It makes all the difference in the world. Back in the back half of 2018, the word more often being used when compared to that year’s first half had been “slowing.” By the later months, it was pretty obvious this was taking place no matter how many times the American unemployment rate was dusted off and trotted out in front of the media parade.

In Europe and then in the US, officials (and the media) shifted to promoting the idea that this was somehow no big deal, nothing other than the scorching economy of 2017 cooling off just a touch. Coming down from an extreme high couldn’t be a bother to anyone in it. More to the contemporary point, Jay Powell and Mario Draghi’s big inflation push (their necessary confirmation of successes in monetary policies) could be preserved if the only danger was it merely becoming a little less epic.

What if it had never got even close to epic? Understandable everyone’s confusion about 2019.

Since that boom never really boomed, this was more than simply misplaced expectations. An economy that never actually took off (the data more forcefully confirmed as much, if years later) that then drops down more is a very different one from a system racing ahead downshifting a gear maybe two at most.

Bonds traded on the former while booms and labor shortages got splashed all over the internet even as neither of those things existed in reality.

All is not forgiven but has absolutely been forgotten.

COVID subsumed that pre-COVID recession which had already thumped Japan as well as Europe into contraction long before any pandemic. Emerging Market economies were on the precipice, too, many already pushed over the edge. By far the biggest (negative) contributor had been a China talked about in the West as the solid rock of recovery when its own government kept warning, “look out below!”

Rinse. Repeat.

As we move forward further into 2021, the word emerging even in the mainstream media isn’t “strong” as it had been, now it’s “slowing”; as if time-warped backward to October and November 2018 only in this instance without “trade wars” to scapegoat. This time, it will be “supply chains.”

Like before, it starts with and in China. That country’s National Bureau of Statistics (NBS) reported last night its Big Three estimates for the month of April 2021: Industrial Production; Retail Sales; and, Fixed Asset Investment (FAI). It was difficult to plausibly disguise the thorough disappointment.

Yet, in true 2018 fashion, the frankly downbeat results are being surrounded in the more pleasing, inflation-plausible context like that from a few years back. Without China, the key global factor in all these things, what’s left isn’t inflationary at all. But it might still be if this now-recognized “slowing” amounts to just a little off the exceedingly robust top.

China’s factories slowed their output growth in April and retail sales significantly missed expectations as officials warned of new problems affecting the recovery in the world’s second-largest economy.

While China’s exporters are enjoying strong demand, global supply chain bottlenecks and rising raw materials costs have weighed on production, cooling the blistering economic recovery from last year’s COVID-19 slump. [emphasis added]

No longer “trade wars” now “trade bottlenecks” to blame in case the otherwise surefire inflationary excesses of successfully executed recoveries remains true to established form. And, like two years ago, there’s that sinking feeling how everyone is trying too hard here; bonds, the majority opinion where opinions mean something, just aren’t buying any of it.

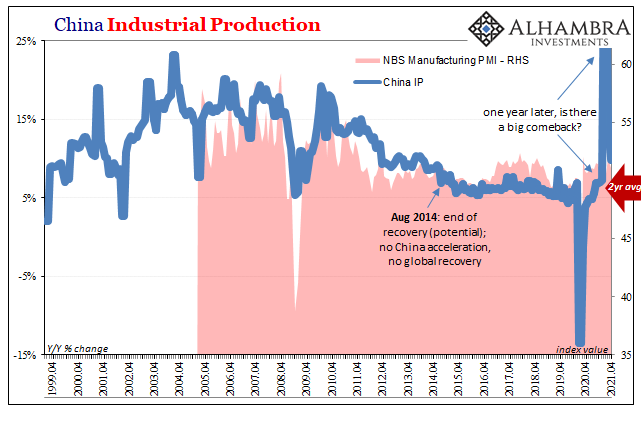

For one, where’s this “blistering?” Like 2018’s “boom”, each absolutely deserves the scare quotes. Even the NBS pours so much cold water on the overheating in Western rhetoric by prominently stating the 2-year (average) changes in each economic account right in the opening paragraphs of its various press releases. Big numbers compared to 2020, base effects to dazzle the easily-distracted; looking back to 2019, on the other hand, ouch.

According to the Chinese government, Industrial Production rose 9.8% year-over-year in April. Compared to April 2019 instead of April 2020, however, IP was up just 14.1%, or a compound annual change of 6.8%. That’s about the same level of growth as Chinese industry had been experiencing during…2018, and it only gets decidedly less sweltering from here.

