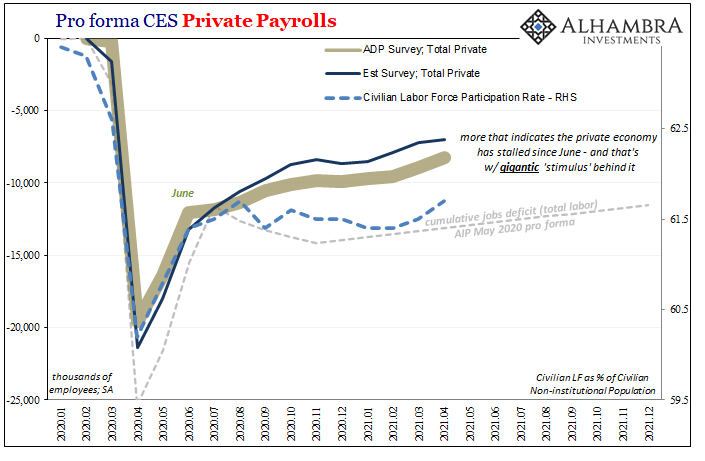

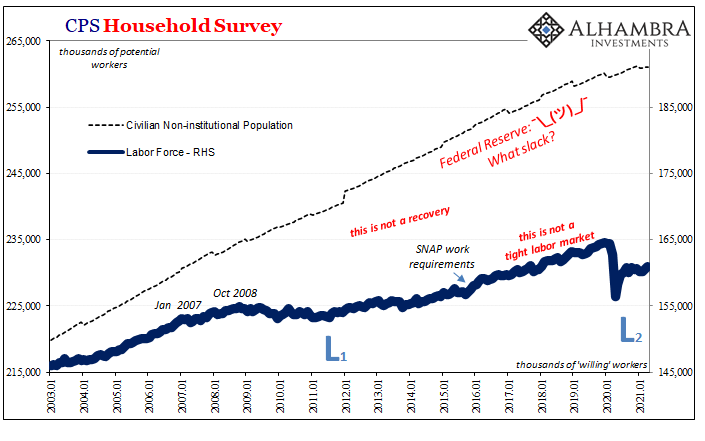

One idea for why the labor market hasn’t come back in nearly the same way as the goods economy or “aggregate demand” has, each spurred on by Uncle Sam’s repeated use of his TGA-fueled helicopter, is that yet another of the federal government’s rescue efforts has hindered the employment rebound – from the worker side. Businesses, many say, really, desperately want to scale back up but are unable, prevented from reaching recovery potential by what’s become a purported labor shortage.

With unemployment bonuses and benefits, for many there’s more money in not working than working.

While true, the question is how widespread; for how many does this comparison apply? Some seem to be saying it can and does account for all or nearly all the still-Great “Recession” sized shortfall in employment. Time seems to be a factor, at least in how it has been a whole year suffering at this level, therefore artificiality must be the only way reason for this drastic difference.

Hardly anyone, outside the bond market, anyway, seems prepared to accept that instead the economy of 2020 really might have suffered more than a temporary if tremendous shock. What if all those jobs haven’t been refilled because there aren’t those jobs left to be refilled?

Unemployment bonuses fall under a different light; rather than keeping the unemployed home banking an unearned difference in their favor, state generosity has been keeping them (minimally) afloat with few alternatives.

Labor market struggles such as this latter version are nothing new to the US economy. For every shock suffered under the heavy burden of whichever GFC and recession or comparably less dollar shortage and near recession, the labor market comes out of them unrecoverable.

Like now, Economists and those expecting inflation have tried to explain this away as exogenous deficiencies unrelated to macro factors; previously, it was alleged Americans had become too lazy, too old, and too drug addicted. Now, too much vacationing at the taxpayers’ expense.

The contrary argument has been far simpler and with direct evidence. Basically, companies can’t and haven’t made more money because the economy remains depressed, meaning they then overmanage and focus too much on costs rather than risk-taking, running entirely too lean payrolls, chronic underemployment which then further reinforces the lack of economic robustness which prevents companies from making more money.

