Enormous. Terrific. Unbelievable. Biggest ever. The superlatives for US consumer spending during the month of March 2021 are appropriate, and for once they aren’t caused by some artifact of arithmetic or some other trick. While there are absolutely some base effects within the numbers, these levels of retail sales are far and away more than those.

It’s so ridiculous that there’s really little purpose in producing charts since all the estimates one after another just print way, way off them.

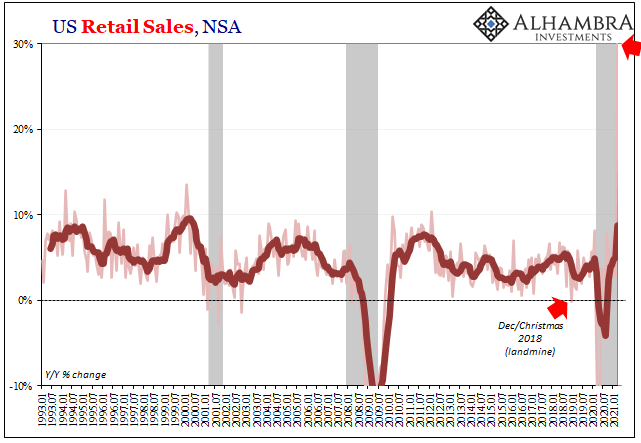

Headline, total retail sales smashed upward by 30% year-over-year (not adjusted), only some of which, again, are due to the low comparison by way of March 2020 in decline. The latest figure is an historic 21.8% better than retail spending in March 2019.

And so it continues: ex autos, up 21.0% year-over-year; retail trade +29.9%; retail auto sales (which did have a much higher base effect) +79.8%; etc. About the only category which didn’t register an unusually huge increase was, interestingly, of the online variety. But Amazon and its tiny competition weren’t exactly hurting since non-store retail sales managed another 30% annual increase, it’s just that since COVID those have become common.

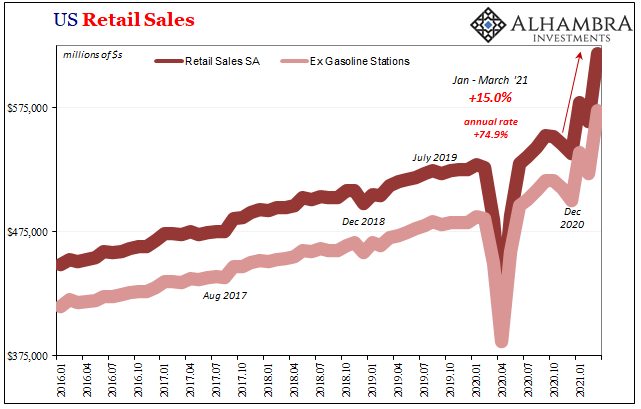

Seasonally adjusted, retail sales were almost 10% higher in March than they had been in (upward revised) February. Not too long ago, to end 2020, consumer spending was barely able to manage a 2% or 3% annual increase. In the latest month, just shy of double-digits in a single one. Not only that, showing just how much of a gain other than base effects, going back to that low set in December 2020 retail sales are up a massive 15% (which works out to an annual rate of 75%).

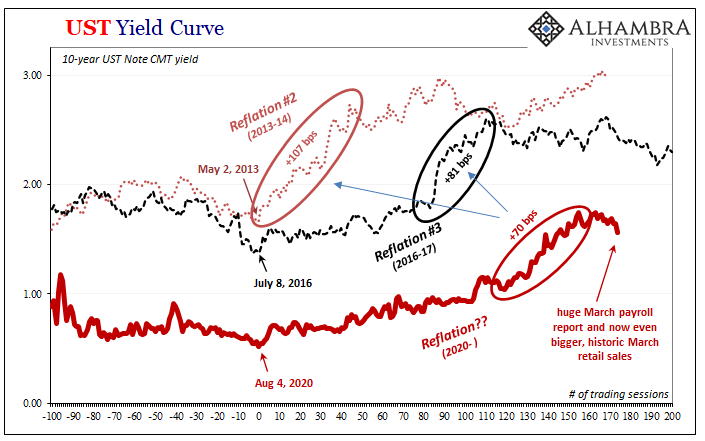

With Americans seemingly buying everything there is available to be bought, why aren’t markets buying the surge in spending? And in this case, I don’t just mean the bond market, I more so refer to the real economy marketplace which is what bond market prices are discounting to reflect.

Producers.

