It is said that there are two types of people in this world. Those who see the glass as half full and those who see it as half empty. On Wall Street, we call them bulls and bears. A bull can see an economic report and perceive it in a way that seems wholly illogical, misguided, and downright stupid to a bear. And vice versa for the bears who see every report as a harbinger of doom. What’s really strange about this is that, at times, they are both right, bull and bear. They just see things from a different perspective. They perceive the world through different lenses, and in doing so, create their own realities. The problem, of course, is that the lens we each use, is distorted by our experiences, our knowledge, our preconceived notions, emotions, and, of course, self-interest. None of us is free from cognitive bias; the best we can do is recognize it for what it is and try to overcome it. We won’t always be successful but we don’t have to be. Successful investors acknowledge their errors, learn from them, and cut their losses short.

We are at an interesting point in this economic recovery and bull market. Stocks are either discounting a very large increase in next year’s earnings (bull) or completely nuts (bear), both of which are at least partially true. Bonds are either forecasting economic recovery or offering a stern warning about future inflation. Commodities are experiencing a rapid recovery in demand (or anticipating one) or constrained by supply issues due to shutdowns and other COVID restrictions. The dollar is either rising because the US is performing better than the rest of the world or on the verge of collapse because we’re in debt up to our eyeballs. A year ago, few saw this bull market coming, sentiment about as negative as I’ve ever seen it (and I’ve been doing this a long time). Today, it is hard to find anyone who isn’t making money in stocks (at least according to them) and Instagram is full of people with no clue offering advice to people with no job and gathering later on Reddit to brag about how little they actually know and how much they’ve made despite it. I have never in my life seen such widespread schadenfreude – in all aspects of life – and I can’t help but wonder about the effect on our souls. Karma is a bitch too.

I can’t tell you who will prevail in the current market debate between the bulls and bears. I’d also suggest, politely, that neither can anyone else. You can spend 24 hours a day reading economic reports and poring over charts and you will not know any more about the future than that guy on Reddit. If you have learned nothing else over the last year, it should be this – anything can happen. Last week produced another in a long line of “damn, look at that” moments in this bull market. Around 11 AM Friday, I was scrolling through a list of stocks I watch when I noticed one, Discovery Networks, was down about 25%. I owned DISCA last year before the Reddit crowd offered me a price I couldn’t refuse and I’ve been keeping an eye on it because I still like the content business. I couldn’t find any news on the company, no obvious reason it should be down 25%. I just chalked it up to more Reddit craziness and went about the rest of my day. Over the weekend, it was reported that Discovery and a number of other stocks were part of a margin call on a large family office. My first thought was that can’t be right. Family offices don’t use leverage. My second thought was, never mind, this is a crazy market where anything can be true. And it was apparently. Some ex-hedge fund guy with previous regulatory issues (in the US and China allegedly) blew himself up. Had a net worth of $10 billion and leveraged it up to $50 billion. Apparently, there is no dollar shortage if you need them to speculate on stocks. I don’t care how much you know about macroeconomics or trading or how well you read a chart, you can’t predict a multi-billion dollar margin call.

In addition to whatever craziness this market offers up next, we are facing some serious questions about the economy and markets right now. I spend most of my time asking questions, usually to myself, sometimes to others. Here’s a few I’m pondering now.

