China isn’t the only country actively resisting the “stimulus” certainties which go for inarguable wisdom around most of the rest of the world. Xi Jinping has stated his case very plainly, only no one wants to listen to the dictator; or at least take him literally. People would rather believe there’s only the one way to respond to big economic and financial challenges and furthermore that there aren’t any doubts as to its success.

What the Chinese have asked since 2014 is, what’s the point? If the rest of the world, the formerly globalizing economy, isn’t going to get its act together anytime soon, if ever, then there’s really no need to continue pumping up the financial sector at the same time fiscal authorities waste trillions.

More debt, absolutely, but not more economy.

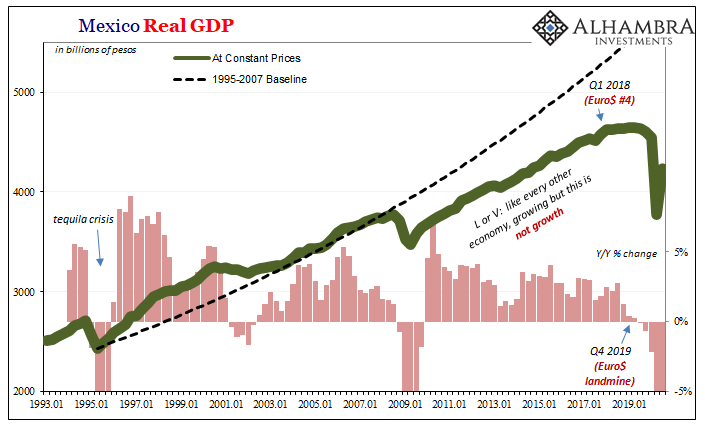

This is scenario that Mexico and its President Andrés Manuel López Obrador knows only too well. Having been around during the decadent eighties and nineties, surrendering sound currency to the Latin Debt Crisis in one decade only to be devastated again in the next by the so-called Tequila Crisis, AMLO (as Obrador is known) would prefer the more restrained approach.

Mexico’s response to the COVID crisis, or what everyone has been told is directly a result of COVID alone, is among the slimmest. Compared to the rest of the G-20, the Mexican government is by itself at the bottom of the “stimulus” pile-on. When contrasting Latin America’s largest economy, Brazil, with its number two, Mexico, the latter has undertaken one-eighth the fiscal depth of the former.

As you might imagine, Economists worldwide are howling mad. The IMF criticized AMLO’s handling of the economy back in October, and has done so again just this month. Its Director of the Western Hemisphere, Alejandro Werner, said recently, “We think they could have done more.”

Sure, they could have done more, but to what end?

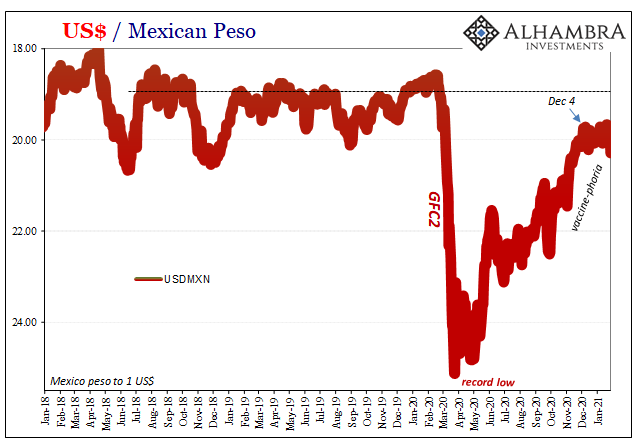

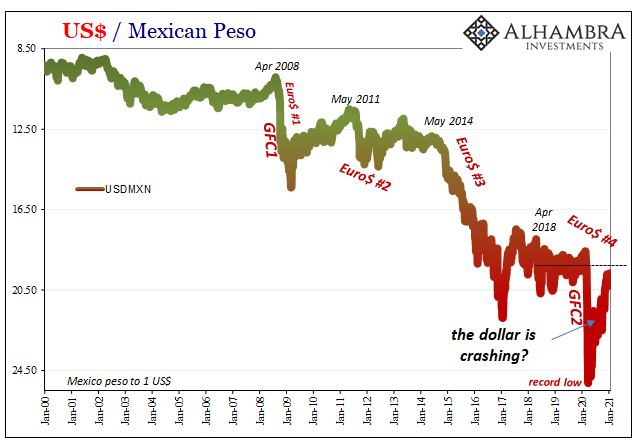

To begin with, the peso isn’t exactly brimming with relative strength. While Western commentary is colored by claims of a crashing dollar currency, that’s only been true against the euro and pound (based on the growing realization of a seamless Brexit more than anything else). We’ve heard constantly about a world flooded by Jay Powell with overflowing digital dollars, yet against much of the EM world, Mexico included, the dollar is still a huge and immediate problem – meaning here, specifically that the peso continues to be lower now than when the March crisis began.

Unleashing a fiscal monster might temporarily boost output, but at what further cost in currency? This country is already hanging on by a thread and can’t really afford more downside.

