Japan is just the name of a group of large islands on the far side of the Pacific from the United States. For most people, there’s not much else more to say beyond the charm of weird, ofttimes masochistic tendencies embedded within the inscrutably fascinating Japanese gameshows. Maybe something about suicidal demographics.

The financial media has done such a poor job of its only job, to illuminate the facts and disseminate the data backing them up. As one American “stimulus” after another rolls off, it’s as if these are the first in every category. Met with unbridled optimism one after the other, each is a surefire fix to problems that only get worse.

Didn’t you see how big and innovative it is?

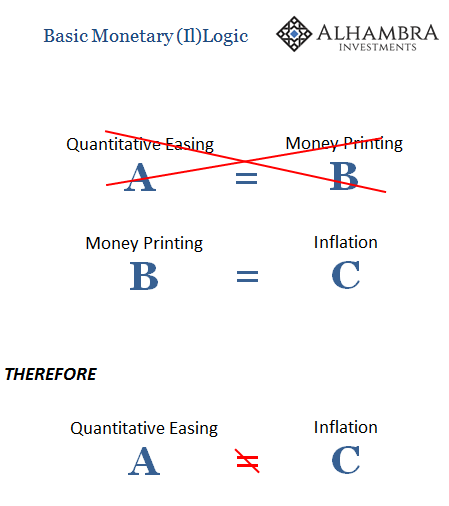

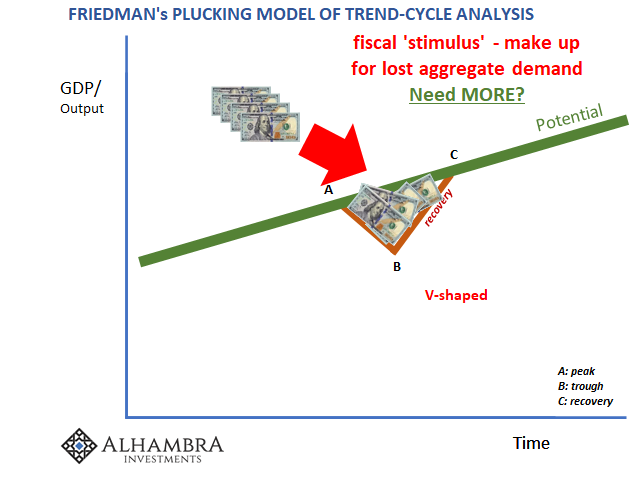

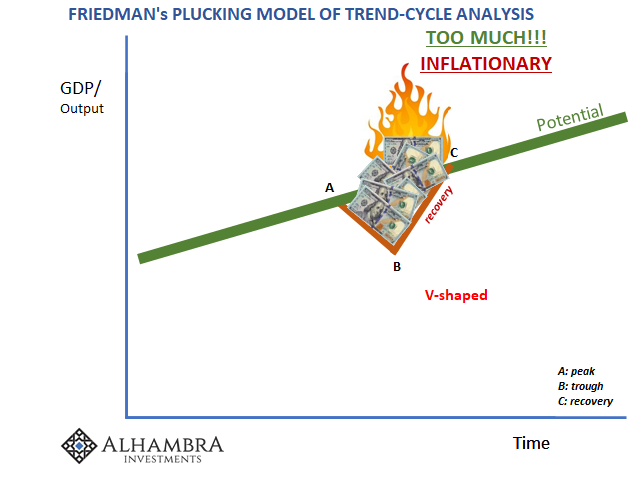

We’d know if they’d worked when the inflation shows up to confirm their success. It’s not really about consumer prices so much as it is about demonstrating effectiveness. To have stimulated the economy to the degree necessary following some of the biggest economic dislocations in modern history, such stimulation eventually becomes inflationary excesses.

If it works.

