Since we’re still on the topic of Treasury auctions, here’s another one to take a closer look at. Yesterday, Treasury sold $18 billion in 5-year TIPS – the inflation protected security (91282CCA7) – and though there were plenty of bids they came in at prices somewhat out of whack with the secondary market. This left two-thirds of the offering to be taken down by indirects (foreigners mostly central banks and governments who place bids largely through FRBNY).

Even with $12 billion allocated to them, the auction high was -1.631% with a median -1.69%. Dealers grabbed only $2.3 billion despite $24.8 billion in bids. I guess the prices they offered were way low, somehow seriously unenthusiastic for what you’d think the whole market would be falling all over to snap up.

Since TIPS are auctioned infrequently, at least when compared to its non-protected nominal coupon cousins, these sales can and have at times shuffled the deck when it comes to inflation expectations (and real yields, obviously). What’s unusual perhaps worth taking into account is just how this particular one has done so.

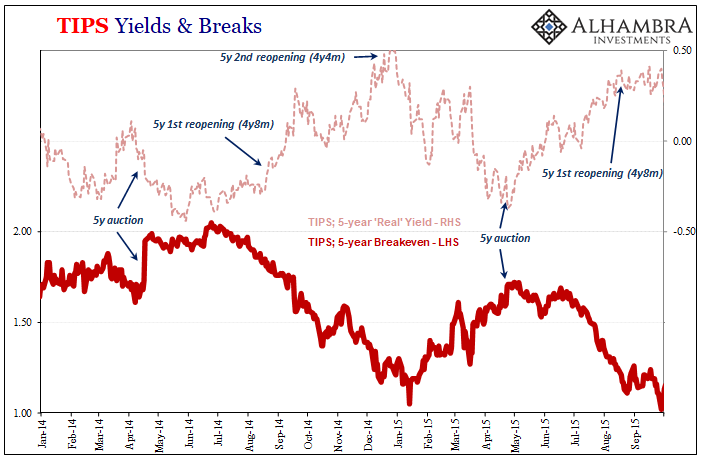

Before going over what I mean about yesterday, first some background. Perhaps the most famous of these auction-dynamic reshuffles had been the TIPS sale in April 2014. While Euro$ #3 (deflationary) had been in the works in eurodollar futures (from September 2013), Chinese yuan and US Treasury nominal yield curve (both from January 2014), it hadn’t yet smacked into the oil market which dominates the CPI therefore the government’s protection payments.

Not only that, early on in 2014, the US economy had apparently shaken off the very cold blast of Polar Vortex which had actually sunk Q1 GDP into a minus. Such shock over such fragility was quickly set aside because Ben Bernanke had, he claimed, handed Janet Yellen the nearest to perfect circumstances each could imagine.

The boom was just around the corner and it was global (just not synchronized, that would have to wait until 2017). In the mainstream version, the big risks for that year and the one beyond were “overheating” following what it would describe as the “best jobs market in decades.” Sustained, accelerating inflation pressures and consumer prices.

By the time the Treasury schedule struck 5-year TIPS on April 17, 2014, there emerged huge demand for what was on deck. The results don’t really say much about it: of the $18 billion floated, there were $48 billion in overall bids and once again the indirects took the majority of it ($10.5 billion).

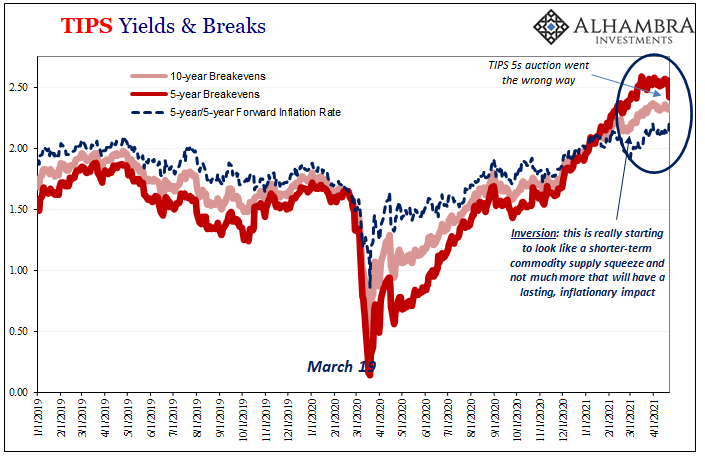

As you can see above, however, the price each accepted bidder was willing to pay was much better than the secondary market prices trading up to that date. This overwhelming demand spiked the 5-year breakeven rate (shorter run inflation expectation) in just the way you’d figure given the background narrative.

At that time, the federal government only sold one “true” 5-year TIPS bond per year but did reopen the auction twice more each calendar. The two in later 2014 were by contrast unremarkable, which is understandable given the collapse in rates, oil, and general attitudes about inflation and growth (in reality; the delusions of “transitory” deflationary factors would plague Janet Yellen and her companions at the Fed and in the media for quite some time more).

In fact, the next time we find even a modest reordering of expectations due to any TIPS auction was the next full note set off in April 2015 amidst some renewed optimism after the big oil/rate crash, dollar spike of the previous year. This time, it was much less than 2014’s and wouldn’t last very long (as Euro$ #3 ramped up instead into its more deflationary second act).

