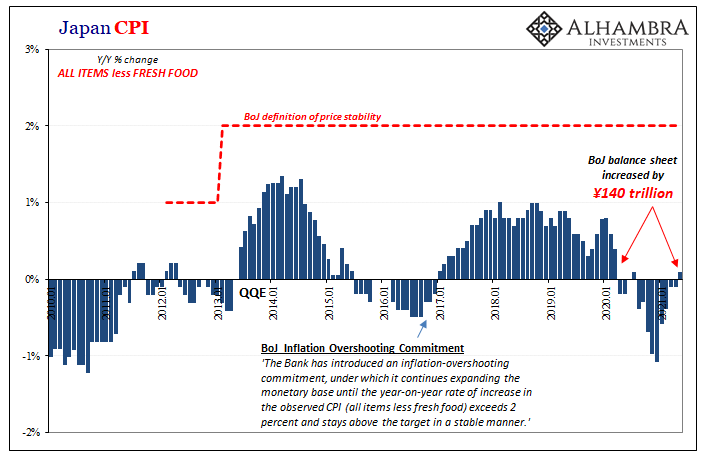

Consumer prices in Japan fell again in May, according to that country’s Ministry of Finance. The headline CPI was 0.1% less last month than it had been in the same month during 2020. Though it was the eighth straight for outright deflation, there was some good news in the core rate, if you could call it that, which flipped to the plus side – by the smallest amount, 0.1% – for the first time since last July.

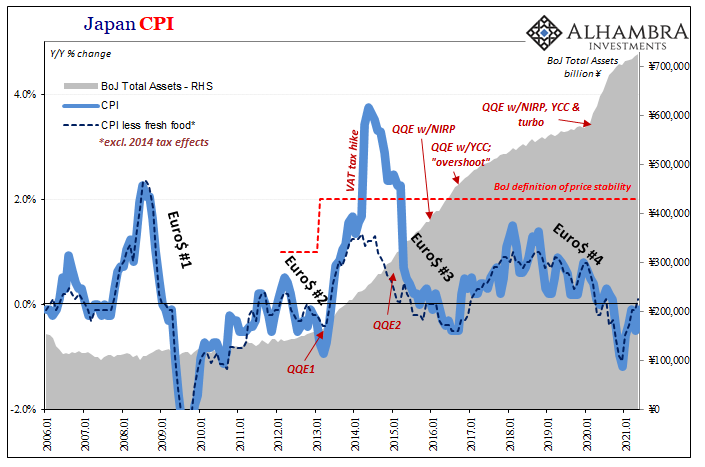

These miniscule inflation figures aren’t just typical for Japan, they are just as consistent with those for consumer price conditions around much of the rest of the developed world. It doesn’t matter (never does) that the Bank of Japan added ¥140 trillion more assets to its balance sheet since last March, that “central bank” had already passed over the half quadrillion mark from its previous QQE experiments that never ended.

If half a quadrillion hadn’t moved inflation, then what’s another hundred or two hundred trillion more?

