February’s cold winter blast throughout the Southern United States was supposed to have been the extent of the weakness. The unusual and unusually severe freeze caused a great deal of havoc, making its way very quickly into economic data. The recovery was said to have been on a winning streak (vaccines, gov’t payments, etc.) so it seemed the easiest correlation more likely the explanation.

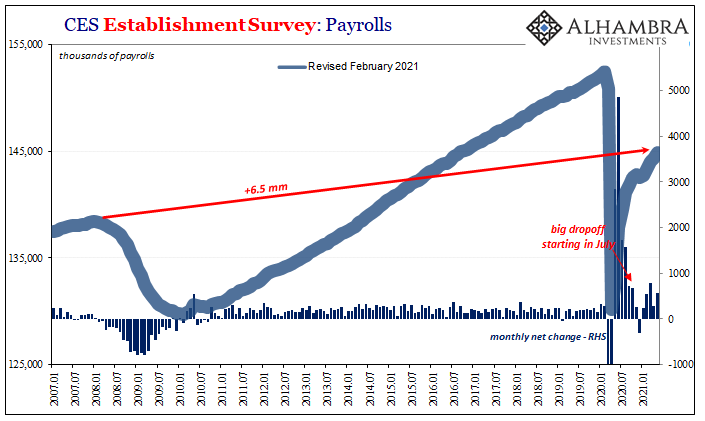

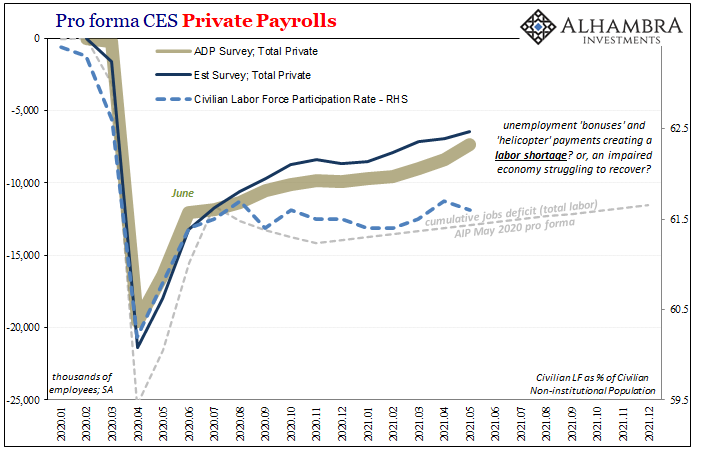

In terms of the Establishment Survey, or payroll report, this didn’t really happen. The low-point ending up having been December, last year’s summer slowdown combining with second (or third) wave pandemic fears caused employment to shrink significantly (currently believed to have been -306,000) in that month.

From that ebb, the labor market roared back barely stopping in February (+536,000) before the big jump in March (since revised downward to a still impressive +785,000). The trajectory seemed clear enough once employers nationwide cleared the cold snap. Normalcy within perhaps a few months, maybe half a year.

The “whispers” for April were talking like in exactly that way, that the monthly employment change might come out better than a million. It didn’t. Instead, the BLS said the labor market severely underperformed at (since revised) +278,000.

Not to worry, all would be made up in May, with rumors pegging the monthly gain again into seven figures while mainstream estimates were hoping for between +650,000 and +700,000 (strengthened by ADP’s private figure from this past Wednesday which was much better than expected).

Today, the BLS did it again. At +559,000, just +492,000 private, this makes two in a row when reopening appears to be the only factor at work (pun intended). That’s not what’s supposed to be happening right now, instead the combination of those non-economic impediments being removed so that the rest of the economy fully set free to recover actually does.

Because of this repeat, now explanations are being demanded and given out in typical (2018-style) fashion. LABOR SHORTAGE!!!!

The recovery would be doing so much better, very much like what had been projected starting from February and surging into March’s headline estimate, except, so the story goes, Americans have grown too fat and lazy on the government dole. Unemployment bonuses and the like, helicopter payments with more promised, closed schools, why work when the feds will pay you as much possibly better to sit home?

Companies would hire more, evidently, if more would show up for interviews.

Undoubtedly, this situation applies to perhaps millions. It cannot, however, explain a few facts. The first is how more American workers have been pleading with their local authorities to more completely open everything back up so that they can go back to work. There’s even be a modicum of protestation on this point. However many might not want to go back, there’s been more who would like nothing more than the opportunity.

