52.1 Fedwire Breaks: Anomaly or Trigger?

Fedwire, the interbank system that transmits billions between 9,000-plus members, broke on Wednesday. The Fed says, “operational error” implying mere technical trivia – an anomaly. Why do some breaks stay mere anomalies while others trigger volatile, systemic consequences?

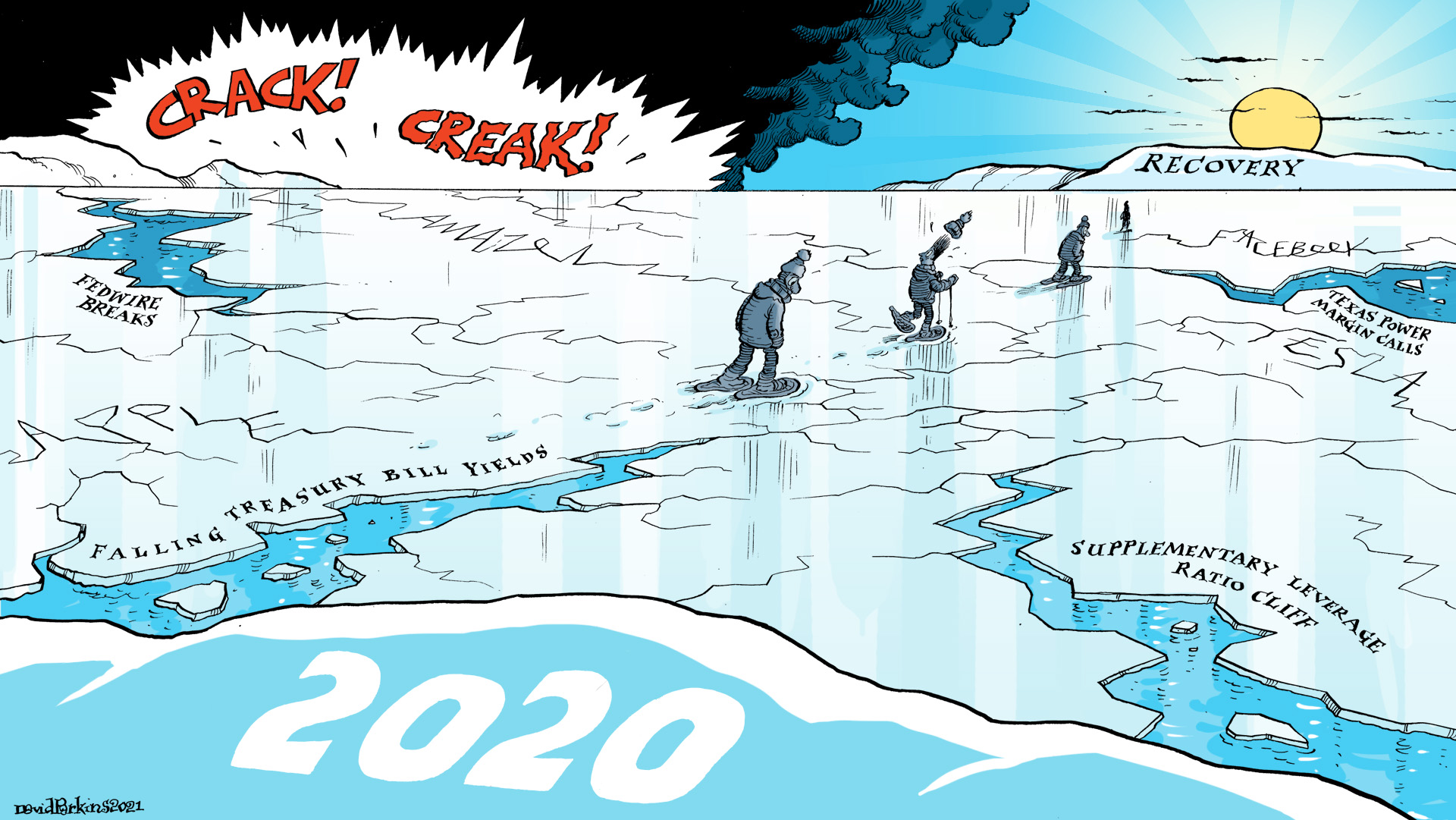

[Emil’s Summary] The theme of Making Sense Episode 52 is how an environment reacts to an anomaly. Resilient systems keep these aberrations constrained. But fragile ones can retroactively redefine what had earlier been labeled as an “irregularity”, “oddity” or “operational error” to something altogether more unsettling: “cause”, “spark”, “trigger”.

In part one Jeff Snider continues his multi-week review of breaks to the smooth functioning of interbank payment and messaging systems. This time a look at a sequence that led to a week-long disorder to Fedwire in August 1990. Part two, also a continuation of a multi-week review, ponders what may be causing the disquieting twist in the US Treasury yield curve. Is the demand for short-term collateral a disqualification of reflation, as was the case during 2013’s so-called Taper Tantrum? Lastly, some words on oil and the developing Texas power market credit crisis, in which electric retailers failed to make $2.1 billion in required payments and put the largest power generation and transmission cooperative in Texas into bankruptcy.

Fedwire “operational error[s]”. Unsettling demand for Bills. Texas margin calls. An approaching quarter-end seasonal low point in liquidity. A looming regulation-mandated US Treasury cliff on April Fools’ Day. All anomalies… in a resilient system.

———WHO———

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Art: https://davidparkins.com/

Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, dateless. Art by Winterfell resident, David Parkins. Podcast intro/outro is “Some Thing” by Rambutan at Epidemic Sound.

———WHERE———

AlhambraTube: https://bit.ly/

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———WHEN———

00:05 Fedwire went offline, as it does occasionally, and as it did in mid-August 1990

03:49 A remarkable collection of monetary, financial, economic, and geopolitical events in 1990!

05:38 A Financial Times story on the Fedwire disruption is rather blase about it all

07:44 The 1990 Fedwire freeze coincided with a US Treasury bond sell off

09:50 The 2021 Fedwire freeze coincided with a US Treasury bond sell off

11:28 The Federal Reserve examined a collection of interbank plumbing ‘shocks’ in 2003

13:11 Why do some anomalies remain just that – anomalies – and others become systemic triggers?

16:25 The Federal Reserve is treating the Fedwire problem as no problem at all; move along

———WHAT———

Why Price Alone Does Not Render An Asset Class ‘Safe’: https://bit.ly/3suB0Td

‘Operational error’ disrupts Federal Reserve payment system: https://on.ft.com/3stDlOe

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch