The Australians are doing quite well, at least according to more recent data. A few hiccups hear and there, the economy Down Under has been riding high(er) on the Chinese rebound and the potential end to the pandemic. Earlier today, National Australia Bank’s survey of the first quarter business environment was thoroughly positive. At an index value of +17, this was substantially higher than cyclical averages indicating a continuous upswing.

The survey is consistent with other indicators pointing to a rapid recovery in the economy in recent months, led by surging employment growth. Australia has largely contained the Covid-19 virus, allowing a more normal running of the economy to emerge.

Don’t count on the Reserve Bank of Australia to stand in the way, either. Central bank Governor Philip Lowe reiterated that monetary policy in his country, like nearly everywhere else around the world, will not be adjusted anytime soon even as normalcy finally seems within reach.

Lowe, as Jay Powell or Christine Lagarde, intends to allow inflation time to get hot and sustainably so – as the others, Aussie policymakers have been fooled by inflation-ish developments one too many times before. Their operative word is now “sustained.”

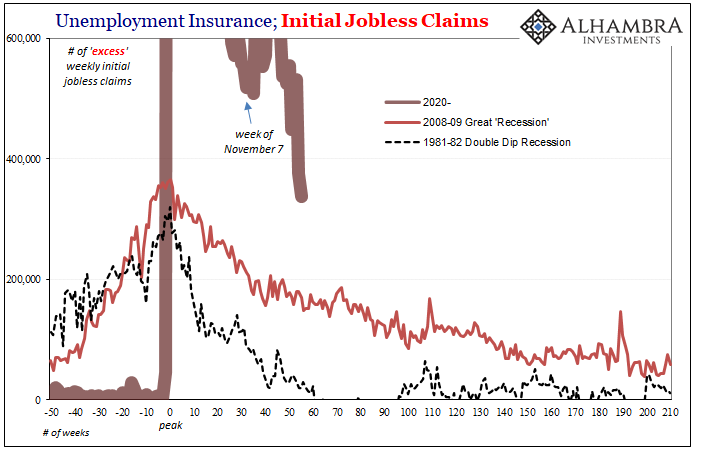

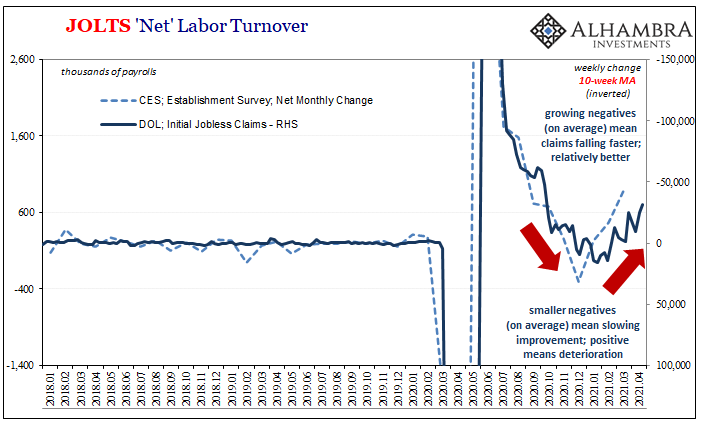

Over here in the US, Federal Reserve Chairman Jay Powell was delivered some likewise super news. The Department of Labor reported that initial jobless claims had fallen further last week from the prior week’s big decline. No longer is this crucial measure of labor market slack being sustained above pre-recession record highs; at 547,000 for the week of April 17, that’s down by 300,000 since mid-February and more importantly trending in the right direction.

