One of the most deceptive stumbling blocks to figuring this whole thing out has been the rigidly binary approach to whatever any central bank does. The public is given one of only two choices: either monetary policies have been Goldilocks, just right; or, the message from critics, it is always ever in danger of being too good. That’s it; those are the only offered options.

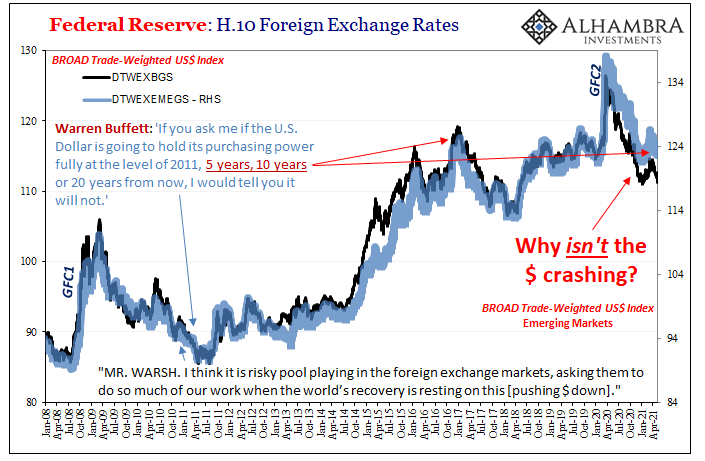

By the end, it can only work out for the Bernanke’s and Draghi’s of the world because their critics have all falsified themselves. Authorities have managed to appear less clueless at least by comparison to those set up by the mainstream media as the sole voices opposed. When you make the FOMC seem reasonable by comparison; hey, we said we’d lower the dollar a bit and that didn’t happen, but they kept saying it would crash.

There is, has been, and will continue to be, a third view which just so happens to be the one consistent with every bit of evidence: neither of those other two groups has more than an outdated worldview (1960’s view of the 1930’s) of the monetary, financial, and economic ecosphere. These people aren’t idiots, it’s just that the discipline of Economics hasn’t advanced such that they have no way of interpreting facts.

That’s how there was a GFC1 in the first place. Credentials instead of evidence and real science.

Like QE, however, this is not a neutral situation; by contributing bad economics these inflationistas discredit more than their own theories and understanding since “all” monetary criticism gets lumped together, all critics painted as if having exactly the same objectionable track record.

When her name was first brought up as a possible nominee to serve on the Federal Reserve’s board, Judy Shelton thought it unlikely to succeed (it didn’t) because, as she admitted in early 2017, she’s been “sort of tagged with this gold bug idea.” Not just tagged, Shelton fit right in as someone who, like Warren Buffett, goes crazy over the Fed’s “money printing.”

Writing in 2013, for example, Shelton starts out right, as most like her do:

Who could have foreseen a global financial crisis that would utterly confound such reasoning? Certainly not the Fed; our central bank was clueless about the credit bubble that would burst in 2008…

And then she only a cursory appreciation for the whole situation by saying that the Fed was directly to blame for it; claiming the housing bubble was the central bank’s doing via “low interest rates” rather than correctly having failed to identify an out-of-control global shadow money system paying no attention whatsoever to Alan Greenspan’s fed funds kabuki.

When it went bad, they let the world go illiquid for a few months, that was true, except now critics claim officials have since committed the bigger mistake via QE pushing the money pendulum all the way in the other direction.

Back to Shelton in 2013:

The Federal Reserve is not your friend. Whether you reside on Wall Street or Main Street, whether you are a borrower or a saver, whether you lean toward the Tea Party or the Occupy Wall Street movement—or whether you simply believe in free markets and free people—loose monetary policy is bad for you and for your economic prospects. [emphasis added]

In January 2013, when this was penned, it may have seemed like the perfect reproach to what was then unfolding. Ben Bernanke’s Fed had just begun a QE3 (MBS buying) which it quickly became apparent wasn’t working (see: repo) followed a few months later in December 2012 by QE4 (USTs).