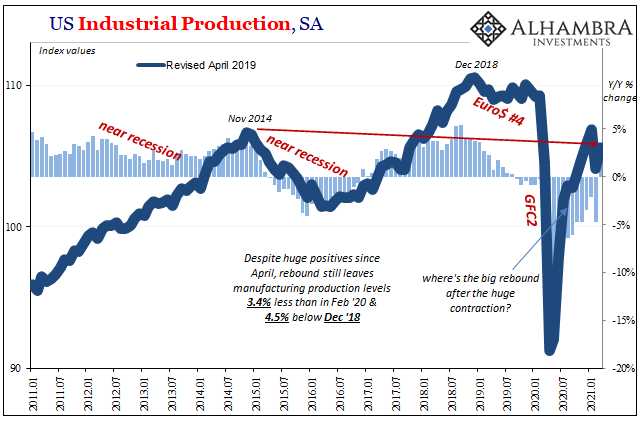

The same day the Census Bureau reports these unqualified smashing retail sales figures, the Federal Reserve comes out with Industrial Production at the other end of the spectrum. Disappointing is to put it mildly; after a February filled with Texas cold weather and therefore electricity-starved manufacturing, March was supposed to have been – along with producers greedily eyeing the consumer bonanza – more than a dead-cat bounce.

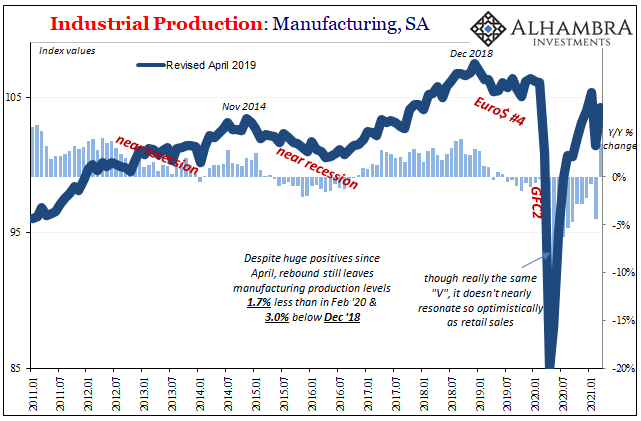

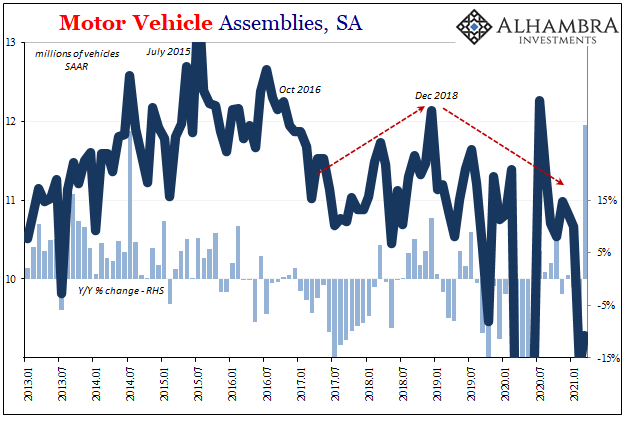

Yet, it wasn’t: overall IP regained just 1.4% last month from a downward revised month before. That meant, with base effects in this data, too, total production was up just 1% when compared to a declining March 2020. Manufacturing by itself fared slightly better, up 3.4% year-over-year, but that is still about 2% less than last February and, more importantly, 3% below peak output levels set during December 2018.

In other words, there is very clearly no rush (demonstrated reluctance way beyond the short run) to bring production back up to last year’s levels let alone surpass them or the peak from more than two years ago, so it really is fair to write that production in March was near enough the opposite of retail spending.

The question is, as usual, why.

While February’s dive on the production side was attributed largely to winter, the underwhelming rebound as the US Southern states warmed right back up more than puts that defense to rest. In its place, however, chip shortages, worker shortages, all kinds of other excuses which are being thrown around in order to attempt to bridge the now-incredible divide between production and consumption in favor of the latter.

