Ben Bernanke saw it even before he took over from Alan Greenspan. Like his “maestro”, however, Bernanke didn’t really know what to make of it. So, while early in 2005 Greenspan told of his version as an interest rate “conundrum”, his successor a month later tried to add more dimensions and details to the same puzzle via recognizing its clear, and clearly related, monetary flows.

Both officials became aware – because it became overwhelming – that funds were flooding into the US especially mid-nineties onward. What they couldn’t figure out was where all this was coming from.

In their authoritative view, this could not have been an offshore dollar system operating way outside the control of the Federal Reserve and every domestic authority (including Treasury) because as the key domestic authority for monetary matters that would have been tantamount to admitting the Fed does not do what it tells everyone it does, and it isn’t a central bank like it has led the world to believe.

To conjure some explanation in lieu, Bernanke came up with his global savings glut. A flood of money from outside the US, only in his version it had to have been foreign savings converted (somehow) into dollars. For reasons he would never sufficiently explain, these savers apparently preferred to park all this spare cash in the safest and most liquid US$ assets. US Treasuries and such.

As noted a little while ago, Bernanke’s idea hasn’t aged very well. In fact, its plausibility didn’t really last more than a few years. By August 9, 2007, bye bye foreign money.

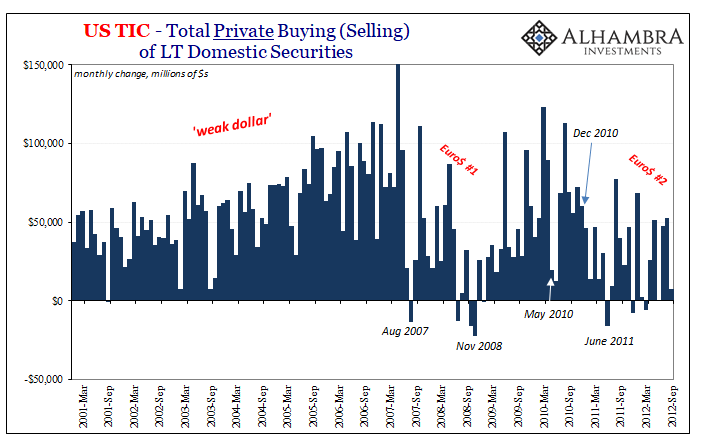

In terms of TIC figures, it so obviously sticks out; huge growing net positives before suddenly a shocking negative right on August 2007.

Foreigners – including private sources (above) and not just official accounts – had been steadily buying and bidding up Treasuries, domestic corporate bonds and agencies, along with US equities. It all came to a screeching halt that particular month when the entire global dollar system froze. Without the availability of dollars, there were none leftover to flow back in as they had before.

Suddenly, even private overseas counterparties were desperately and outright selling their domestically-held US$ assets to cover what had been a building up of a synthetic short US$ position (globally). Mostly US Treasuries because those were readily saleable and liquid (unlike some of the other stuff like MBS treated as corporate bonds also including other kinds of packaged securitizations).

The savings glut hadn’t disappeared; it had never been that. Instead, offshore money (eurodollars) that had been expanding in the shadows and spilling over back into the US vanished into the illiquidity (global dollar shortage) of this first global financial crisis (GFC1, or Euro$ #1). Bernanke like Greenspan had witnessed these effects didn’t know what to make of them.

No surprise, then, their Fed wouldn’t perform any better as all those things reversed.

Recovery followed in early 2009 anyway though not for reasons of QE (SFAS 157, but that’s another story). In terms of offshore money and TIC, private foreigners getting some trickle of global dollar supply reestablished, it began to spillover back into the US markets all over again.

But it was never quite the same; while monthly totals were on the rise late in 2009 and early in 2010, there was the obvious trip in May 2010 (stocks flash crash, “Greek bonds”, repo, etc.) which had already indicated a “new normal” first in eurodollars therefore Mohammed el Erian’s global economic condition.

Then in June 2011, private foreign selling materialized for the first time since the crisis, representing in data the big escalation toward renewed problems. July 2011, you may remember, things really started to go wrong, a Euro$ #2, which also led to severe financial and economic repercussions (Bernanke’s confused Fed by early August 2011 debating a “bail out” the repo market for reasons they couldn’t figure).

Long story short, whenever we see significantly less net buying by especially private foreign parties in the TIC data it has indicated a serious warning of less than fully operable offshore money conditions. The disorderly disappearance of the eurodollar glut, in other words.

And when that lack of buying becomes outright net selling, as in June 2011 or August 2007, more serious global outcomes typically follow; and not the good or reflationary kind.

