As Ben Bernanke has another one of his myths begin the process of falling apart, his successor Janet Yellen chimes in today with yet another reminder why that must be. Though Yellen now sits in an even bigger chair, so to speak, having failed upward to Treasury, this one’s the sort of thing upon which a Federal Reserve Chairman would opine.

Before being forced to walk back her clumsy, ill-conceived comments, Secretary Yellen talked about how interest rates might have to rise a little bit if only to constrain the inflation so much beneficial government spending could unleash. As if 2015’s debacle never happened, here she is yet again talking about modest overheating if this time as a consequence of fiscal tomfoolery.

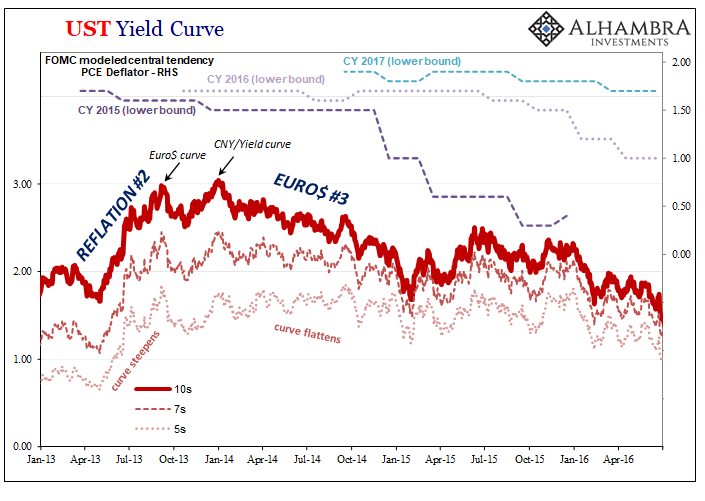

Remember, back in 2015 after having terminated QE’s 3 and 4 (yes, there had been four) in December 2014, she and the rest of the mainstream crew had expected to begin the rate hiking phase as early as June of that year (brought up by her maladroit “six months” gaffe delivered at her very first press conference). The “best jobs market in decades” had driven the unemployment rate down into what outwardly seemed inflationary full employment – while a lot of other indications warned there was so much more to the monetary, financial, and economic picture.

Because of that, Yellen’s Fed would manage only a single rate hike in December followed by a yearlong pause no one there or anywhere has yet managed to explain (while Ben Bernanke clung more tightly to his “term premiums” nonsense). The intent then, as she is saying now, was to bring rates up so as to head off and control modest inflationary pressures she believed were already evident but which didn’t actually exist in reality.

The same situation as had been forecast and foreseen by falling not rising rates.

Most people typically learn from making such crucial, highly public errors.

It had been the bond market globally, of course, which had pointed this out going all the way back to the beginning of 2014 (and eurodollar futures several months earlier still). Getting things complete backward, it had been rising yields in the second half of 2013 (the incorrectly labeled “taper tantrum”) which would’ve been the inflation confirmation – if it held.

What that meant was rising yields don’t choke off inflation – they confirm it as a realistic possibility, when they go up farther and then stay up. Having nothing whatsoever to do with “too many” Treasuries or a supply problem, even Bernanke saw the Fisherian consequences; he just couldn’t line them up properly missing that key (global) piece.

These contrary disinflationary pressures arose and proliferated worldwide while yields fell even though Yellen or any Economist claims this is what happens when rates rise. Their cart always in front of the horse.

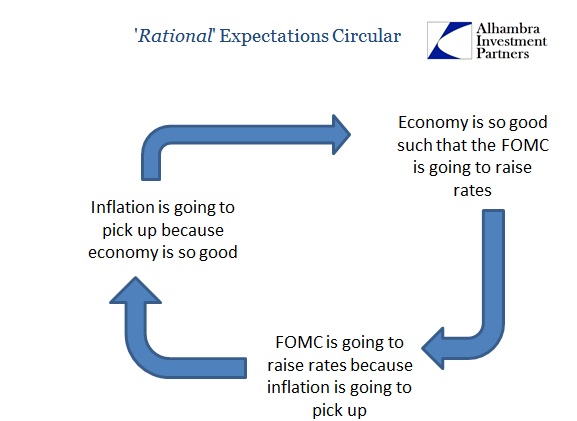

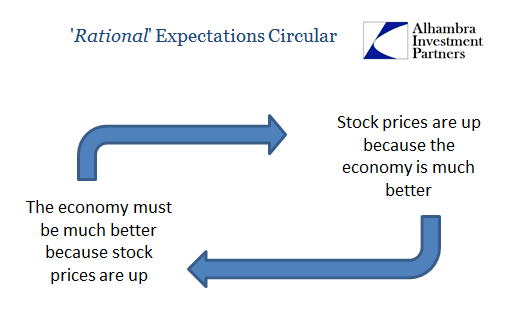

Thus, what Yellen was saying then as now the equivalent of circular logic.