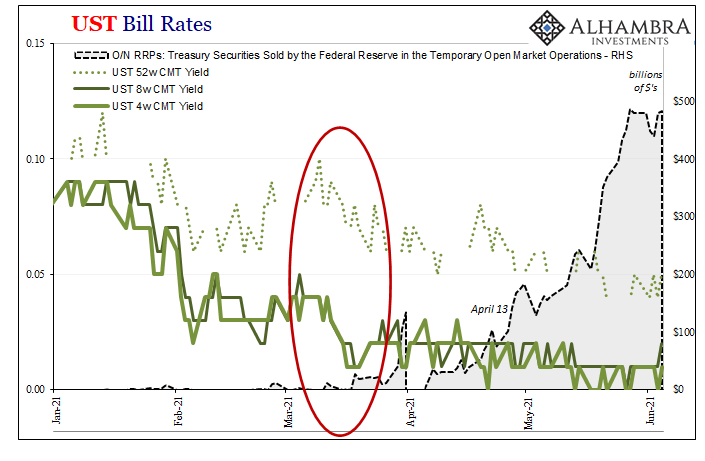

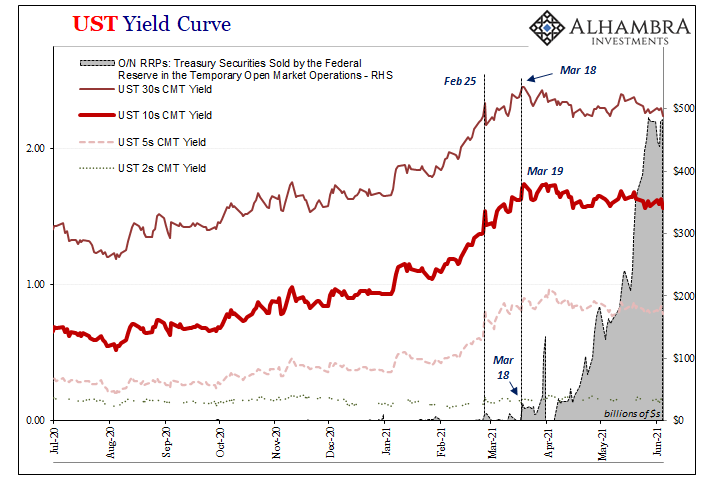

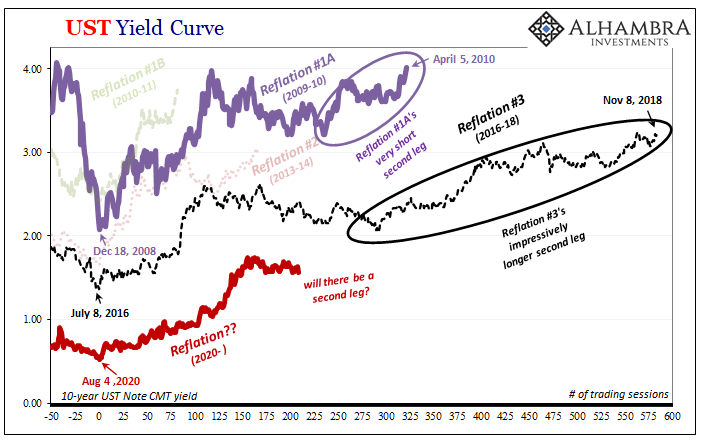

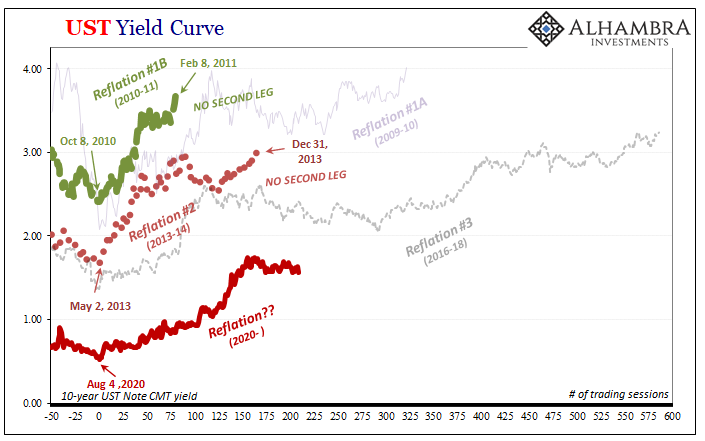

Second, notice the timing here; where have we seen a transition from reflation-like as in the job market to curious, “unexpected” not reflation-like, and this taking place in that same February to March timeframe? Yes, the Treasury market. Reverse repo and all that fuss.

