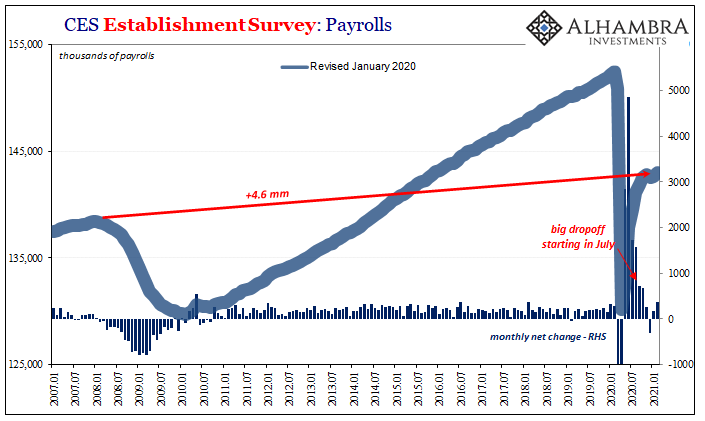

At first glance, the numbers weren’t bad. Maybe even borderline OK. The headline payroll figure nearly doubled consensus estimates, even better when taking into account only private payrolls even after ADP earlier this week had reported the opposite. Topline, the Establishment Survey gained 379,000 in February 2021, of which 465,000 were reportedly added to the private economy (government employment shrank by 86,000).

The problem, such that it is one, the combined leisure & hospitality industry was responsible for 355,000 of the increase, leaving not much from everywhere else. These people absolutely need to get back to work after having been shut down for nearly a year due to both economic and non-economic reasons, and the increase due to more rational government stances is an unqualified welcome development.

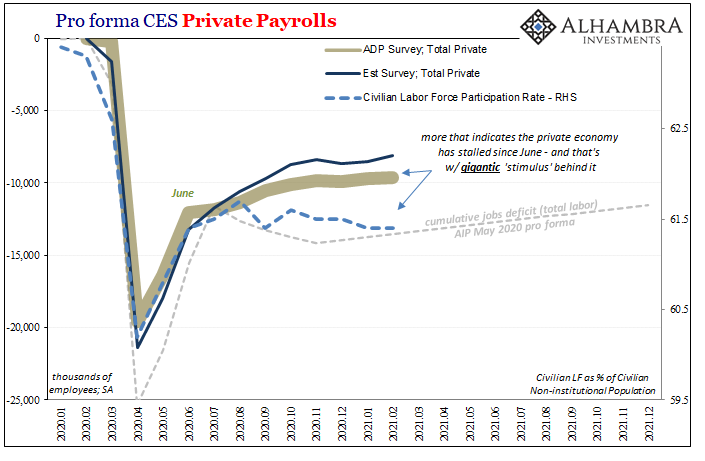

However, it shouldn’t account for the vast majority of any gains that are less than, say, 1 million or better (like the early parts of the reopening last year). If non-economic re-reopening is adding ~350k back to the labor market, then if the economy had been otherwise recovering there’d have been as much or more gained from the rest of it spun off by legit growth.

