It really is about abnormality. What I mean by that is, contrary to popular imagination fed by the Fed and other central banks, ever since 2008 the inflation paradigm has changed. The first global financial crisis (GFC1) has proven time and again how it wasn’t a one-off, and since it was a monetary breakdown (global dollar shortage) that’s been permanent the entire global economy involuntarily transformed from modestly inflationary to durably disinflationary (and at times and in some places outright deflationary) where it has remained.

That is now normal, to the eternal consternation of the so-called monetary stewards professing powers they don’t possess who long ago gave up on the concept of money. Money, legitimate economic growth, and ultimately inflation all go together.

These things actually do make a lot of sense when you contemplate the background.

What this further means is that if the world has been removed from 2008-20 normal of disinflation toward or even achieving some new condition of inflation – by whichever means you prefer: fiscal recklessness adding a few more zeroes to prior reckless attempts at rescues; or their non-money monetary counterparts who have done the same thing to their own interventions – we would see these things as clearly becoming abnormal.

We should be able to easily find evidence that this time is different (M2 is just not enough by itself).

We’ll start our inflation tour in China where, also contrary to recent imagination, the Communists aren’t using the neo-Keynesian top-down textbook any longer. They remain focused top-down, sure, but reading from their original Mao rather than the second edition Deng.

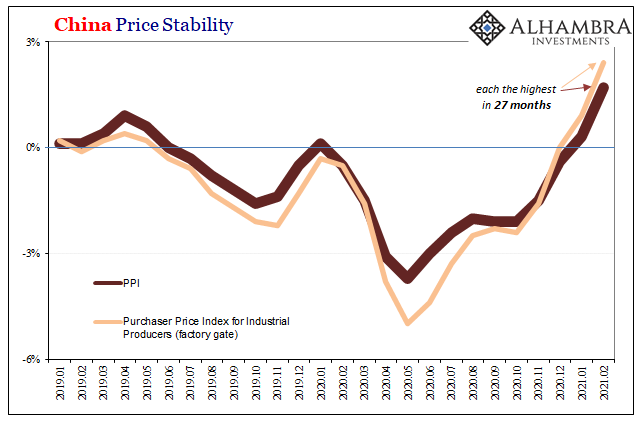

Even so, much of the rest of the world has said, hey, look at China booming and find in it the very start of the inflationary reset! Just a few days ago, the Chinese National Bureau of Statistics (NBS) reported that the country’s producer price index (PPI) as well as the purchaser price index for industrial sector firms (factory gate) each gained the most year-over-year in 27 months; the fastest industrial and producer inflation in more than two years.

Good start, right?

In many places around the internet, that’s how this is being described; here cometh Mr. Inflation (with Chinese Characteristics).

China’s factory gate inflation accelerated to the fastest pace since 2018 in February, official data showed on Wednesday, in line with a sharp pickup in exports and bolstering expectations for robust growth in the world’s second-largest economy.

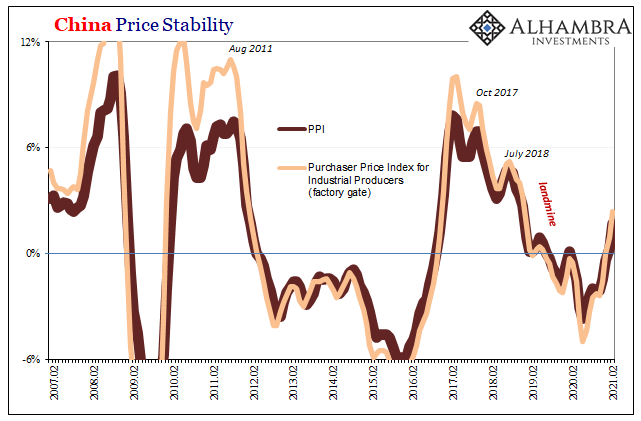

Fine. However, taking a closer look at Chinese prices we therefore expect to find that this is somehow different to qualify up to “robust”; prices in that sense rising in a manner unlike the way they had during at least the last decade in China. After all, over the past ten years the Chinese economy has only underperformed and failed to contribute “expectations for robust growth” every single time.