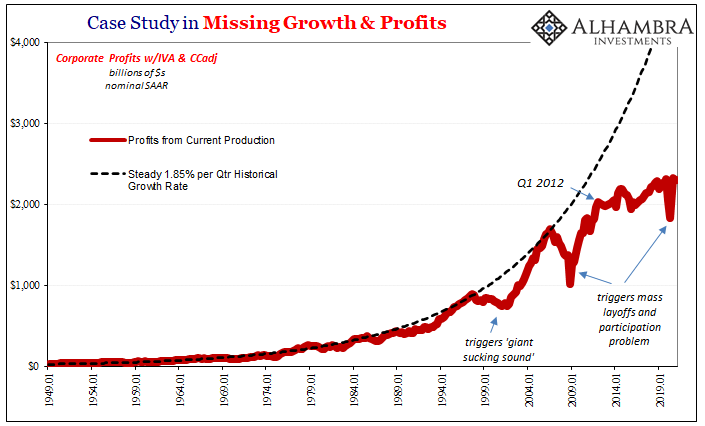

Corporate profits.

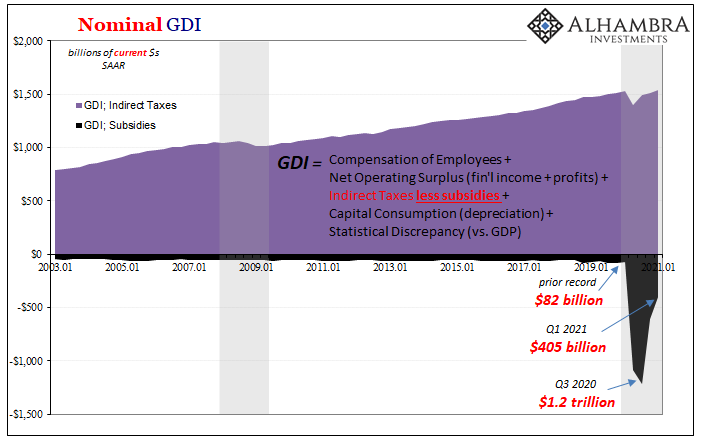

Since last year’s recession, Uncle Sam has shown up in company bottom lines, too. There’s been all sorts of things, only starting with the PPP that in GDP (really GDI) is accounted for as subsidies. Enormous subsidies. According to the revised GDP/GDI estimates for Q1 2021 released today, these had totaled $405 billion (SAAR), still a huge boost to what must still be hurting businesses.

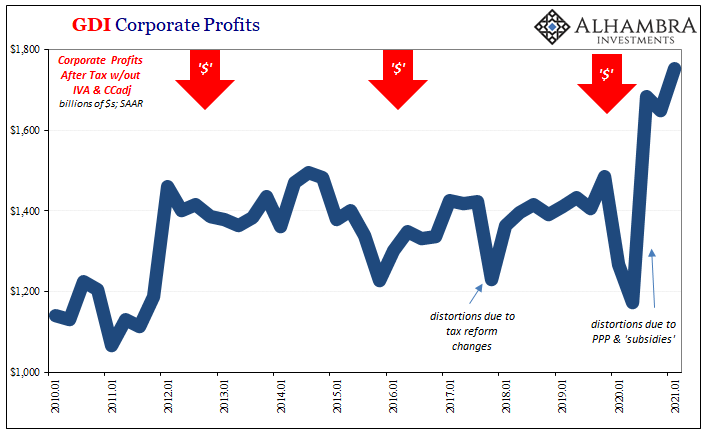

Along with GDP/GDI’s revisions, the BEA also today gives us the first look at corporate profits during the first quarter. The subsidies are visible in several of these series, those looking after tax which account for whatever government credits.

But if subsidized profits are up pretty big, does that necessarily mean companies will promote, give raises, and hire workers both previously laid off and new? The permanent income hypothesis applies to the corporate sector as much to individual consumers. No one in any management is rehiring workers based upon past subsidies; they’re looking at the underlying economic fundamentals and profits derived from actual, sustainable business.

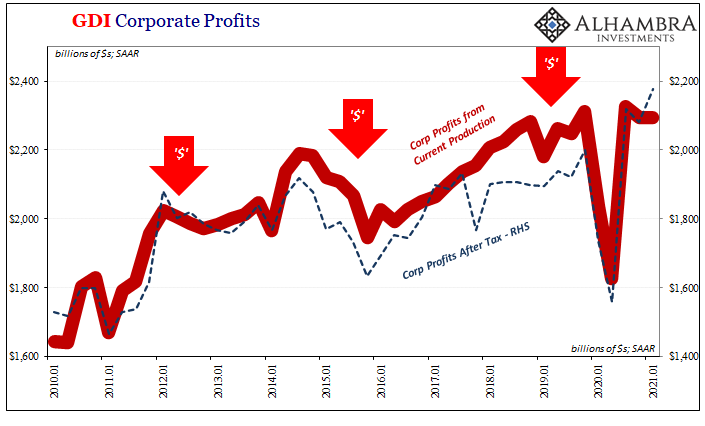

The BEA data gives us one accounting of this: corporate profits from current production (Corporate Profits with Inventory Valuation Adjustment (IVA) and Capital Consumption Adjustment). The numbers aren’t nearly as neat here as those others.