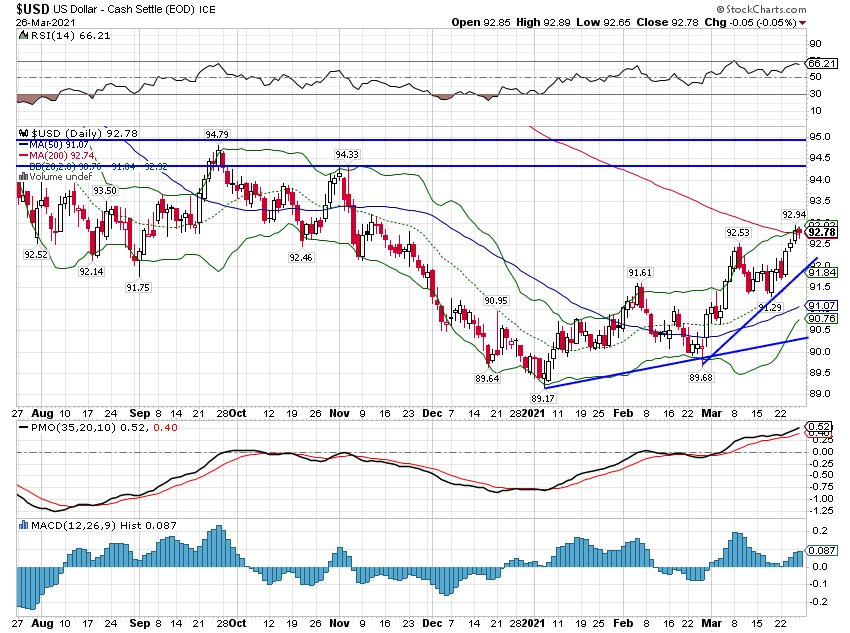

Is the dollar back in an uptrend? The DXY is up about 4% since the beginning of the year. Weak dollar assets (commodities, foreign stocks especially EM) have performed very well over the last year, but if the dollar continues to rally that is going to end. The short-term chart of the dollar index looks pretty bullish:

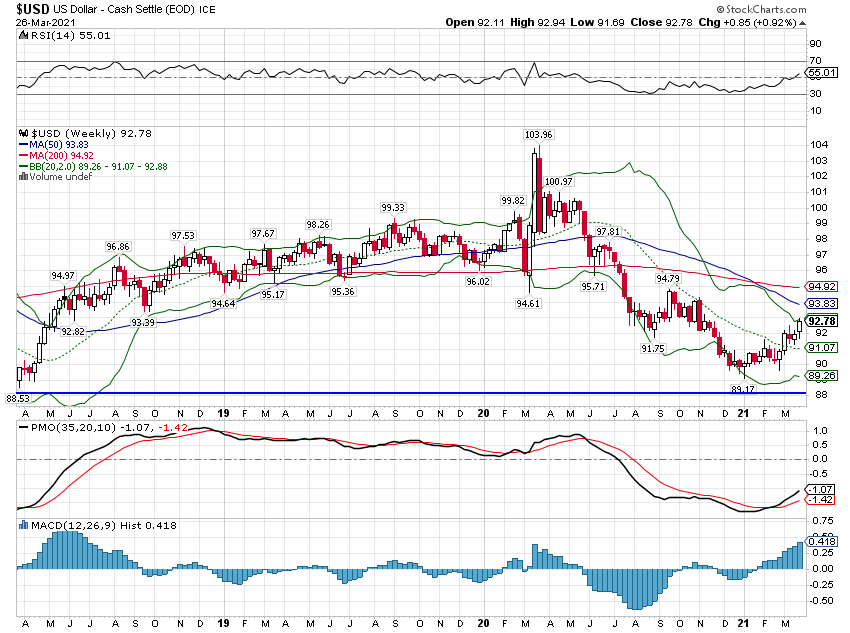

A longer-term view – a different perspective one might say – shows the recent move only puts the dollar back where it was in November.

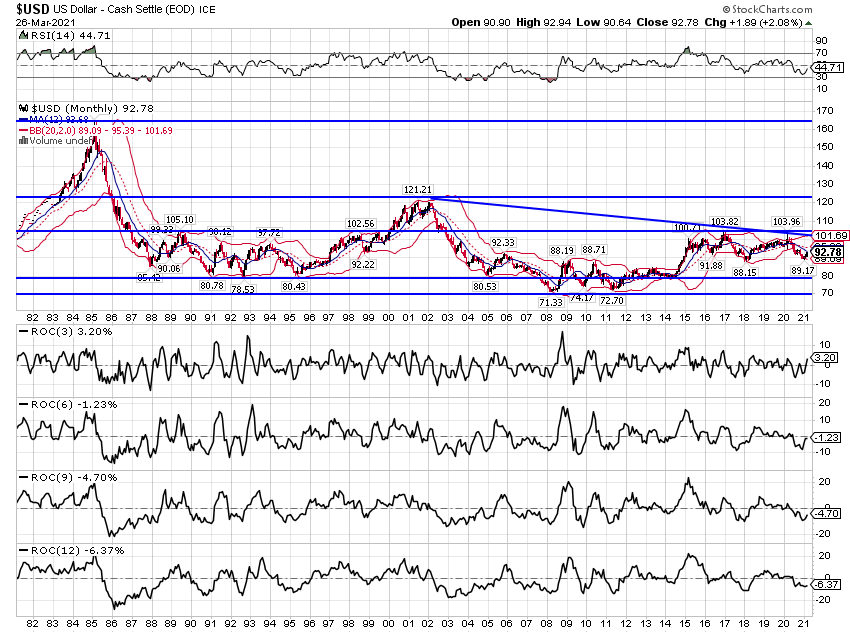

An even longer-term view shows the dollar in the middle of a range that has persisted – with a couple of outliers – since the late 1980s.