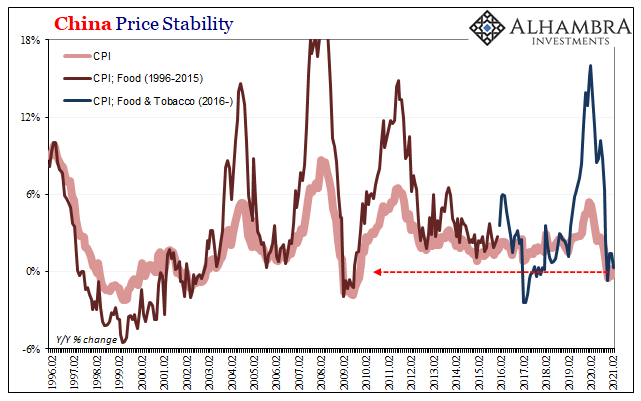

Not even close. In fact, when the NBS published its PPI and purchaser index figures it also released estimates for broad consumer prices in China, too. While commodities have clearly boosted the price trend on the production side of everything, though to a much smaller degree here than is being hyped up, consumer prices only exhibit mild yet outright deflation; their CPI fell 0.2% year-over-year in February 2021, in what had been the third decline over the past four months.

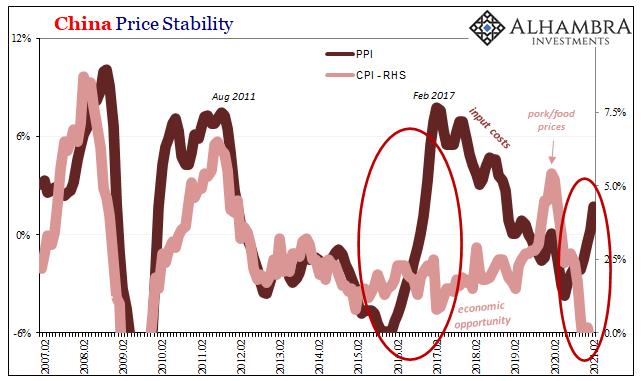

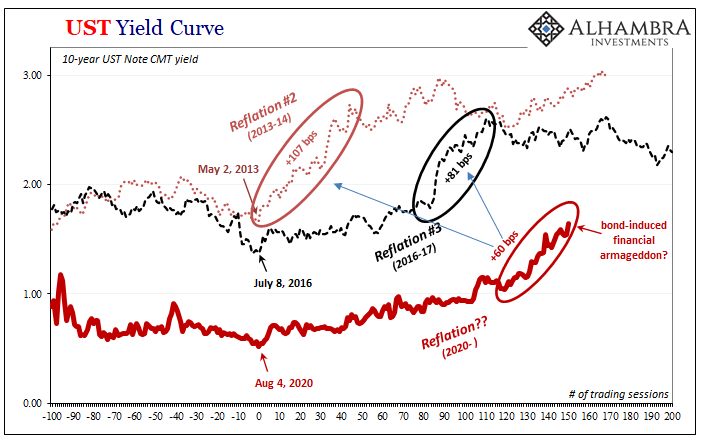

Even more remarkable, this also is nothing new. Going back to Reflation #3 (absurdly glorified globally synchronized growth), back then the commodity rebound from the preceding Euro$ #3 likewise had pushed producer prices seemingly skyward also because of commodities only for consumer prices to seriously lag indicating the near opposite possibility from “bolstering expectations for robust growth.”

So far as China is concerned nothing is different, or even close to different. Even producer prices, boosted by surging commodities, aren’t really rising all that quickly in comparison to just recent history.

