The Chinese erstwhile dictator Xi Jinping asked the Davos gathering of the superrich, can’t we all just get along? More than a weird juxtaposition, appearing virtually before other virtual attendees, the Communist strongman wanted to make plain his view, therefore China’s, he harbors no desire for a renewal of the Cold War. Though we come from very different places and have lived very different experiences, these shouldn’t be impediments to more peaceful cooperation.

What is and really has been over the last thirteen years isn’t (ever) on the agenda. Instead, COVID and its lingering aftermath. Xi just wants to get the whole system back on track as quickly as possible.

We are going through the worst recession since the end of World War II. For the first time in history, the economies of all regions have been hit hard at the same time, with global industrial and supply chains clogged and trade and investment down in the doldrums. Despite the trillions of dollars in relief packages worldwide, global recovery is rather shaky and the outlook remains uncertain. [emphasis added]

That’s not a small point, don’t you think? The casual observer making the same observation notes the death of last year’s “V” and how so much “stimulus” didn’t keep it alive for very long. Coming from the Chinese leading echelon, there are a few additional quite serious implications.

What he was saying, in effect, was chastising the rest of the world for not doing enough. Coming on the heels of recent statements given internally, those where Xi extolled the brilliance of the Chinese approach which led China’s economy to its leading global position (meaning, last year wasn’t as bad there as everywhere else; the cleanest dirty shirt), this guy is pointing fingers. If anyone needs to get it going, it ain’t China according to its top guy.

We need to focus on current priorities, and balance COVID response and economic development. Macroeconomic policy support should be stepped up to bring the world economy out of the woods as early as possible.

The funny thing about this follow-up statement is that many if not most around the rest of the world are counting on Xi to further step up his approach in China. This “global growth” thing, throughout the last dozen years everyone keeps waiting for the Chinese to pull everyone else out of their own mess (when it’s really all the same monetary mess).

This time, Xi’s saying China is waiting on the rest of you to get it together first. In the meantime, there are “no sharp turns” on the docket for 2021 where his regime will be concerned. If global growth does ever pick up again, he’d be glad for some reciprocation (dual circulation).

Unfortunately, that’s another misconception widely believed outside China. They’ve gone big, according to what passes for Western analysis; and are only going to go bigger this year. There’s a mistaken obsession over some Chinese obsession with growth at all costs; it just doesn’t exist any longer. It is widely believed they’ll do more “stimulus” bursting from every fiscal and monetary orifice until the “V” gets right back going again, if maybe only delayed.

It wasn’t true in 2020 and, again, no sharp turns, it’s not about to be in 2021. Take Xi at his word.

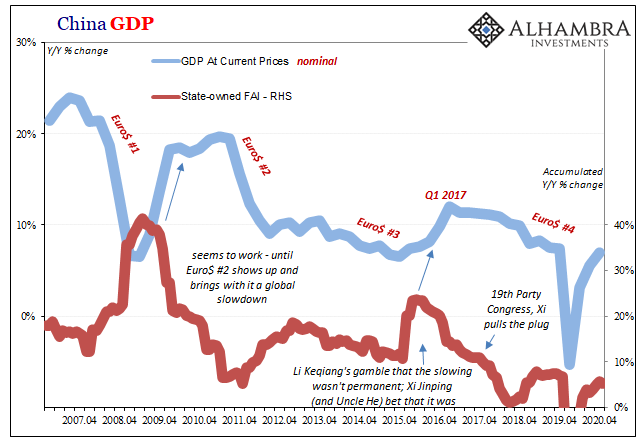

The fiscal track last year was nowhere near the level of “stimulus” even when compared to 2016 – though it is written about as if it was something like 2009.

