Mario Draghi is back to save Italy by now running it. Like Janet Yellen resurfacing at the US Treasury, these people are thought of in the most positive terms simply because the public remains blissfully unaware of basic data. Not without good reason; the public had for decades come to count on central bankers (for all anyone knew) to keep the world on track and therefore people generally believe what central bankers tell them.

And monetary policy independence has meant that officials get to self-evaluate without challenge.

For all Italians appear to know, Draghi “saved” Italy, in particular, about eight years ago. Italian borrowing costs were spiraling into the stratosphere, threatening something worse than the 1930’s for them and their Club Med neighbors, and now they aren’t. Cue up the parade, and today a likely ascent to Prime Minister who’s tasked yet again with “saving” the country.

And, for old times sake, all of Europe.

Amid turmoil from the coronavirus pandemic, the economy, and political infighting, the man known for leading Europe’s economy from crisis has been tapped to assemble a new government for Italy.

Mario Draghi, known as “Super Mario” from his time as the president of the European Central Bank, has agreed to form a new government at the request of Italian president Sergio Mattarella.

That’s what most everyone believes, a first rate hero. While yields on Italian government bonds have kept low for all these many years, was that actually the point, though? A tactic, yes, but what was the overall strategy?

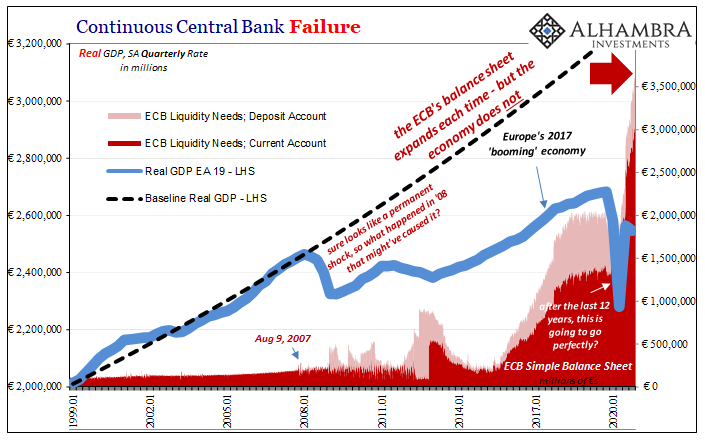

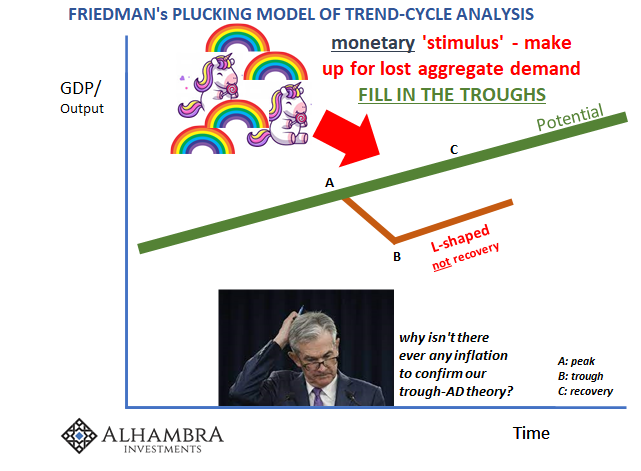

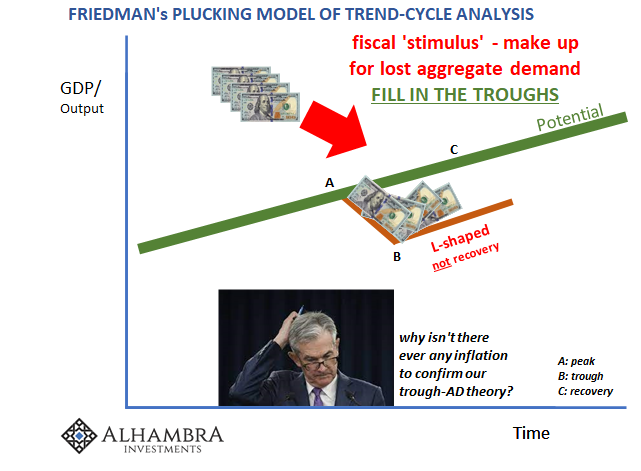

It has been merely presumed, and officials have been careful not to be too specific, that the one thing equaled the real object; that by buying up a whole lot of bonds across Europe’s troubled sovereign issuers, that lowering debt rates by doing so would lead to a recovery from first 2008 and then 2011’s crisis. Not a rebound, not some reflation-ish conditions, a full recovery FULL STOP.