LT UST yields which had been very much onboard with the more robust reflation trajectory spelled out in the progression of jobs reports up to March abandoned it in the middle of that same month. Just random coincidence? Not likely at all.

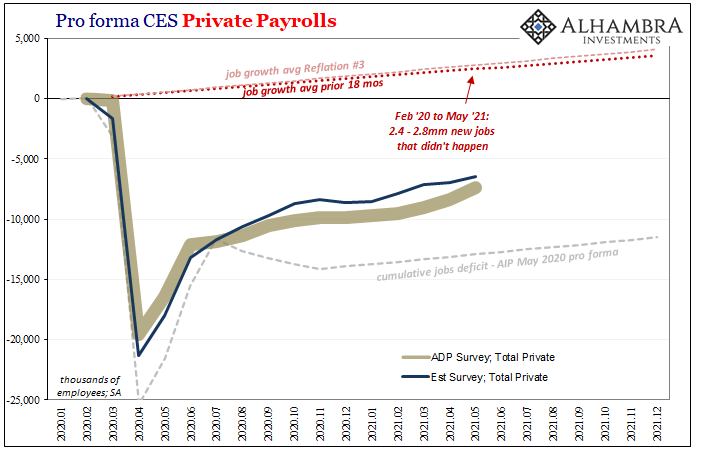

Finally, we all should be quite familiar with this sort of economic “mystery” – the enlarging distance between expectations for recovery and its strength and reach versus lack of recovery which turns out little better than some unnatural, insufficient reflation-ish rebound.

The economy should be doing better, the labor market should be coming back quicker; but it “somehow” doesn’t. Again.

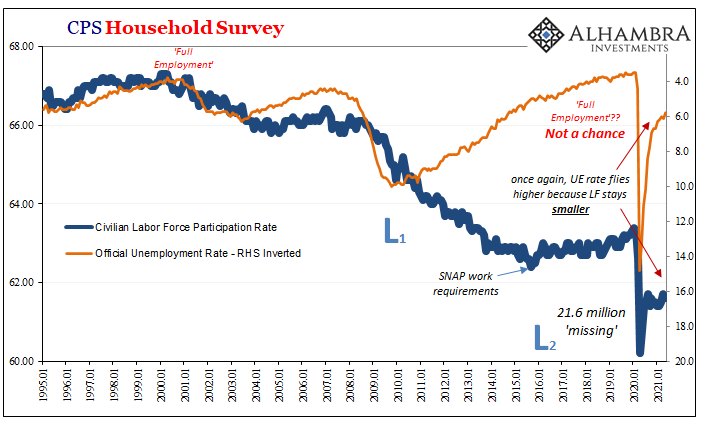

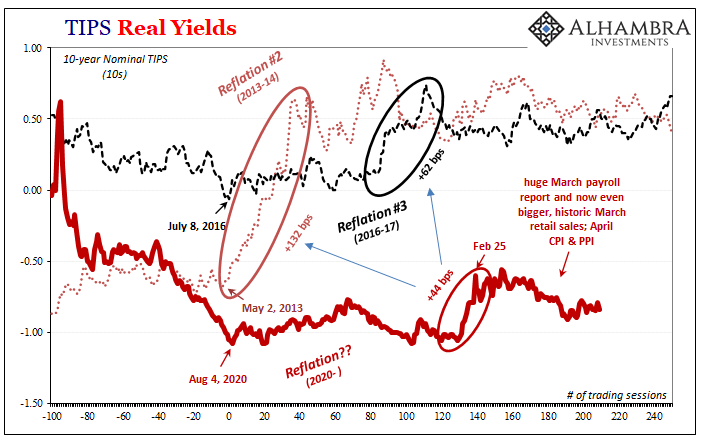

This, I believe, is how we reconcile the labor statistics (including another drop in the unemployment rate, down to 5.8%) with, well, pretty much everything else globally including global bond yields that haven’t been reflation in more than three months (including real yields in UST’s). The recovery or at least rebound got going again after last summer’s slowdown extended all the way past autumn and into winter, but then…

Therefore, the recalcitrant level of labor force participation isn’t fat and lazy workers who have no intention of coming back from their taxpayer-funded vacations, or at least it’s not all or mostly that, the labor force dropping slightly in May so that the participation rate remains stubbornly 61.6% is, like the prolonged aftermath of GFC1, workers who are very acquainted with economic as well as non-economic pandemic reality and aren’t even bothering to look for a job because they know there really aren’t enough of them.