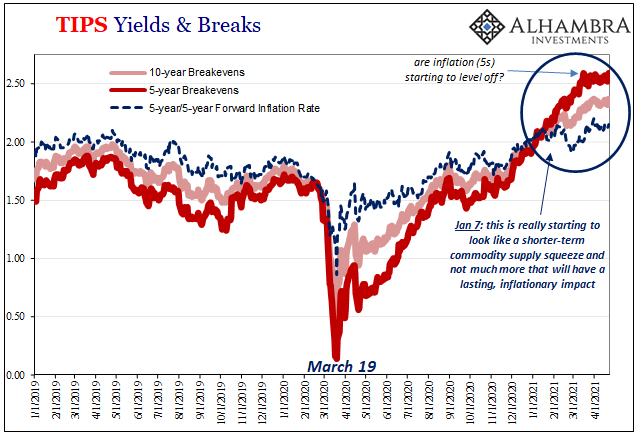

Powell, as Lowe, has reiterated how he needs to see much more before the Federal Reserve will even think about flinching (no matter what other scattershot FOMC members might say about COVID vaccine rates and such). His word is “transitory” in that given 547k in jobless claims there’s still a long way to go for the labor market so any inflation which might show up over the next few months isn’t at all likely to be “inflation.”

Just temporary effects of base comparisons coupled with commodities, neither of those indicating the same goal of “sustained.” For once, he agrees with the inflation market.

With so much good news including in Europe where having suffered setback after setback this year, even that ridiculous situation is trending favorably again. It’s all coming up in exactly the right way, everything getting better or so it seems.