The rates did drop, but…

Italy continues to be a disastrous mess precisely because Mario and his peers haven’t once been held to account. The problem wasn’t overspending in Italy any more than it had been for Greece. Borrowing costs were a symptom of a very different disease, one which Draghi’s ECB, like Yellen’s Fed, remained totally oblivious to and thus unable to ever solve.

They all just move goalposts.

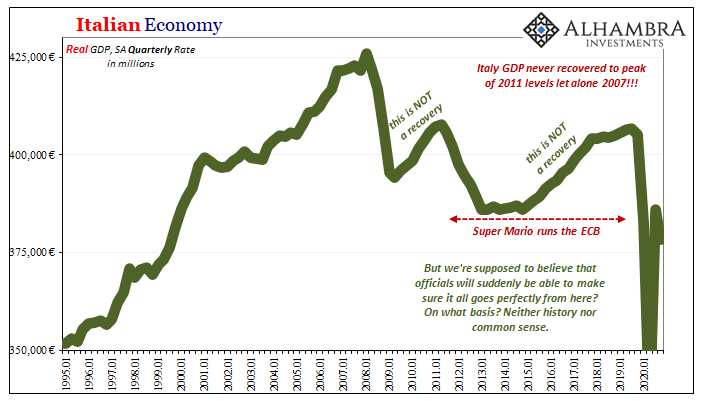

See for yourself what “success” Italy has truly gained from Super Mario’s tenure:

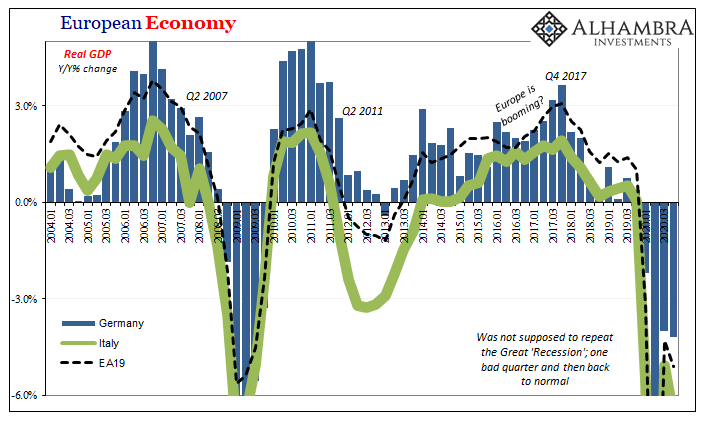

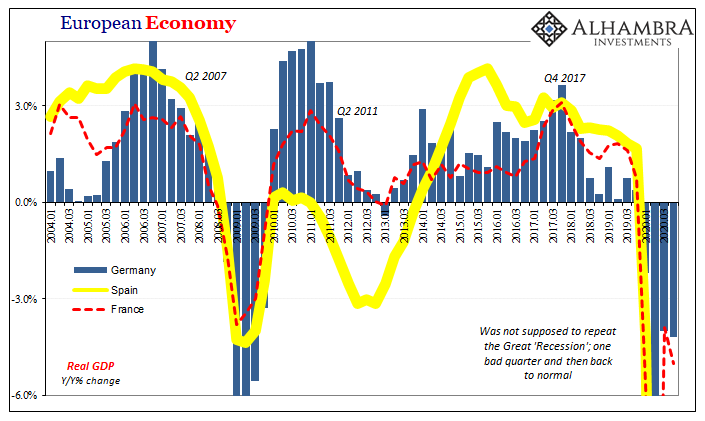

Italy began it late in 2011 experiencing a recession having never recovered from the prior one in 2008. This economy then ended Draghi’s term in 2019 under extreme pressure from another one (pre-COVID) having yet not recovered from the 2011 recession despite all that “boom” nonsense led by Draghi during 2017 and 2018; lower sovereign bond yields nevertheless.

