There is a bit of a benefit from all this SLR “cliff” business, though tangential in nature. It is another test of the “too many” Treasury hypothesis, the idea that a lot of the problems in funding markets like repo had been caused by the government’s fiscal profligacy (especially following December 2017’s TCJA “tax reform”). With foreigners selling UST’s, and the government issuing many more of them, banks were, many said, becoming stuck with unwanted government bonds.

The greater implication was supposed to have been when all this came to a head – and the Treasury market crashed, interest rates not just going up but exploding in a bond rout supernova (I’m not really exaggerating; go back and read any number of hyperventilated predictions on the topic; and that was just Bill Gross).

It was, of course, complete nonsense given what dealers are and always will be: money and bond dealers. I wrote about this feature many times during the past few years, but this particular one sums up the flaw in “too many” Treasuries awfully well:

I guess we aren’t supposed to notice that the rest of the world has been buying UST’s at a furious pace. How else did the yield curve invert in the first place? Sure, the money market fund and other nonbanks like it may have preferred commercial paper or even unsecured LIBOR to a very low UST yield, but someone is buying to push every UST yield lower to begin with.

Not just someone, but a whole ton of someones. To believe in this convoluted theory, you are asked to believe that primary dealers whose entire job is to find buyers for Treasuries are disrupting repo markets and other funding mechanisms because they can’t find enough buyers for Treasuries during a time when there is otherwise so much demand for Treasuries it has upended the natural order of curves everywhere.

Quite simply, if dealers don’t want the Treasuries there is absolutely nothing stopping them from selling the overburdening assets to the financial public. This was what market pricing – both primary and secondary – had indicated all along. Never once had there been “too many” Treasuries, and more than that dealers didn’t actually want to sell, instead preferring to hold them (for various reasons beginning with the susceptibility of repo collateral chains).

Now the SLR cliff has put this to another market test; over the past few weeks, in anticipation of last year’s SLR exemption expiring, dealers have, indeed, been furiously selling down their held UST inventory. About $80 billion, a princely sum for the short run, has been shed into the secondary market.

You can read about why dealers have been selling related to the SLR here. And you can read about why I believe Jay Powell is pushing banks over this regulatory cliff here.

While this has nothing whatsoever to do with the debunked “too many” Treasuries theory (which has made a comeback given reflationary yields), what we’re finding anyway is that, yes, when dealers choose to sell there is no undersupply of demand (pun intended). The Treasury market did not, in fact, explode into utter chaos over the past two weeks without dealer support; if anything, as that selling has taken place the Treasury market hasn’t even been all that reflationary (see: today).

That, not the SLR cliff, is why long end yields have been rising since January. There remains even now a gross appetite in the secondary market (to say nothing of the short end).

The more interesting question is why.

For one, look at what’s going on in oil. Another, dollar – especially CNY.

This begins with China’s situation. Perception is that the Chinese economy is either booming right now or will be shortly given how closely its modern government is believed to follow the mainstream Keynesian playbook. The rest of the world is left to count on this oversized contribution to propel the global rebound.

But what if that economy isn’t booming and the Communists years ago already confessed they don’t use that textbook any longer?

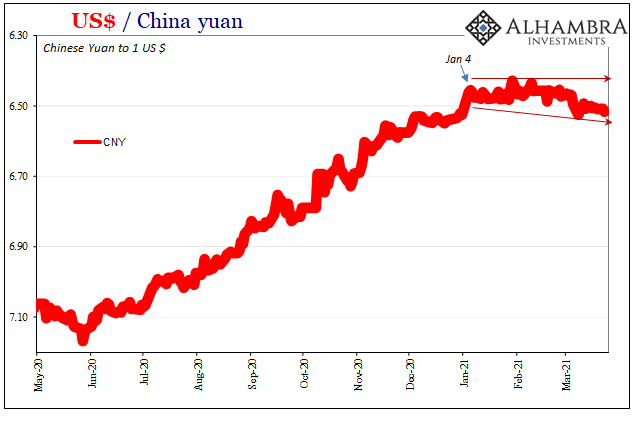

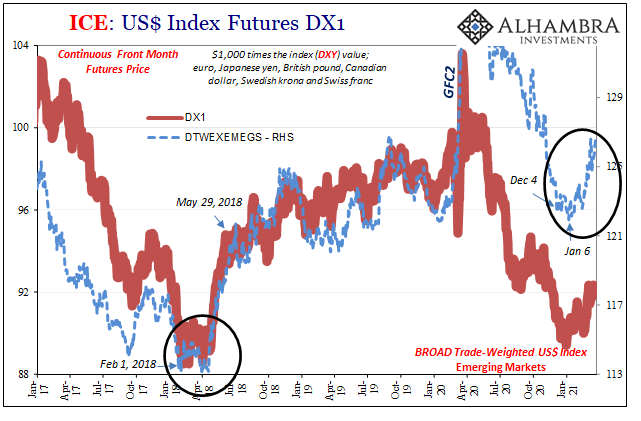

Suddenly, maybe around early January, China and really the entire global situation appears at the very least murkier, more palpably uncertain. In terms of CNY, where once a curiously hollow but relentless rebound in its currency it all abruptly goes silent.

But not just silent and not just a few days or weeks; sideways for several months.