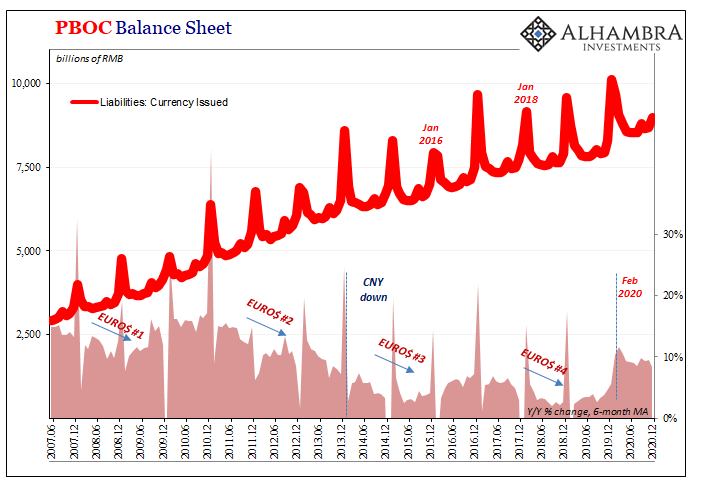

In terms of monetary policy, the PBOC has only shifted in terms of physical currency allowed into the system. Going back to March, it isn’t so much “stimulus” as it has been the very least the central bank can do; managing the problem, not flooding RMB to inflate the country, thereby the rest of the world, out of this morass.

And even this much has been waning over the past six months; currency growth, on average, remains under double digits when in past “stimulus” periods it would move closer to 20%. Restraint rather than inflationary excess is their governing principle.

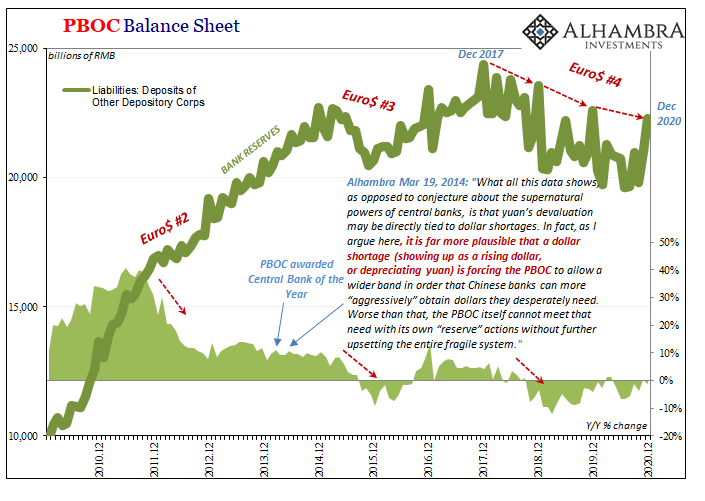

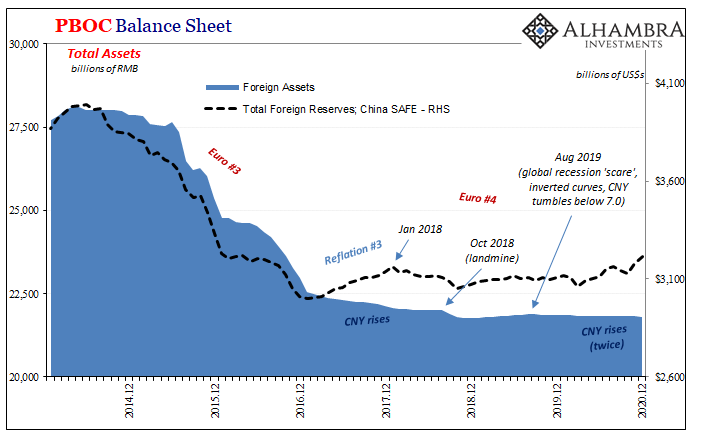

That much is even better demonstrated by how the central bank continues to treat bank reserves. In the Chinese system, these have been contracted (as a matter of policy) for several years running; no change last year. Forced upon the PBOC by Euro$ #4 (and its continuation through 2020), there just hasn’t been the balance sheet expansion to accommodate broad money growth.

Authorities continue to judge, as they have since the 19th Party Congress in October 2017 (and even before), the risks remain more tilted to over-wrought financials than to underperforming economy – no matter how much the economy underperforms any real standard (recent levels of growth rather than in comparison to the rest of the world).