Of course, how the dollar moves within that range matters too so we want to keep an eye on the changes. For now, the dollar’s 3-month rate of change is slightly negative while 6, 9, and 12-month rates of change remain negative. That is barely an uptrend in my book and not anything I can get too worked up about.

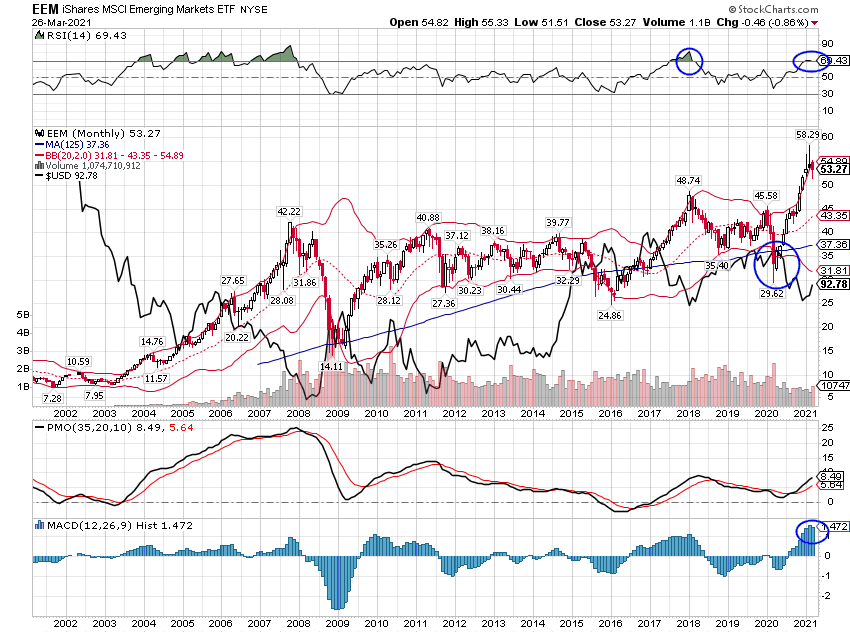

If the recent dollar rise isn’t enough to worry about, the recent weakness in EM stocks probably isn’t either. I’ll be watching the dollar closely though because emerging markets are very dollar sensitive. EM stocks have had big run off the lows and some pullback makes sense. Even bull markets ebb and flow. Right now EM is ebbing.

If the dollar resumes its downtrend, there is probably a lot more upside for EM stocks. The index essentially made no progress from 2007 to 2020 until the break out last year, and one of the consequences of that is that these markets are generally pretty cheap compared to the developed markets. But they need that weak dollar tailwind so until that resumes EM will probably struggle a bit.