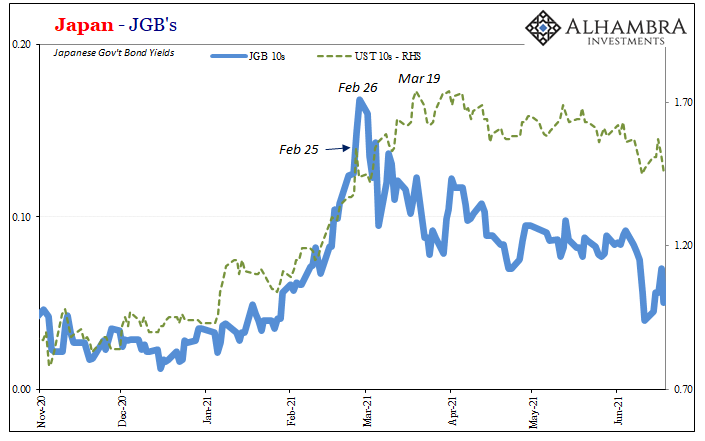

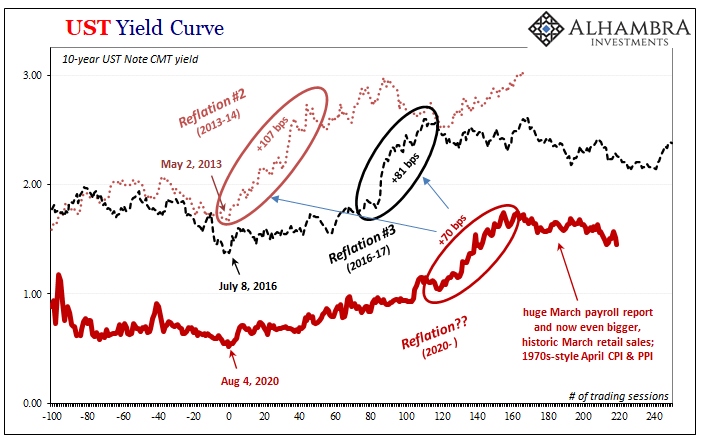

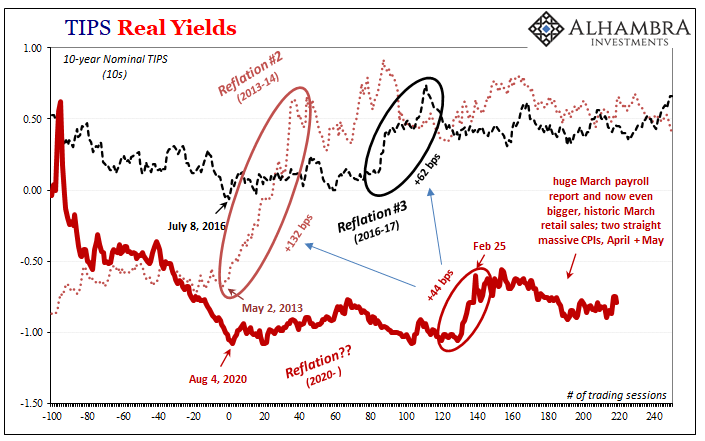

Any disappointment with the inflation rate in Japan, therefore, is less about (Q)QE or “money printing” and more a product of real economic conditions in more than just Japan. There had been a reflationary burst over there in JGB’s just like in the rest of the world – up until February 25.

With vaccines and fiscal “stimulus” the major contributors to sentiment, unchallenged by anything else, there really is now a sense of discontent how in the middle of June (with May data) there’s very little tangible progress across too many places. Contrary to all the chatter and whispers, the data keeps coming up well short.

The contrast with the US CPI, for example, only raises the same concerns that whatever was behind the reflation wave it wasn’t legit, nor organic.

Once Uncle Sam’s nickels stopped circulating so fast, then what? It’s a question not just for Americans to ponder, it’s a global issue. Does the world converge with US inflation rates, feeding a more realistic potential for recovery if not overheating? Or does America’s artificiality fall away leaving it exposed to falling back in line with the rest of the world?

This isn’t really about consumer prices.

We know how bond markets are answering this set of questions, particularly the last one. Japanese inflation, lack thereof, isn’t just a Japanese concern. It tells us a lot about what must be the true state of the global economy underneath the fiscal paper poured into it.

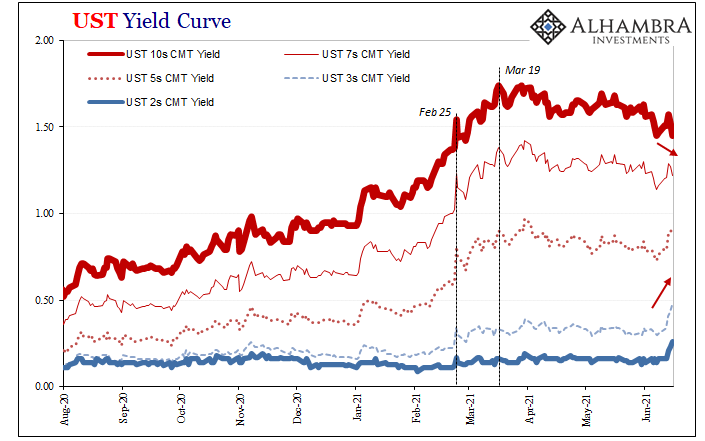

According to Jay Powell’s Fed, however, the FOMC this week has judged any such downside risks as having been seriously diminished. The dots and such. The Treasury market at first agreed – but then immediately took half of it back. The wrong half.

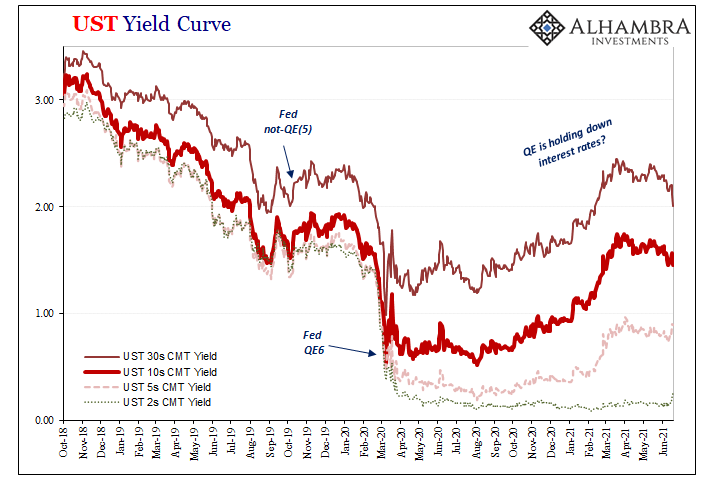

The entire curve sold off on Wednesday in light of this “hawkish” dot turn. The longer-term maturities gained all of it back, and then some at the 30s, on Thursday and today. The shorter note tenors (leaving aside bills and the RRP stuff) did not.