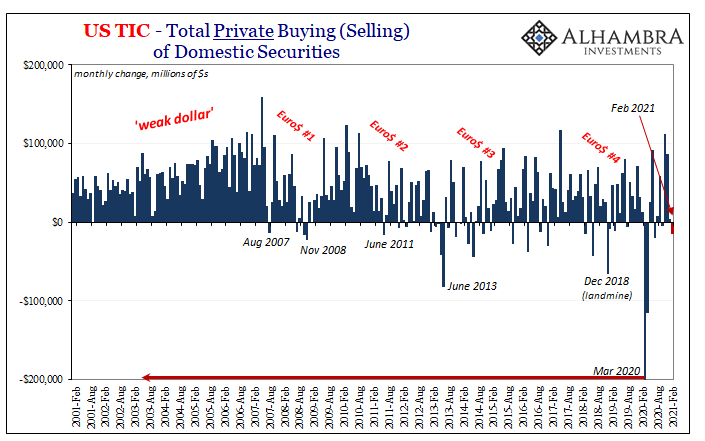

Indeed, June 2013 (below) amidst the wrongfully assigned “taper tantrum” turned out to be, as I warned at the time using these very numbers, a pretty good starting point for what would become Euro$ #3 instead of Recovery #1 as planned and promised.

With reflation supposedly on full blast December 2020 on into January and February 2021, how does TIC end up with a net negative for private assets two months ago (the latest data)? By all accounts, reflationary accounts, there’s no way that should be there.

It wasn’t an enormous net minus, but it needn’t be. Anything less than a substantial positive and you should be asking what’s really going on.

The details behind the net selling were, most of all, a big drop in foreign holdings of US Treasuries. In February, this was a continuation of large private selling begun in January. It at least seems consistent with reflationary distaste for just these assets.

Had it been that, however, we would expect reinvestment elsewhere in the domestic asset sphere. The Treasury’s February figures show that instead where $60 billion in UST’s had been disposed of, only around $45 billion had been put into other domestic classes leaving foreign private holders their red-lined -$15 billion net.

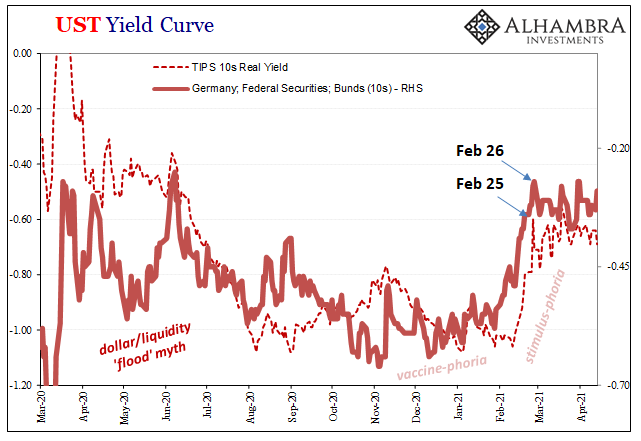

Was this reflation selling after all? Though the Fedwire-related incidences didn’t show up until closer to the end of that 28-day month, 24-26, the middle of that specific date range did happen to prominently feature one enormous selloff in…US Treasuries.

And, as we’ve continued to document, there’s less reflationary selling about that particular UST rout than it may otherwise have appeared (the singled-out 7-year note auction). In short, maybe the unusual private TIC minus for February was more dollar shortage-inspired than it may otherwise appear right now, too.

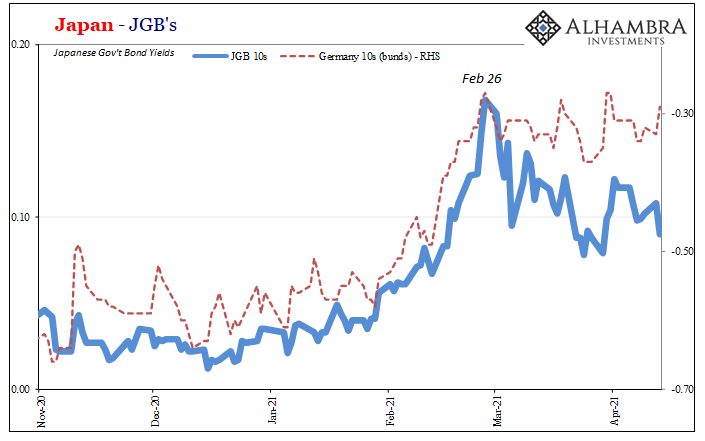

Furthermore, what has followed in global bonds and money ever since the end of February? If that had all been reflation, in TIC and market prices global reflation trades proliferate and deepen. On the contrary, what has followed has been a pause perhaps even inflection in the whole reflation trade in every major location around the world.

Reflation is not, nor could it ever be, so obviously fickle targeted to disrupt only a solitary instance. Then there’s all the rest relating to the global marketplace which over the next few days transitioned itself out of reflation entirely (including, importantly, TIPS real yields!)

To this day, mid-April approaching two months since all this, while global bonds aren’t being hugely favored, they are at the very least still reflation-paused more than suggesting something serious did take place at that time – in TIC, sometime during that month.

That February minus does seem to corroborate the offshore money interpretation consistent with the Feb 24-25-26 re-arranging of markets. This wasn’t reflation spiking the 7s auction, it really must have been a sizable disturbance to have rippled this badly throughout the global system, though, I don’t yet think, a wholly overturning one.

Another instance of corroboration for the wrong kind of UST selloff.

Bernanke had glimpsed the eurodollar’s work decades ago, but his worldview left him with no way to interpret it appropriately. Even though his theory had fallen apart, there’s been none offered to replace it. While the foreign dollars don’t exist officially and never have, they sure do exist in reality and show up in all the same places anyway.

Or, at key times, don’t show up.

Stay In Touch