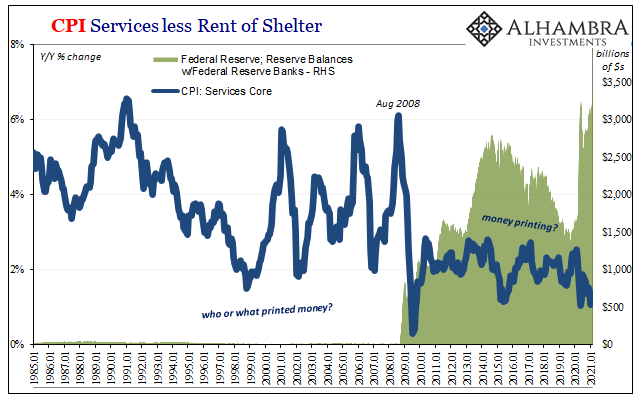

This particular part of the hysteria is understandable, if thoroughly unconvincing. Forget the Fed and its bank reserves for moment, whatever those are now and then. The banking system is where it’s at, monetarily speaking, and it is the banking system which seems to have lost its handle on the money printing lever. If we’re focused beyond bank reserves and upon broad deposit-based money, there does seem to be reason for alarm.

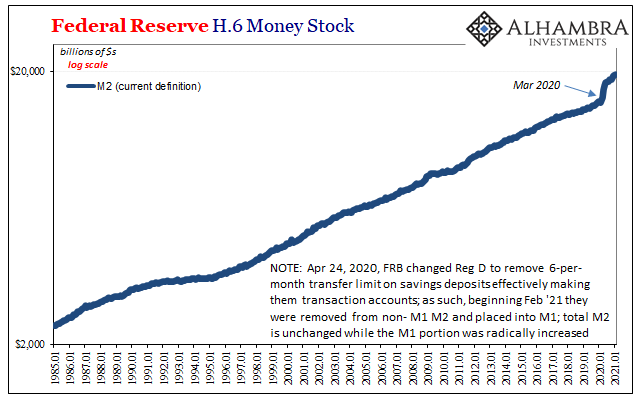

The increase is simply unprecedented; even on a log scale, it sticks right out:

Much of this bank/deposit money surplus arose from connection to the Fed’s super-charged QE6, so even if the central bank’s bank reserves don’t count as real or effective money (and they don’t) then the banking system has at least performed the task on behalf of Chairman Powell (the details on the rise in checkable deposits and their connection to central bank purchases here).

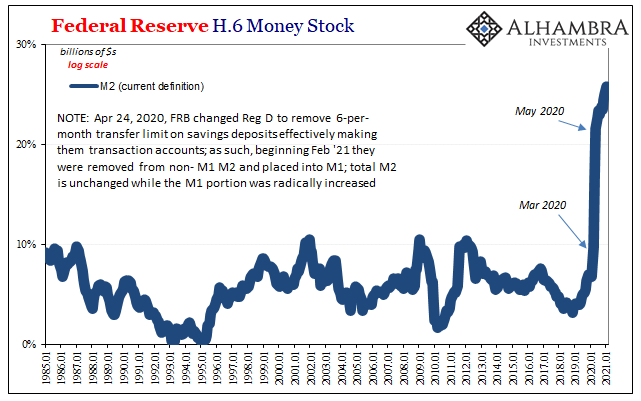

By May 2020, the broad M2 measure had increased by 21.6% when compared to May 2019. It’s been in the twenties moving upward ever since. Simply staggering levels of expansion.

But, and here’s the question, does it mean anything more than academic trivia?