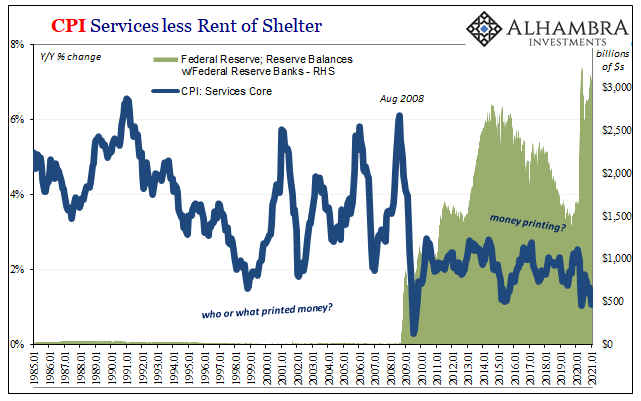

The attempts at it never really ended, in the US these had been restarted in 2019 (not 2020). One key reason why is that the official world never really figured out who or what to blame as inflation kept coming up short of stimulus confirmation. Promised over and over (and over and over), the prolonged disappearance of price pressures led instead to a big mystery (and then an even bigger joke).

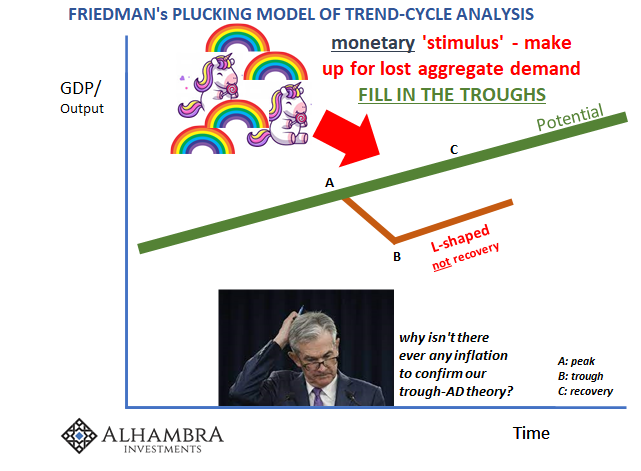

There never should’ve been one because the Japanese have done all these things. All these things. Size. Scope. Manner. Media.

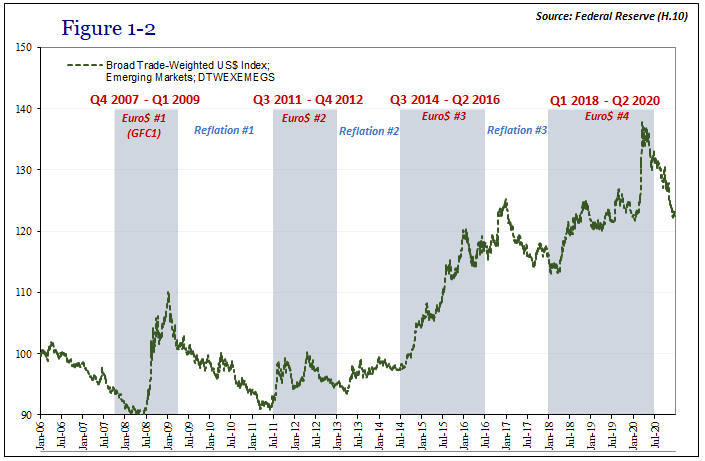

Not merely repetitive in the Western versions, complete cookie cutter. As it has been for the inflation “puzzle”, these likewise transported east along the international trade-crushing routes of central bank “money printing” and right down to “money-financed fiscal expansion.”

Before arriving at COVID, there had been:

That point was repeatedly driven home in the years before the pandemic. Policy makers were surprised when unemployment kept falling without triggering inflation. Many economists said Donald Trump’s 2017 tax cuts, an unorthodox effort to juice an already growing economy with fiscal stimulus, would drive interest rates and inflation higher, but they didn’t.

In fact, nothing ever did. Again, Japan.