The same can be said over here in the United States even as its Bureau of Labor Statistics (BLS) today reports “scorching” producer prices. Always the hype, this “blistering” inflationary base can only be derived from – like China – the narrowest of possible comparisons:

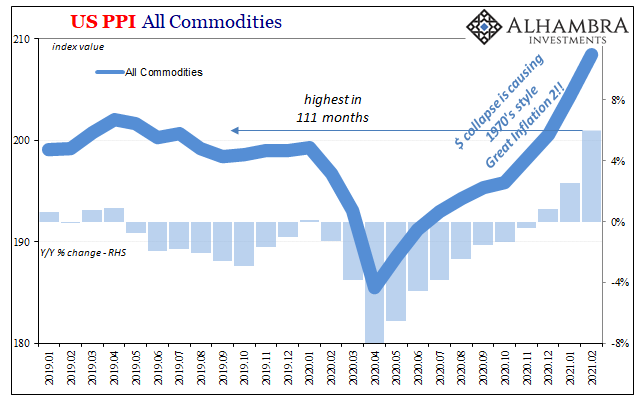

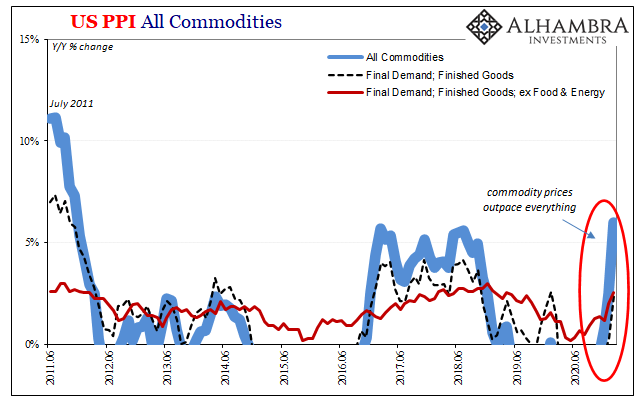

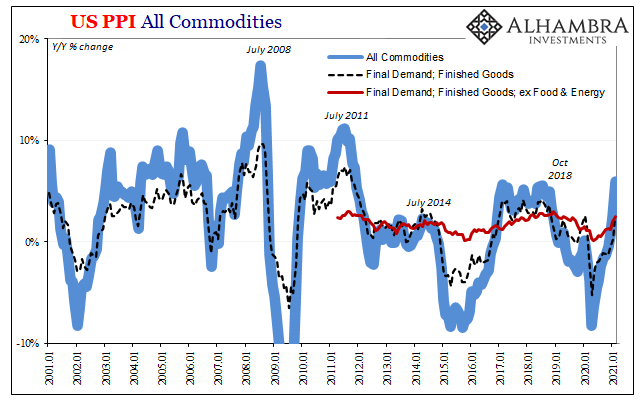

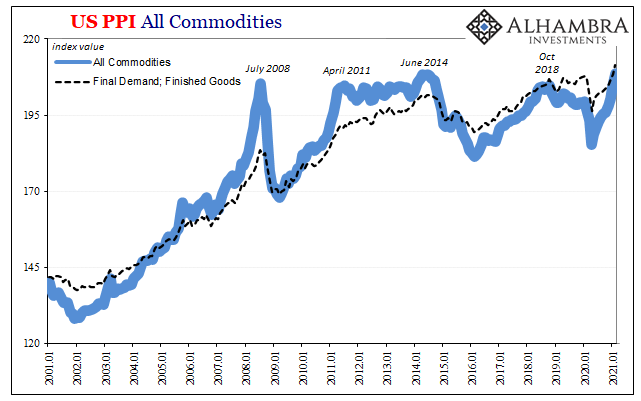

Rising 6% year-over-year last month, the commodity PPI index in February gained the most in 111 months dating back all the way to November 2011. This at least seems different (until you realize how 2011’s inflationary flirtation ended).

But outside of the commodity contribution (also realizing the supply rather than demand factors behind it), producer prices everywhere else aren’t exhibiting anything unusual. Producer prices for finished goods (final demand) increased by 2.47% year-over-year in February, which is only the highest since January 2020. The core PPI rate (finished goods) rose 2.54% year-over-year, the best since January 2019.

Those are not impressive months to be compared to; suggesting that commodity prices are not representative of the overall inflationary environment on the producer side of the economy (we’ve already covered the consumer side of the US system). And even commodity prices at the producer level aren’t threatening to move out of line with the post-2008 paradigm.

Nothing different here, either.

