:

The strong cyclical momentum, the ongoing reduction of economic slack and increasing capacity utilisation strengthen further our confidence that inflation will converge towards our inflation aim of below, but close to, 2%. At the same time, domestic price pressures remain muted overall and have yet to show convincing signs of a sustained upward trend.

This is basically the current ECB position, with only a few minor wrinkles due to COVID. Regardless of the pandemic’s impact in 2021, however, it remains the official forecast – inflation is coming, even if, like 2018, there is yet any evidence for it.

Just trust the clowns.

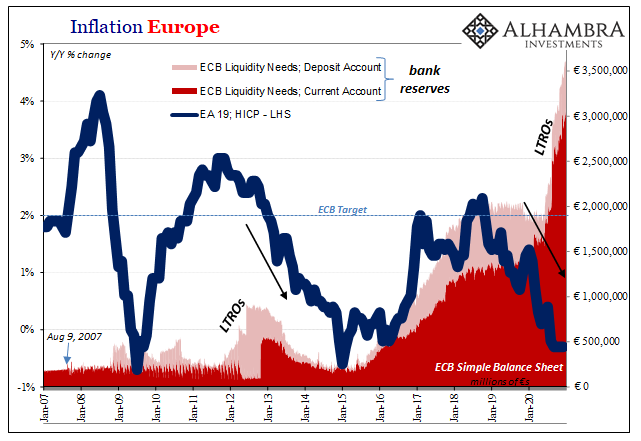

And that last part is absolutely true; there is absolutely no evidence. At the moment, European consumer prices persist in outright deflation. Eurostat confirmed today that headline HICP inflation during December 2020 was -0.3% year-over-year for the fourth consecutive month (and the fifth in a row below zero).

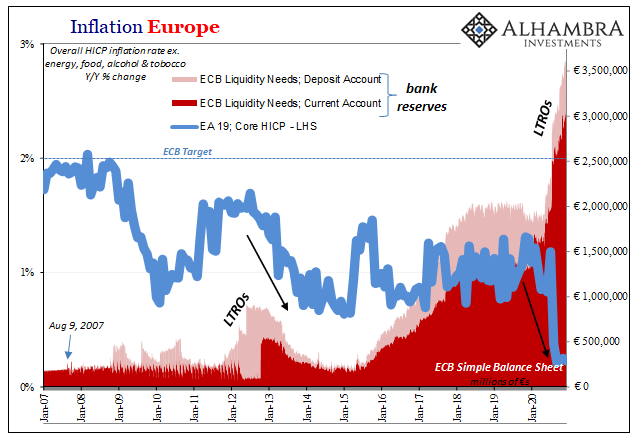

The core rate, excluding food, tobacco, alcohol, and energy prices, though it remained on the plus side it was likewise stuck for the fourth straight month at 0.2%, which is this series’ record low.

The European central bank is on record stating that it looks long and hard at the core HICP figure when deciding what it should do with monetary policy. This is very hard to believe given what it has said about monetary policy for a very long time, meaning QE is more closely and accurately associated with performance art.

Who’s fighting the ECB? From 2018 forward, bond yields simply reflect widespread knowledge – outside the financial media and the mainstream Economists it always turns to for its opinions – these central bankers have absolutely no idea what they are doing.

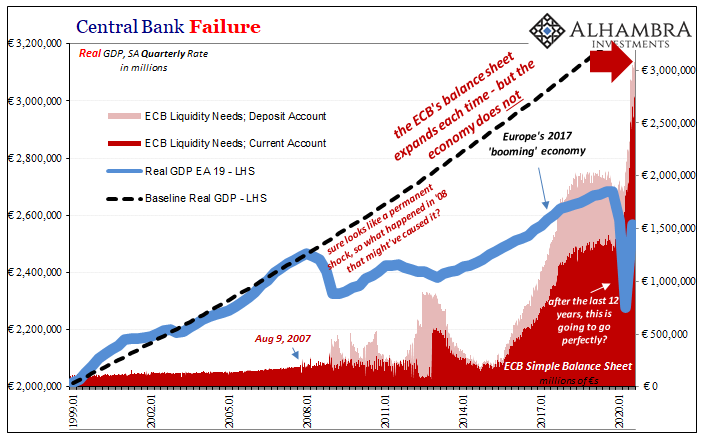

Indeed, the more the central bank buys in bonds, however it wishes to label or modify its purchasing behavior, the more proof of its failure. What’s credibility here? While Europe has kept to the lowest levels of inflation, very much like what’s going on in both Japan and the United States, the ECB has been engaged in accelerated and “excessive” “money printing” for ten months running.

The amounts are truly staggering, too; and that’s really the whole point. By the end of 2020, the net contribution from all these European bonds (including those purchases by issuers outside of the QE’s, such as corporates and covered bonds) taken in has been a €1.3 trillion increase in the central bank current account (bank reserves) to go along with an additional €371 billion in its deposit account (also bank reserves).

The total combined balance of both finished 2020 at €3.5 trillion, very nearly double what bank reserves had been created up to mid-March.

It’s been written up as huge accommodation, the media has persistently said this is massive inflationary stimulus, and yet, as 2018, the actual evidence isn’t just lacking it is outright contradictory:

At least in 2018, for a little while, the headline HICP rate came close to the ECB target.

There is no correlation whatsoever between ECB activities and inflation (or economic growth, for that matter, which is really the whole point of all these things).

Central bankers have only one tool in their ridiculous clown kit: the financial media. If monetary policy looks like inflationary currency debasement to you, and the newspapers all say the same thing, and you follow the newspapers, then Economists really believe that it will become a self-fulfilling prophecy – even though, going back to Japan and in time two decades, it has yet to ever become so.

With bond yields worldwide reflecting this gross and obvious impotence, it makes sense that policymakers would feebly attempt to “take credit” for low rates which in reality defy each and very policy. As they have done for more than a decade all across the world.

They really are clowns – who stopped being funny a long, long time ago.

Stay In Touch