This is evidence for gross failure even negligence, but, as had long ago become standard practice, the guy is taken off the hook by a compliant establishment system which lets him claim the narrow and misidentified goal of “save the euro” via interest rates rather than the humanity of the only true success which is always and everywhere the real recovery. Recovery by every reasonable definition which never happens no matter what these Draghi-types ever do.

And now 2021.

During the downside to 2020’s worst global recession since the thirties, one that surpassed in its depth the 2008 and the 2011 European experience, many people had claimed that it would be very easy to bring everything back up to normal again. Aided greatly by Draghi’s successor, Christine Lagarde, who has led the ECB to the most massive “money printing” among the central bank’s major peers, should everything go smoothly from the bottom, forming the recovery “V” shape, there would be no long-term suffering.

Rather than go smoothly, it’s been one misstep after another; only starting with supreme reliance on central banks.

According to the preliminary assessment by Eurostat, Q4 GDP for Italy was again negative (-1.98% qq). The rebound continues to come up short, blamed mostly on renewed pandemic constraints. But what about the lack of economic momentum which was supposed to have cushioned the blow of continued forced hardship?

Not just Italy, either, the entire EA19 set shows a small but disheartening setback during fourth quarter GDP. Down 0.7% quarter-over-quarter, with three quarters in the books Europe’s economy, like America’s, has suffered the depths and nearly the same time now as the Great “Recession” which wasn’t supposed to have been repeatable – not with all this “stimulus.”

Various European countries have fared somewhat differently – Spain, perhaps surprisingly, among the best (at least in Q4) even though it has felt the worst of COVID – though altogether output remains historically depressed.

Forget all that, “they” say again. So, 2020 didn’t go smoothly but 2021 surely will! Vaccines are here and so is much more “stimulus.”

As to the latter, see below and ask yourself why more of the same of what didn’t produce last year will suddenly become effective moving forward. Less COVID, sure, but more ECB and EU?

For the smooth ride in vaccination, Europe, oh boy: in Germany, where the Health Minister declared it the “biggest crisis since WWII”, only 2.7% of the population has received a single vaccine dose; likewise less than 3% in Denmark; in Poland, where supplies are already running out, a little more than 1 million out of its 38 million population; Draghi’s Italy, fewer than 2 million out of its 60; and so on, and so on across the continent.

Germany’s Die Zeit called this widening European vaccine debacle, “Die beste Werbung für den Brexit (the best advertisement for Brexit).”

In other words, for any chance to get normality on the agenda even for late 2021 this will require things everywhere to go even more “perfectly” than they were originally supposed to but didn’t come close. Sure, even governments absorb lessons from their mistakes, a learning curve for anything new, but just how much should we expect from the same officialdom heralding Mario Draghi to lead Europe’s third largest economy after having learned absolutely nothing, and expertly covering this up, during his crucial time at the ECB.

Things will get better, and GDP will go higher, but that’s not the same thing, is it? Nowhere is this fact better presented than in Italy staring directly at now three massive “L”s.

This isn’t just about Draghi, Italians, or Europe in general. Risks in 2021 haven’t been banished to the reflationary highlands; as described in detail earlier, there are reasons, good reasons, why we keep having to hold off categorizing this as Reflation #4 yet. The last half year, one thing after another, in all parts of the world (including US, as shown by its labor market and its own stumble in Q4 GDP), proves why markets – outside of stocks – remain closer to the depths than surging toward inflationary redemption.

The challenge, not momentum, is mounting. And the clock is ticking. The longer this goes on the greater the long run damage to economic capacities. Just ask Xi.

Stay In Touch