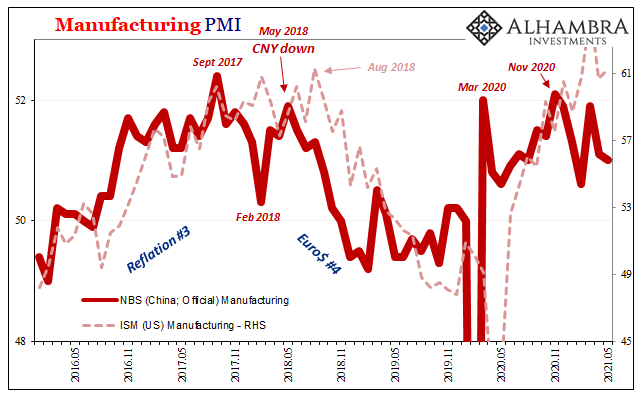

It’s not really a war so much as somewhat of a disagreement. And it’s not an unfamiliar one, as time and again these things tend to come down to timing. The global economy remains synchronized, only certain parts of it go ahead first before others then the rest end up joining. Carried into the realm of PMI’s, diverges in sentiment more about when than what.

The first part of each month brings with it the latest flood of these things (though IHS Markit produces an initial “flash” estimate late in the month under question). By now, June 3, we’ve got pretty much all of them for May 2021.

In the US, they’re legit stunning – at least so far in what they should’ve been a year ago. Finally catching up, reopening more completely has let loose whatever was left of the non-economic pandemic restraints.

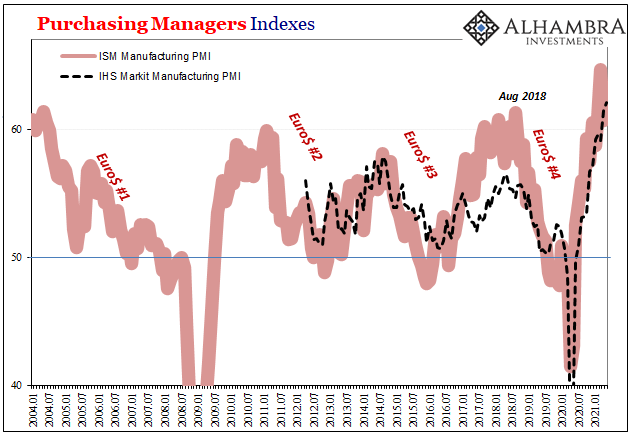

Numbers-wise, Markit puts its manufacturing index up a bit more in May 2021 (62.1) than from April (61.5), a record high for the series. ISM’s Manufacturing PMI likewise up a touch last month from the month before, though less than its record high set in March. Either way, manufacturing is experiencing a widespread rebound.

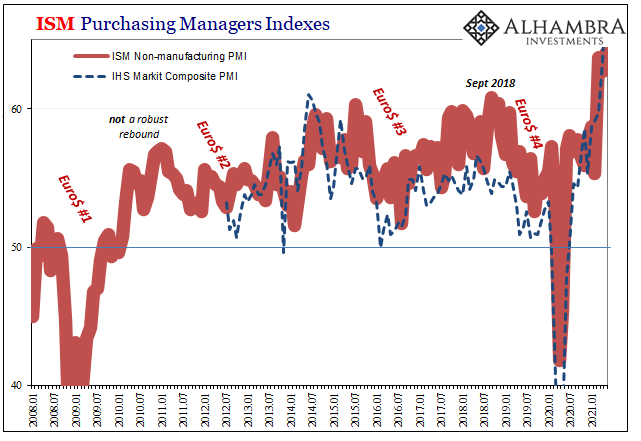

It is the US services sector, however, where the numbers become very nearly V-like; and for good reason. It was here that lockdowns had still mostly applied, where the stifling non-economic influence of government was the most interfering. Now that these are being removed almost universally, sentiment estimates have comparatively surged.

ISM’s non-manufacturing reached a record high of 64.0 in May while IHS Markit’s similar for the service sector blew past it all the way to just more than 70. The latter’s composite, therefore, also a new record at almost 68 in a class all by itself (and right off the top of the chart below).

This along with employment data of late, including ADP’s jump in private employment for May along with weekly unemployment claims now less than 400,000 (plus whatever big number for the BLS payroll report tomorrow) these all show the beneficial effects of getting out of the way. The US economy is moving sharply in the right direction.

But it’s done this once already before that original reopening “V” turned out instead to have been a tease. Thus, the question which remains is whether it lasts, and if it does (or does not) how far it gets.

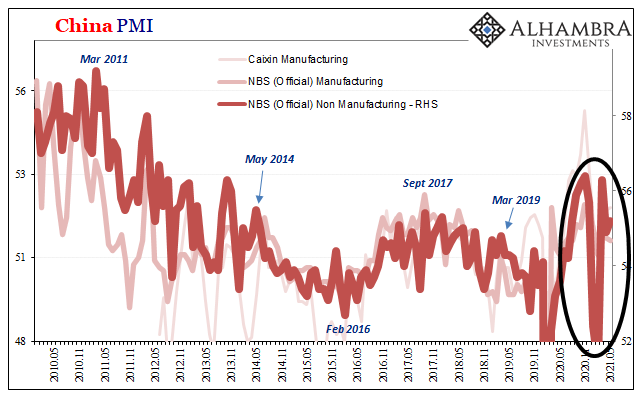

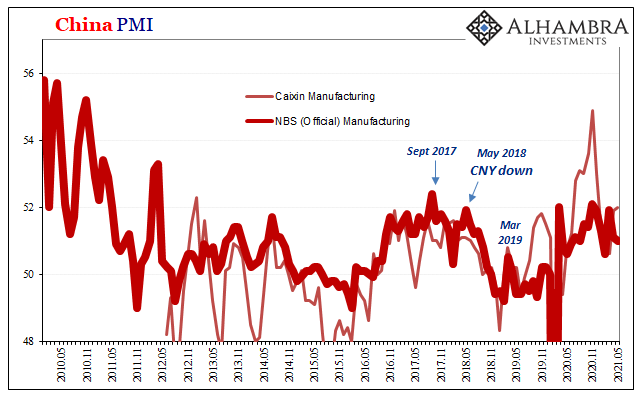

To that end, toward there is the other side of things in China. The Chinese PMI’s, by contrast, they peaked months ago at relatively uninspiring levels. The non-manufacturing PMI bounced a tiny bit for May, to 55.2 from 54.9, while manufacturing “unexpectedly” dropped a tenth to stick right at 51.0.

Given the situation, and the depth of last year’s recession, I’ll repeat: curiously uninspiring here.

Taken together with official statements and so-called hard economic data recently (particularly retail sales), while not proposing a different direction (re-recession) it does call into doubt the strength of the current rebound or at least its uniformity of momentum and intensity.

In fact, the Chinese data is more like what you find around the rest of the world. The US goods economy, in particular, has plunged ahead if only as a world-busting outlier. Even if the domestic services economy comes up in sentiment, that doesn’t necessarily mean full recovery, either, after having been held down for so long.

And then there’s timing. The Chinese rebound began much earlier than the American (or that for the rest of the world), and it may have peaked much earlier, too – all the way back in last November. With Communist authorities repeatedly on record stating this is all they expect, their system having arrived then at full potential, no wonder uncertainty – global uncertainty – proliferates despite what’s shaping up to be (though transitory) V-like American strength.

This, too, not anything new. You need only go back a couple years for all the same “inconsistencies” which were only differences in timing. If China’s ahead, then truly transitory inflation everywhere else including the US.

Stay In Touch