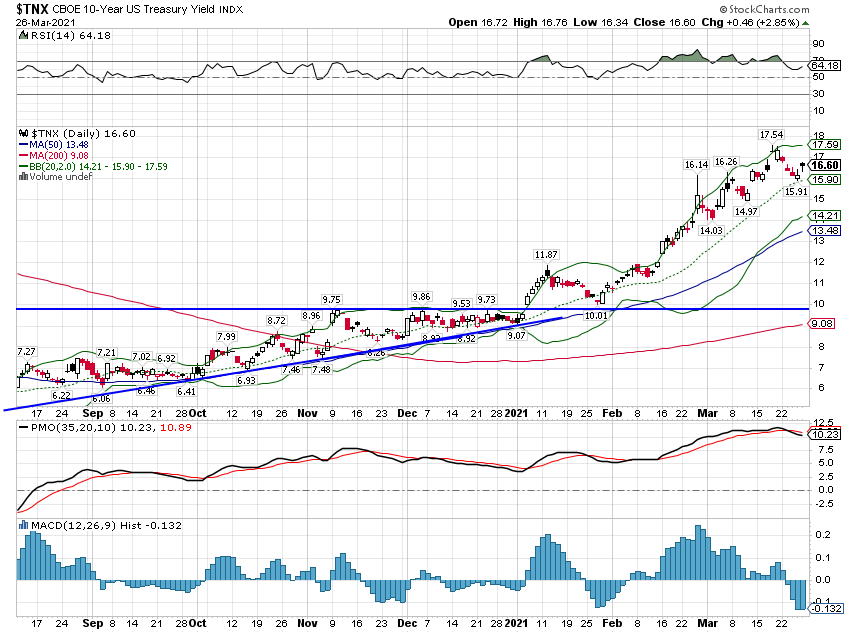

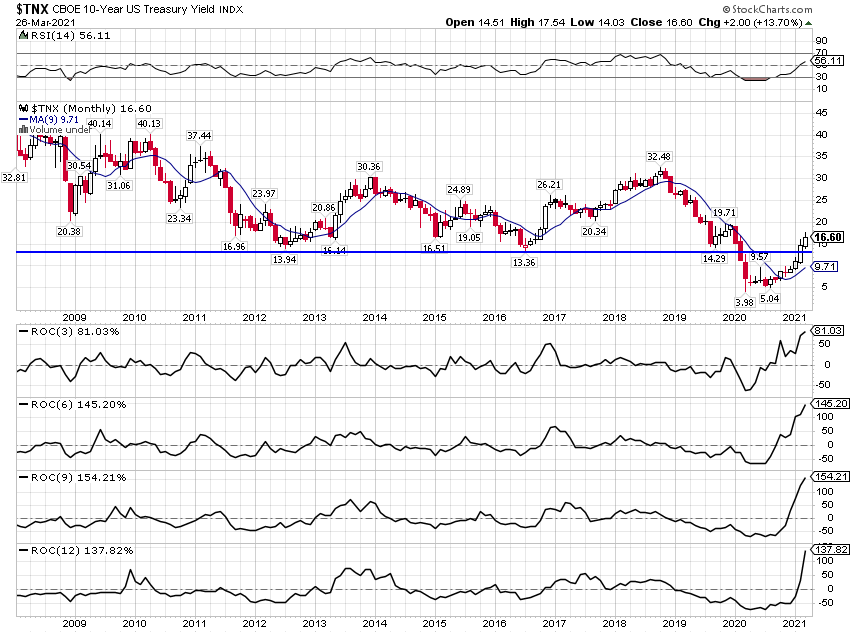

What about bonds? Bonds are one those assets where the bulls and bears both have a point. The bond market tells two stories depending on your perspective. If you are looking at the present, it is pretty obvious that yields are rising, partly because of rising growth expectations and partly because of rising inflation expectations. In other words, things are improving; the economic bulls have the advantage.

But if you pull back a bit, take a longer-term view of things, yields are just back to the bottom of the range that prevailed for the last 8 years. A period during which the economy can best be described as meh. Not great, not terrible but more than anything a matter of how you experienced it from your perspective. Some people did really well, but a lot didn’t which is easily confirmed by the current state of the body politic. The economic bears win the longer-term view.