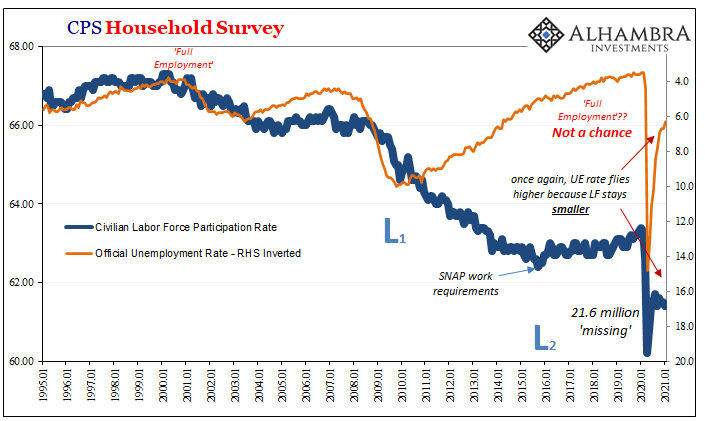

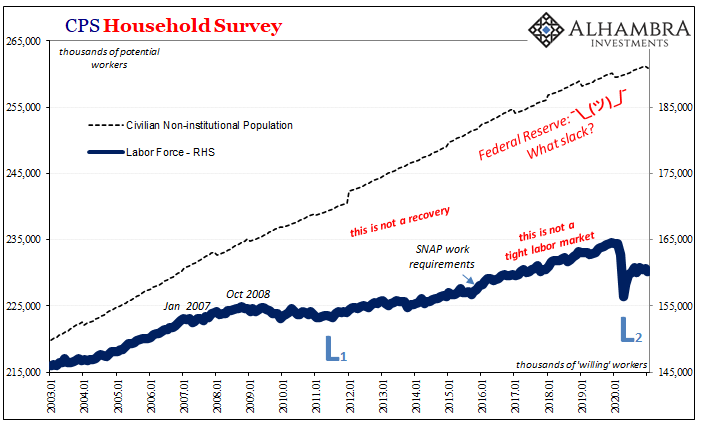

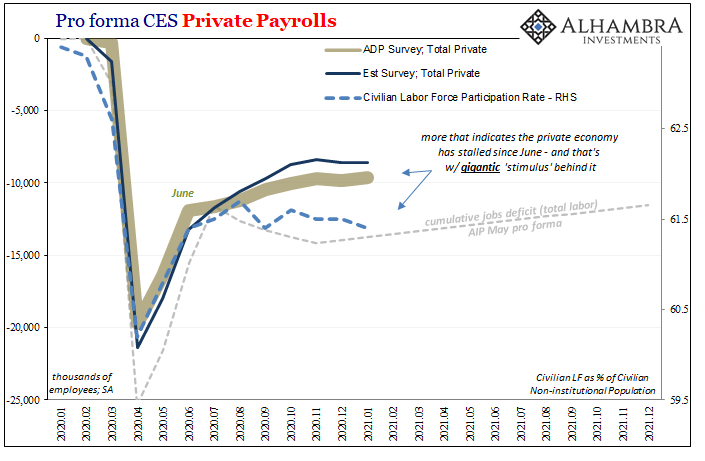

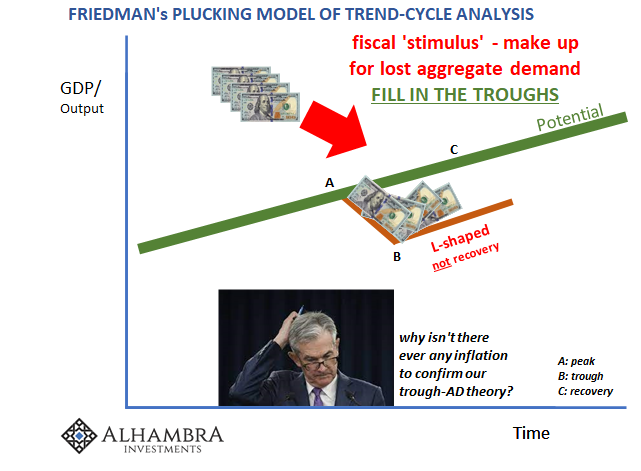

Now the economy finds itself in an even bigger mess, stuck in a larger hole – the worst ongoing employment crisis since the Great Depression, surpassing the Great “Recession’s” unbelievably huge expanse – creating and recreating the same stupid “puzzle.” They’ll never figure this out because they believe the Japanese experience was entirely Japanese.