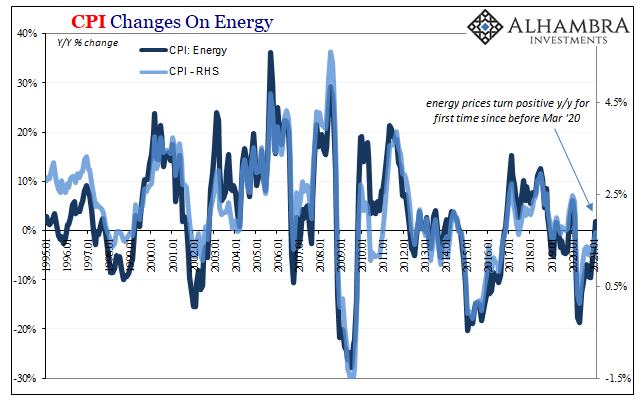

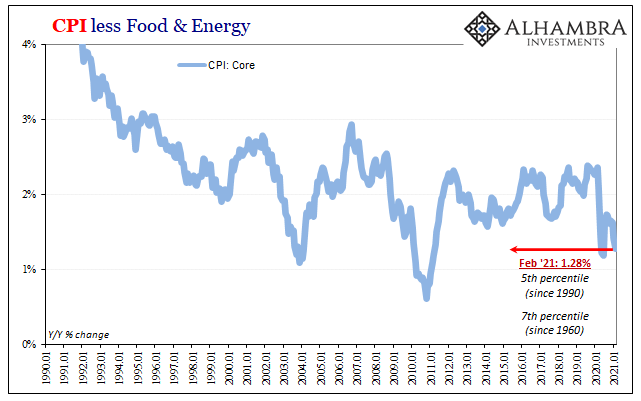

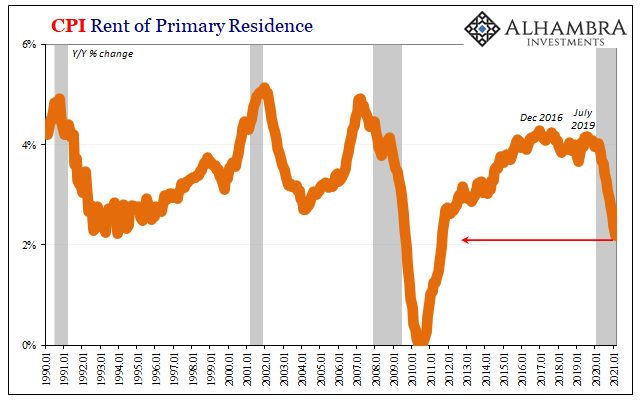

According to inflation figures, no, this M2 business is not meaningful to US economic business. When the BLS reported CPI estimates for February 2021 today, outside of the modest oil/energy contribution these continued to be among the lowest rates in series history.

This already proposes some categorical disconnect. As noted above, the full speed of the M2 brrrrrrr had been achieve by May last year, really picking up the month before in April. That means for at least the last nine and really ten months, according to this definition of it, money has been otherworldly exploding.

Three-quarters of a year at better than 20% “money” growth would be more than sufficient time and at a way-more-than-sufficient pace for this deluge to have flooded itself all the way completely through any economy and have months ago left behind not just a detectable inflationary signal but more likely a completely unambiguous one. This simply has not happened (leaving many M2 alarmists to fall back on the same the-BLS-must-be-cheating excuse; there might be many things to disagree about where it comes to inflation indices and how they’re constructed, that’s not one of them).

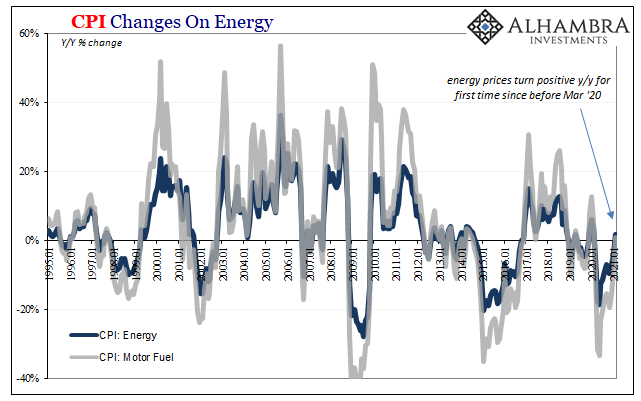

Year-over-year, the headline complete CPI bumped up to 1.68% broad consumer price inflation during February 2021. That’s up from 1.40% in January as annual comparisons in the energy parts of the bucket turned positive for the first time since last February. CPI energy gained nearly 2% year-over-year last month, from -4.0% the previous month, as the gasoline (motor fuel) index was 0.7% higher compared to -8.5%.

Despite these outsized contributions from oil and energy, just the 1.68% topline – even after nine months of +20% M2.