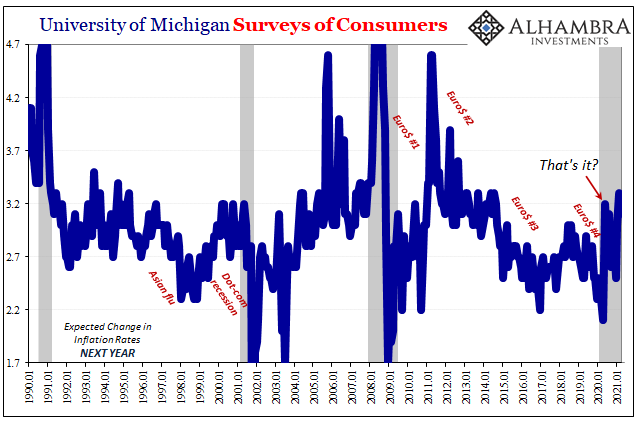

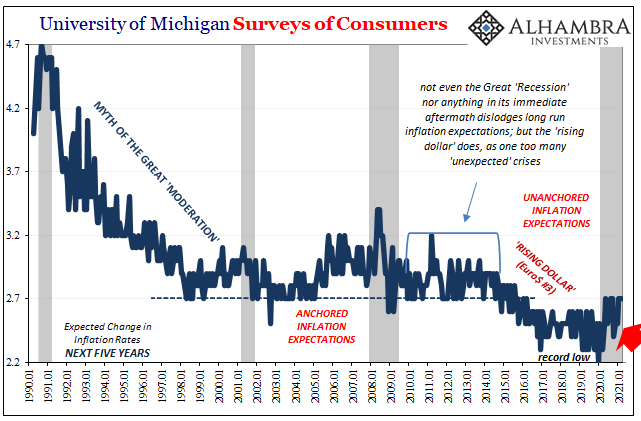

Given these facts and data, it would follow that US consumer expectations for inflation – like consumer prices themselves – haven’t really moved much. According to the University of Michigan’s latest consumer survey, specifically asking about anticipated inflation levels one and five years ahead, expectations in the short run have been somewhat higher than they had been certainly compared to last year as Uncle Sam’s helicopter drops and gasoline prices leave their short-term impressions upon the consumer mind.

And even then, these aren’t exactly blistering nor scorching their economic feelings.

Beyond that, however, long run inflation expectations haven’t really moved at all. They remain firmly rooted in the same disinflationary (sometimes deflationary) mindset (to borrow the Japanese excuse) even as gasoline prices jump.

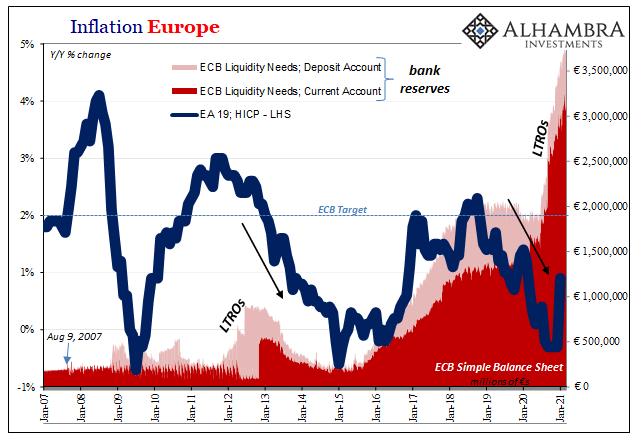

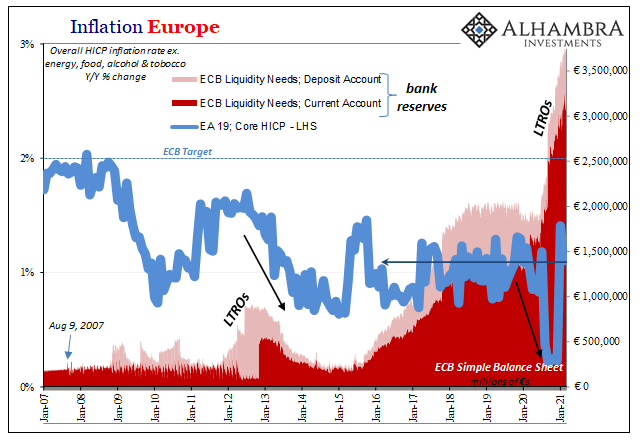

We could keep going on and on, surveying the entire world, but we’ll make just one final stop on our tour this time in Europe. This place, more than anywhere else, has been visited by the combined largesse of fiscal profligacy alongside an ECB acting like it has been asked to win a race of central bank balance sheet expansions.

