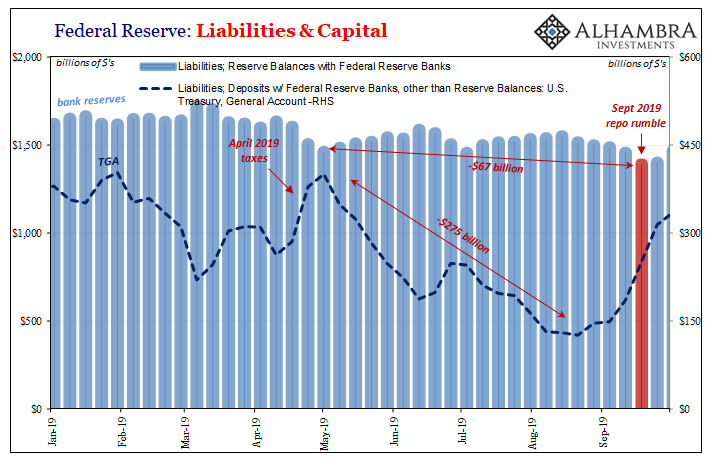

If you remember back to September 2019’s repo rumble, in its immediate aftermath – as well as for some time thereafter – a common explanation put forward for the disruption had been related to a sudden increase in tax liabilities. It was said that an unusually high level of especially corporate receipts had left the Treasury flush with extra cash. These funds had to go somewhere, and in the post-2008 world they ended up in Treasury’s checking account the federal government maintains with the Federal Reserve.

The Treasury General Account, or TGA.

Why was this windfall a problem? For the same reason as during one very interesting, very relevant episode from way back in 1997. Pretty much the same kind of thing, only back then the taxation bonanza had been due to a flood of dot-com capital gains liabilities. These were actually refused by the commercial banking system at first, for collateral reasons, wouldn’t you know, meaning, like 2019, the tax cash ended up in the TGA, too.

This was a problem because:

Any dollar, electronic or otherwise, paid to Treasury would be a dollar deducted from the banking system unless Treasury left that dollar with somewhere still inside it [Treasury Tax & Loan program, or TT&L]. In this case, the dollar rather than being cleared out of the depository system merely switches beneficial owner of that dollar and at which depository that ownership is custodied.

But most of the government’s day-to-day business runs through its main account managed by the Federal Reserve, something called the Treasury General Account (TGA). As such, the Treasury Department – like depository banks – seeks to maintain a minimum clearing balance from which ensure it doesn’t bounce any of its checks or electronic payments (including entitlements like Social Security).

Unlike the TT&L option, a dollar of taxes paid and directed instead to the TGA is one dollar that is removed from the depository system; it gets deducted from the taxpayer, then the taxpayer’s bank’s reserves and credited at the Fed to Treasury’s TGA; now a dollar outside this one specific ecosystem.

Getting back to September 2019, the unexpectedly higher tax payments meant unexpectedly lower levels of bank reserves which, in addition to the Fed’s QT, balance sheet shrinking, left the entire system with too few reserves for whatever (no explanation ventured) triggered the mid-September repo dislocation.

In conventional thinking, it’s always and only ever about bank reserve levels – to the point of excluding the whole wide rest of the world.

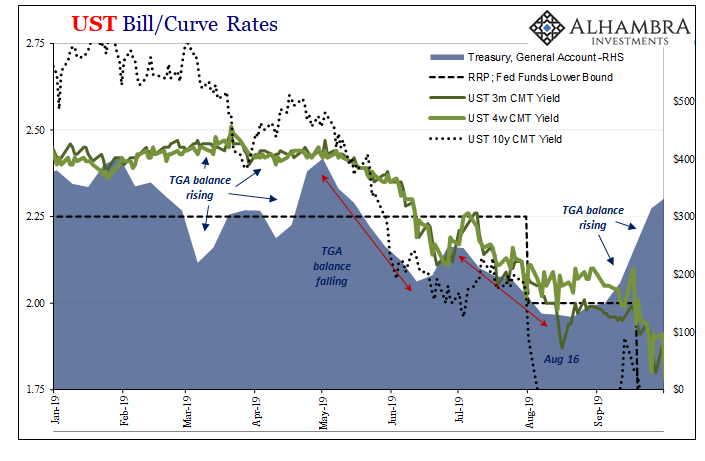

The numbers make it seem plausible except that the TGA balance had been declining sharply since the beginning of May 2019. That had meant, like the upcoming months of 2021, fewer dollars in the TGA therefore more available in bank reserves (QT notwithstanding). The sharp rise which began in late August simply pulled out from bank reserves only some of what had previously been put back in.