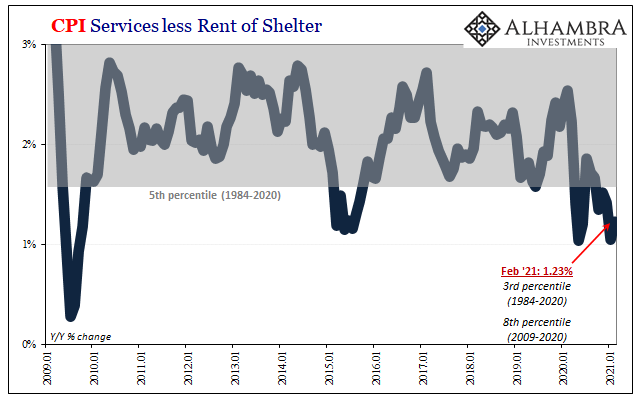

The primary reason was that the core CPI rate in February sank to just 1.28% year-over-year, the smallest since last June and one of the lowest rates on record. In the services sector, stripping out rent prices, this other “core” rate improved (1.23%) from January’s just about lowest on record (1st percentile) to merely near the lowest on record (3rd percentile).

Outside of crude and other commodities, only a conspicuous absence of inflationary pressures (see also: rent).

What must be missing from the M2 focus?