And the numbers, the balance sheet figures, anyway, support the narrative – if ultimately fall short in data and evidence. In other words, the monetary policies clearly are different and huge, truly staggering: as of yesterday, March 11, “excess liquidity” has piled up to €3.69 trillion due to the ECB’s mostly dual QE’s PEPP and PSPP (the former, the pandemic version, has purchased €879 billion while the latter, the original QE, is up to €2.37 trillion leaving other purchase programs contributing the rest, all of them adding up on the central bank balance sheet’s opposite side in the form of offsetting bank reserves created as the byproduct of these combined policies).

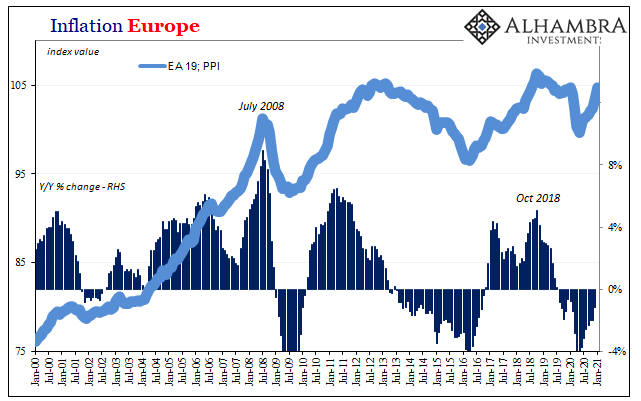

The inflation numbers, on the contrary, are not different. Like the US and China, commodities show up in Europe’s PPI, too, though as it only hit zero for the first time since the middle of 2019. Consumer inflation, after being boosted by January’s VAT tax return, stalled in February with the headline rate just 0.9% (despite oil) for the second straight month while the core rate dropped from 1.4% (a multi-year high) back to just 1.1% (very much like the last decade).