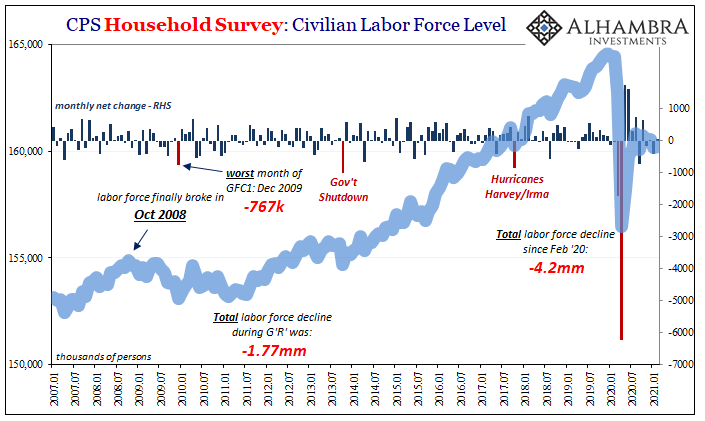

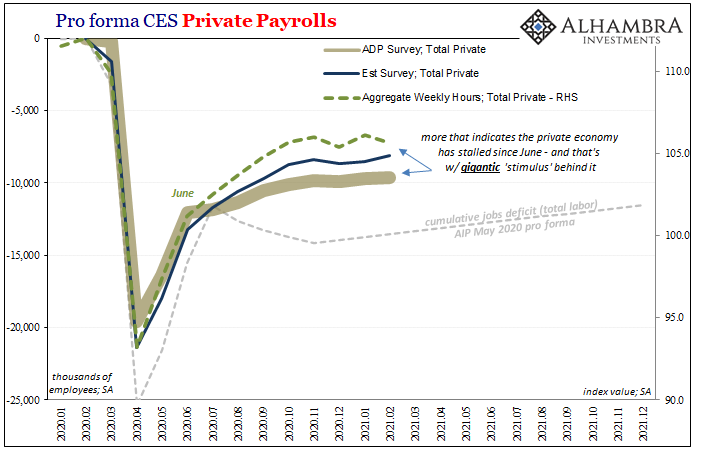

These slim pickings are instead why the labor force has contracted slightly since the apex of the rebound in June 2020. After figuring more than 400k former workers left the labor market in January, despite a “good” payroll report in February only 50k came back. There remain 4.3 million fewer workers counted as in the labor force, a gigantic drop that hasn’t improved over the last six months, half a year, since peaking last August.

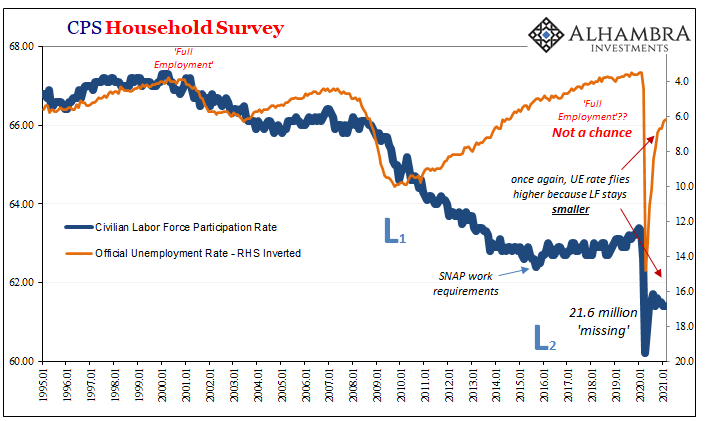

And with only 50k added back to it, with a more modest (compared to the CES) 208,000 increase in the Household Survey the unemployment rate ticked down to 6.2% from 6.3%. Even at slow speed, more jobs than potential laborers; those officially not in the labor force add up to nearly 101 million yet again.

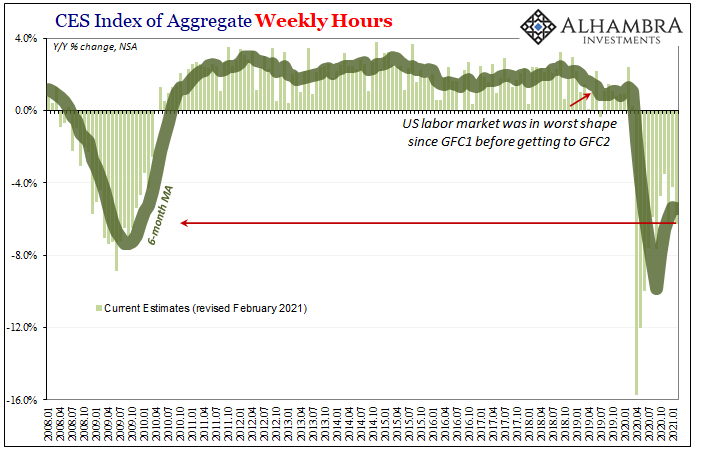

The most remarkable and illustrative part of the payroll reports continues to be the hours series. Even with more leisure & hospitality workers back in the mix, the total number of aggregate hours worked – in the private economy – somehow declined on a seasonally-adjusted basis; that is, according to the BLS calculations, there were fewer hours worked (-0.5%) in February than January.

Unadjusted, total hours last month were down a whopping 6.3% year-over-year. To put that into perspective, this is just about the same level of contraction as the worst eight months of the 2008-09 Great “Recession.” Given this figure, no wonder there weren’t many other jobs added besides in revived bars and restaurants (and it looks more like ADP); there was, apparently, no work for possible new workers to be staked.

It raises the further possibility of fallout from the summer slowdown that persisted through autumn and has nearly finished its own winter – there’s only so much left that can be put back from further reopening. More and more, it seems that while some jobs are still available for being reanimated in non-economic terms there are millions upon millions more which may never be.

The former tend to be the waiters and bartenders; the latter appear to be the rest of the system.

Job losses were supposed to have been temporary (then again, we all heard the same things in 2009). Like flipping a switch, the economy was turned off and could therefore, in theory, be turned right back on again, an ensuing “V”-shaped recovery widely promised and forecast. After having gone missing, it was said the rapidity was only delayed.