And won’t be anytime soon.

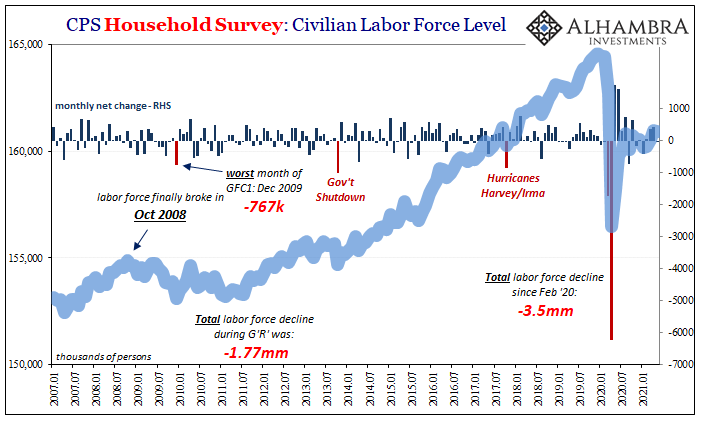

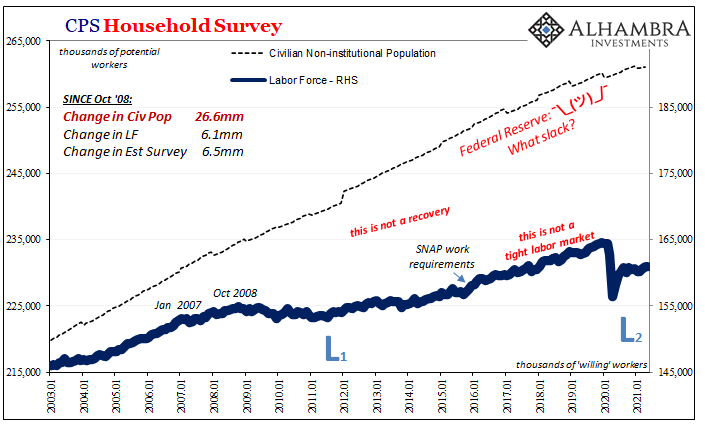

To demonstrate this point, the consistency over the long run again emerging toward the middle of 2021, we can dice up these data series any number of ways and it still works out in this fashion. I’ll compare them to October 2008, the very month when the labor market changed, so that you can more easily see the long run fit of employment dynamics unable to fit enough workers into the mix.

The Civilian Non-institutional Population, this being the total of all potential workers, has increased by 26.6 million between October 2008 and May 2021. As the results of the Census Bureau’s latest decennial census (2020) had shown, this period includes the lowest rate of population expansion since – imagine this – the 1930’s. So, the labor market hasn’t exactly been flooded by young labor eager to get working (who can’t seem to find gainful employment, and therefore put off if not give up on having families in the first place).

Even as 26.6 million more potential workers arrived, given last year’s deep recession there were in May 2021 only 6.5 million more payrolls than there had been in October 2008. Where does that leave the other twenty-some million? Enjoying themselves on a beach somewhere cursing reopening and the end of $300 worth of unemployment generosities?

Again, not likely for the vast majority. Instead, the labor force total matches up all-too-closely with those others; the civilian labor force is up just 6.1 million in those same 151 months, including the last fourteen That’s twenty million who are pretty well assured there’s just not enough economic growth producing job opportunities for them to even bother looking for work.

And this is where inflation really comes into it. It’s not about consumer prices, per se, it’s what consumer price acceleration – sustained increases beyond a few months – would confirm one way or the other. In 2018, that purported LABOR SHORTAGE!!!! ended up being no such thing, no inflation pressures emerged whatsoever which only proved the macro slack remained too large and unfilled.

Bond yields absolutely got that one right.

Now in June 2021, especially after today’s payrolls numbers, where are bond yields again? Distinctly lower and less buoyant than even Reflation #3. They’re quite consistently describing the same lack of inflation (actually more lack) ahead along with what sure seems to have been a prescient rethinking of the most recent reflation trajectory. Both those things are pricing growing, not shrinking, potential for a(nother) failing recovery.

Which puts them on the same side of the labor force itself.

Like 2018, this latest LABOR SHORTAGE!!!! stuff is the same wishful thinking, a way to try to preserve the idea of a paradigm change into inflation after more than a decade of disinflation if not, at times, outright deflation; doing so because the evidence keeps lining up in the wrong way. A shortage of workers you can’t see against another growing pile of evidence you really can.

Stay In Touch