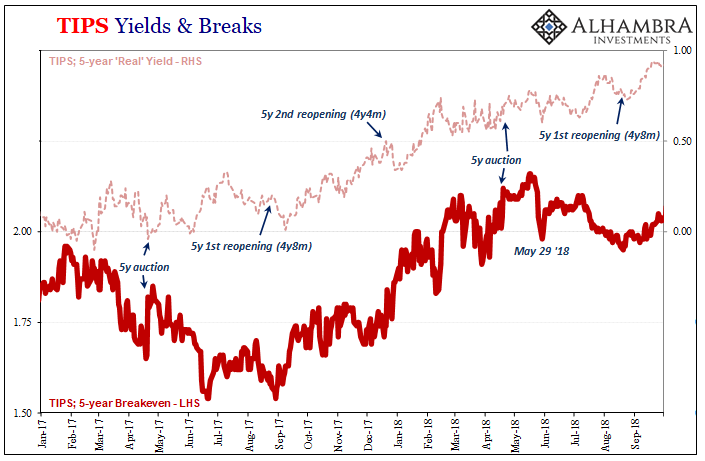

The 5-year TIPS auction in April 2016 was likewise unremarkable (just following the worst parts of Euro$ #3) so it wouldn’t be until the following year’s full offering that we see the deck reshuffled again. April 20, 2017 ended up being very 2014-like which was actually pretty consistent with the developing consensus as to globally synchronized growth.

Even though inflation expectations were falling at that time, the full TIPS 5s auction and the demand for what was sold suggested more optimism beyond that short run – which is where the market shifted just a few months later in September.

The second 2017 reopening in December was a small blip but again consistent followed by the full auction of TIPS 5s on April 19, 2018. Very much like 2017 and 2014, the 2018 came out with heavier participants paying above-market premiums clearly boosting breakevens.

The April 2018 sale was conducted right as the dollar was starting its Euro$ #4 confirmation (surge), taking place about six weeks before the deflationary break in collateral on May 29 that year (and then the eurodollar curve inversion two weeks after that).

Unsurprisingly, by the time we get to the 2018 reopenings later on, there was no longer the same inflationary enthusiasm.

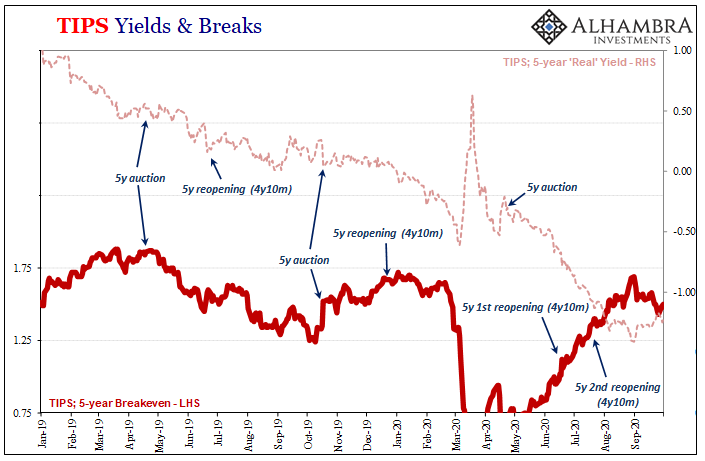

That Euro$ #4 inflation attitude continued into 2019, driven sideways by Jay Powell’s bewildered stance having been turned totally against him by the global bond market switching out his bird before he really realized it (from steadfastly hawkish to I-think-I’m-now-dovish-but-I-really-don’t-know-why).

April 2019 TIPS auction, therefore, another of the unremarkable variety again amidst growing recession “fears.”

That same year, the Treasury Department had reworked its auction schedule so that there would be two full TIPS auctions, leaving 2019’s second scheduled for October. By then, the market had shifted more reflationary/inflationary, and certainly that was the conventional view following first rate cuts and then the Fed’s not-QE introduction just weeks before, as well as the yield curve having steepened (moving out of inversion) since the end of August.

As you can see above, the October 2019 full note TIPS 5s ended up very much like the full April 2014, April 2015, April 2017, and April 2018. Breakevens broke upward once the bids and prices were tallied and allocated.

There is pattern here which has been pretty well established – an overall inflationary mood and outlook yields much better demand for the TIPS auctioned especially when it’s the full thing (not reopening).