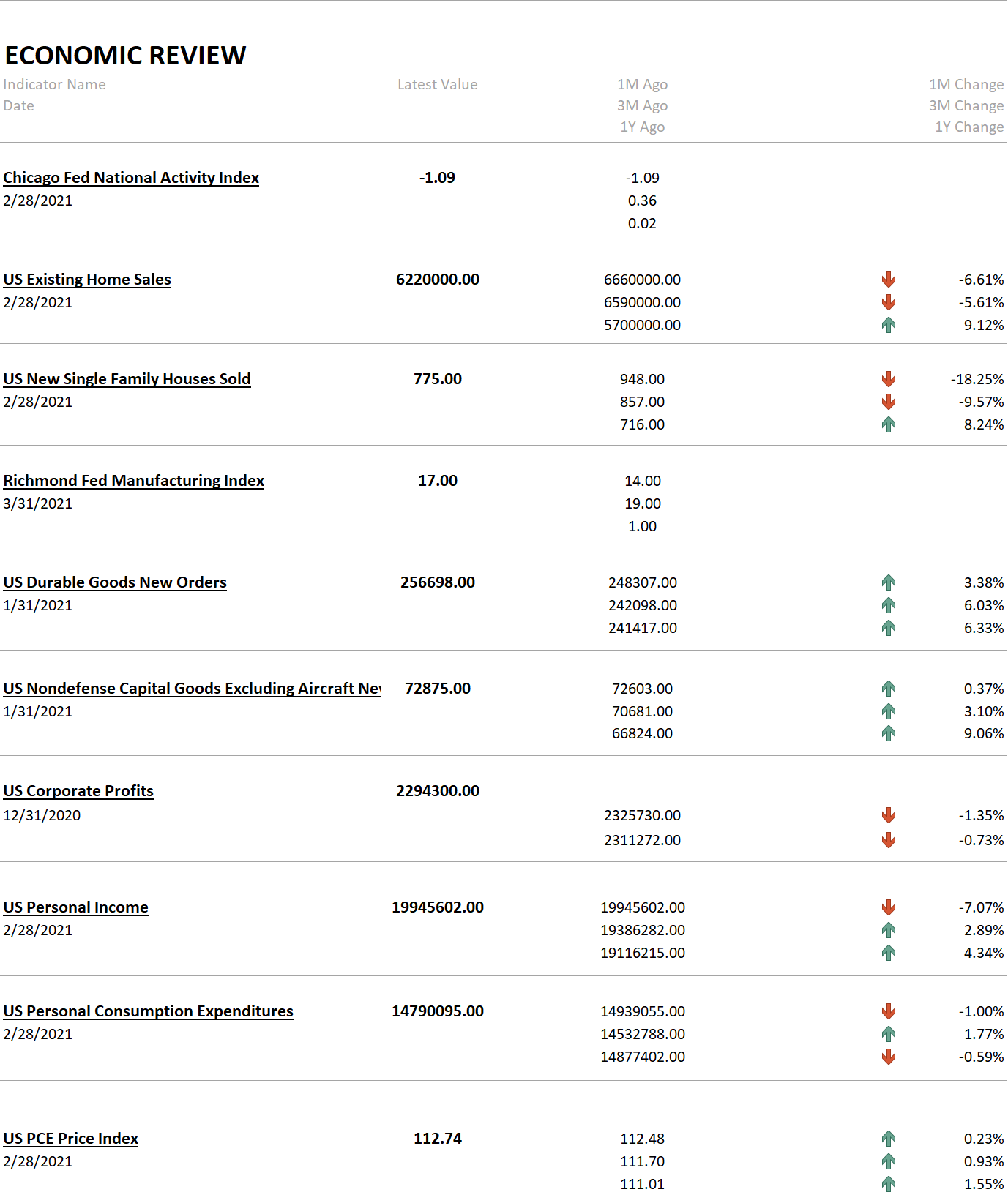

Markets continue to trade on the expectation of a post-virus boom but the economic data hasn’t been on the same page recently. The February read on the Chicago Fed National Activity index came in at -1.09, a truly awful number that hasn’t in the past been seen outside of recession. On the other hand, the 3-month average is -0.02, a reading that is consistent with trend growth (0.0 is trend). Existing and new home sales were down from last month but up considerably from last year. Personal income was down over 7% from last month after the stimulus boost but is up over 4% year-over-year. And this month’s read will likely show another large jump based on the (bigger) stimulus checks just sent out. Plenty for bulls and bears there.