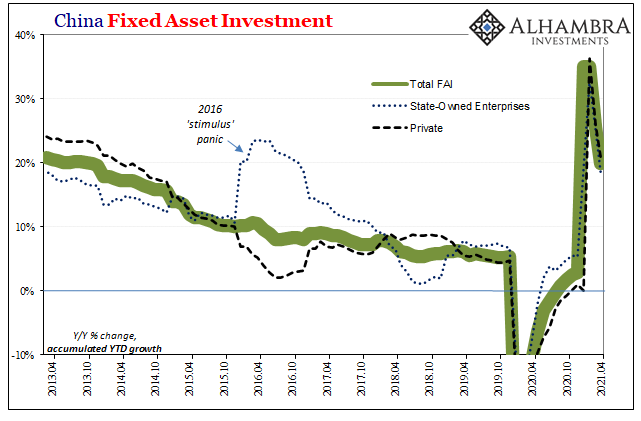

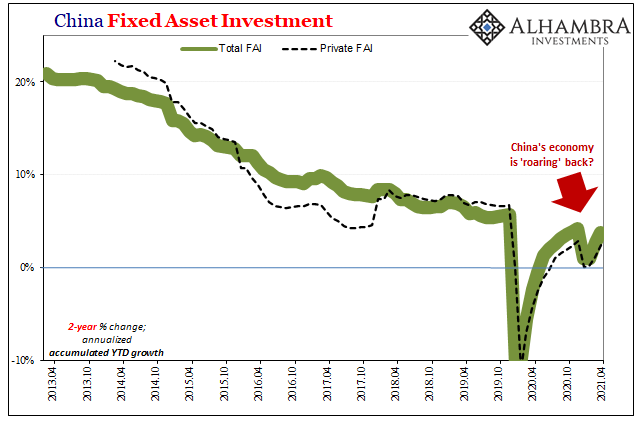

Total FAI during the four months January to April 2021 was 19.9% more than the same four months of 2020. But it was only 7.6% more than cumulative January to April 2019. The 2-year change (an ugly 3.7%; just 2.4% in private FAI) best illuminates China’s true economic state as well as unambiguously illustrates the deception; where’s the boom?

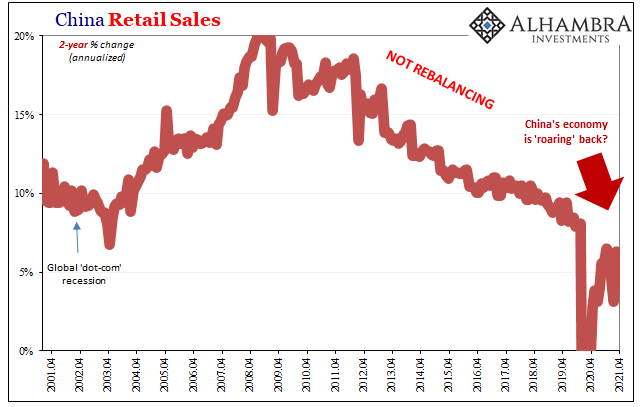

The real missing piece, however, is the very one upon which the Communists have already said – repeatedly – they are going to rebuild themselves back better-ish. It used to be called “rebalancing” and nowadays is labeled “dual circulation”, under any terminology authorities have made it their purpose to go after internal economic growth on a consumption-based model.

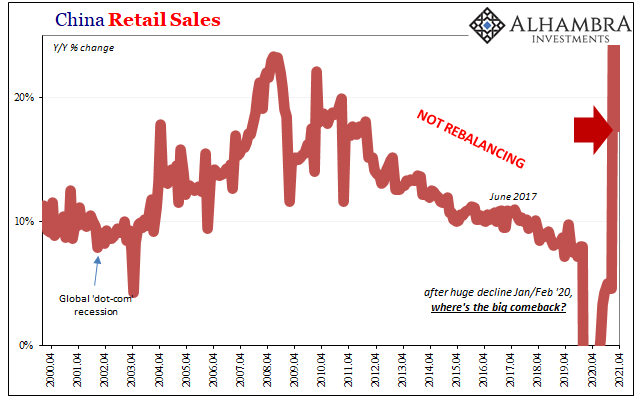

If China is going to recover, then it is being pushed to do so on the spending of Chinese consumers. According to the same government forces doing the pushing, as you can clearly see, Chinese consumers aren’t spending on much this year which isn’t much change from last year’s recession year. Retail sales not only missed badly to expectations last month, again the 2-year change:

The NBS figures, using its own methods, that retail sales rose 17.7% year-over-year, which, given that retail sales had fallen 7.5% year-over-year the previous year, means the 2-year compounded increase was only a little more than 4%. Four.

It hadn’t even been this bad during the 2001 economic year when China had both the tail-end of the Asian Financial Crisis as well as the global dot-com fallout on its 2-year comparison. There was, in 2020, a very real recession but certainly these estimates demonstrate only a lack of recovery yet from it let alone any kind of extraordinary strength consistent with the world-economy-is-on-fire-inflation stuff.

All of these numbers are on the opposite side of the spectrum – struggle, not strong – just like they had been in 2018.

Even the mainstream view has been forced to acknowledge this global “slowing” but is doing so first as if there are artificial impediments (supply issues) responsible for it, and then, second, like this is just a system decelerating just a touch from white hot to mere red hot. It’s trying to reconcile and reverse engineer a case for the inflation case when instead, according to China’s economy, its decade-long slump is showing itself in plain, typical form.

Wouldn’t this explain (a lot about) low global bond yields looking past last week’s scorching, “70s-style” US CPI as if it didn’t matter? An economy slowing already after never having gotten going, there’s both repeated empirically-established precedence, historical data, and now current estimates all over the world. Beginning, and in some ways ending, in China.

Wishing for an inflationary recovery is so 2018.

Stay In Touch