Consistent with Xi’s statements, including Davos, the Chinese aren’t ramping up anything. Global cooperation in this post-19th framework will have to start in the global economy away from China; and the Chinese really aren’t counting on it.

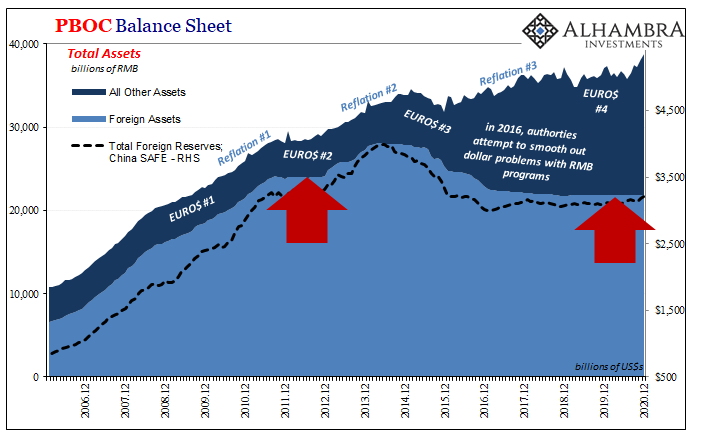

One reason why is the glaring inconsistency on the PBOC’s balance sheet. Its basis has, or had, always been “foreign assets.” The (euro)dollars flowed in, a great deal end up in the central bank’s hand and on its books thereby creating the upward movement necessary for the domestic monetary space to have accommodated rapidly rising RMB bank reserves and physical currency together for the rapidly growing Chinese basis of globalization.

Nowadays, foreign reserves are practically the same balance month after month (after month after month); an obvious consistency which draws only skeptical attention especially in light of CNY’s trajectory since the middle of last year (note: the difference between SAFE and PBOC figures, the former are reported in dollars and at market values which means the rise in CNY increases the relative value of the reserve assets regardless of any change in the quantity of them).

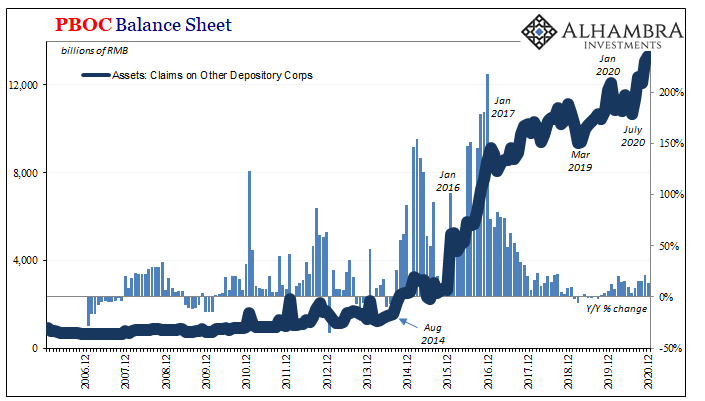

In order, then, to “make room” for any minimal increase in physical currency it has been channeled via the mid-level bank windows (raising further questions about collateral, which we won’t get into here). Yet, even here the asset side line item is notable only for the clear restraint being shown even as this is the only place where asset-side expansion has been permitted.

In other words, this isn’t “stimulus” or “money printing” in excess, it’s the last resort to get some RMB growth somewhere (and, as you can see going back to 2014 when it started, it hasn’t been very effective at “stimulus” and maybe not even that effective at the more minimal goal of monetary maintaining).

Circling back to Xi, what he said was, we’ve got our own problems largely made from trying to get back to the pre-2008 economic baseline which we’ve seen over the years in GFC1’s aftermath just isn’t possible. There aren’t dollars coming in, and the global economy is now in even worse shape.

They’re going to do what they’re going to do to manage, they’ll worry instead about holding their own and nothing more, but if the rest of the world is waiting for the Chinese to spark any recovery, Cold War won’t be our biggest problem.

Stay In Touch