82.3 The Federal Reserve is NOT a Central Bank Pt. 3

———Ep 82.3 Summary———

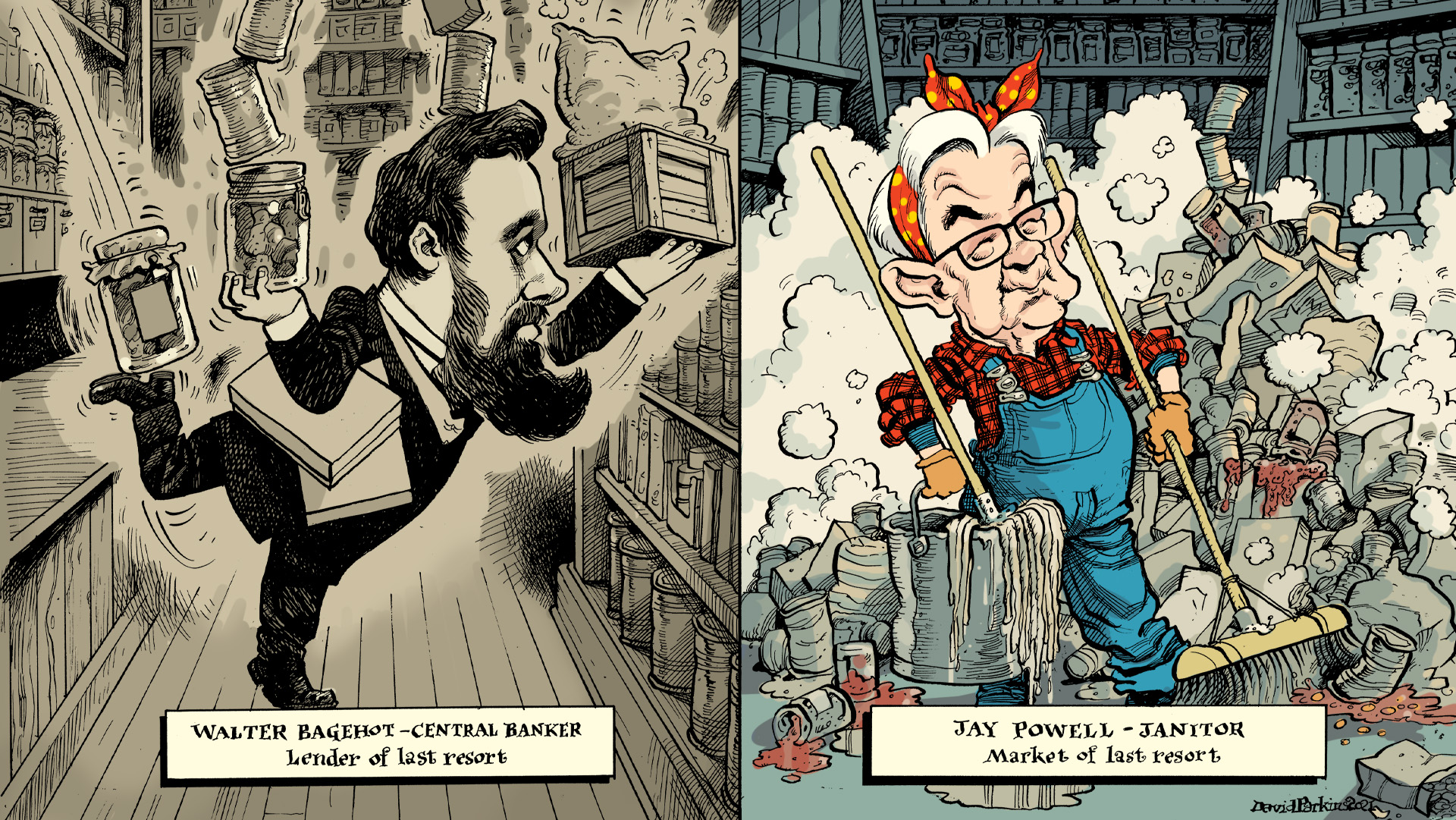

Central banks inject liquidity into money markets to PREVENT a crisis. Let us review the last 14 years: Global Financial Crisis I (2008), European Sovereign Debt Crisis (2011), Chinese Reserve Crisis (2015), Global Financial Crisis II (2020). Not too good. Do they know what they’re doing?

———See It———–

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Alhambra YouTube: https://bit.ly/2Xp3roy

Emil YouTube: https://bit.ly/310yisL

Art: https://davidparkins.com/

———Hear It———

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———Ep 82.3 Topics———

00:00 What is a central bank supposed to be? It is the institution that is supposed to step in.

01:23 But should or do central banks step in front of an asset bubble?

02:27 The mainstream narrative of March 2020 starts with foreign banks selling US Treasuries.

06:49 Why were foreign banks selling US Treasuries at all? What caused the selling?

08:21 There were six quantitative easing episodes by the Federal Reserve between 2008-2020.

09:33 A wave of Treasury selling did not clog the repo market – it was already impaired.

14:39 Are the European Central Bank and People’s Bank of China janitors too?

17:00 The Fed’s behavior as janitor negatively impacts the real economy and employment.

18:34 The Fed’s behavior as janitor negatively impacts the private banking system and credit.

———Ep 82.3 References———

When You Aren’t Actually A Central Bank, Part 2: The Stubborn Deflation: https://bit.ly/3x5fMxt

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

———Who———

Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski.

Stay In Touch