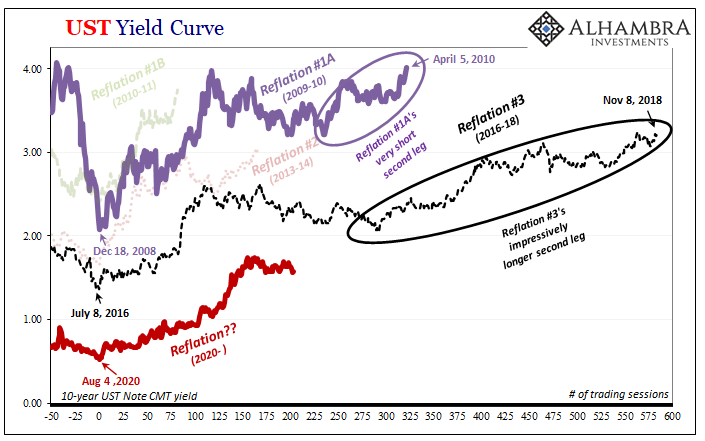

More to the long run problem, the US economy has had itself a profit problem for a very long time. In Q1 2021, current production profits were down slightly for the second straight quarter (despite positive GDP), and about the same as Q4 2018. Compared to Q3 2014, the Reflation #3 peak, profits are up just 4.7% – total, not per year let alone per quarter.

They aren’t really all that much higher than at the beginning of 2012, very well describing more than a decade of futility yet sprinkled with repeated anecdotes of labor shortages that don’t and can’t exist given these facts.

Quite simply, the US economy like many other parts of the global economy, continues into 2021 with a serious profit problem somewhat obscured by government intervention. Not coincidentally, it still exhibits a serious labor deficiency.

Unemployment bonuses no doubt account for some of the multiple millions of labor market slack. How much? Given that these trends remain it’s unlikely nearly enough to make up the entire difference. Instead, as in the aftermath of GFC1, and that profit depression, recovery isn’t happening because it’s not able, the economy limited to limited gains that leave it further behind than it already was before COVID.

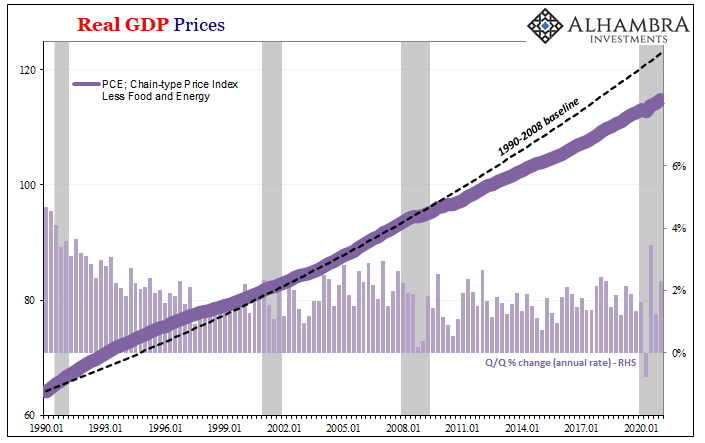

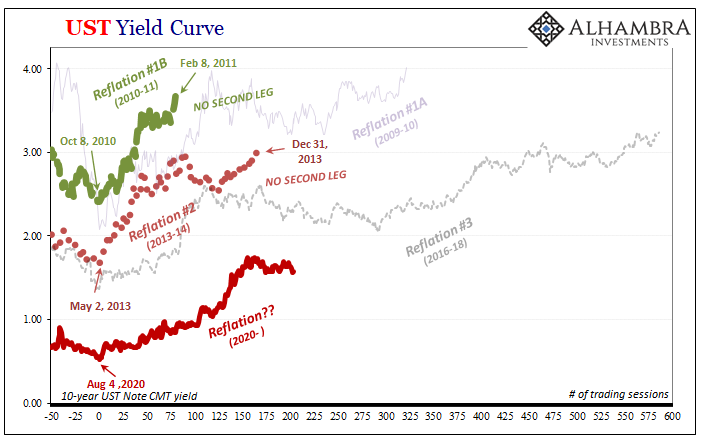

The rebound is set to continue, but not more than that modest, underwhelming reflation. Consistent with both yields and inflation (even recent “inflation”).

Stay In Touch