QE’s painfully obvious ineffectiveness, I should add, was apparent to those paying attention, a group not including Shelton – though it did include Ben Bernanke; he and the rest of the FOMC never did figure out how to deal with it, instead they just stuck with the same plan calling for an-ever higher level of bond buying and offsetting bank reserves.

That’s what critics can’t seem to figure out. The more bank reserves, the more QE, the less success it must be having.

For the mainstream, her January 2013 stuff was perfectly standard for that time. Again, the binary: either Bernanke had hit the magical sweet spot, fourth time the charm, or in short order we’d all see how he’d done too much. The inflation genie released surely by 2014.

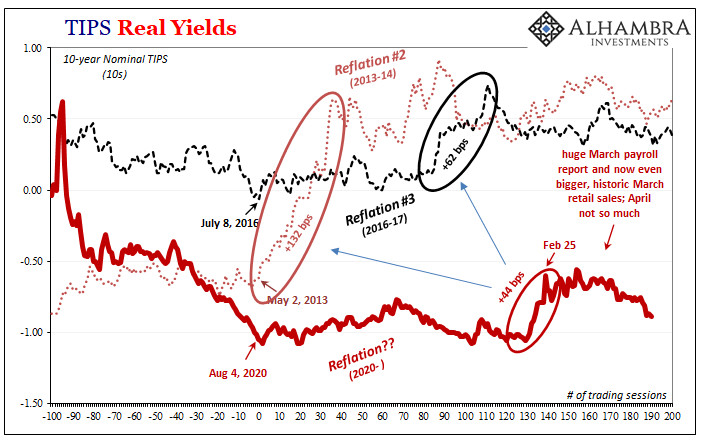

On the contrary, neither of those proved to be true in exactly the same way they’d fallen apart in 2011 just two years earlier. The issue came back again in 2017 and 2018, of course, only to be settled all over and in the same wrong direction during 2019. Rinse. Repeat. The inflation puzzle actually applies to both the Fed’s mainstream critics as well as those who operate the monetary policy puppet show.

For monetary policy’s real opponents, there never was any puzzle (deflation, interest rate fallacy).

Judy Shelton returned to the mainstream press last week, this time writing for the Wall Street Journal how it is unfortunate the Federal Reserve’s board, denied her spot on it, is engaged in “groupthink” just as, as if we were back in 2013, you know the rest. She says the i-word still isn’t being considered strongly enough despite its thirteen-year absence (and counting).

Policymakers need more diverse voices so that, as Shelton would have it, the current QE-works clique can be opened up to include a few belonging to the QE-works-too-well faction.

While it might seem reassuring when members of an institution concur, the Fed’s tendency toward groupthink carries the risk of missing other important perspectives. Forging a consensus can mean trimming the edges of troubling concerns over future developments…Echoing this commitment to easy-money policies stretching well ahead, Fed Gov. Lael Brainard’s speech in March to the National Association for Business Economics was titled “Remaining Patient as the Outlook Brightens.”

Yes, the “trimming the edges of troubling concerns over future developments”, might those include at least a small nudge in the direction of maybe-QE-doesn’t-work-at-all? After all these many years, we’re still in the “easy-money policies” for both the Fed and its detractors who, ironically, are actually engaged in its very same groupthink.