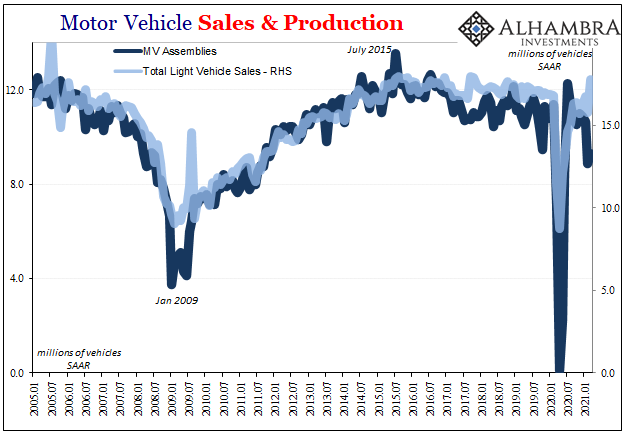

Maybe the best example – in both cases – is automobiles. For one month, anyway, the BEA’s estimates of auto sales were in the same ballpark as Census retail sales. The Fed thinks that domestic production only amounted to 9.3 million units (SAAR), one of the lowest in many years and barely better than downward revised, cold weather-distorted February.

Chip shortages, sure. But that can’t be the only thing holding back production in automobiles otherwise we’d find it different than the rest of the IP series. It isn’t.

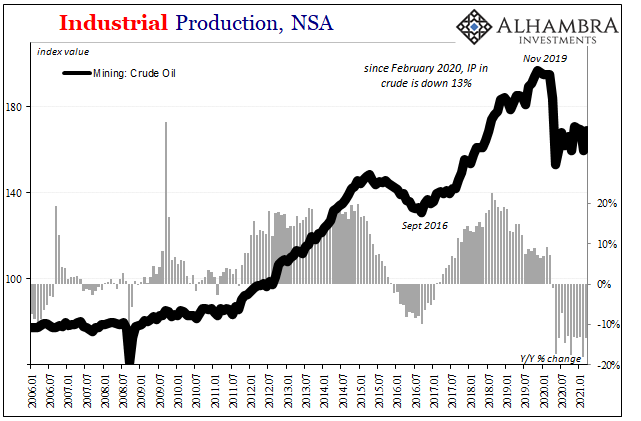

Crude oil mining, for instance. Even though oil prices have surged since January, and like much of domestic industry the energy sector was negatively affected by February’s blustery burst, crude output only came back as far as about the same as January – which was about the same as every other month since last year’s reopening. Conspicuous for what is lacking.

Oil prices are way up while Americans are splurging on all things, including automobiles, presumably driving around for the first time while they can (retail sales at gasoline stations were up 30%, too), so why aren’t oil producers ramping up production in anticipation of having to meet so much future demand?

The answer is the obvious one; the same reason why retail sales were so absurdly huge to begin with. For all the superlatives that fit with the March 2021 figures, the one that perhaps does not is the one which the economy really needed most – sustainable.

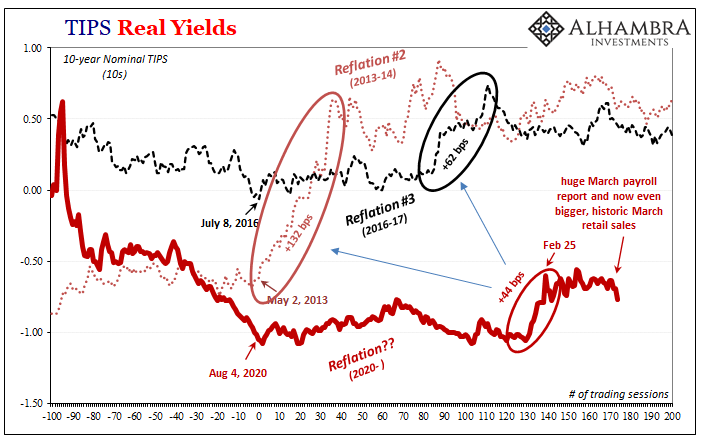

Everyone knows, and not just in US Treasuries (including TIPS real yields) or German bunds, that this short run economic outburst was financed by Uncle Sam and only Uncle Sam. Even as jobless claims dropped to their lowest since last year in today’s weekly DoL update, there’s still no real indication that the US nor global economy is actually on a path to legitimate recovery.

Sustained spending derived from earned income.

Serious questions remain. Gross uncertainty abounds. Given these things, you can understand why the real as well as financial marketplaces (outside of stocks, of course) would take a more conservative approach. In fact, the more ridiculous the skyrocket flight of retail sales in March the more likely consumers will more quickly exhaust themselves.

Economic recovery, any decent economy in any instance, is a marathon rather than a sprint. The closer you get to the real world, the more reluctant participants have been to embrace the Treasury-fueled euphoria. Producers aren’t buying it, and global bonds are right now, since February 25 being bid on the producers’ view (while stocks are furthest removed like always).

Either way, March 2021 retail sales will stick out in a good way for as long as Census reports on it. One last fitting description for the figures: historic.

Stay In Touch