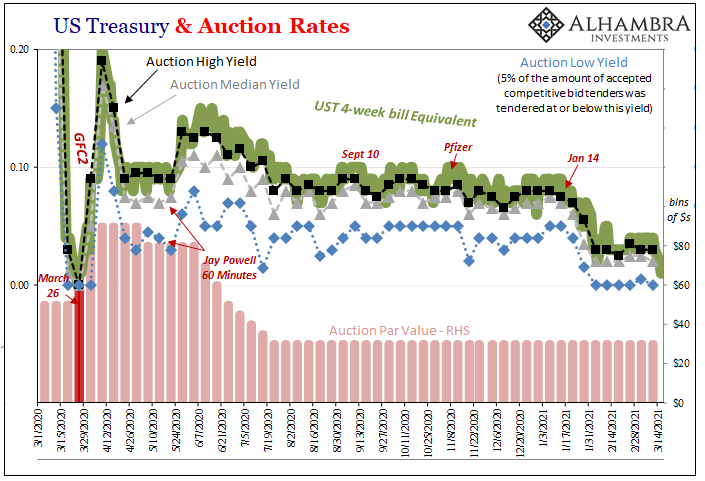

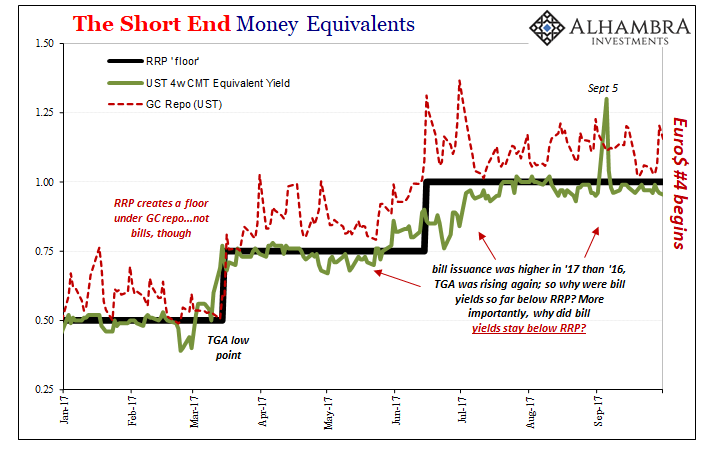

When the 4-week Treasury bill equivalent yield traversed the so-called RRP “floor” back in 2017, hardly anyone noticed. With rates nominally rising due to the Federal Reserve’s historically dovish hawkish normalization push, it was all a jumbled mess. What if the 4-week bill rate (or 3-month) was somewhat less than this RRP thing-y, they were all moving anyway.

Even as the distance grew to nearly 25 bps at one point, such huge demand upsetting what is theoretically a straightforward paradigm should’ve created more notice and wariness. After all, why lend to the federal government for four weeks (or three months) when buying a T-bill at a rate less than you can lend to the Federal Reserve collateralized by the same or similar instrument?

The latter is what the RRP really is; a collateralized loan to the Federal Reserve which is only interested in controlling interest rates, not borrowing your cash. The idea shouldn’t be so controversial, yet it is and has been.

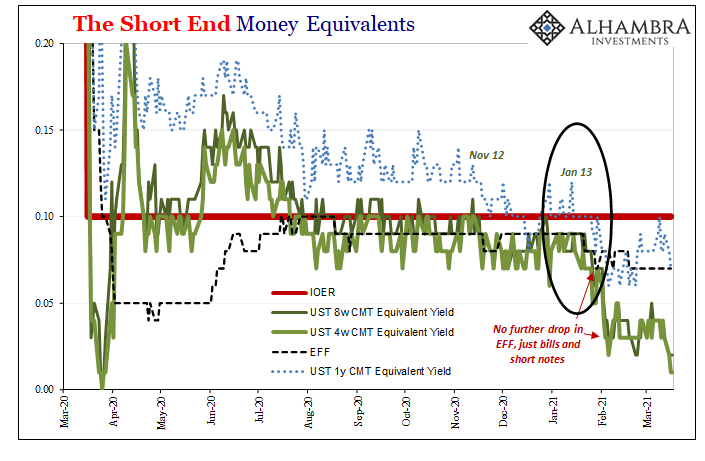

It’s about to be again, though the reasons for this are muddied by the same intellectual and technical blindness. Only, this time the bills won’t be so easily ignored; with the RRP set to zero, and likely to stay there for years to come, anything that increases relative demand for bills will push their equivalent yields into the negative.