That has left the curve seriously flatter than before the FOMC meeting. What does this mean?

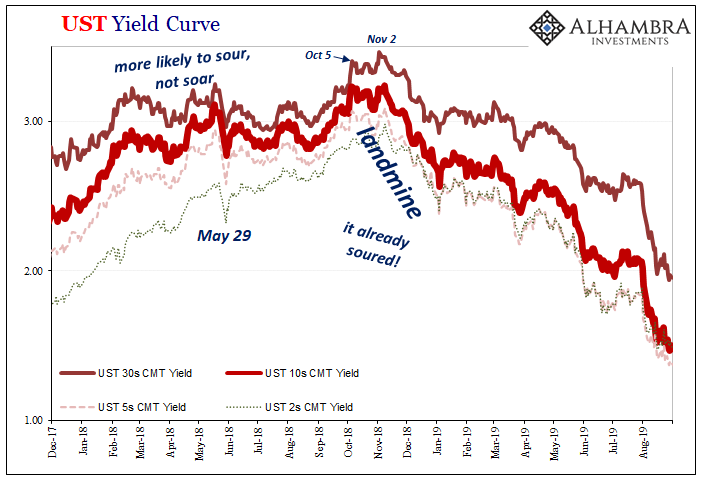

For one, it has a very 2018-ish vibe to it in that the market is taking policymakers at their word. They may even be able to raise rates at some point over the coming years, but that if they ever do so it will be, like 2018, for the wrong reasons. Insofar as the longer-term outlook, nothing much has changed regardless of the dot plot (remember how worthless the dots have been since being introduced).

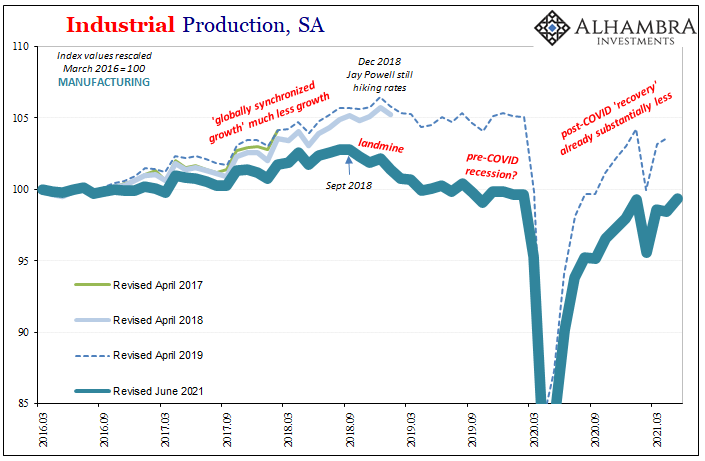

But also like a few years ago, this isn’t actually a “policy mistake” in the conventional view which assigns the term the meaning of the Fed causing material weakness by hiking rates. There are many still today who believe that’s what happened back then; that Yellen’s and then Powell’s rate hikes went too far and created the very slowdown they didn’t see coming.

No.

The policy error was in thinking there were solid economic reasons for raising rates in the first place. Even the data, only later revised, shows that there was never that justification at least not in reality in the first place. The bond market – with first its flattening curves – kept warning that the rate hikes were inappropriate due to the fact the economy was never strong, never in any inflationary danger, and was increasingly likely such material weakness would produce a downturn if not recession.

That’s just what happened beginning as early as October 2018.

This week, the curve flattened in pretty much the same way if smaller in scale – as well as, it needs to be pointed out, from much lower nominal levels. And the Japanese inflation figures are germane to this curve shape shifting in how they further demonstrate the global factors Jay Powell and the FOMC have ignored and will continue to ignore claiming instead fewer downside risks.

In terms of COVID and whatnot, yes. If only that was the only monetary and economic factor capable of spoiling everything. Weakness continues to be strongly evident for the global system. Longer-term yields are, like 2018, even more firmly in the “sour, not soar” camp no matter what the FOMC dots plot out.

Stay In Touch