Instead, what Japanese experience had uncovered has turned out to be a universal problem. Government’s are simply powerless, at the very least nowhere near as powerful as you’ve been led to believe your whole adult life. We’ve been taught, from Day One, that a determined government utilizing its central bank can and will create, through spending and monetizing, any level of inflationary impulsiveness it wishes.

In the textbook, and in the financial media, it is made to sound as easy as pushing a button. The monetary magic button.

The button depressed, still nothing, then these same “teachers” move the goalposts in order to re-establish the predetermined conclusion that the theory is forever sound, thus it must be some flaw in execution; usually meaning stimulus was “too small” no matter how biblically epic it was once described when it was being announced (sometimes, not all that long before).

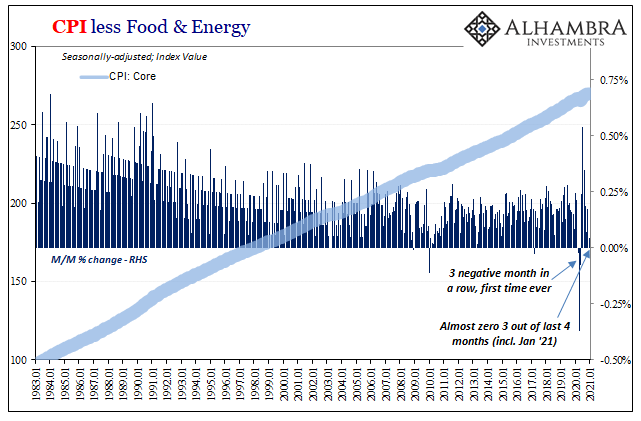

This is now apparently true for the gigantic numbers uncorked in 2020. Reacting to the Bigger “Recession” last year, the combined fiscal and monetary “rescues” weren’t enough; they could not have been. Almost an entire year away from the worst of it, and the most of the hugest rescues to date, there’s not a single sign of inflation anywhere. Not a one.

In fact, there’s even less now than pretty much any time in modern history. Once again, this is not about consumer prices; rather, it’s about pricing power as a reflection of deeper economic fundamentals.

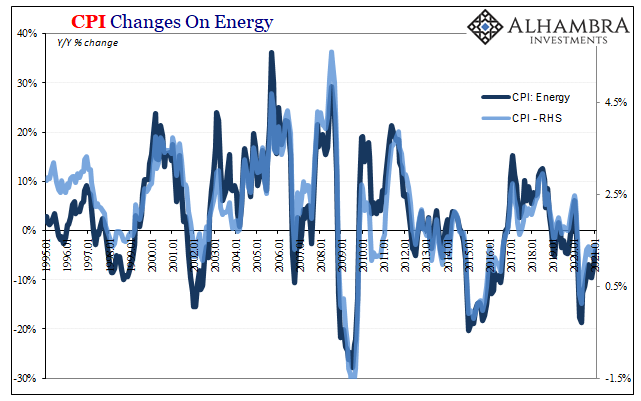

According to the latest estimates from the Bureau of Labor Statistics, the headline CPI rose just 1.40% year-over-year (not seasonally-adjusted) in January 2021. A full month of the last fiscal stipends (the much-complained $600 payments), two with vaccines, and even with the oil market getting more comfortable with either of those pretenses higher oil prices only managed to boost the overall inflation rate by 0.04 pts from December’s 1.36%.