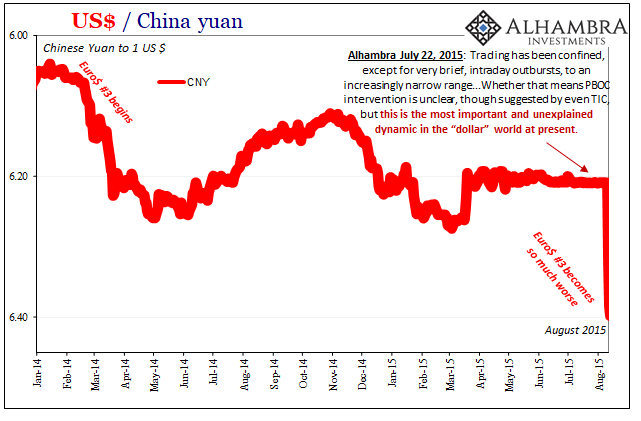

Going back to early January, it’s been limited (surely inorganically) to a suspiciously narrow range which immediately brings to mind the last time this had happened under very similar circumstances: 2015. I wrote on July 24, 2015, just a few weeks before CNY would show itself to be the head-fake I claimed at that time:

This is what the “dollar” has been predicting for more than a year, as funding retrenchment (the global “dollar” short becoming more and more “expensive” and uncertain) is fundamentally linked to leading economic factors. Crude oil, commodity prices and currency disorder more generally are all manifest interactions between economy and finance under these conditions. All the world’s central banks, including the PBOC, spent a few years and trillions in “currency” and all they could produce was some uneven, artificial and short-lived momentum.

At the same time CNY was sideways, in the later months of that period, other currencies were already succumbing to the global dollar short becoming more and more expensive; China’s currency wasn’t yet falling, but those from around the rest of the world particularly EM’s were.

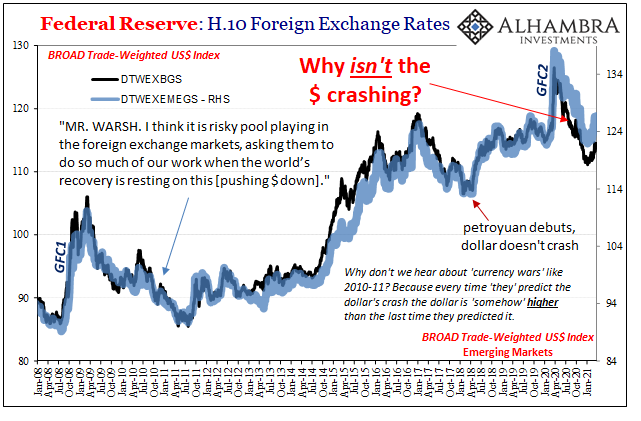

In 2020-21, the dollar may have been lower against most other currencies, coming down from extreme highs during GFC2, but why wasn’t it so much lower given Jay’s idea of a digital flood of them? Its stubborn exchange value, like 2015, already proposes not everything may be what it’s said.

The global economy was supposed to have been on the cusp of roaring, then and now, with inflation breaking out far and wide. Instead, back then, the dollar had already disrupted those expectations punctuated by CNY in August 2015 showing how that sideways period hadn’t been calm at all but increasing tensions (purposefully) hidden from view:

But, like a coiled spring…the PBOC, caught between trying to project calm as “dollar” liquidity turned only worse and thus entangling yuan liquidity has now been pushed into drastic measures where neither end of the conduit are responding with much favor; despite the break in the yuan [August 2015], not really “devaluation”, the internal dynamic continues to grow worse suggesting that last week’s break wasn’t nearly enough of a game changer.

If the past is prologue, dealers sell UST’s into a mildly reflationary secondary market in no way upset by this because global dollar-wise there’s too much resembling other similar periods of not nice dollar behavior. Risks are supposed to be dissipating as more cash floods particularly the US end of the global system (even the Chinese are complaining about potential spillovers).

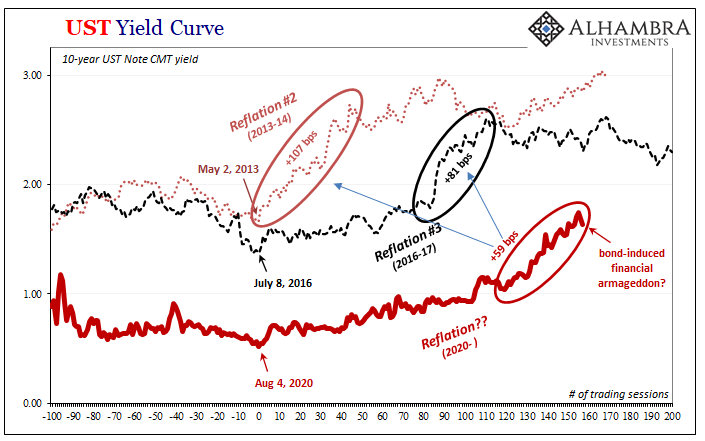

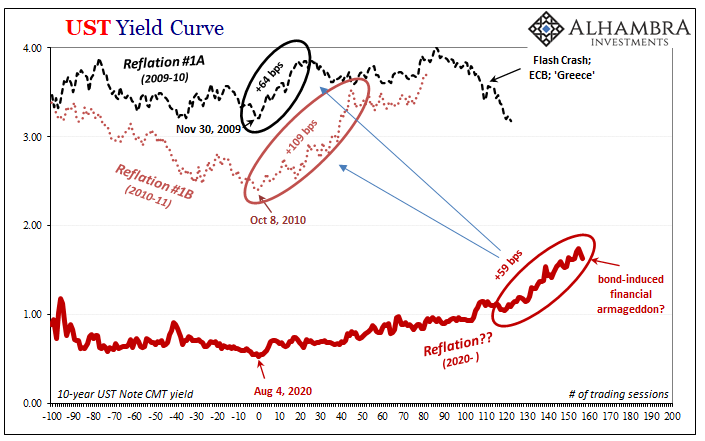

That’s not what’s showing up here, including China’s currency regime. Demand for UST’s is perhaps still equally if not more determined, to the point reflation thus far keeps coming up so much shorter compared to past episodes.

Stay In Touch