That’s why the “unexpected” part of these tax receipts is doing most of the heavy lifting. Supposedly, banks weren’t anticipating them and therefore hadn’t been prepared for the smaller systemic reserve level (even though they’d been experienced with QT up to that time).

The question then becomes two: first, what must’ve been the real problem in September 2019? Second, why weren’t those months in the middle of that year more inflation-y, or at least more effective at blunting the deepening disinflationary trend, with so many reserves being put back? You can argue that QT “sterilized” the Treasury’s drain, but even so the level of bank reserves had at least remained relatively stable.

And yet, the summer of 2019, in particular, the months leading up to the repo mess, these were not particularly inflation-y kinds of months, were they? This was a looming globally synchronized downturn consistent with so much of what had been identified throughout 2018 and projected forward into 2019 hard against Jay Powell’s acceleration and inflation mistake – including continued suggestions of rising risks, potential collateral bottlenecks, and all kinds of liquidity issues plague repo, fed funds, swaps, etc.

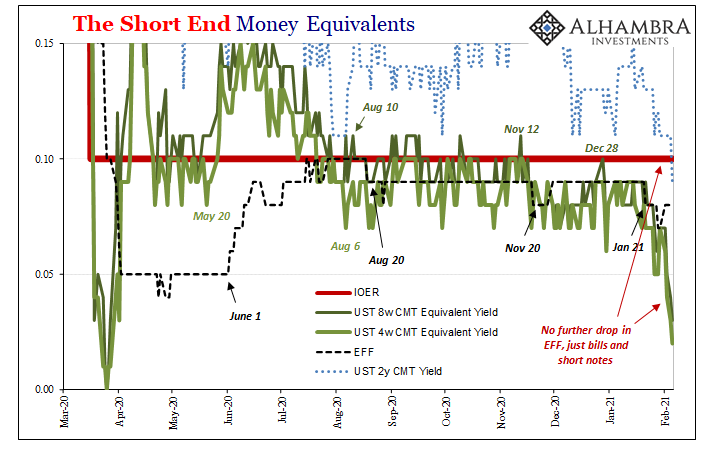

We’re reminded of this TGA excuse given that it has been repurposed in early 2021, if slightly reworked. Treasury will be drawing down the account – it forecast this week – by nearly three times the level observed in the middle of 2019. This has further been put forward as one primary reason short-end money rates are declining so much in January and February 2021 (supposedly in anticipation of TGA declines that hadn’t started yet).

When we go back to mid-2019, however, though it was “only” about $275 billion top to bottom, at that time this was an enormous change; the second largest short run TGA drain/contribution into bank reserves in the more than decade since Treasury basically dropped TT&L’s (for reasons you can read about in the article cited above).

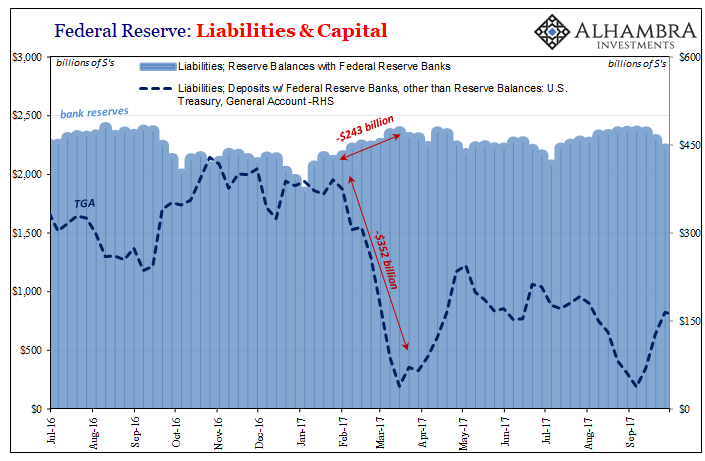

The largest such decline occurred in the first few months of 2017; a little more than $350 billion came out of TGA and into bank reserves, most of which were left there by the Federal Reserve not yet into QT.