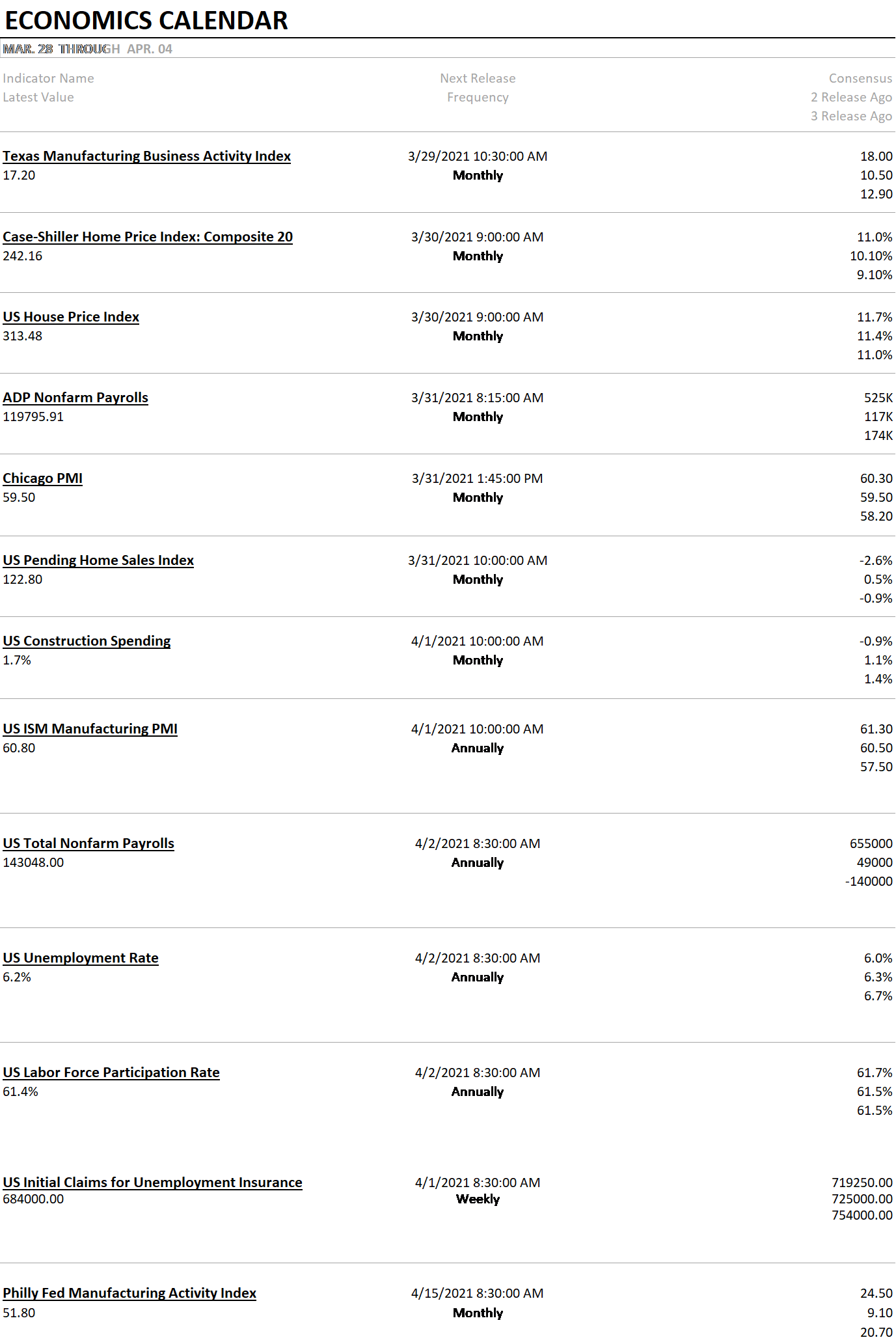

We get employment numbers this week and the jobs added are expected to be up big, confirmation that the virus is fading and everyone is going back to work. Well, Airbnb is booked solid now and summer is filling up apparently. Airlines are hiring again. Rental car companies don’t have enough cars in resort cities. The real estate market, despite the fall-off recently, is hot, hot, hot just about everywhere. States are opening up the vaccine lines to anyone who wants one and new cases are still falling in most places (NY a prominent exception). It seems the boom scenario is coming true right before our eyes. Maybe….but might a ramp-up in travel and leisure be offset somewhat by fewer goods purchases? People could buy a couch while laying on the beach but will they? At least they wouldn’t have to worry about delivery anytime soon. The couch my wife ordered in January won’t be ready until June or July. Shortages are real and growing so keep an eye on those inflation numbers. I actually agree with Powell that the inflation will be “transitory” (supply will catch up) but it might be an uncomfortable few months for the Fed chair.