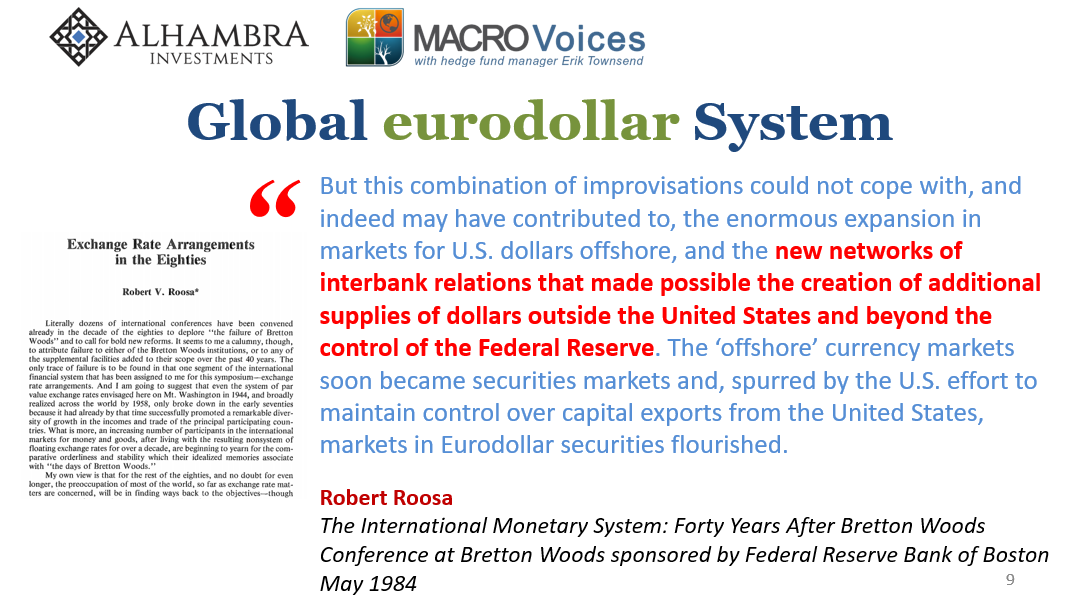

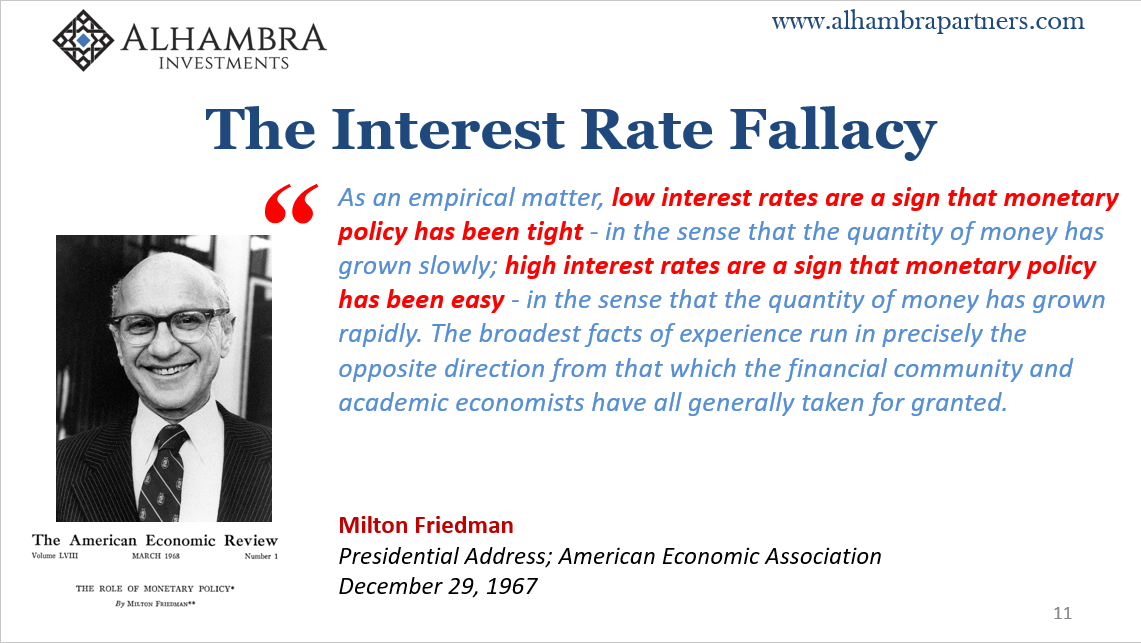

The answer to that question began to be pieced together a very, very long time ago. I’ve referred to the period of the late sixties and early seventies on many, many occasions over the years because that’s when monetary evolution first began to cause enough trouble even for central bankers and Economists – beyond that whole Great Inflation thing they didn’t understand.

[CORRECTION: the quote below was originally attributed to Charles Coombs in error, and was improperly quoted from non-source material; the article has been updated to correct the source and the full quotation.]

It had taken them more than a decade to finally start taking drastic money and banking changes seriously, as any number of official or academic discussions had illustrated at the time. The one I use most often gets right to the heart of this current M2 issue; all the way back in 1974, George Mitchell, the Fed’s Vice Chairman, realized the funny business wasn’t being limited to fun outside the US boundary:

Mr. Mitchell said he could think of no time when the monetary aggregates were less useful for policy purposes than they were now…Another uncertainty in the interpretation of the monetary statistics arose in connection with Euro-dollars; he suspected that at least some part of the Euro-dollar-based money supply should be included in the U.S. money supply. More generally, he thought M1 was becoming increasingly obsolete as a monetary indicator. The Committee should be focusing more on M2, and it should be moving toward some new version of M3… [emphasis added]

M1 was pretty much obsolete already while M2 was steadily moving in that direction – in 1974 – leaving Mitchell to suggest an even broader M3. Why?

Go back and reread what Mitchell had said; essentially, these eurodollars outside the United States were creating undeniable problems for conditions inside the United States. Let me rewrite that: offshore dollars causing issues inside US to the degree that even central bankers conditioned to their own narrow bureaucratic domain couldn’t look away (“benign neglect”) from them any longer.

While the Federal Reserve staff did attempt to include eurodollars (and repo) in their M3, they never came close to capturing enough of them to make M3 worthwhile, either.

But if M2 never changed its definition, then what about all the stuff that should have gone into M3 but remained way beyond even the Federal Reserve’s technical abilities to define and measure? These offshore dollar formats didn’t disappear; they just never got even close to properly M-ed.