Again, while a little less than half of what’s the amount Treasury will draw down between now and the end of March, you might remember that 2017 didn’t suddenly turn into an overabundant, inflationary fire of a mess either way – it was just talked about like it was about to be, though more so attributed to “globally synchronized growth” with only a few hardy (and obsessive) souls paying much attention to these arcane plumbing flows.

OK, so record flows out from TGA didn’t become the inflationary fuel either time. Did these at least account for any declines in money and bill rates?

Unsurprisingly, no.

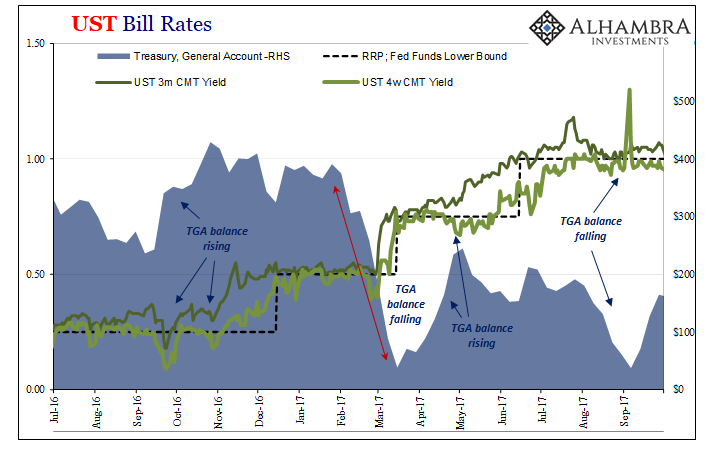

First, 2017:

If you can detect a solid correlation from this time period, my hat’s off. Otherwise, we find spikes in yields, big drops, either when TGA is moving up or moving down. Yes, forecast and predicted Fed “rate hikes” affect bill rates ahead of time, but there was no real sustained pressure on bill yields whenever TGA fell by substantial amounts – including February and March 2017.

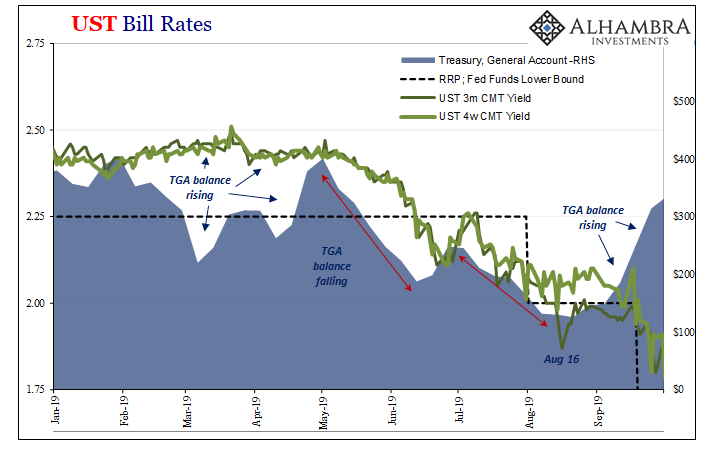

As for 2019:

At first glance, it does seem like the mid-year drawdown in TGA corresponds pretty closely with a sustained drop in bill yields – especially as they moved from a positive spread to the RRP “floor” to a sustained negative one.

But if you account for other facts and factors – those described above – the TGA’s influence isn’t a straightforward matter at all. In fact, again, it’s a contradictory one. Were bill yields really declining because of “too much” or at least stable reserves? Or was that more consistent with everything going to crap, including clueless Jay Powell being forced to go back on himself due to getting everything about that year wrong?

In other words, in 2017, no correlation with TGA whatsoever, even during a much larger drawdown (and positive contribution to bank reserves). In 2019, a possible correlation though one that’s much stronger between the collapsing yield curve (represented by the 10-year yield) and growing (correct) risk aversion consistent with the overall environment of the time.

Middle 2019 was nothing, absolutely nothing about “too much” money gifted to banks by Treasury. Furthermore, that repo issue was merely the continuation of illiquid behavior that had been building and building for more than a year beforehand; not “unexpected” taxes.

Like 1997, these later events further remind us:

Clearly, bank reserves and domestic fed funds, the collective reach of the Federal Reserve and the federal government Treasury, are not the exhaustive factors they are presented to be.

They explain federal funds, at times, but little else that might matter. Even Peter Fisher had conceded more than two decades ago, on the narrowest terms of his own technical domain, how collateral, for one thing, had been an extremely important constraint.

Is this time actually different?

Stay In Touch