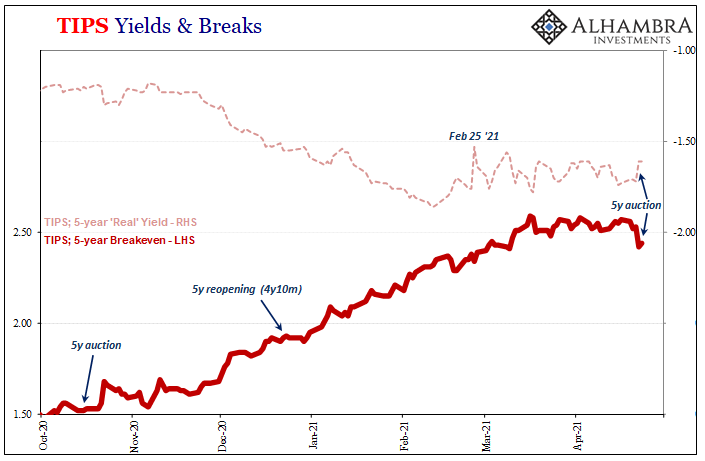

Currently, we are amidst even greater fury and certitude than any of those prior, where the inflation narrative has become even more hysterically virulent than it had been in either 2014 or 2017-18. Given this, shouldn’t we have expected there to be the same kind of deck shuffling demand for the April 2021 TIPS auction?

That’s not what happened; on the contrary, for the first time the auction shuffle produced the opposite reaction for inflation expectations. Whereas the uninteresting prior sales didn’t produce much of an effect in the secondary markets, and the inflationary ones spiked breakevens, this one went the other way tanking inflation expectations by 11 bps following it.

They’ve continued the same after today’s trading.

Everything in the world is supposed to be going the right way, big numbers globally from governments removing themselves from all limits of sanity and central bankers each egging everyone on in all possibilities. Vaccines, a clear pickup in recent economic conditions – not just in the US labor market or the US economy – and optimism, inflationary optimism being sung proudly and widely from every corner of every jurisdiction.

Maybe this 5-year TIPS auction result is a true anomaly, a trivial curiosity quickly forgotten once the market turns back more favorable. Then again, it is absolutely anomalous in that for any auction to have gone “poorly” this is the last one anyone would expect (because it is inflation protected). The long 20-year bond sold with overwhelming demand just the day before. It’s more than a little weird to see here the first TIPS auction to have flipped around inflation expectations in this way.

And to have done so now of all these times.

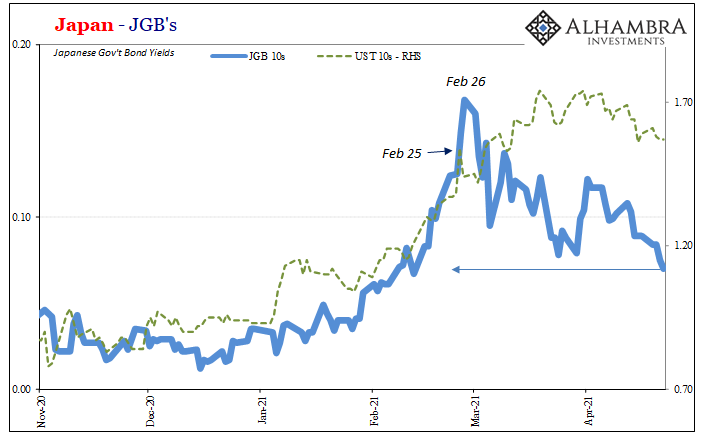

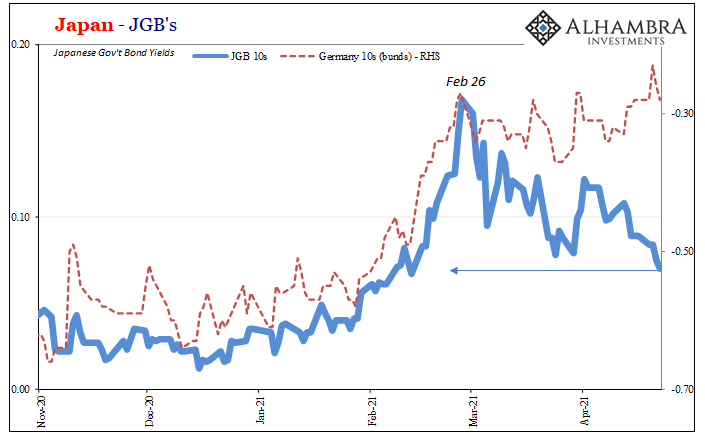

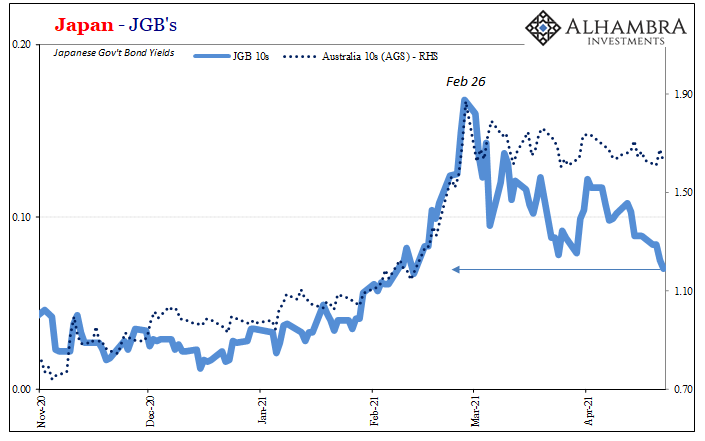

This is not by any means a definitive sign or even a top-tier indication; it is, however, perhaps too-consistent of a reshuffle for a post-Feb 24-25-26 market.

Stay In Touch