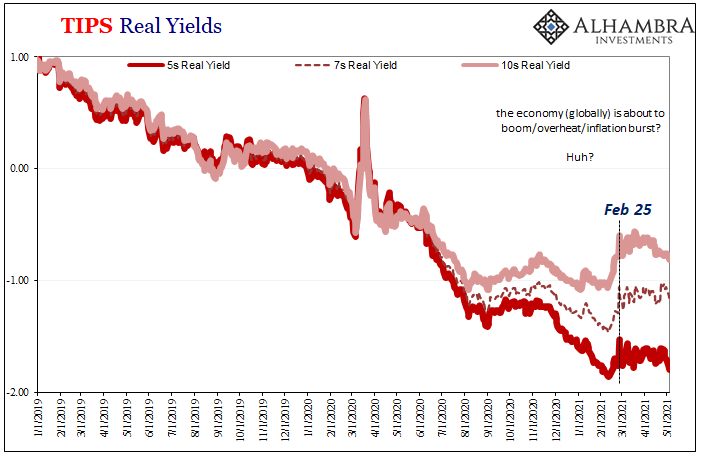

The fact that interest rates are, like back then, not rising undercuts the very center of her thesis. The bond market leads not follows, and it is looking at the same government wastefulness, looking straight past it to the unchanged underlying condition which just so happens to be the same deflationary circumstances which thwarted Yellen the last time she did this.

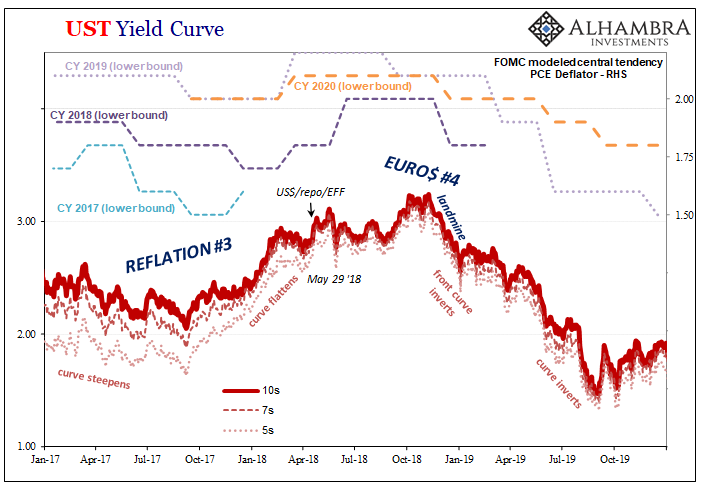

And then Jay Powell committed the same egregious error in practically the exact same way as his predecessor.

She says government spending will bring up some “modest” inflation and then rates will have to rise to cut it off. The bond market disagrees; no inflation is being forecast despite very much having factored all that government spending (some markets unlike Economists don’t just ignore Japan) and more. This reflationary period so far in 2021 by far the weakest and least impressive of the bunch as if to put further emphasis down on it.

And that’s with not one, not two, but three thirteen-digit fiscal “rescues” already in the books in the short space of thirteen months as well as whatever will become of “infrastructure” under Biden/Yellen.

If she were in any way correct, yields would already have gone up so much more which wouldn’t have constrained inflation, rather accelerating rates thereby confirming it.

That’s the part these people never get. They pretend they are in charge, that their “big things” actually mean big things. When you realize that central banks (and central governments) are not central, you then see how bonds aren’t following any lead, they’re simply provable, well-established skepticism as to all those things.

One of these days Janet Yellen might want to start listening, not that it will do the world much good now. At least then, like some Fed staff, she might be able to appreciate just what she’s done already.

And that’s all before they even get to figuring out, and figuring in, Feb 24-25-26.

Stay In Touch