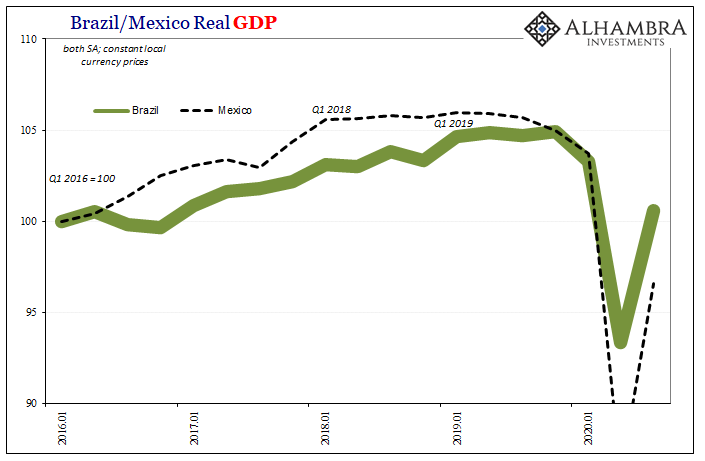

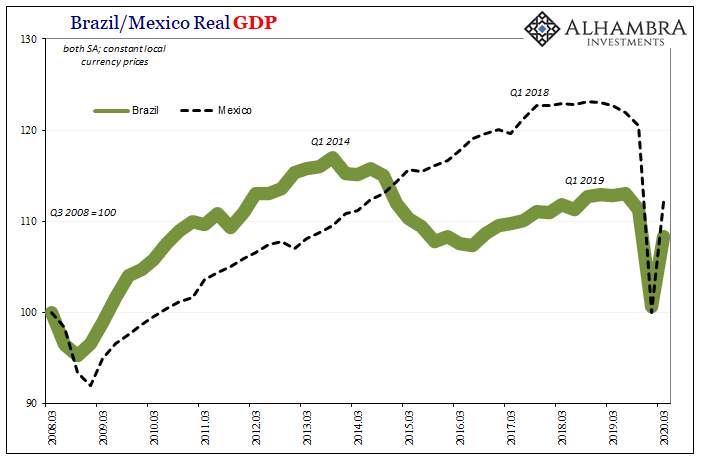

Not to mention the questionable benefits of “stimulus” to begin with. If the Mexicans are viewing it much like the Chinese, both have very good reasons for the entrenched suspicion. Compare Brazil’s economy – and its eight-times bigger fiscal “rescue” – with Mexico’s performance of late:

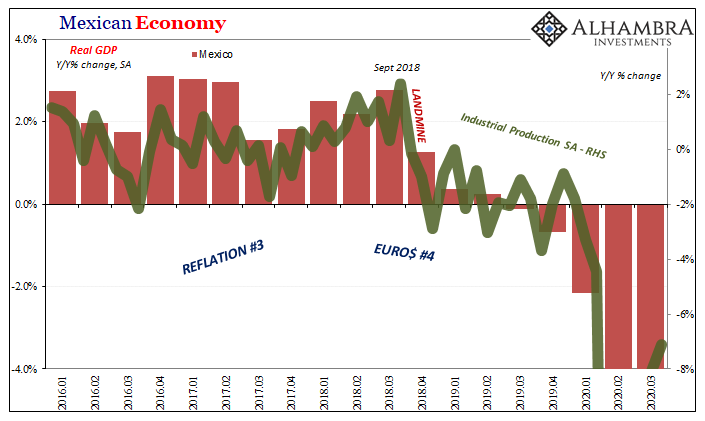

Is that a material difference in Brazil’s favor? Not at all, and one key reason why is one key factor which mostly escapes the latest inflationary fads of fiscal floatation. In other words, government “rescues” aren’t just a post-March thing, each economy has been in trouble, big trouble, for years. For Mexico, since the beginning of 2018; for Brazil, far, far longer; each for the same problems if at different times.

Occasionally, even when agreeing with the IMF and forcefully forwarding its case, the media must admit this uncomfortable fact:

Mexico’s economy was contracting even before Covid-19 struck and IMF estimates suggest that it suffered the third-biggest contraction among Latin America’s major economies in 2020. The economy has shrunk year on year for six straight quarters, according to the state statistics institute.

Mexico, like Brazil (or China), wasn’t suffering COVID or a lack of fiscal spending during those preceding years, it was being dragged downward by the globally synchronized downturn which came about due to Euro$ #4 depressing the entire global economy.

Thus, again, what’s the point of Mexico spending freely and racking up huge government debts? To make the short run less awful looking? If it can’t escape the global situation, and that situation isn’t looking so hot, like Xi, AMLO is moving on to managing without the conventional Economics textbook.

This year is supposed to be the year of massive, unchallenged “stimulus.” That’s the view being pieced together following last year’s disappointing death of the original “V” narrative (another feather in AMLO’s skeptical cap; what good was 2020’s “stimulus” worldwide?) With China not at all isolated in its resistance, it may be that more of the world refuses to go along with Economists than is currently being penciled in for “global growth.”

Stay In Touch