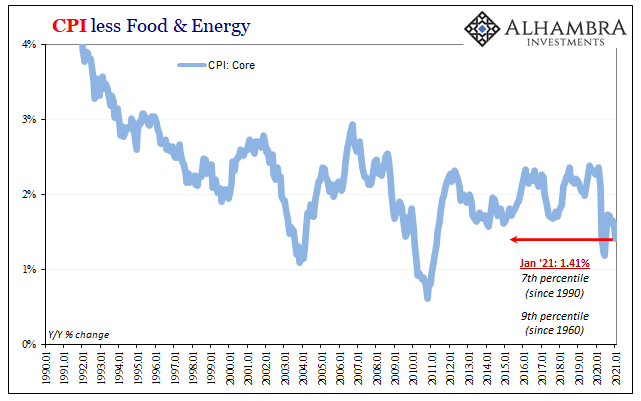

The big reason why is that outside of oil (oh, the irony) consumer prices have rarely been so tame and timid. The so-called core CPI rate, removing food and energy prices, tumbled to 1.41% last month, down from 1.62% the month before. Not only is that the lowest since last June, core inflation has only been less in just 9% of all the months dating back to 1960.

Let me reiterate: these are numbers for the month of January 2021, the eleventh month since last March’s introduction of now-forgotten, then-ridiculously overhyped “stimulus” consisting of monstrous fiscal spending and a Noah-level “flood” of “digital money printing.”

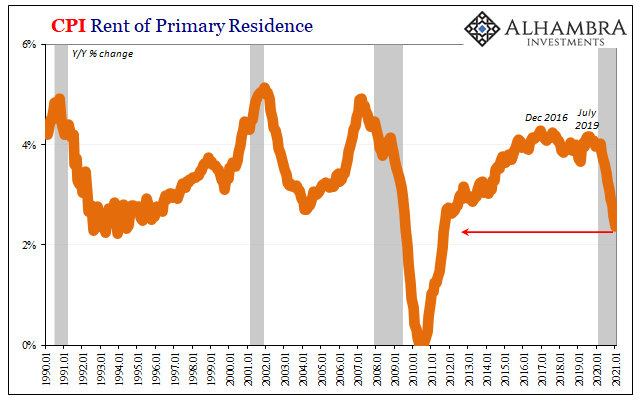

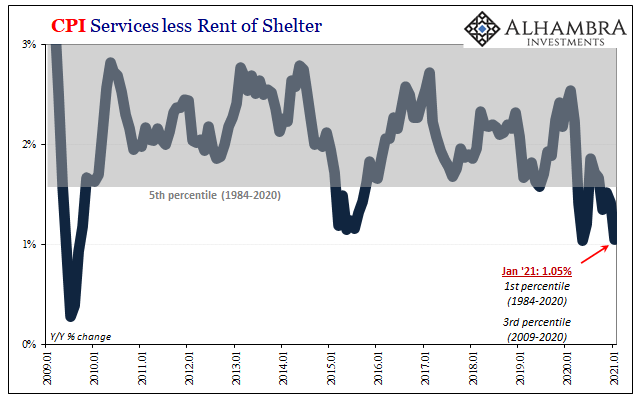

Searching the rest of the CPI’s details, it only gets worse. Another crucial “core” rate, services less rent, declined even further during January. Dropping sharply to 1.05% year-over-year, down from an already historically low 1.42% for December, we’ve almost never witnessed this low level of consumer price gains in the service sector; this counts as the 1st percentile for data dating back to 1984.

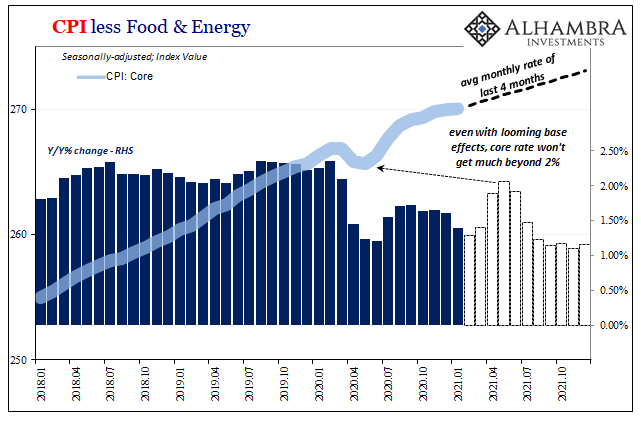

Unless pricing pressures pick up (a lot) soon there won’t even be much boost from last year’s deflationary dip. With base effects looming beginning with the upcoming March – March 2021 prices will be compared to March 2020’s deflation – at the current pace this will mean at most a core inflation rate barely more than 2% at its comparative “peak.”