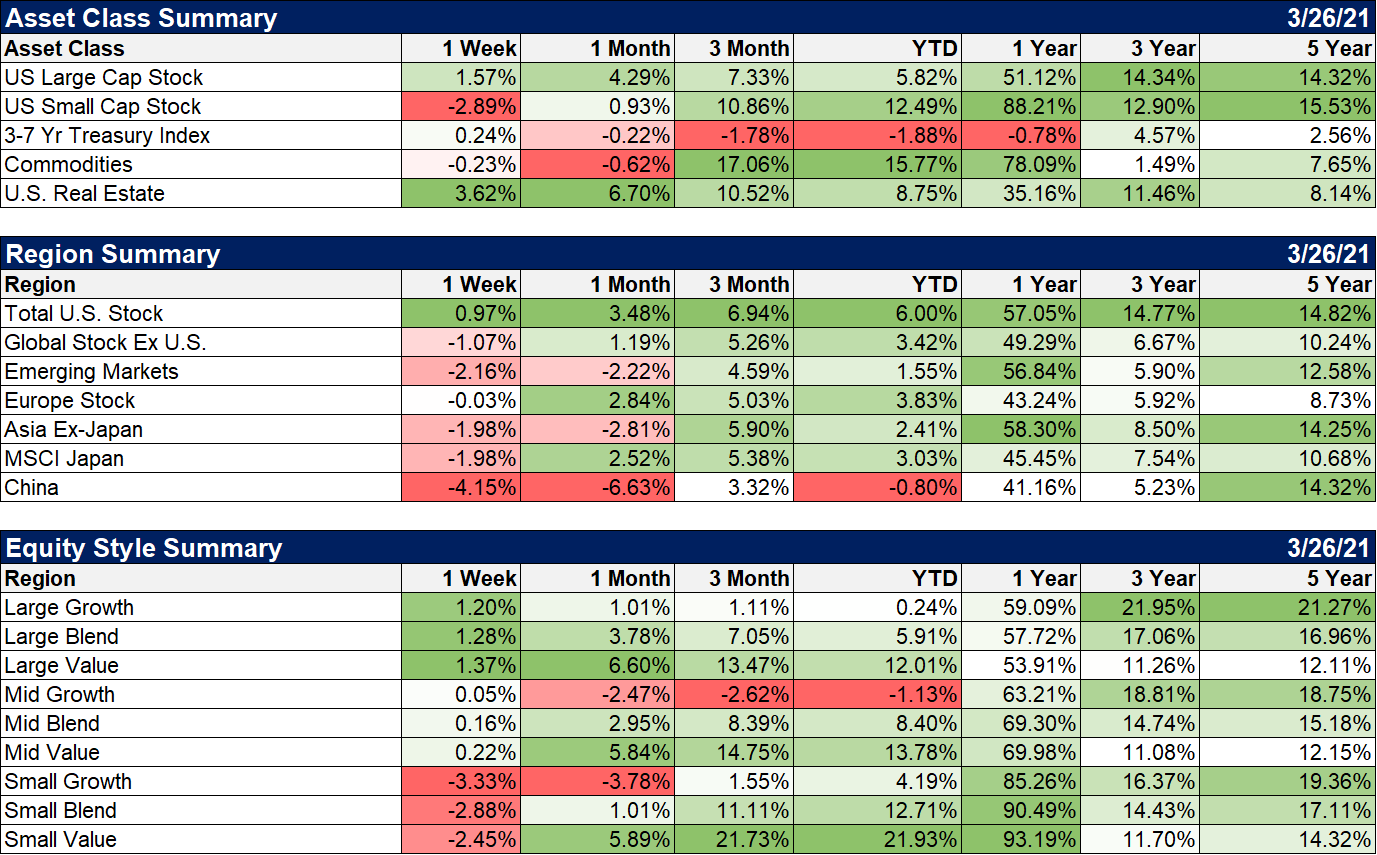

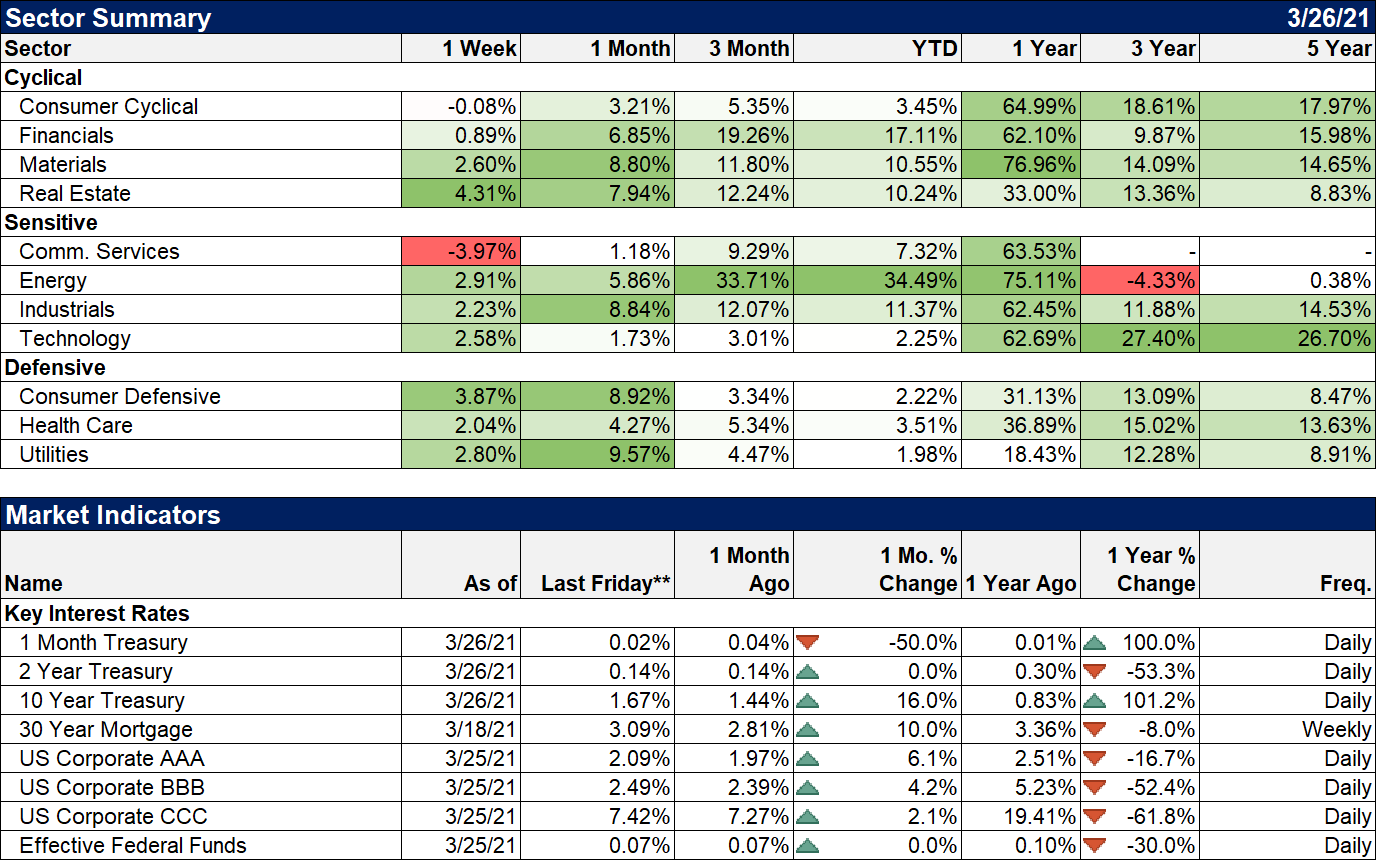

Stocks were more mixed last week with large-caps up and small-caps down. But the boom narrative still dominated the action with real estate the big winner of the week. It seems that re-opening fever is finally hitting the real estate sector. People are now reckoned to be sick of working from home, a sentiment I find easy to believe. Foreign markets were down with China leading the way, down over 4% on the week. Some of the China selling was likely related to the hedge fund blowup though so that might see some reversal in coming days – assuming the margin call has been met. EM stocks were down too but not bad considering nearly 40% of the fund is in China. Value continued to outperform across all market caps.

Real Estate was the big winner last week but energy is still way out ahead for the year.

Perception is actually not reality no matter what psychology says. There is an objective reality for most of the issues we face as investors. The economy will improve or not. The dollar will go up or down. Earnings will justify today’s stock prices or they won’t. All we have right now is a lot of questions. As investors, we are always acting without complete knowledge. We don’t know how the future will turn out. We don’t know what idiot rich guy is loaded up on our stock on margin and is about to get a call from the most powerful person on Wall Street, the margin clerk. But perception is what drives markets. Through interest rates and exchange rates and commodity prices and numerous other markets, we discover what the majority believes about the world. And that can be very useful information.

Stay In Touch