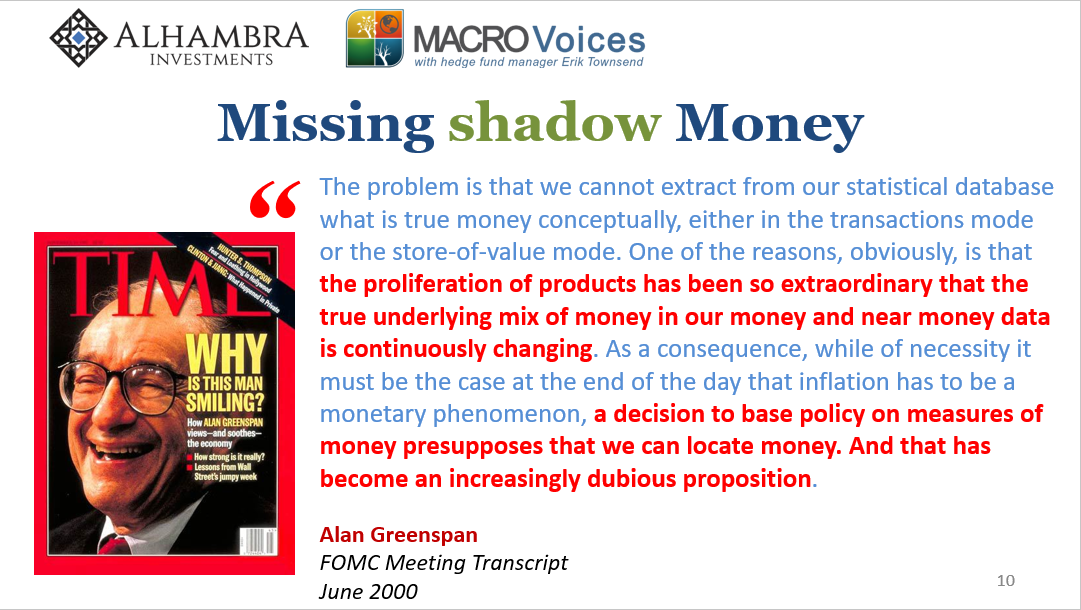

And it was this shadow money outside the M’s which explains the world before GFC1, what really happened during GFC1 in 2008, and almost everything which has followed, including what has failed to materialize ever since – the inflation (therefore real recovery) always promised due to “money printing” theories that never account for what lies beyond the M’s.

To put it back into Mitchell’s terms; yes, M2 has increased dramatically in 2020-21, but that only includes domestic, deposit-based money and does not include, not one single penny, non-domestic, non-deposit-based money to which, offshore, there’s an enormous amount (see: quoted passage above; if just eurodollar deposits, not even the exotic stuff, back in 1988 was 130-some% of domestic M2 would eventually become in 1991, just how large had the shadows grown by 2007? 2015? 2021?)

And since in 1974 these Fed guys could see how the hidden offshore money outside their M’s was causing problems even inside the US, what might we conclude for 2020-21 just like 2008-09? The shadow money must continue to be an even larger deflationary (or disinflationary, to be more specific) drag than the visible inflationary deposit-based increase pictured in M2.

Though identified fifty years ago, this monetary blind spot was never actually corrected, the M3 effort never more than half-hearted at most (as Alan Greenspan would admit a few decades later). To put it very simply: if the shadow money you can’t define and measure is so much more and more relevant than the traditional money you can, why bother with either of them?

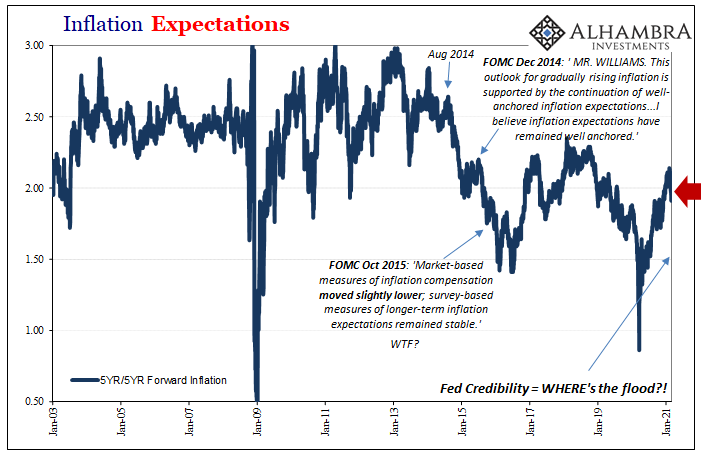

This explains why our central bank transitioned from an actual central bank and into nothing more than a domestic bank regulator which specializes in expectations-based policy rather than money. In short, if they can make you think they, or the banking system, is printing money then they believe you’ll act in anticipation of expected future inflation even if no effective money (on net) ever gets printed.

As we’ve witnessed and observed time and time again over the last thirteen years (longer in Japan), it just doesn’t work that way. Again, M2 is way up – like the Fed’s bank reserves – but there’s no inflation. Even that tells us something specific about the rest of the much broader monetary system both inside and outside the US even though we cannot directly observe the offshore (and onshore) shadows; furthermore, it fits neatly with all the rest of the indications more directly affected by the gross eurodollar system (bond yields, curves, etc.).

This M2 part of the inflation hysteria is at least understandable, though, in the end, not at all compelling lagging, as it does, (at least) half a century behind.

Stay In Touch