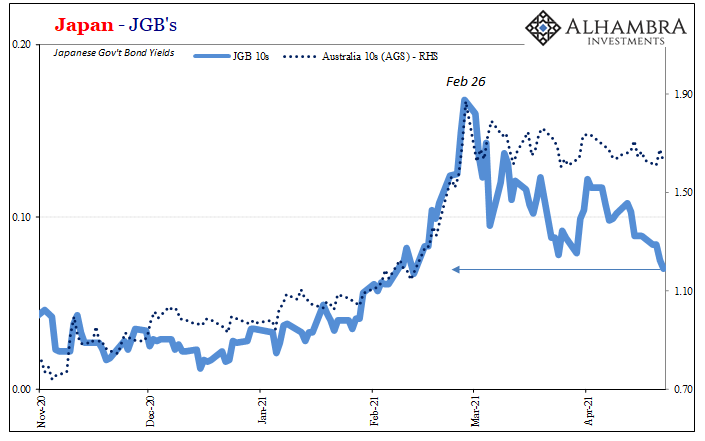

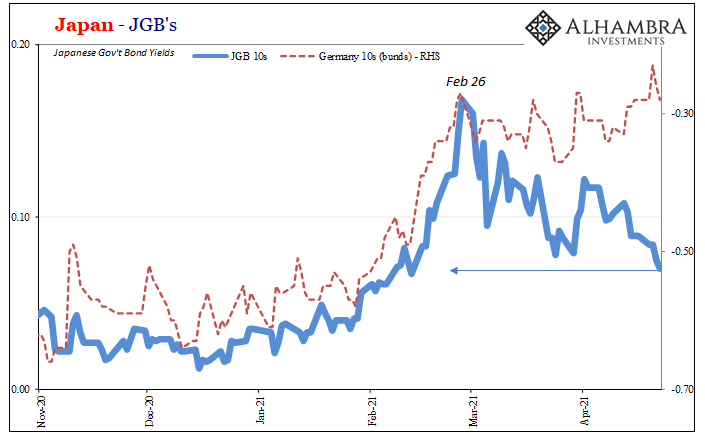

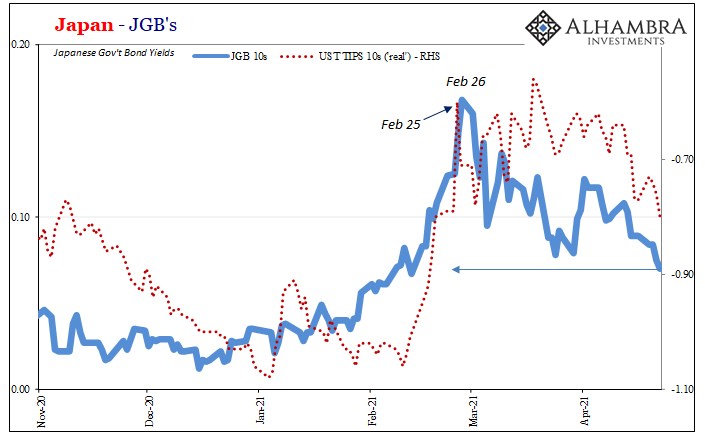

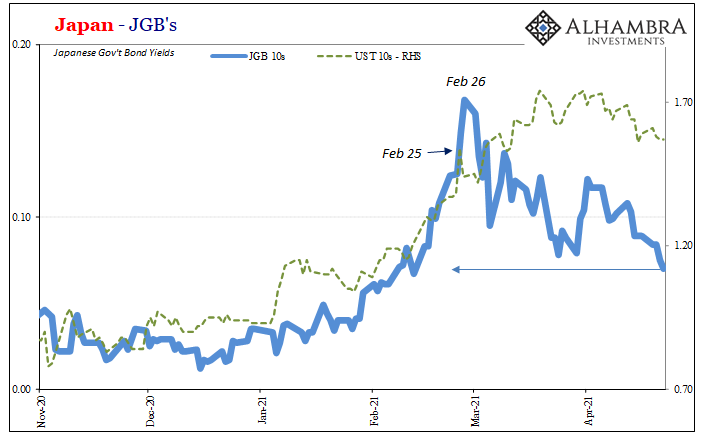

Why, then, aren’t bonds globally getting their coupons ripped off by desperate sellers running for the reflationary exits anticipating a world emergent and rip-roaring ready to go after its serious slipup? So much “excess” cash, so little time to spend it once shutdowns, lockdowns, and cutdowns come to their necessary ends.

It’s been just about two months since the Feb 24-25-26 calendar triangle of curiosities, and the data, at least, has gotten only better along the way. Uncle Joe’s big “stimulus” checks have cleared, the Chinese economy is said to be inviting Australia’s blistering rebirth, and Europe, again, is becoming less Europe-y by the week.

Something’s obviously missing here.

Back in early March, Fed Vice Chairman Lael Brainerd virtually stepped out of DC to webcast herself up to NYC if only to provide relatively brief remarks on where she believes the US system stands. Echoing Chairman Powell, there was far more caution in them than perhaps otherwise might have been expected.

Among that, a very clear display of inflation shyness inadvertently giving away a key piece of what it is that is still “missing”:

Likewise, while I will carefully monitor inflation expectations, it will be important to achieve a sustained improvement in actual inflation to meet our average inflation goal. The past decade of underperformance on our inflation target highlights that reaching 2 percent inflation will require patience, and we have pledged to hold the policy rate in its current range until not only has inflation risen to 2 percent but it is also on track to moderately exceed 2 percent for some time. [emphasis added]

That word again: “sustained.” What’s more importantly absent is any explanation for what today – unlike just a few years ago – these central bank officials are willing to admit. Given some cover under COVID, still someone might ask Brainerd or any of them to venture some guess as to why there had been that whole “past decade of underperformance” and therefore how it “will require patience” moving forward.

They always just skip over that part.

This is no small thing and it goes a long way, I believe, as to what we see in global bonds never mind all the big numbers and improvements in all the other things.

In other words, that they can’t really figure out (if they had and came up with a good explanation, officials would certainly have gone out of their way to blast it out there already) what really had happened last decade and this more than casts a pall on the likely circumstances of the coming one. If you don’t really know what went wrong before COVID, can’t say much about if it’s still wrong.

How do we know that once the pandemic actually does end, with that end almost in sight, the economy beyond corona is actually going to be robust in a meaningful sense (and not just written up that way in the media like it was before when all that inflation had gone missing)? Rebounding up from a very low trough in 2020 is not the same thing at all; it’s just being talked about that way by all the same people who tried to sell you on Recovery 2010s.

This inflation stuff isn’t trivial nor is it really about consumer prices. It’s actually about recovery and while the bond market is pricing substantial economic improvement that – so far – is coming up way, way short of the finish line. In that sense, same thing as before.

At some point, you’d think authorities and commentators would like to figure out why; starting with how it might be that bond yields in all these different places so often do the same things at the same times no matter their geographic as well as other clear differences.

The global reflation selloff in January and February was confirmation, I think, of what we’re seeing now; pandemic done. Yet still remains the far more critical and unanswered question: then what? The bond market’s current guess is that it just might be different in the 2020’s when all gets said and done pandemic-wise, but more likely than not it won’t be better different.

Stay In Touch