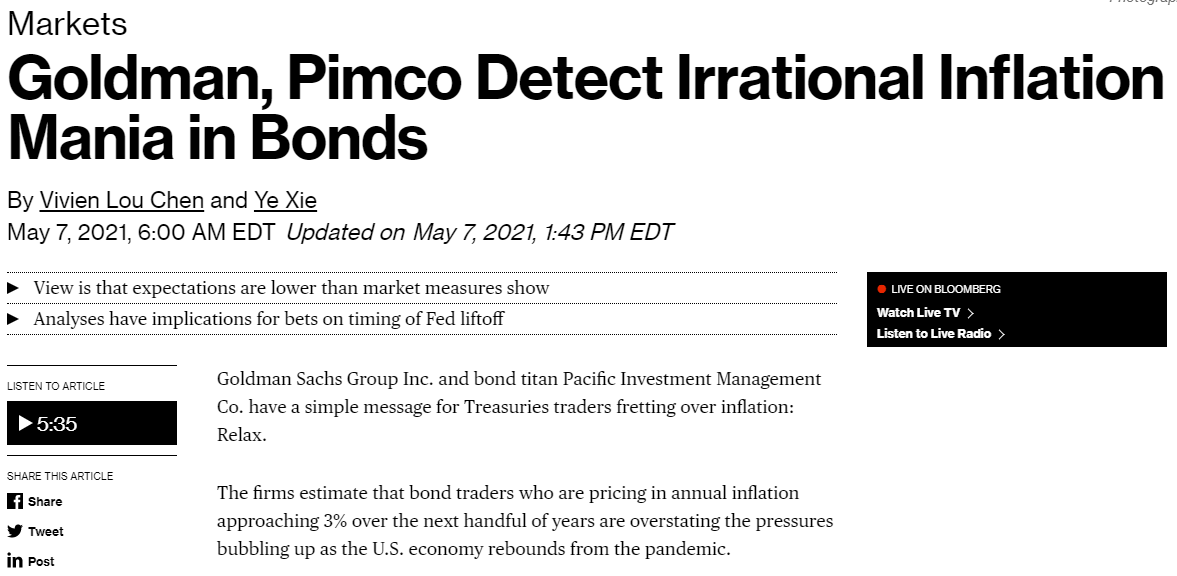

This is how we end up with Goldman Sachs and Bill Gross’ former employer PIMCO actually talking sense (I’d write making sense, but that’s supposed to be our thing).

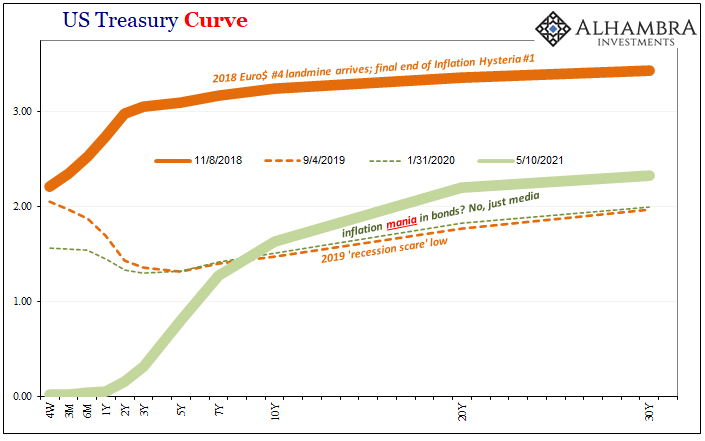

Even the mainstream framework presented above is heavily influenced: irrational inflation mania in bonds according to the article’s title. No. The mania is in the media further fueled and fed by this Fed binary. The bond market, on the contrary, continues to express, trade, and price deep skepticism – this third option – as to whether either of those camps will ever be able to figure out.

Even in 2013, it was a hard sell this inflation stuff outside the financial press. Eight years later, same programs, now supposedly totally different result? As if the Japanese hadn’t already tested the “huge” number variable several times beginning with QQE (also in 2013).

Judy Shelton gets WSJ space, even a nomination to the Fed board if only because she’s actually on the same side, the QE “money printing” side. That she says it will go too far actually does Jay Powell a huge favor (boosting, in theory, inflation expectations which is really QE’s entire purpose).

The problem from the very beginning is just that simple. News to Shelton and others in her cohort, QE never was and never will be “money printing” nor “highly accommodative.” Her favor to Powell is in her helping him try – and fail all over again – to sell the illusion.

Stay In Touch