The 4-week bill is nearly there already (just 1bp today and yesterday) with the 8-week and 3-month (2 bps each) right behind.

What’s going on in bills?

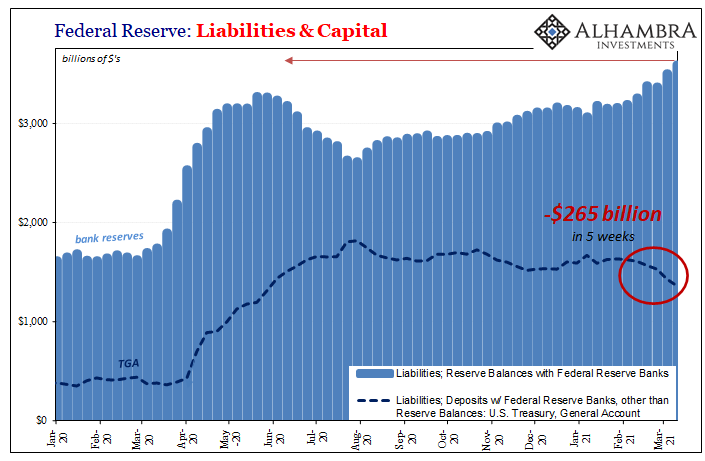

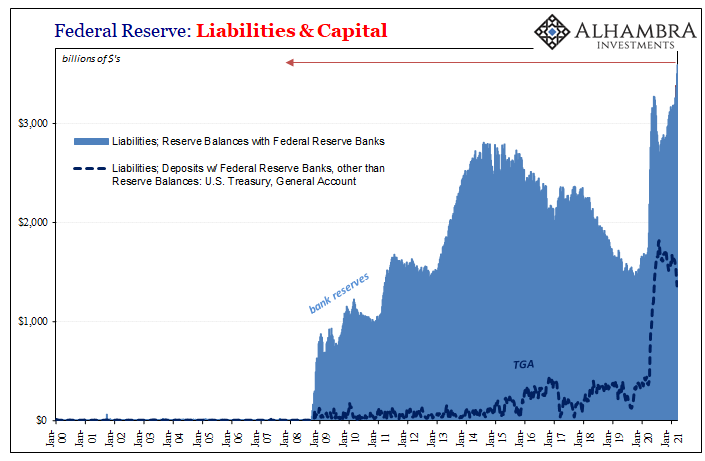

Some have said it must be the TGA – you can read why that it is here. Sure enough, Janet Yellen’s Treasury Department has finally drawn off nearly a quarter of a trillion over the past five weeks. At the same time, by mere accounting, bank reserves held by commercial banks with the Federal Reserve have increased to new record levels.

But if this responsible for low bill yields, as many suggest, why hasn’t the effective fed funds rate moved at all recently? Stuck at 7 bps since mid-February, around 9 bps in late January, this technical cash side flood of money markets would surely have reached fed funds. Instead, right now, the 12-month T-bill yields the same as overnight EFF (and it has been less recently).

After all, this isn’t much of any marketplace and hasn’t been since 2007. Thus, if there was an overwhelming deluge of additional cash being forced into the whole system affecting bills, why hasn’t a good chunk of that cash found its way into fed funds. Since it is a relatively small marketplace, even a trickle of it would make a huge difference (burying EFF alongside bills). The spread at the shortest end (4w to EFF), would be worth the minor frictions.

Unless, of course, what’s pushing bills lower and lower (higher and higher in price) isn’t the TGA at all; just like it hadn’t been back in 2017. Isolating market rates, factoring for repo, even the Fed is thinking this way even if it has no real idea why. The RRP isn’t just about to be tested, and the Fed knows this much, it appears ready to be contested in a way it already has before.

What happened at the end of 2017 wasn’t the successful monetary achievement of inflationary liftoff. Instead, suggested long before by bills vs. RRP, shortages. Thus, Euro$ #4 showed up at the outset of 2018, “unexpectedly”, of course.

Stay In Touch