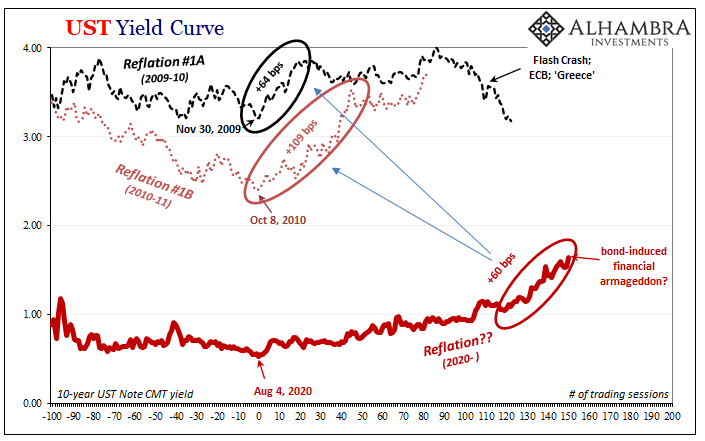

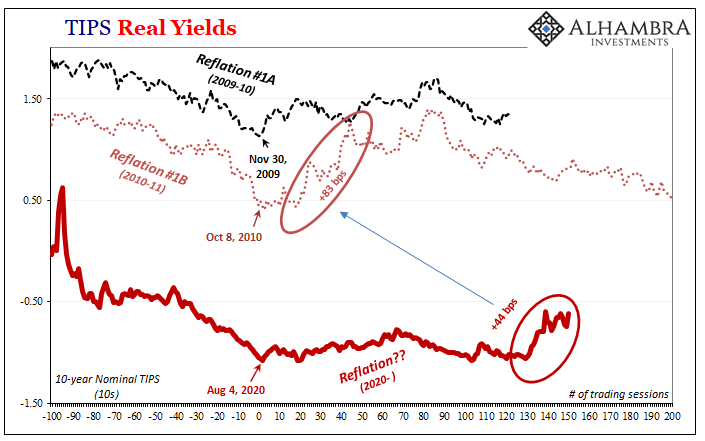

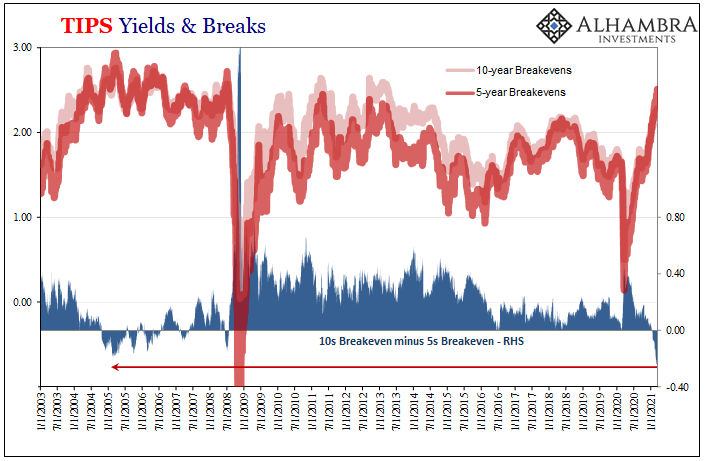

Our price expedition throughout the world’s largest economies shows that, no, there isn’t any indication anywhere that what’s going on is anything more than the usual, tepid, ultimately unsatisfying and too timid rebound or reflation. Commodity prices have risen sharply before, so that’s really nothing new, either.

Along with them, albeit to a lesser extent, producer and consumer prices rebound as it looks like the world is getting better, because it is. But then everything falls short of anything more than this reflationary rebound simply due to the fact that it can never get better enough to reach full recovery let alone the excessively inflationary. The real money drag, unseen worldwide, remains visible anyway in the form of these non-inflationary destinations and datapoints.

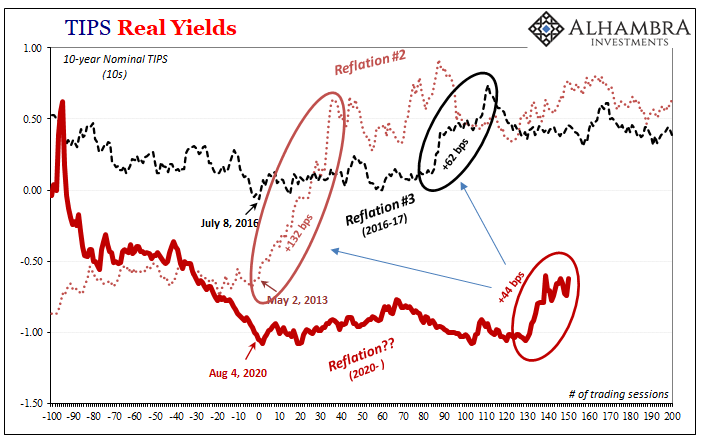

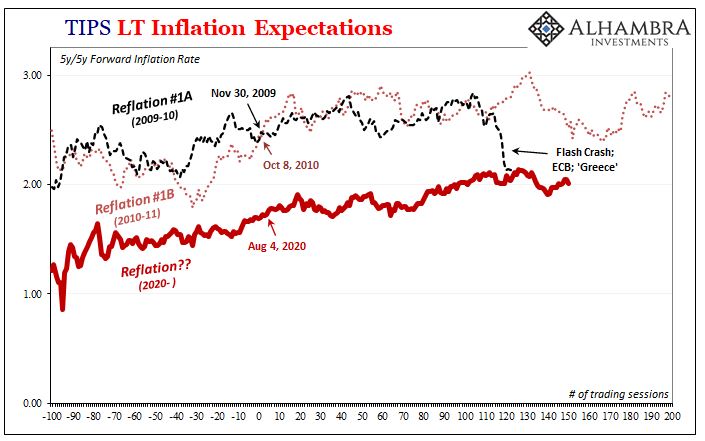

Having seen all these things time and again before, let’s not get carried away – even the BOND ROUT!!!!, and even after today’s blood-letting, is normal.

Stay In Touch