That level wouldn’t even match the previous disinflationary plateau which had so confounded policymakers for years (and the Fed’s 2.00% average inflation target mandate is applied to the PCE Deflator not the CPI; the way the CPI calculates its index indicates a roughly 2.75% to 3.00% equivalent to the Deflator). If the economy can barely touch 2% core CPI even with the most favorable comparisons since the bottom of 2009, we aren’t talking the same language as is reported conventionally.

But, textbook proponents will continue to claim (using obsolete statistics like M2), that’s just the thing. Inflation will, they say, begin to pick up…tomorrow. They said it for January, just as for last December, and last November. And 2019. Like 2018. The pressures are there, the government will is there, and so it is merely a matter of time.

Didn’t you see how big and innovative this latest one is?

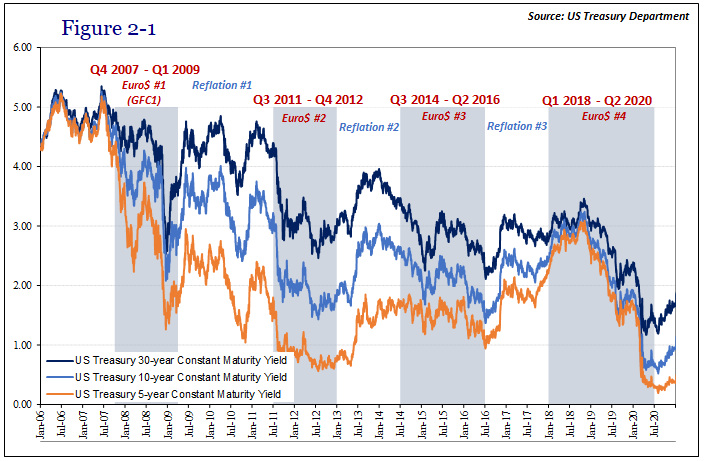

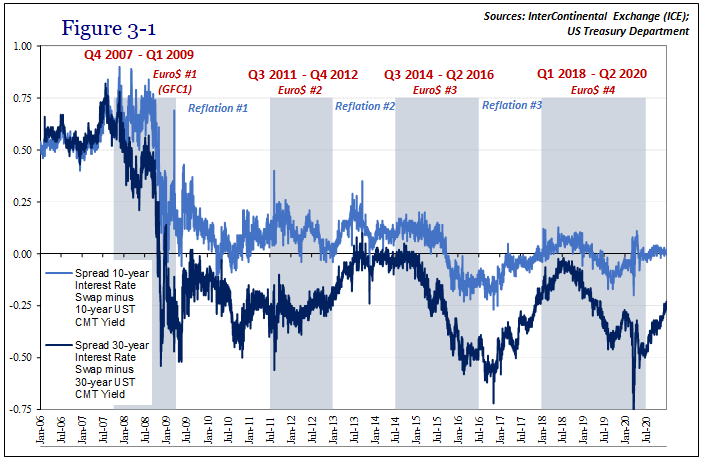

There’ve been 4,074 tomorrows since America’s QE1 was introduced all the way back in December 2008. That has also meant 4,074 todays when we’ve heard how, we’ll see, the inflationary burn is a foregone conclusion, interest rates will have to adjust nowhere but upward, and the textbooks, biggest of all to Economists, must have been correctly written.

There’ve been 7,268 tomorrows since Japan’s QE1 way, way back in March 2001. That has also meant 4,074 of those when we’ve heard how the Federal Reserve and Uncle Sam working together must be totally different than the Bank of Japan and Japan’s central government collaborating in exactly the same ways.

Not merely a standalone collection of islands west along the Ring of Fire, Japan is a cautionary tale of raw insanity. Einstein will need a new definition of it: doing Japanese over and over and expecting non-Japanese results.

Stay In Touch