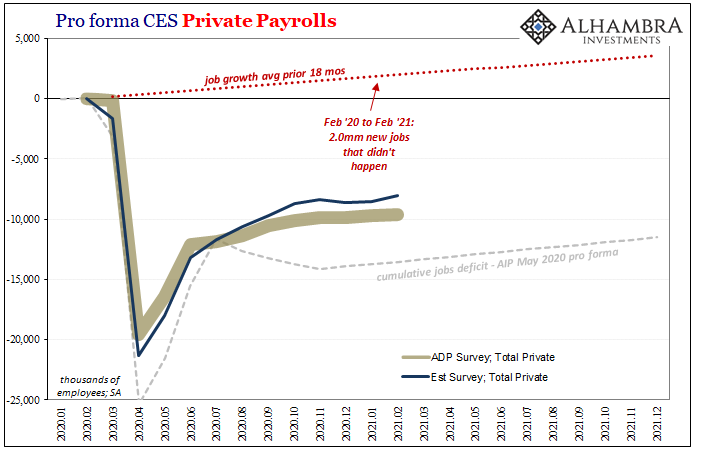

Despite massive doses of “stimulus” of all kinds interjected along the way, approaching the one-year anniversary the US economy is remains more than a Great “Recession” worse off! While other economic accounts have at least rebounded closer to, or even have reached, their prior highs, what matters most is labor and jobs.

Here nothing is even close; forget about eleven months of added growth which never happened.

Vaccines and more of Uncle Sam’s TGA-funded political “generosity” will help close the gap somewhat over the months ahead, however, it is increasingly clear these will only do so much and are limited in reach and depth. More and more, longer run economic damage is becoming apparent.

Then what?

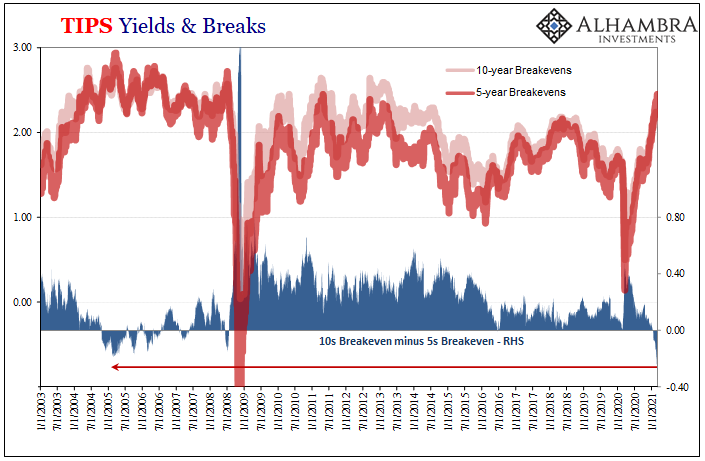

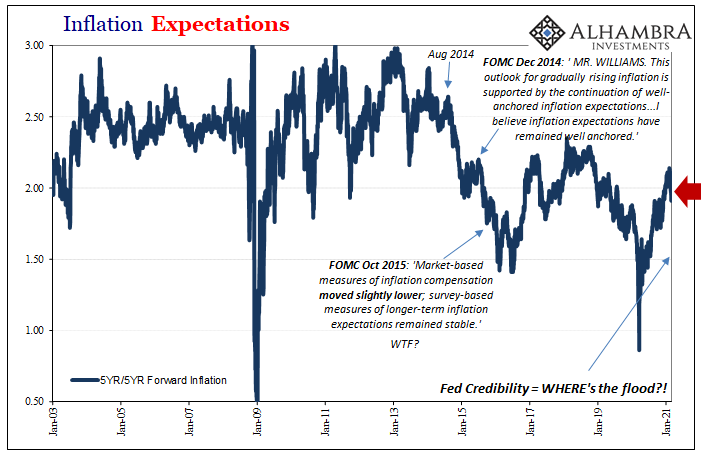

Where the inflation story is concerned, it most likely won’t be that; can’t be that. Commodity prices can shake up the short run like they have, eventually these kinds of labor fundamentals (demand shortfall) supersede everything. Therefore:

So, like the middle 2000’s, this inverted TIPS situation suggests the same thing in reverse; whereas rising oil prices hadn’t unanchored long run inflation expectations back then, failing to convince them upward and therefore indicating a more serious inflationary condition, nowadays the rise in oil prices has yet to alter the long run expectation only this time unable to push it out of its post-2013 deflationary rut.

WTI pushes up short-term breakevens while background inflation expectations remain firmly anchored in the same disinflationary category, becoming, perhaps, even more firmly fixed by among other things (China) the continuous stream of labor market indications demonstrating more perceptible and then tangible long run damage.

No matter how many, or few, employees are thought to be involved in the aggregate, a private economy that doesn’t put in the hours isn’t really producing, so it can’t really be recovering beyond mere superficial metrics – the unemployment rate the most insincere of them all. February 2021’s payroll report looks very, very different down here at the bottom.

Stay In Touch